Precious Metals Charging Higher As Stocks Keep Pushing On a String

Commodities / Gold and Silver 2021 Feb 11, 2021 - 04:21 PM GMTBy: Submissions

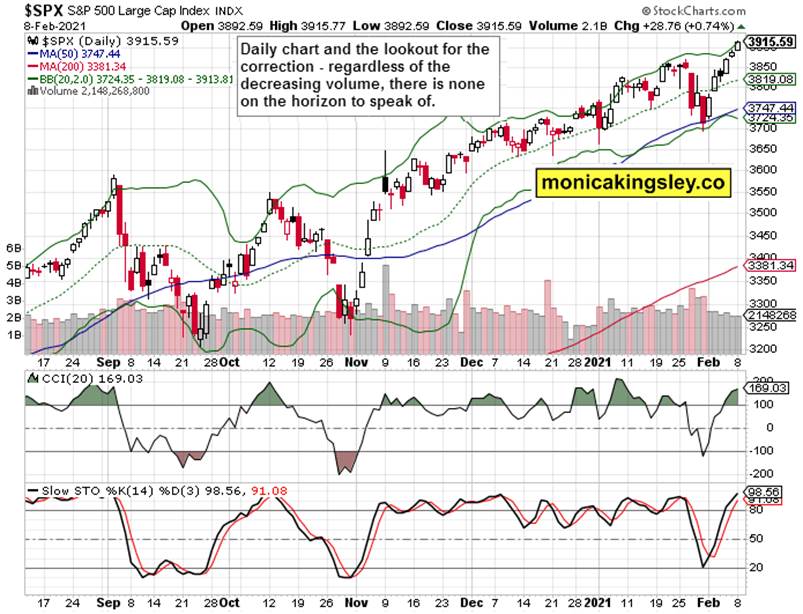

Stocks keep cooling off at their highs, and calling for a correction still seems to be many a fool‘s errand. Does it mean all is fine in the S&P 500 land? Largely, it still is.

Such were my yesterday‘s words:

(…) It‘s still strong the stock market bull, and standing in its way isn‘t really advisable. With the S&P 500 at new highs, and the anticipated slowdown in gains over Friday, where is the momentary balance of forces?

Still favoring the bulls – that‘s the short answer before we get to a more detailed one shortly.

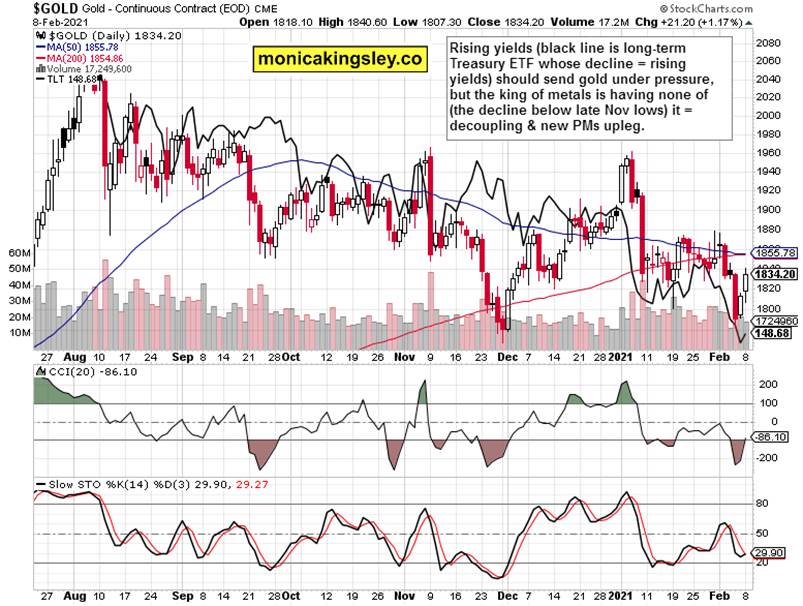

The anticipaded gold rebound is underway, and my open long position is solidly profitable right now. In line with the case I‘ve been making since the end of January, the tide has turned in the precious metals, and we are in a new bull upleg, which will get quite obvious to and painful for the bears.

