Captain Biden now Piloting MMT Adventure

Economics / Coronavirus Depression Jan 28, 2021 - 02:12 PM GMTBy: Richard_Mills

Gold may have come off the boil after rising above $1,900 an ounce in the aftermath of the US election, but the precious metal, and its sister silver, will do very well under a Biden presidency, an Ahead of the Herd analysis has found.

The main factors are drastically increased government spending, leading to even more unsustainable US debt levels than currently, along with rising inflation; dovish monetary policy as the Federal Reserve continues to advocate near 0% interest rates; and a sinking US dollar. Gold prices and the USD generally move in opposite directions.

Covid spending ‘out the wazoo’

Within the current structural bull market for gold, the antecedents of the next phase are in the spending promises of President-elect Joe Biden.

Biden, despite claiming otherwise, believes strongly in the power of the state to tax and spend, and will face overwhelming pressure from the left wing of the Democratic Party – supporters of hard-left progressives like Elizabeth Warren, Alexandria Ocasio-Cortez and Bernie Sanders – to toe the party line. A long wish list waits to be filled, with little to no concern regarding the already out of control $28 billion national debt, courtesy of Modern Monetary Theory, or MMT.

MMT is a new way of approaching the US federal budget that is both unconventional and absurd. It posits that rather than obsessing about how large the debt has grown and the ongoing annual deficits that fuel debt, we should focus on spending, specifically, how the government can target certain spending programs that will cause minimal inflation. Fiscal policy on steroids is, according to its proponents, to be the new engine of US growth and prosperity.

Government is therefore given a free pass on spending, because the only thing that we have to worry about with the national debt is inflation. Curb inflation and the debt can keep growing, with no consequences. This is because the US government can never run out of money. It just keeps printing it, because dollars are always in demand (with the dollar being the reserve currency, and commodities are traded in dollars).

MMT and the ideas of the Democratic Party’s far left fit like hand and glove. Pleas for universal medical coverage, free college tuition and a minimum $15 per hour wage can all be paid for by setting the money presses free.

Hence it was fully expected that Biden would last week unveil his American Rescue Plan, centered on robust spending to attack the coronavirus pandemic.

Among the key elements of the $1.9 trillion proposal are larger stimulus checks; more aid for the unemployed, hungry and those facing evictions; additional supports for small businesses, states and local government; and more funding for vaccinations and covid testing.

The spending package augments several of the measures contained in the $3 trillion coronavirus relief bill from March, and the $900 billion legislation from December, the latter watered down considerably by Democrats to garner support from Senate Republicans.

The political matrix, of course, has changed. Results from the hotly contested Nov. 3 election have Democrats retaining control of the House of Representatives, albeit with a slimmer majority, winning the White House, with Biden set to be inaugurated this Wednesday, Jan. 20, and dominating the Senate. Results from two run-offs in Georgia earlier this month saw both Republican candidates losing to Democrats, effectively giving the Dems control of the upper chamber — votes tied at 50-50 will be broken by Democratic Vice President Kamala Harris.

While $1.9T is a considerable sum (not long ago the word “trillion” was rarely expressed in government circles, being so large a figure. The highest spending items were, at most, hundreds of billions), it’s worth reviewing how much the United States government has shoveled into coronavirus relief funding, since the virus appeared nearly a year ago.

Forbes does a nice job of breaking it down. Over the course of five relief bills, including the CARES Act and the $900 billion passed by the Trump administration at the end of December, the federal government has authorized $3.5 trillion in new spending to shore up the economy during the pandemic. That equates to more than $10,000 per American.

The largest portion of the funds, the $2.1 trillion CARES Act, passed last March, was the biggest stimulus package in American history. It accounts for about 60% of the $3.5T total, according to Forbes. The rest comes from the $900 billion December aid package, and a $484 billion bill that renewed the Paycheck Protection Program (PPP) for small businesses, contained in the CARES Act.

When Biden’s $1.9 trillion is bolted onto the $3.5 trillion in coronavirus spending already spent, it brings the total to $5.4 trillion — an amount greater than the entire federal budget for fiscal year 2020, set at $4.79 trillion. Also worth comparing is the $1.8 trillion of fiscal stimulus spent in 2008 during the Great Recession, equivalent to 2.4% of GDP, compared to 2020’s relief legislation, which is estimated to cost about 3% of GDP over the next four years.

