US Coronavirus Pandemic Final Catastrophe 2021

Politics / Pandemic Jan 15, 2021 - 12:35 PM GMTBy: Nadeem_Walayat

Hope you had a great start to 2021, 2020 the year of the Pandemic has finally coming to an end. However the chinese virus is not done with reeking havoc on the worlds population, at least in western nations with their ageing populations that for the likes of Italy stand at an average age of 45 against developing nations such as Pakistan with an average age of just 22 years which at least goes some way to explain why the covid crisis is just not as bad as it is in the West. Though India with an average age of 26 seems to be suffering that bit more than Pakistan is so this anomaly could be down to -

a. A weaker strain of the virus.

b. Less testing so most patients with covid are unrecorded much as was the case in the West during the March / April first wave of the chinese virus.

This article is an excerpt form the latest extensive analysis that concludes in a detailed trend forecast for US house prices.

US Housing Market Trend Forecast 2021, AI Stocks and Coronavirus Pandemic Finale Catastrophe

- UK Coronavirus Catastrophe at Start of 2021

- US Coronavirus Catastrophe at Start of 2021

- US House Prices Trend Forecast Review

- The Inflation Mega-trend QE4EVER

- US House Prices Trend Forecast 2021

- General Artificial Intelligence Was BORN in 2020!

- How AI will come to rule the world

- Intel Fights Back!

- AI Stocks at Start of 2021

The whole of which was first been made available to Patrons who support my work so immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Nevertheless the virus is not quite done yet with the West as my warnings of to expect worse 2nd and third waves starting in August and right into early October are materialising with a vengeance. And where the primary reasoning behind this outcome boils down to GROSS NEGLIENCE AND INCOMPETENCE! On the one hand we have literally MAD SCIENTISTS encouraging the likes of herd immunity, EVEN as late as September 2020, as what's her name the so called Cambridge University Professor could be seen babbling on the likes of Channel 4 news encouraging non action, IGNORANT of the facts that the virus was starting to pick up speed as millions of Brit's returned from their summer holidays soaking up the virus on Portuguese and Spanish beeches that seeded the virus across the UK the price for which would be paid in terms of 2nd and then third worse winter waves. Clearly the scientists advising the government had been WAITING for the Pandemic for decades so that they could now bask the light of media attention, many of whom of gone on to become media whores, household names! These mad baskets have literally had their wish come true!

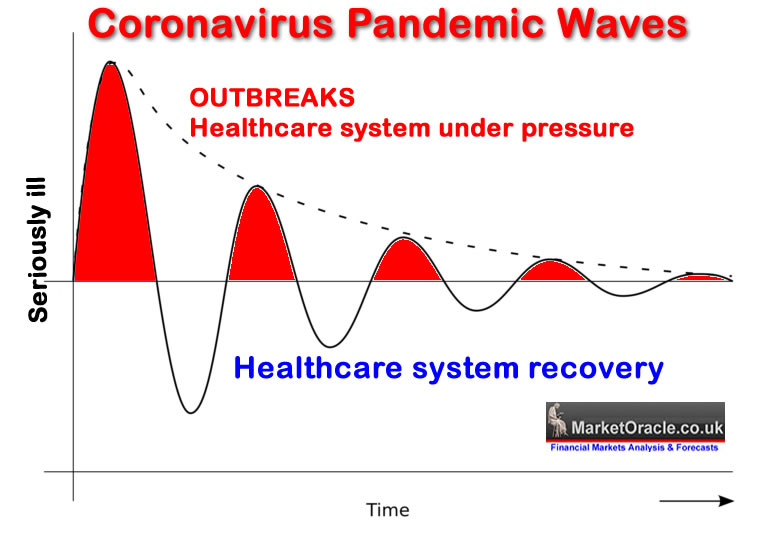

Then we have the negligent stick their heads in the sand governments, who would rather not read the writing on the wall until it was too late! With hospitals filling up in their brim and the number of deaths doubling every couple of weeks. So the warned of WORSE Second AND Third waves were INEVITABLE. Even if this is not how the Pandemic should have played out if the government and healthcare sectors response had been competent as my graph from Mid March illustrates that each successive peak was supposed to diminish in severity with each subsequent wave of the virus.

The logic being that increased intelligence on the virus should result in a more efficient healthcare response, that and gradually the more people that became infected and immune or died from the virus then there would be less scope for the virus to spread with each successive wave. However, I clearly gave too much competency to the government and it's self serving mad scientists hence where we stand today at the start of 2021 with the virus literally going on an out of control rampage.

