Intel Empire Fights Back with Rocket and Alder Lake!

Companies / AI Jan 24, 2021 - 04:08 PM GMTBy: Nadeem_Walayat

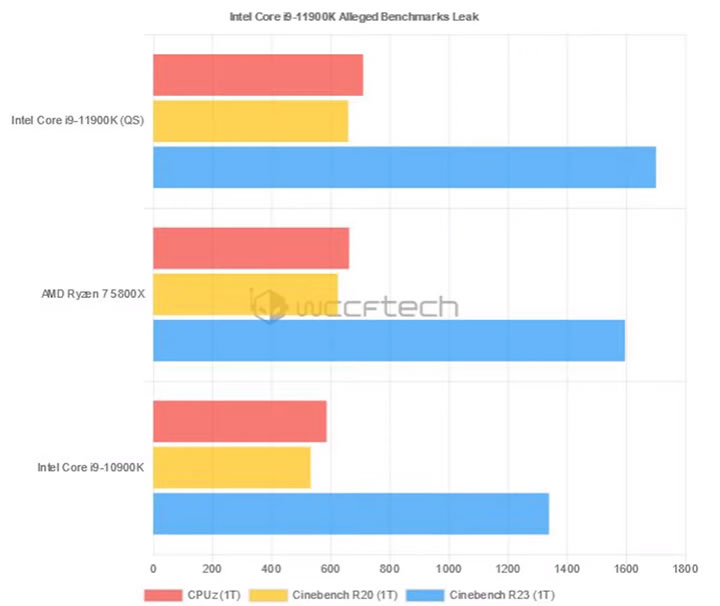

Leaked benchmarks on the performance of Intel's 11th Gen rocket lake processors due to make an appears as early as March 2020 suggest that the Intel's slide into CPU market oblivion could soon be halted on at least core basis (especially important for gaming) that deliver a 30% leap over their 10th Gen processors. And even more importantly Intel BEATS AMD's BEST processor even when overclocked, the 5950x running at 4.9ghz by about 3%! Which IS what Intel should have done with it's 10th Gen processors! Still it looks like the Intel has finally read the writing on the wall and plowed a large chunk of it's cash mountain into trying to compete against AMD, though STILL stuck on the 14nm node!

However now Intel can compete against AMD Zen 3 processors on single core performance and against AMD mid-range CPUs on multi-core i.e. the 5800x. Which means Intel has given up on trying to compete against AMD at the higher end of the market i.e. against the 5900x and 5950x, where Intel hopes to offer some competition early 2022 when 10nm 16 core Alder lake processors are expected to make an appearance, though given Intel's track record they could be delayed AGAIN, after all Intel 10nm processors were first supposed to have made an appearance during 2019!

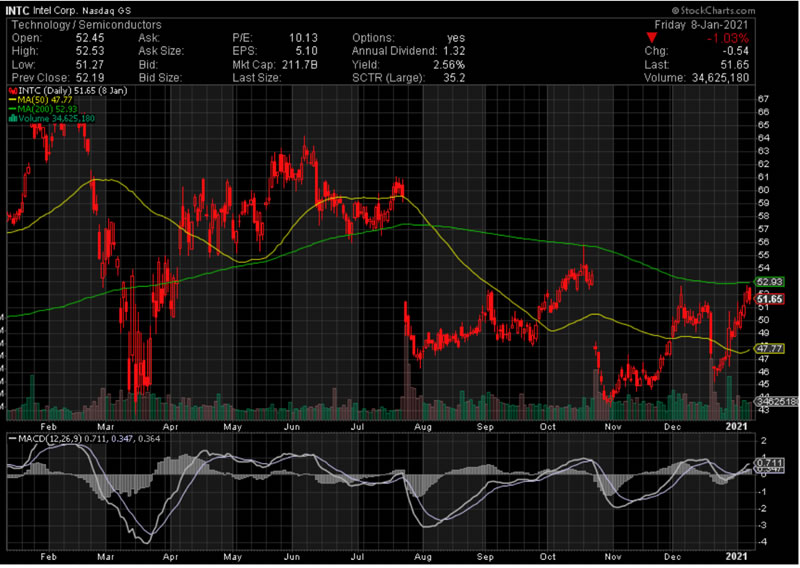

Anyway there is a glimmer of hope that Intel is starting to turn the corner and likewise the In tel stock price should rise in advance of expected Q1 good news. IF the leaked benchmarks turn out t be true.