In tallying up the amount of stimulus thus far, we should also mention the trillions in tax breaks given by the Trump administration to the richest 1% of Americans and multinationals. The genesis of this giveaway was the 2017 Tax Cuts and Jobs Act, under which corporate taxes were lowered from 35% to 21%. The controversial legislation took trillions in profits held offshore, and gave the ultra-rich and multinationals a tax holiday to bring the profits home. According to Forbes, in 2018 the 400 wealthiest Americans made history by paying less tax than any other group. That same year, at least 60 companies reported their federal tax rates amounted to effectively zero, or less than zero, on income earned on US operations. Among the tax laggards, enabled by Trump’s $1.5 trillion tax cut, were Amazon, Netflix, Chevron, Eli Lily and John Deere.

This loss of income to the federal government has to be made up for somewhere. For Joe Biden, the answer is to create new money, that will never be paid back.

Completely separate from government spending to cushion the economic blow from the pandemic, is money printed by the US Federal Reserve. All of the emergency actions taken so far by the Fed amount to $7.3 trillion. According to the Committee for a Responsible Federal Budget (CRFB), that includes central bank purchases of securities, municipal and corporate bonds, new loans to banks, and emergency facilities like the Main Street Lending program.

If we include this new money, we get $12.7 trillion, which works out to around three years worth of US government spending. It should be stated that Janet Yellen, a former Fed Chair who is President-elect Biden’s nominee to run the Treasury Department, fully supports the new government’s spending priorities.

“Neither the president-elect, nor I, propose this relief package without an appreciation for the country’s debt burden. But right now, with interest rates at historic lows, the smartest thing we can do is act big,” Yellen said in a prepared opening statement for her hearing before the Senate Finance Committee, Tuesday.

Beyond the United States, similarly huge checks are being written by governments intent on containing the economic damage wrought by covid-19.

In China, where the virus originated, the central bank last March reduced the mandatory reserve ratio among Chinese banks, freeing up 50 billion yuan, or about USD$7.7 billion, to support the economy. This was followed in May by a stimulus package worth $0.675 trillion. Another half-trillion was issued in local government bonds, plus a combined $280.5 billion anti-virus special government bond, to be transferred directly to prefecture and county governments.

In Europe, among the countries worst affected by covid-19 were Spain and Italy. Last July, EU leaders agreed on a €750 billion recovery effort, called Next Generation EU, to help the EU tackle the crisis. Combined with €540 billion of funds already in place for the three safety nets (workers, businesses and member states), the EU’s initial recovery package amounted to €2,364.3 billion, or USD$2.8 trillion. In December, the trading block which now excludes Great Britain, agreed to deploy another €1.8 trillion (USD$2.1 trillion) in funding, including €1.1 trillion for the EU’s normal seven-year budget and the rest for stimulus spending in economies cratered by the pandemic.

Across the English Channel, the British government has had to dig deep into its coffers to find the money for covid relief. According to the BBC, the government in 2020 budgeted £280 billion (USD$381B) on measures to fight covid-19 and its impact on the economy, including £73 billion for paying the wages of furloughed government workers. To fund the huge stimulus package, the government of Prime Minister Boris Johnson will have to borrow £394 billion, which is the highest figure ever seen outside of wartime. Before covid, the British government only expected to borrow about £55 billion for the year.

Rounding out the global stimulus totals — obviously not an extensive list — are Australia, Canada and Japan. According to KPMG, the Australian government provided AUD$257 billion in direct economic supports, with the 2020-21 budget committing a further $98 billion. This includes $25 billion in direct covid-19 response measures and $74 billion in new measures to create jobs, bringing the government’s overall support to $507 billion, or USD$389.9 billion.

In Canada, the CBC reports the Trudeau Liberal government spent CAD$240 billion fighting covid in the first eight months of the year, an average of $952 million per day. In November, total government spending on the pandemic was pegged at $322 billion (USD$252.6B) for the fiscal year ending March 31, 2021, including newly pledged funds and budgeted amounts yet to be spent.

The Japanese government has so far committed about $3 trillion to help the economy recover from its pandemic-induced slump. Reuters reports the country is considering a fresh round of economic stimulus, as a state of emergency in Tokyo is expanded to seven more prefectures, amid a surge in infections.

