Stock Market Investors’ Limitless Risk Appetite

Stock-Markets / Stock Market 2021 Jan 27, 2021 - 05:26 PM GMTBy: Troy_Bombardia

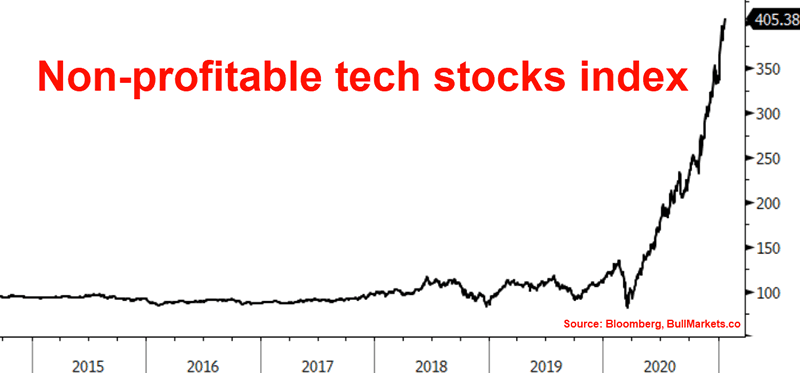

Investors are buying anything and everything in a manner that’s reminiscent of the 1990s. The best stocks to buy these days: money-losing tech companies. The more losses, the better because growth is the name of the game. In the 1990s, profits didn’t matter. All that mattered was “eyeballs” and user growth.

Summary

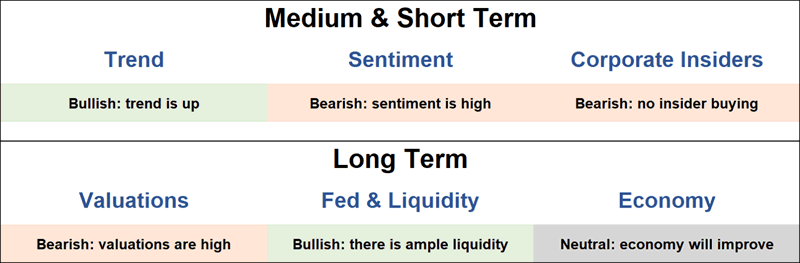

Here’s how I approach markets based on 3 different strategies & time frames.

- Short term trend followers should continue to ride the rally because no one knows exactly when it will end. If you are a short term trend follower, you must use stops.

- Medium term contrarian traders should go neither long nor short. Wait. Risk:reward doesn’t favor long positions right now, while shorting into a speculative rally can end in disaster.

- Long term investors should be highly defensive right now. This speculative bull market may last another 6 months or even 9 months, but in 2 years time, long term investors will be glad they did not buy today.

Bottomline: trend is up, but beware of mounting risks.

Let’s look at some bullish and bearish factors to consider.