And of course no matter how good the single core performance is, 8 core CPUs are no match for AMD's 12 core and 16 core processors in multi-core performance. So rocket lake buys Intel only a few months, with a lot of work remaining to be done in terms of Intel moving to the 10nm and then 7nm node process so as to allow for more cores. Unfortunately for Intel, AMD is working on it's Zen 4 5nm architecture that will likely make it's appearance Mid 2022 that once more looks set to obliterate the competition, which means Intel really needs to use 2021 to innovate else face the return to fast trending towards CPU market oblivion.

In a sign of who is winning the CPU wars, what would I buy today ? Rocket lake or Ryzen 5000?

It would still have be AMD given the 5950x multi-core performance, as Intel's single core advantage of about 8% is nowhere near enough to counter the 35% advantage in multi-core performance of the 5950x . Still Intel is showing that it is not quite dead yet. Now lets see Intel soon move to 10nm and then 7nm by Mid 2022 with Alder Lake, else Zen 4 will crush Intel like a bug AGAIN.

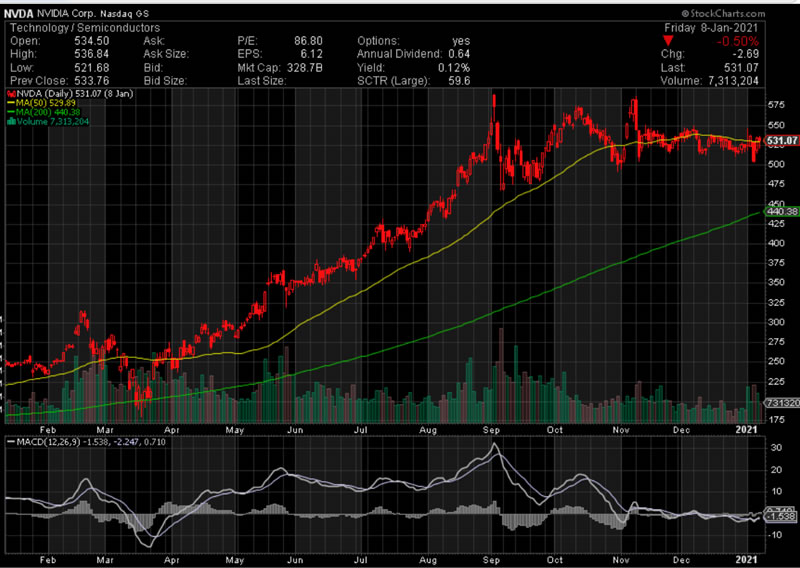

Meanwhile Nvidia is launching many more variants of it;s market conquering RTX 3000 series of GPU's including at least 3 mobile variants in attempts at seeing off the competition from AMD's 6000 series GPU's. Though given continuing extremely high demand then both Nvidia and AMD still continue to sell as many GPU's as they can physically produce. That and prices they tend to sell for continue to be well above MSRP. For instance in the UK a regular RTX 3080 will cost over £700! That's OVER $930! Whilst the more premium 3080's ship for over £900 / $1200!

(Charts courtesy of stockcharts.com)

So all those who failed to hit the buy button on Nvidia or AMD or just failed to heed my warnings of not selling out of with a view to buying back later will have to bite the bullet and buy at a high price because as things stand the prices look set get yet higher!

Microsoft

Microsoft has seen what Apple has done with it's M1 processors and so is now also set to embark down the road of producing it's own Arm based SOC's, which does not bode well for Intel or AMD, but the consequences of which are several years down the road and even then likely to be focused on Microsoft surface books as unlike Apple, Microsoft does not have any presence in the desktop hardware market. Nevertheless the market can expect Microsoft to try and replicate what Apple has done to some degree over the coming years which will be good news in the long-run for Microsoft investors.

Bottom line is the the AI tech mega-trend continues to rage and there are signs of life in Intel, so what you waiting for ? BUY INTEL! IT's CHEAP!