From this brief analysis, we see the global spending on covid — about $23 trillion thus far — is getting stupid, which is why, we believe, you should own silver and/or gold.

Green New Deal

The Democrats winning the White House and both Houses of Congress is bound to be good for both metals because of Biden’s propensity to add to the debt. If you think the nearly $28 trillion national debt is too high now, it will go even higher under a Biden administration (with all the forecast spending, the debt will most certainly reach $30 trillion over the next few months).

In an earlier article we showed the close relationship between debt-to-GDP ratios and gold. The lower the GDP and the higher the debt, the better it is for gold. Beyond covid-19 expenditures, we know that Biden is putting clean energy at the center of a US$2 trillion plan to decarbonize American electricity in 15 years, and create a net zero-emissions economy by 2050.

Biden has signaled he will embrace central concepts of the “Green New Deal” — a program first espoused by New York Congresswoman, and Democratic wing-nut, imo, Alexandria Ocasio-Cortez. (“AOC” will reportedly serve on a panel helping Biden to develop climate policy.)

Dubbed “Clean Energy Revolution”, Biden’s plan calls for installation of 500,000 electric vehicle charging stations by 2030, and would provide $400 billion for R&D in clean technology.

Republican critics contend that his clean energy and climate strategy, stripped down from its AOC-inspired origins to be more palatable to voters on Nov. 3, could end up costing as much as $93 trillion. The President-elect has promised nearly $5.4 trillion in other new spending over the next decade, according to the University of Pennsylvania’s Penn Wharton Budget Model, including $1.9 trillion on education and $1.6 trillion on new infrastructure — roads, bridges, highways and other public structures. Some of it would be paid for by tax increases. Biden has said he would boost the corporate income tax to 28% from 21%, reversing half of Trump’s cut from 35% in 2017.

The Biden administration will allow the International Monetary Fund (IMF) to provide a new allocation of Special Drawing Rights to all its member countries; US$2 trillion is the number being considered.

Biden is also going to rejoin the Paris climate agreement. This entails two huge commitments, reducing US greenhouse-gas emissions, and to provide financial assistance to vulnerable developing countries.

New commodities supercycle

As we have suggested, one way to spring the United States from the coronavirus trap is a massive infrastructure spending program.

A global infrastructure spending push would mean a lot more energy metals will need to be mined, including lithium, nickel and graphite for EV batteries; copper for electric vehicle wiring and renewable energy projects; silver for solar panels; rare earths for permanent magnets that go into EV motors and wind turbines; and tin for the hundreds of millions of solder points necessary in making the new electrified economy a reality.

Expanding on this idea when I was interviewed by Financial Sense last fall, I explained the four over-riding global themes I believe are setting us up for a bull market in commodities like no other in history. They are:

- Blacktop/ basic infrastructure such as roads, bridges, water & sewer systems, etc., that has been poorly maintained. Governments need to spend trillions to repair their crumbling infrastructure and bring it up to the needs of a modern economy. The latter includes investments in smart power grids, 5G and high-speed rail.

- Electrification of the global transportation system. The move away from fossil-fuel-powered vehicles to EVs run on batteries is happening in almost every country. Governments are spending billions on EV charging infrastructure and subsidies to incentivize consumers to switch to hybrids and plug-in electric cars, vans and trucks. China is the leader but other countries are catching up, as large automakers like Volkswagen, Mercedes Benz, GM and Ford come out with new EV models and plan new EV manufacturing/ assembly plants in North America and Europe.

- Reducing our carbon footprint. Not only do we need to figure out a way to transition from gas and diesel-powered vehicles, there is also the question of how to fill the batteries demanded by electrification. Creating that energy — mostly solar and wind but also hydro-electric power — involves a massive use of metals to build batteries, battery storage systems, transmission lines and smart grids.

- Meeting the global demand for food.Food supplies are constantly under pressure due to expanding populations, and as developing countries move up the “food chain” to include more protein in their diets. Reducing food insecurity thus has to be an important part of this latest commodities boom, which sees the first three trends happening all at the same time.

In 2003 the commodities supercycle was driven by growth in China, which demanded almost every commodity under the sun to meet double-digit annual increases to its GDP. This time is different. I believe we are going to see demand across the board for nearly every type of commodity, based on infrastructure renewal, electrification, reduction of carbon, and food demand.

