3 Top-Performing Tech Stocks for 2021

Companies / AI Jan 26, 2021 - 11:52 AM GMTBy: Robert_Ross

Dear Reader,

One of my favorite reads to start off a new year is Byron Wien's list of 10 surprises, which he's published for 36 years.

While I could spend an entire article debating each point in his 2021 list, today I want to tackle the last part of No. 8:

"The equity market broadens out. Stocks beyond healthcare and technology participate in the rise in prices…

"Big cap tech… stocks are laggards for the year."

Big techs lagging the broad markets this year would indeed be a surprise. But I'm making the opposite bet—that tech will be the year's top-performing sector.

Today I'll tell you which stocks I believe will lead the sector… and the markets… higher.

Big Tech Is About to Get a Lot Bigger

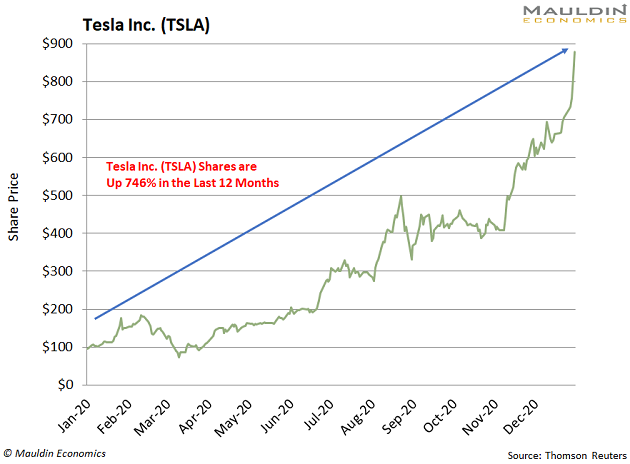

I can hear you now: “But Robert, technology stocks are so expensive! Haven’t you seen Tesla (TSLA)?”

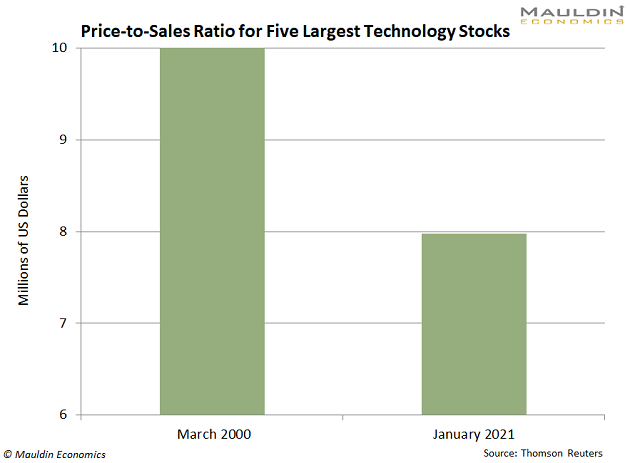

Yes, some technology stocks are overvalued. But if you compare today's tech stock prices to their March 2000 peak, they’re actually reasonably priced.

The five largest technology stocks are 20% cheaper than they were in March 2000.

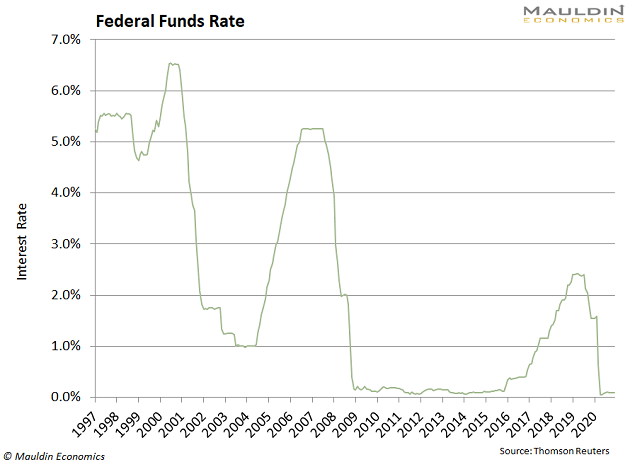

And that’s with the Federal Reserve’s easiest monetary policy in US history.

Fed to Keep Lending the Market a Helping Hand

Remember the good old days of earning 5% on a bank savings account?