Little noted and commented upon, don‘t forget though about my yesterday‘s dollar observations, as these are silently marking the turning point I called for, and we‘re witnessing in precious metals:

(…) The weak non-farm employment data certainly helped, sending the dollar bulls packing. It‘s my view that we‘re on the way to making another dollar top, after which much lower greenback values would follow. Given the currently still prevailing negative correlation between the fiat currency and its shiny nemesis, that would also take the short-term pressure of the monetary metal(s).

What would you expect given the $1.9T stimulus bill, infrastructure plans of similar price tag, and the 2020 debt to GDP oh so solidly over 108%? Inflation is roaring – red hot copper, base metals, corn, soybeans, lumber and oil, and Treasury holders are demanding higher yields especially on the long end (we‘re getting started here too). Apart from the key currency ingredient, I‘ll present today more than a few good reasons for the precious metals bull to come roaring back with vengeance before too long.

Finally, I‘ll bring you an oil market analysis today as well. So, let‘s dive into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook and Its Internals

A strong chart with strong gains, and the volume isn‘t attracting either much buying or selling interest. That smacks of continued accumulation, with little in terms of clearly warning signs ahead.

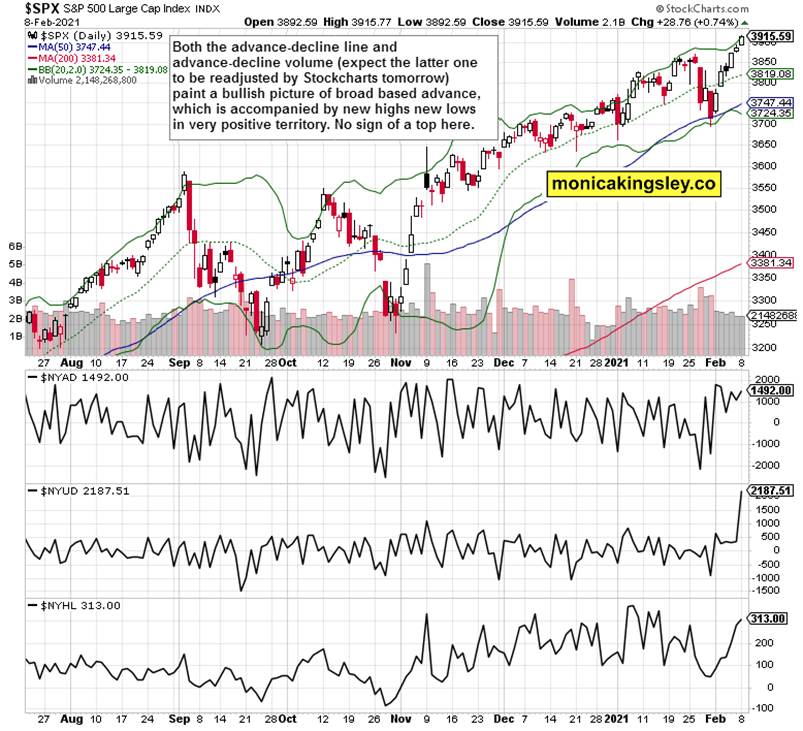

The market breadth indicators are all very bullish, and pushing for new highs, as the caption points out precisely.The intermediate picture remains one of strength.

Credit Markets and Technology

High yield corporate bonds to short-term Treasuries (HYG:SHY) ratio is powering higher significantly stronger than the investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) one. The bullish spirits are clearly running high in the markets.