Goldman Sachs agrees that the next structural bull market for commodities will be driven by spending on green energy.

The effects of new money: debt, inflation, dollar weakness

Gold, being a hedge against inflation, has done well under periods of quantitative easing, when central banks literally “print money” to purchase sovereign debt instruments (like US Treasuries) and mortgage-backed securities (MBS).

Last March, when the Fed began to “spray billions into the US economy” to deal with covid-19, a Bloomberg article stated that Combined with an unlimited quantitative easing program, the Fed’s souped-up lending facilities are set to push the central bank’s balance sheet up sharply from an already record high $4.7 trillion, with some analysts saying it could peak at $9-to-$10 trillion.

As of Jan. 4, 2021, the Fed’s balance sheet stood at $7.3 trillion.

What’s the problem with debt? Already at 98%, a level not seen since World War II, the Congressional Budget Office said it expected federal debt held by the public to exceed the size of the US economy (ie. debt >100% of GDP) on Oct. 1, 2020. With overseas investors like China and Japan continuing to gobble up US Treasuries, and zero interest rates likely to remain in place for the foreseeable future, allowing the federal government to keep borrowing to pay for more stimulus, the debt to GDP ratio will almost certainly go higher.

It’s not inconceivable for the ratio to spike to $150%, or 200%, meaning for every dollar the US economy produces, it has to borrow $1.50, or $2.00. That’s insane.

Of course, the profligate spending promised by Biden will only exacerbate the debt problem, which extends beyond the United States. The current global debt level is a whopping 320% of world GDP. According to Foreign Policy, The next U.S. administration will likely face a global debt crisis that could dwarf what the world experienced in 2008-2009. To prevent the worst, it will need to address the burdensome debt plaguing both the United States and the global economy.

But there is a more immediate challenge facing Biden, the Fed and other central banks, that continue to shovel money into their moribund economies: inflation.

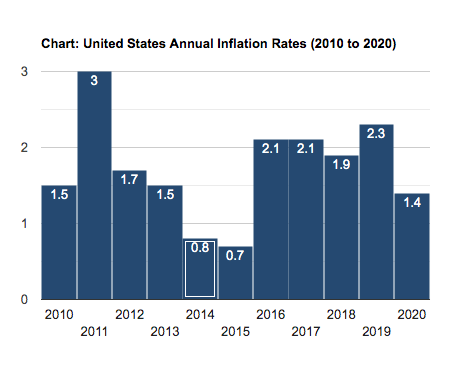

Currently gold is suffering because some traders are selling, their thinking being that marginally higher Treasury yields recently, alongside a slight pick-up in inflation, is bearish for gold. However the idea that the Federal Reserve is going to raise interest rates anytime soon, to combat inflation, is absurd. Fed Chair Jerome Powell has already said that the Fed is prepared to let inflation run above its normal 2% target “for some time” (it’s currently sitting at 1.4%), which also means that interest rates are likely to remain low for the foreseeable future.

We know that negative real interest rates, when the 10-year Treasury yield minus the inflation rate “goes negative”, are always good for gold. Clearly, investors prefer to hold bullion when they are getting a negative return from government bonds. With the 10-year last quoted at 1.1%, and inflation running at 1.4%, we already have negative real rates.

Regarding gold and inflation fears, economist Peter Schiff was recently quoted in a Kitco interview saying “I think gold is getting ready for a tremendous move because in reality, if you’re worried about inflation, gold should be the main commodity that you buy. Because as inflation pushes up the prices of all commodities, it’s hard to store wheat or corn, or oil, live cattle, so if you think you need these commodities in the future, it’s easy to stock up on gold. It has a store of value, so gold should be reacting faster. It hasn’t yet but it will.”

Schiff also points out that the $2,000 stimulus checks may seem like great news, but they aren’t any good for the economy. “It’s not a stimulus, it’s a sedative,” says Schiff, the CEO of Euro Pacific Capital and frequent resource investment conference speaker. “All that’s happening is more money is being printed and being spent that is not going to grow the economy, it will stifle it further. What’s going to grow is the cost of living. Prices are going to go up as the dollar loses purchasing power due to all the new money that the Fed prints to monetize all the debt the Treasury sells to finance the spending.”