The Federal Reserve’s easy money policies that push people out of “safe” investments (i.e., money market funds and bonds) and into riskier assets (i.e., stocks) ended that.

Fun fact: The Fed’s easy-money policy was not nearly this easy back in the Tech Bubble days.

That’s why—though tech stock valuations are inching closer to the highs we saw in March 2000—the historically low Fed Funds rate means valuations should be much higher than the Tech Bubble 1.0.

No Bubble Here: Smart Money Expects Techs to Pop Higher

A recent Bank of America survey showed hedge fund managers have more exposure to stocks than at any period in the last 18 months.

Analysts see more upside, too. Potentially a lot more.

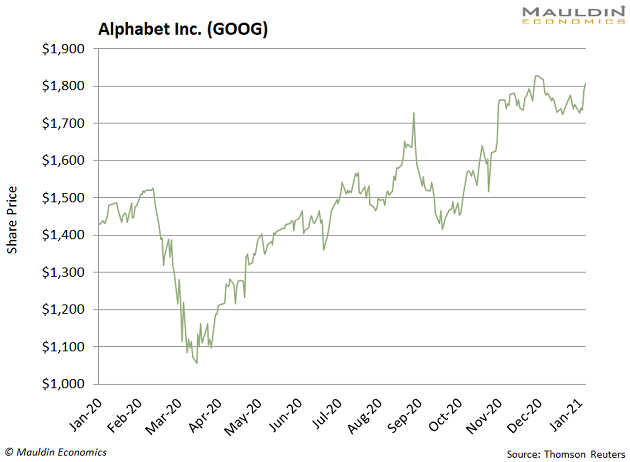

For example, Goldman Sachs just raised its price target on Alphabet (GOOG) to $2,250:

That's a pop of about 25% from its recent price of $1,797.

There are plenty of opportunities for dividend-paying tech stocks as well. One such company is Oracle (ORCL).

The IT giant generates over 80% of its sales from cloud-related products. Oracle also secured a bid to become the "trusted technology partner" of TikTok—the wildly popular social media app that’s been all over the news lately.

Oracle is a trusted name in another key way: It pays a solid 1.7% dividend yield. Plus, it earns a perfect 100/100 score on my proprietary Dividend Sustainability Index (DSI), so you can rest assured this dividend is safe.

We can say the same about a surprise technology stock: Walmart (WMT).

Don't be one of those people who don’t consider Walmart a tech company. This Bentonville, Ark., retail empire boasts the second-largest e-commerce platform in the US.

Walmart grew its e-commerce sales a massive 74% over the last year. This bests even Amazon’s (AMZN) robust 48% growth.

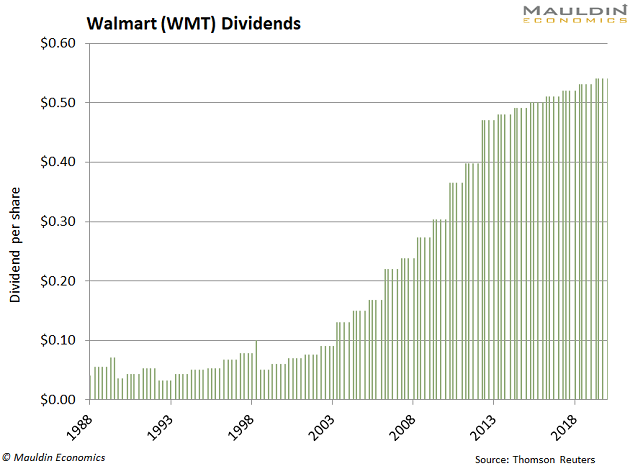

And when it comes to dividend payers, Walmart is tough to beat. This Dividend Aristocrat has raised its dividend for 31 years in a row:

The company pays a modest 1.7% dividend yield, which my DSI system tells me is safe AND set to grow over the longer term.

Bottom line: While technology stocks are on an incredible run, I think this is only just the beginning.

So, look forward to the continued outperformance of some of the world's biggest tech companies in the coming year. To see how else I'm investing, read my top three predictions for 2021 here.

Robert Ross is a senior equity analyst at Mauldin Economics. He is the editor of the income investing-focused letter Yield Shark and the free ezine The Weekly Profit.

By Robert Ross

© 2020 Copyright Robert Ross - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.