Powerful breadth

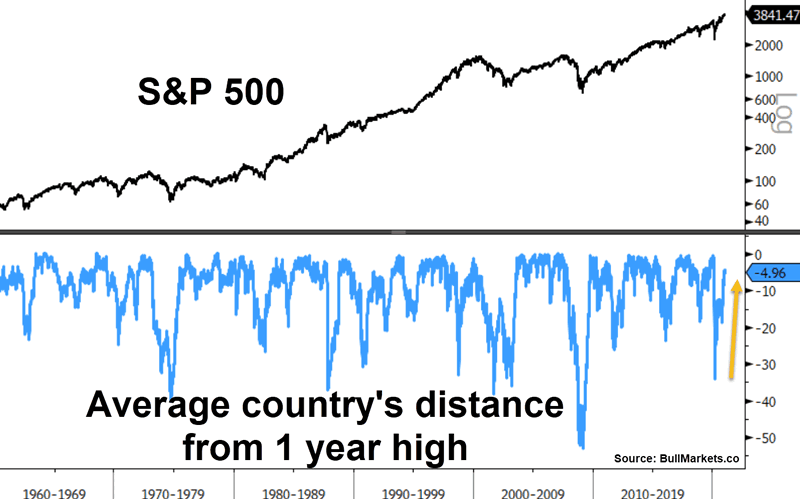

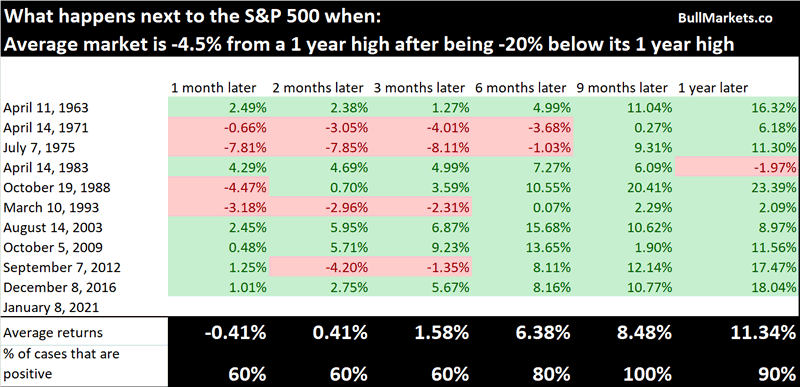

More and more stock indices are rallying around the world. The average of 23 developed countries is only -4% away from a 1 year high:

Historically, these across-the-board rallies usually saw more gains for U.S. and global stocks over the next 9 months:

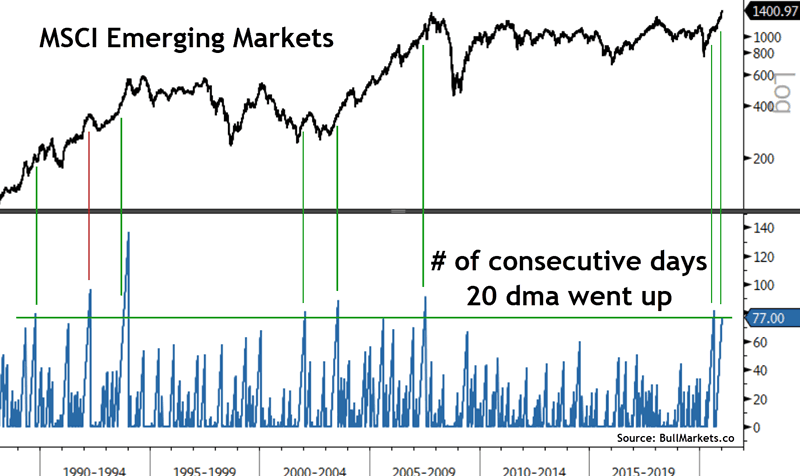

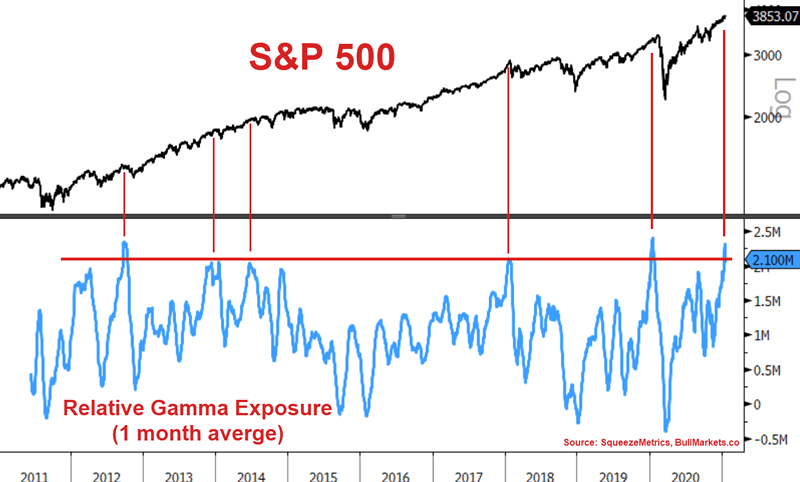

And as I noted on Wednesday, momentum is still extremely strong in emerging markets.

Such strong momentum almost always led to more gains for emerging markets over the next 3 months:

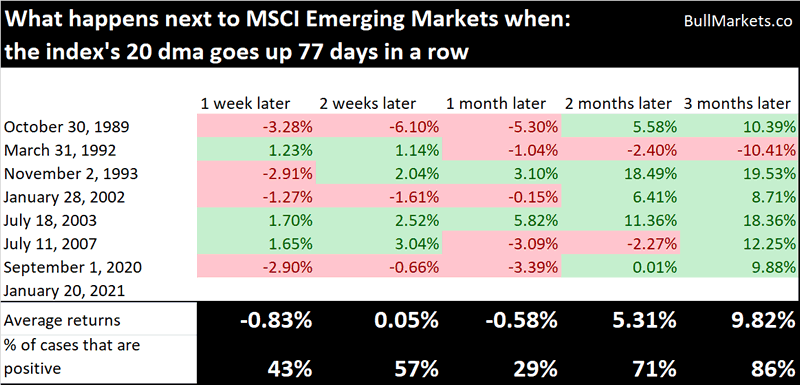

Corporate insiders

Corporate insiders continue to sell while very few insiders are buying their own stocks. The last time this happened was in 2007. Insiders were selling 6-9 months early, but when the collapse came, it was epic (2008).