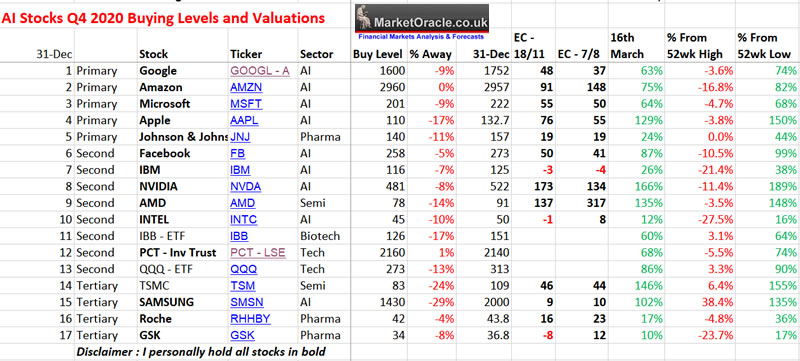

AI Stocks at End of 2020

Someone lit the fuse wire under Samsung, up 25% in just over a month! Gains down to surging demand for Memory and Nvidia GPU's. With similar performance from TSMC as they ceased discounting chip orders from Nvidia and AMD due to unprecedented demand for their services. In fact virtually all of the AI tech giants soared higher into the end of 2020.

I will update the buying levels for 2021 Q1 following a stock market trend forecast. But as things stand I am locked and loaded to buy more AI stocks on any Q1 sell off.

This article is an excerpt form the latest extensive indepth analysis that concludes in a detailed trend forecast for US house prices.

US Housing Market Trend Forecast 2021, AI Stocks and Coronavirus Pandemic Finale Catastrophe

- UK Coronavirus Catastrophe at Start of 2021

- US Coronavirus Catastrophe at Start of 2021

- US House Prices Trend Forecast Review

- The Inflation Mega-trend QE4EVER

- US House Prices Trend Forecast 2021

- General Artificial Intelligence Was BORN in 2020!

- How AI will come to rule the world

- Intel Fights Back!

- AI Stocks at Start of 2021

The whole of which was first been made available to Patrons who support my work so immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Analysis Schedule :

My analysis schedule for the rest of January and into Mid February to include:

- UK house prices trend forecast

- Stock market trend forecast for 2021

- AI stocks buying levels update

- Bitcoin price trend forecast

- US Dollar and British Pound analysis

* UK Housing Market Trend Forecast 2021

Will the UK follow the US inflationary lead or has Brexit and Covid combined to press the pause button on the UK housing bull market for 2021?

* Stock Market Trend Forecast 2021

In respect of which how did my forecast at the start of the year for 2020 fair?

31st Dec 2019 - Stock Market Trend Forecast Outlook for 2020

Dow Stock Market 2020 Outlook Forecast Conclusion

Therefore my forecast conclusion is for the Dow to target a trend to between 30,750 and 31,000 by the end of 2020. For a likely gain of 8% to 9% for the year (on the last close of 28,642).

My series of 2020 stock market analysis will seek to map out multi-month detailed trend forecasts as was the case for 2019. With the first to be completed during January, going into which my expectations are for a correction early 2020. Which given my bullish outlook implies should prove to be a buying opportunity.

Here is how the Dow trended during 2020 and where it ended the year.

* AI Stocks Buying Levels for Q1 2021

If possible before the end of January 2021, if not early February.

* Bitcoin trend forecast 2021

Last two updates forecast conclusions -

17th Sept 2019 Bitcoin Price Analysis and Trend Forecast

Forecast Conclusion

Therefore my forecast conclusion is for the Bitcoin price to hold support at $9,400 in preparations for an assault on $12k, a break of which would target a break of $14k. However if support at $9.4k fails than Bitcoin could trade down as low as $6k BEFORE heading higher.

31st March 2020 - Coronavirus Parabolic Pandemic, Bitcoin Price Trend Forecast

Forecast Conclusion

My forecast conclusion is for the Bitcoin price to mark time by trading down to as low as $7,500 before basing for a run higher to resistance of $10,500 that 'should' break to propel the Bitcoin price towards the next resistance level of $12,000. Thus the bitcoin price could drift lower for the next couple of months or so before resuming a bullish trend as illustrated by this chart.

Your analyst wishing all my Patrons a happy and prosperous covid free 2021

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.