Though inflation in the US is still subdued, there are signs it is creeping up. Consumer prices rose solidly in December, Reuters reported on Jan. 14, and import/export prices recently jumped 1% in a month.

Food prices are rising, so are the prices of several mined commodities, including zinc and copper, in part due to output restrictions and mine closures owing to covid-19. Upstream, a lot of manufacturing capacity has been lost, meaning higher finished good prices.

Another Reuters report states that market measures of inflation expectations are at an 18-month highs, based on renewed hopes that Congress will pass a fresh covid-19 stimulus package.

“I’ve had countless calls with clients about inflation and whether it’s different this time and inflation is going to rise,” the news source cites Citigroup interest rates strategist William O’Donnell. “Many believe that the seeds are there.”

Schiff notes we already see commodity prices hitting five-year highs across the board, whether it’s industrial metals or agricultural commodities, and he thinks “by the end of 2021 we could see prices of commodities hit record highs.”

Often overlooked scenarios for inflation to rear its ugly head are:

- Supply constraints in the economy. When an industry, or industries, fail to deliver enough goods for their market, the result is price inflation.

- An over-reliance on imported goods can also cause price inflation.

- The prices of goods can increase if labor disruptions occur.

- When countries fail to coordinate their internal/ external emergency policies, and instead, act unilaterally. We see this in the higher prices of vaccines being paid by certain countries, for example, Israel.

Of course, the demand for commodities is there and strengthening. Asian growth is humming and Chinese export prices have risen year over year. China reportedly finished 2020 with a 10th consecutive month of expansion in its manufacturing sector. Bloomberg notes that, excluding oil, industrial commodity prices were higher at year’s end than they were at the end of 2019. US imports are also more expensive, durable goods are on a tear, and there are signs that services inflation is going up, too.

As our previous analysis has mentioned, gold prices and the US dollar generally move in opposite directions.

For the moment, it looks as though the only direction that the greenback is headed is down thanks to the US Federal Reserve’s policy changes to accommodate lower interest rates and slightly higher inflation.

Many believe that the dollar, which fell to a 2.5-year low last year, will continue to face downward pressure in 2021 regardless of how the covid situation unfolds.

Alex Kimani, writing for Safe Haven, goes further than that, stating that the buck could stay low for years, based on three factors: a strong euro, a dovish Fed, and more government stimulus.

A cheaper dollar, naturally, will be welcomed by many US companies because it makes their goods more competitive abroad, but the problem is in that case, the dollar’s competing currencies are strengthened.

These gains go against foreign central banks’ efforts to boost economic growth, by keeping their currencies low in relation to the dollar. Reuters quotes Momtchil Pojarliev, head of currencies at BNP Asset Management, who believes the dollar will sink to fresh lows in the first quarter.

“The Fed is very dovish and is going to stay dovish,” he said. “The bigger the stimulus, the worse for the dollar.”

CNBC adds that the dollar is also likely to fall due to the market viewing geopolitical risks to be lower with a Biden win, and the fact that US trade policy will probably become more predictable, without escalating tariff threats. (investors tend to move their funds into US dollars, or USD-denominated assets like Treasuries, in the event of destabilizing events like trade wars, civil unrest or military confrontations)

While chances are high that the dollar will sink and gold will swim, there is also the possibility of the gold price increasing, as the dollar rises. This has happened historically and it occurred again this past Monday, when the prospects of a massive US coronavirus relief package outweighed a stronger dollar, and bolstered gold’s appeal as an inflation hedge. Spot gold rose to $1,838/oz in mid-day trading, having bounced off a near seven-week low.

Conclusion

The current weakness in the gold price — if $1,840 can even be considered weak, historically — is temporary, as metal traders and investors mull the chances of an economic recovery in the United States and Europe, amid multiple vaccine rollouts, and a promised $1.9 trillion covid-19 recovery package promised by President-elect Joe Biden. It’s true that Treasury yields have ticked higher in recent weeks, and the dollar is showing strength compared to Jan. 3, when DXY sunk below 90 for the first time in three years.