The wall of money is pushing previously weak stocks like BlackBerry to multi-year highs, and insiders are using this perfect opportunity to liquidate most of their stocks. Bloomberg also reported that Asian insider selling is at its highest since 2015. The biggest sellers? Chinese healthcare insiders. Corporate insiders best exemplify “buy on the rumor, sell on the news”.

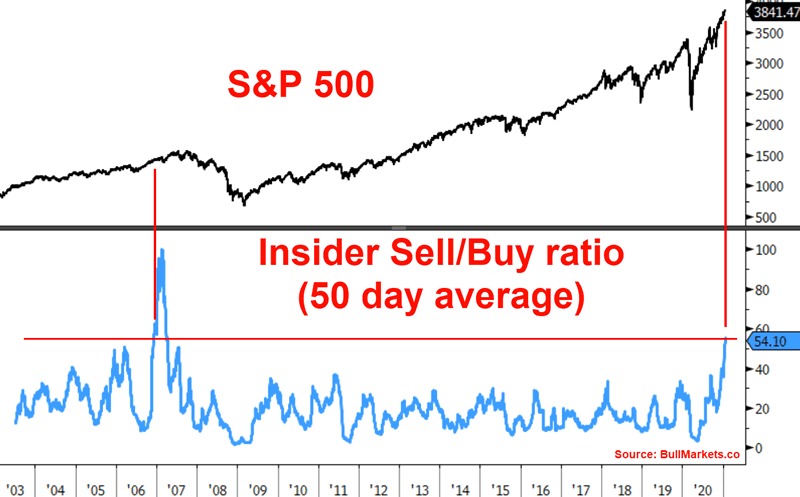

Options

As I noted on Friday, Gamma Exposure relative to the S&P 500’s value is very high. Historically, this wasn’t a good sign for stocks over the next 2-3 months:

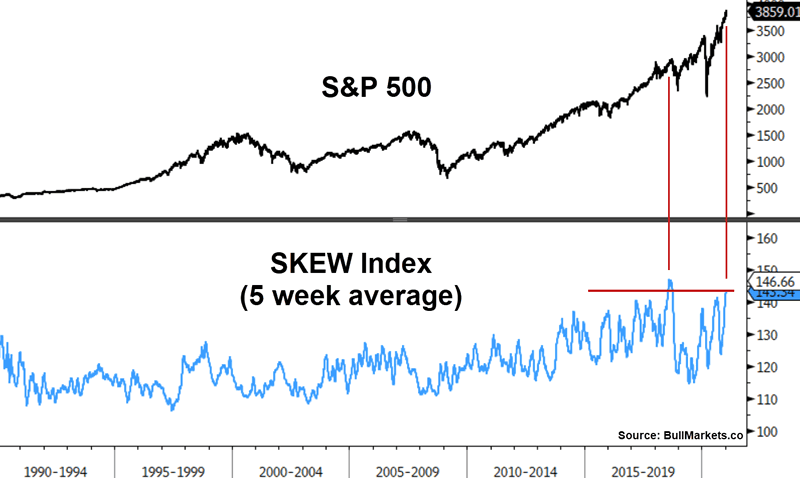

The SKEW Index’s 5 week average is at the highest level since 2018. Stocks fell in Q4 2018.

*SKEW Index is often referred to as a “black swan” gauge.

