5 Reasons Why People Prefer to Trade Options Over Stocks

Stock-Markets / Options & Warrants Feb 17, 2021 - 05:22 PM GMTBy: Chris_Vermeulen

As technical traders, we know the importance of following the price charts using proven trading strategies and implementing risk and position management. Here at TheTechnicalTraders.com we are stepping things up a notch by adding options to our trading.

By using options, a trader can leverage, hedge positions, and generate income via selling premiums. There are basic options, strategies, and complex, and everything in between. Because of that, I have brought options trading specialist Neil Szczepanski to join our team. I will let Neil introduce himself.

Hi everyone! Neil Szczepanski here. In case you are wondering it is pronounced “Sus’ pan ski”. Yes, I have roots in eastern European ancestry and I’m first generation. I love options and have been trading them for many, many years. I like options because you have more ways to be profitable in your trading. I hate putting on a position and then waiting for the market to go your way. I want to be in control of my trades and options allows for that. Also, trading can equal freedom.

Think about this: imagine having a job that you can do from anywhere on the planet, work as much as you want, and make as much money as you want? Imagine having that same job that has no boss breathing down your neck and you call the shots. Well, that is what options trading can be like if you have the skills or access to someone who tells you what and when to buy and sell options contracts.

You control your own destiny and I have seen traders start with as little as $500. Options are especially attractive because they can cater to the small guy with smaller accounts via leverage, allowing them to take on big positions with little capital. On the flip side, the more wealthy sophisticated traders use options to protect and hedge positions and can do more complex strategies that provide even more consistent and lucrative returns with lower risk.

No matter what category of options trading you fall into, they work incredibly well, and I will teach you while providing professional trades to execute. Over my next few posts, I am going to explain some more about why trading options can be consistently profitable without having to take on huge risks. Today I am going to talk about why I love swing-trading options and the power of leverage that options provide us traders.

MAKE BIG MONEY WITH SMALL ACCOUNTS

As I alluded to above, options give the average trader ways to break into the trading world because of leverage. A little capital can go a long way, and if options trading is done properly you can have significantly less risk than buying the stock outright. You can start small, make smart bets that generate returns, and continue building your account through sound risk management techniques like position sizing, etc.

For example, when an underlying stock is super expensive, like Telsa for example, it can be prohibitive for the average person just starting out trading to own that stock… let alone 100 shares! Options give you the ability to control those shares for a specific period of time at a fraction of the price. Each individual options contract lets you control 100 shares of Tesla without having to buy the stock.

Sign up now to receive information on the launch of the Technical Traders’ options trading courses and newsletter!

Let us take a look at a simple example where you want to buy TELSA with an expectation that it will go up at least 5% in value in the next month. If you wanted to buy and hold 100 shares of TESLA, then you would need to spend $80,482 to own those shares. Since all we want to do is to be able to sell the shares and lock in the profit when they go up by 5% or more. We don’t need to own them but rather just have the right to control them within the options contract timeframe. When we hit our targets, we can sell the option contract and take profit (or take possession/delivery of the underlying shares on contract expiry). This is called option assignment.

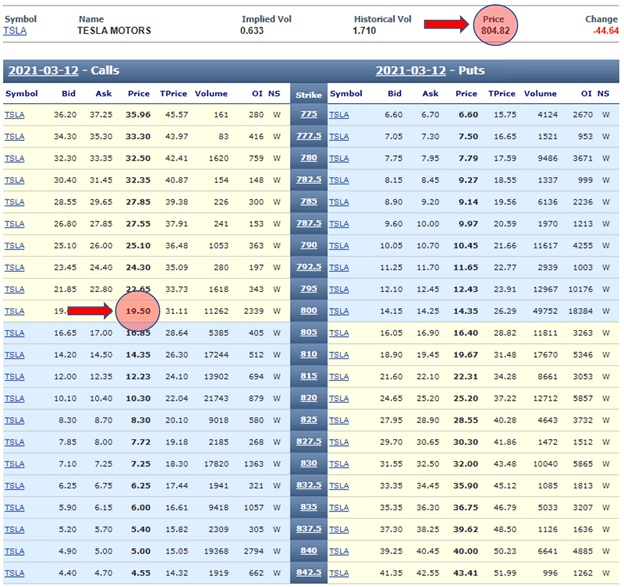

Below is a sample of a Tesla options chain, where we can see that the price of the stock is $804.82. Let’s say you could allocate $2,000 to this trade – you would be able to buy almost 2.5 shares of TSLA. But with $2,000, you could buy an option contract at the money that would let you have the right to buy 100 TSLA shares anytime in the next 30 days at a price of $800/share. With options, you have the ability to take your $2,000 trade and have the same controlling interest in an underlying stock as the person that just spent over $80,000 to buy the stock.