But these indicators, arguably, are red herrings, and mean little against the overwhelmingly strong case for the continuance of the structural bull market for gold we saw taking shape last year. Remember, in August 2020, gold hit a record $2,070 an ounce. Most pundits believe it is going higher, largely due to the factors we have outlined: massive US government spending, leading to even more unsustainable US debt levels than currently, along with rising inflation; dovish monetary policy as the Federal Reserve continues to advocate near 0% interest rates; and a sinking US dollar.

As long as Treasury yields stay under, say 1.5%, and inflation holds steady or rises, we have every reason to believe negative real rates will prevail, which are always bullish for gold and silver. Analysts expect the white metal to break out of gold’s shadow as bullish sentiments from monetary policies and industrial demand spill over.

Not only does silver provide investors with even more torque than gold given the relatively smaller market, it has also become an appealing play for those investing in green energy. Silver is a critical component in photovoltaic solar panels.

According to a report by research firm CRU, solar power generation is expected to nearly double by 2025, and the global solar industry is expected to use on average 81 million ounces of silver through 2030.

Mike McGlone, senior commodity strategist at Bloomberg Intelligence, said in a recent report that silver may “follow its yellow peer” and set a record high of its own this year. Bank of America went even further, stating it expects silver prices to outshine gold in 2021. The gold-silver ratio has narrowed to 72, but that is still higher than historically, hinting that a further correction to the upside is possible.

At Ahead of the Herd, we are bullish on a wide swath of commodities including copper, zinc, graphite and tin.

Copper’s widespread use in construction wiring & piping, and electrical transmission lines, make it a key metal for civil infrastructure renewal.

The big question is, will there be enough copper for future electrification needs, globally? And remember, in addition to electrification, copper will still be required for all the standard uses, including copper wiring used in construction and telecommunications, copper piping, and copper needed for the core components of airplanes, trains, cars, trucks and boats.

The short answer is no, not without a massive acceleration of copper production worldwide.

Tin will play an important role in developing a new economy, reliant on green energy, electric vehicles and advanced technologies like 5G, the Internet of Things and artificial intelligence.

For such a small market, tin has an impressive array of current and potential uses, putting it in the same league as silver, as a metal essential to modern electronics. Its primary use in tin-lead solder practically guarantees tin will enjoy steady demand for years, maybe even decades to come.

Like lithium, graphite is indispensable to the global shift towards electric vehicles (EVs); it is the second-largest component in lithium-ion batteries by weight. The metal not a substitute for lithium either, since graphite (in spherical form) is in the anode while lithium is used for cathodes.

Spherical graphite can only be produced from flake graphite, a form of natural graphite, upgraded to a high purity level, but its manufacturing process is expensive and wastes up to 70% of the flake graphite feed.

Out of the approximately 1.2 million tonnes of natural graphite processed worldwide each year, only 40% are flake graphite. This figure is far from enough to sustain the growing demand for battery materials.

According to the US Geological Survey, while there is currently no domestic production of graphite, the nation does host an abundant graphite deposit in northwestern Alaska.

Democrats and MMT are a deadly combination for the US$. The theory says debt does not matter because with interest rates at zero there’s no cost to borrow. Well, look at it the way we do at AOTH – you have the world’s reserve currency, you have the printing press in your basement. Go ahead and print all the money you want, you’re already in debt $28T, that will never be paid back, why not throw another $50T in the pot?

You don’t pay interest, you will never pay back the tens of trillions so no need to raise taxes. Come sail away on a three-hour tour with the MMT Adventure. Our prediction is an all-encompassing commodities, and precious metals, bull market is getting underway.

I am proud to announce the launch of a new website this week, where readers and AOTH subscribers can enjoy hundreds of top-notch, thoroughly-researched articles on commodities, technologies and companies that are on the leading edge of investing trends.

Despite the pandemic, 2020 was an excellent year at AOTH. We had wins on a number of resource stocks, culminating with a 13-timer on Cypress Development Corp. From a 13-cent buy-in four years ago, I covered every twist and turn of the lithium junior’s story, from its huge resource of lithium claystone in Nevada’s Clayton Valley, to a successful PEA and outstanding prefeasibility study. When the stock hit $2.00, I chose to sell a considerable number of shares, but there may still be more gas in the tank for CYP; it remains an extremely attractive acquisition target for a large EV automaker like Volkswagen, battery-maker or lithium miner.

Richard (Rick) Mills

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.