Other contrarian indicators

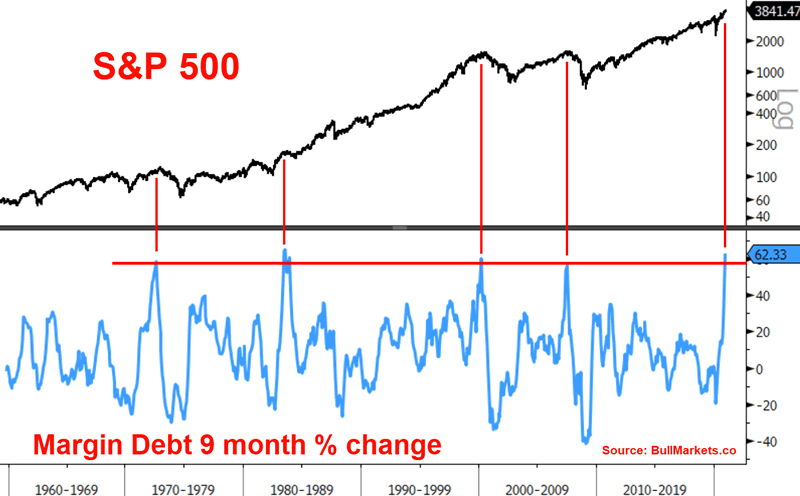

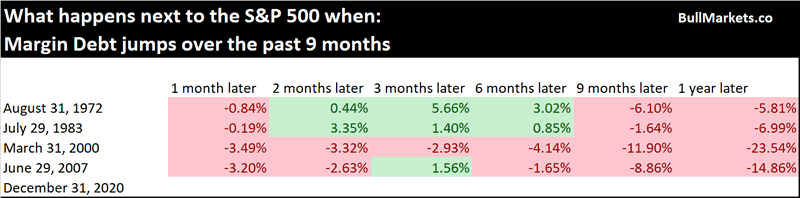

U.S. margin debt surged in the 9 months since March 2020. Such an increase was matched only 4 other times:

- August 1972: the bull market lasted another 4 months before a massive -49% bear market began.

- July 1983: a 14.3% correction that lasted a year began.

- March 2000: a multi-year bear market began (2000-2002)

- June 2007: this was close to the start of the 2007-2009 bear market

If history repeats itself, I think we’re more likely to see a prolonged 10-20% correction instead of a -50% crash. Central banks simply will not allow markets to fall significantly.

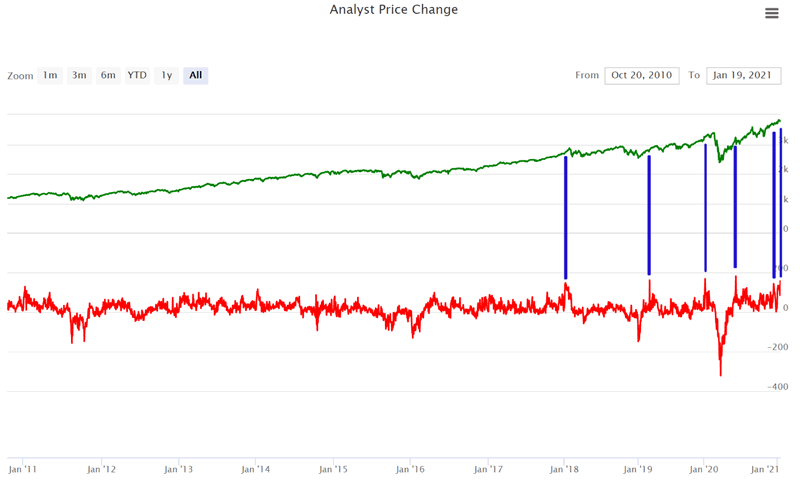

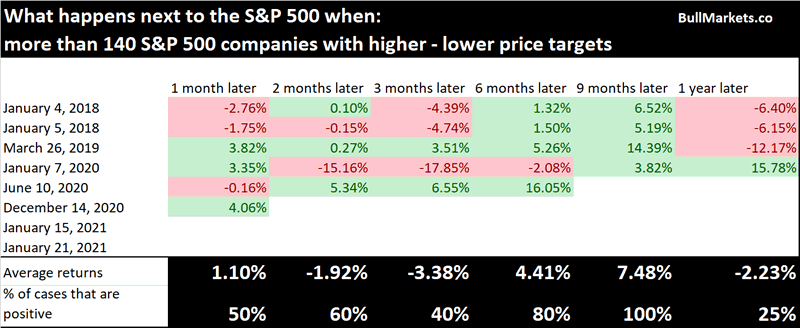

As I noted on Thursday, analysts continue to ratchet up their price targets in order to not be left behind by the market rally.

Historically, this was a minor short term worry:

Conclusion

- Long term investors should be highly defensive right now. This speculative bull market may last another 6 months or even 9 months, but in 2 years time, long term investors will be glad they did not buy today.

- Medium term traders should go neither long nor short.

- Short term trend followers should continue to ride the bull trend because no one knows exactly when it will end.

By Troy Bombardia

Copyright 2021 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.