So to continue with the TSLA example, let’s say on March 12th TSLA was trading for $844 (the 5% gain you were expecting). If you bought and sold the stock, you would have made a 5% return of $4,000. If you had bought the option, and then take on the assignment (let it expire) you would have the right to buy 100 TSLA shares at $800 and then turn around and sell them for $844. Your profit would be $4,400 (less the cost of the option contract), a little more profit than had you bought the shares outright. However, if you look at your return it is more than 225% using options!!!

Options enable the small players to trade stocks that would normally be outside of their price range, and this is one of the reasons we have seen an increase in options trading popularity over the last year. In fact, options trading volume has more than doubled since the start of the pandemic.

Of course, the above trade is a dream, but the reality can be quite scary. If you took the options trade and TSLA dropped below $800, then your liability starts mounting, however, the loss with owning the stock could be over $80,000 while the total loss with buying the options would be the price you paid for the option which is $1,950. A big reversal of the stock would be catastrophic in both cases but can be much worse for the stock owner. So it is important to make sure you trade with proper risk management and protections in place. While the adage “with great power there comes great responsibility” was popularized within a different context, I feel it applies to trading options.

I know at this point you are probably thinking what the heck is he talking about and options are WAY too complicated for me. Don’t worry, I’m going to teach and show you in a very simple and easy way how to trade options. I am also going to provide trades that limit the max loss per trade, and reduce risk so get ready for some excitement!

SWING TRADING OPTIONS IS THE PERFECT SIDE-HUSTLE

I love teaching, technology, and trading. I knew early on that these were the things that would drive my career path. At the same time, I had kids to feed so I needed to supplement my income to support my growing family. I was able to achieve this through swing trading options. This allowed me to focus on my career and family while making modest yet consistent income, without having to be glued to my screen every day since swing trades last a few days or weeks.

We have all seen the traders with 10 monitors looking at charts all day, making trades, and watching and waiting on every single turn in the market. I can tell you this is NOT my idea of trading. I prefer swing trading, where I can set up trades to enter and exit every couple of days or even weeks. Swing trades are meant to be short duration, and they are not intra-day, so you can set up your trades and manage them when you have time to yourself.

I once got advice from a great old friend that sometimes it is wise to look at the animal kingdom to learn how we can improve and live our lives. There is a lot we can learn from the animal kingdom. Some of the necessities we need as a human being is food shelter, social acceptance, and security. As such, we should always have back up plans. Going back to the animal kingdom, if we look at say prairie dogs, for example, we know that they always have two holes. One is for the main entry and exit and the other is for emergency exits. Side hustles are just that and swing trading can be a really useful back-up/extra income plan. It is your second hole!

Swing trading is also a great way to gain entry into the world of trading. It is like dipping your toe in the water to test it before you jump in head first. With swing trading, you can learn all about options and other financial instruments like futures, CFD, and currencies. The best part about swing trading is it can eventually turn into a full-time job, replacing your regular job. Now, instead of trading during your free time, you can trade when you don’t have to be at work, leaving you with even more time to enjoy life and family. This is the ultimate freedom. That is what I have done using several strategies that generate consistent, low-risk gains for 20+ years.

One of my favorite strategies that I have developed is called the C-LEAP strategy. In this strategy, you enter and exit positions once every two weeks. It is one of the least risky strategies I have ever developed, and I use a simple checklist to follow it. I have had past students generate tens of thousands of dollars every month using this strategy, and I have found it to be easy to learn and very consistent.

As you may or may not know, I am preparing some options courses where I will teach basic options trading as well as more advanced strategies. Anyone can learn how options work but the most important thing is what strategy you use. You also need to know how and when to use the right strategy. I love teaching people how to trade options and live by two principles when doing so: “Trading can be simple but it is not easy” and “I want EVERYONE to win not just me and in fact, I have no desire to win if everyone else loses.”. I am really excited to get to know some of you soon when I launch my LIVE options courses and get you on the path to winning trades!

I will also be running The Technical Traders’ new service – Options Trading Signals – where I will share my knowledge, model portfolio, a weekly trade, and opportunities report, and trade alerts with subscribers. Look for the launch of my newsletter and courses at the end of February! Make sure you sign up now to keep informed of the launch of my newsletter and courses. You can sign up at www.thetechnicaltraders.com/options-trading.

In my next article I will keep giving you reasons to love trading options, including how you can trade options with less risk than stocks, how you can better react to volatility with options compared to stocks, and how you can attain consistent profits with lower drawdowns by trading options. So come along with me for the ride and change your life with a new skill trading options!

All my best,

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.