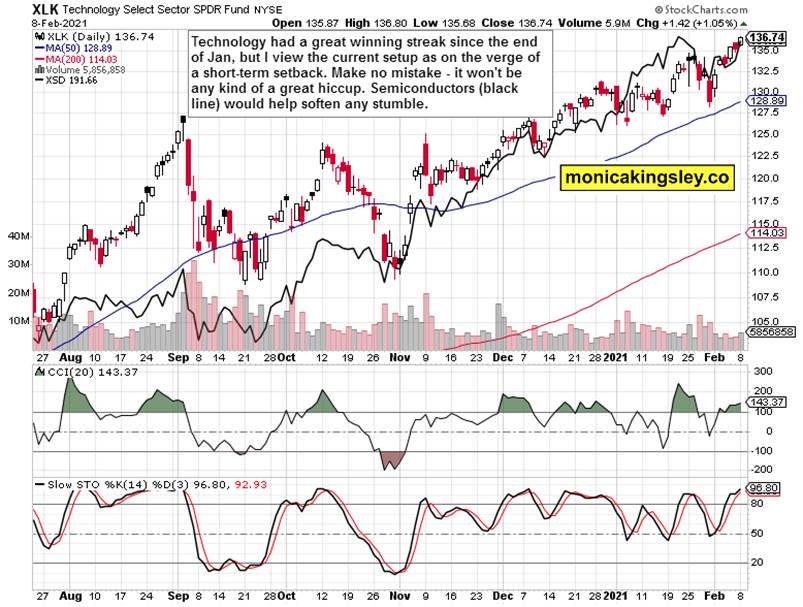

Technology (XLK ETF) as the leading heavyweight S&P 500 sector, keeps charging higher vigorously after not so convincing post-Aug performance. Crucially, its current advance is well supported by the semiconductors (XSD ETF – black line), meaning that apart from the rotational theme I‘ve been been mentioning last Thursday, we have the key tech sector firing on all cylinders still.

Gold & Silver

Let‘s overlay the gold chart with silver (black line). The disconnect since the Nov low should be pretty obvious, and interpreted the silver bullish way I‘ve been hammering for weeks already. Please also note that the white metal has been outperforming well before any silver squeeze caught everyone‘s attention.

Let‘s go on with gold and the miners (black line). See that end Jan dip I called as fake? Where are we now? Miners are no longer underperforming, and the stage is set for a powerful rise.

Just check the gold miners to silver miners view to get an idea of how much the white metal‘s universe is leading everything gold. Another powerful testament to the nascent bull upleg in the precious metals.

Continuing with gold and long-term Treasuries (black line), we see that the king of metals isn‘t giving in. Instead, it‘s rising in the face plunging Treasuries that are offering higher yields now. No, the yellow metal is decoupling here, as the new precious metals upleg is getting underway.

The greenback is the culprit – and again in my yesterday‘s analysis, I called the headwinds it‘s running into. The world reserve currency will indeed get under serious pressure and break down to new lows as the important local top is being made.

From the Readers‘ Mailbag - Oil

Q: "Hi Monica, I am glad I found you after you 'disappeared' from Sunshine Profits! As you had been back then already covering gold and oil at times, I wonder what's your take on black gold right now. A little great birdie told me oil will be the next Tesla for 2021 - what's your take?"

A: I am also happy that you found me too! Thankfully, my „disappearance“ is now history. I‘ll gladly keep commenting, in total freedom, on any question dear readers ask me. Back in autumn 2020, seeing the beaten down XLE, I wrote that energy is ripe for an upside surprise. I was also featuring the fracking ETF (FRAK) back then. Both have risen tremendously, and it‘s my view that the oil sector (let‘s talk $WTIC) is set for strong gains this year, and naturally the next one too. Think $80 per barrel.

Part of the answer is the approach to „dirty“ energy that strangles supply, and diverts resources away from exploitation and exploration. Not to mention pipelines. Did you know that the overwhelming majority of ‚clean‘ energy to charge electric cars, comes from coal? And that the only coal ETF (KOL) which I also used to feature back in autumn, closed shop? Oil is clearly the less problematic energy solution than coal.

These are perfect ingredients for an energy storm to hit the States by mid decade. I offer the following chart to whoever might think that oil is overvalued here. It‘s not – it‘s just like all the other commodities, sensing inflation hitting increasingly more.

Summary

The stock market keeps powering higher, and despite the rather clear skies ahead, a bit of short-term caution given the speed of the recovery and its internals presented, is in place. Expect though any correction to be a relatively shallow one – and new highs would follow, for we‘re far away from a top.

The gold and silver bulls are staging a return, as last week‘s price damage is being repaired. The signs of a precious metals bull, of a new upleg knocking on the door, abound – patience will be rewarded with stellar gains.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for both Stock Trading Signals and Gold Trading Signals.

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.