US CoronaVirus Pandemic 2021

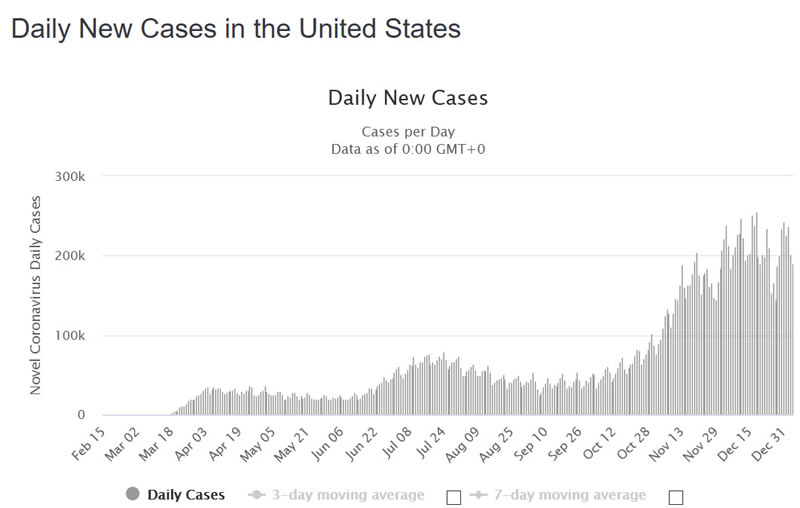

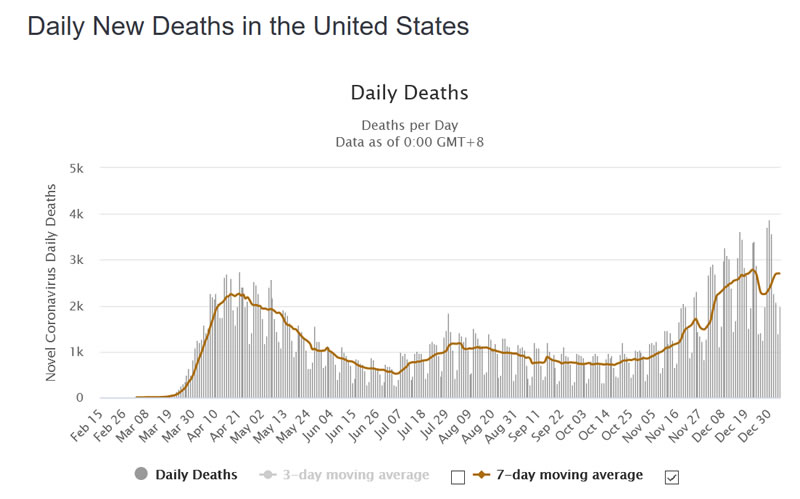

As per my warnings every US pandemic Wave has turned out to be higher than the one before. US death toll now stands at over 350,000, well above the worse case scenario of 250,000 that was being touted during the height of the first wave.

Even worse for the US is that there does not appear to have been much of a dip before the US heads into it's fourth wave that could see the US hit testing capacity constraints with actual positive tests far exceeding testing capacity as was the case during the first wave.

To illustrate the loss of control of the pandemic the number of daily deaths has far exceeded the first wave, this despite increased intelligence and treatments.

With far worse to come for the US as the 'London' strain spreads and becomes dominant. Therefore the US death toll is likely to double once more to pass 700,000 before the end of 2021.

Warp Speed Vaccine Development fails to Delivery shots into peoples arms.

The US vaccination program was supposed to have delivered 20 million vaccinations into peoples arms by the end of 2020. Unfortunately the actual rate of vaccination is running at about 15% of that expected and needed to cope with the pandemic, especially as the London strain of the virus has started to make an appearance across US states which the US is not prepared for the consequences of as was the case for the UK. The US is perhaps 4 weeks behind in terms of the catastrophic consequences of the second more virulent strain starting to become the dominant strain. Valuable time that an inept and incompetent US government response looks set to waste due to failure to contain the virus outbreaks and in terms of ramping up vaccinations.

Despite achieving delivery of over 20 million doses to date, the US only vaccinating 3 million people represents an abysmal failure on a criminal scale that WILL cost many thousands of lives! Valuable time has been wasted. At the current pace of vaccination the US is only likely to have vaccinated about 10 million people by the end of January, instead of a target of 50 million which will be just at a time when the 2nd strain becomes dominant.

All of which continues to confirm that the US as is the case with the UK could see the current horrific death toll of 350,000 DOUBLE to over 700,000 during 2021!

So the coming worse covid storm is likely go have economic consequences where the question remains to be seen if the stock market reacts to immediate term economic pain or continues to discount the end of the pandemic which will be the focus of my forthcoming stock market trend forecast for 2021.

UPDATE - The number of US daily covid deaths now exceeds 4000 as the US explodes into it's fourth higher covid peak prompting vaccine centres to now vaccinate anyone who walks through their doors given the slow roll out of the vaccines that currently numbers just 6.2 million doses administered against a target of about 30 million.

![]()

The US needs to vaccinate some 50 million people for respite from the pandemic to take effect. At the current pace of vaccinations then the US could achieved this target by the end of February 2021 which would be accompanied with a sharp drop in hospitalisations and deaths during March and thus an easing to the pandemic restrictions during March. So the US could be as little as 2 months away from returning to some semblance of normality.

Meanwhile Trump supporters egged on by the President stormed the Reichstag! Democrats started their Impeachment process in attempts at preventing Trump from being able to stand for office again. Twitter permanently suspends Trump as we count down to the end of Trump the politician as the establishment effectively seeks to exclude 50% of the US electorate i.e. all those who voted for Trump which does not bode well for social cohesion.

At the end of the day silencing Trump and hundreds of thousands of others amounts to ending freedom of speech in the US. So it's not Trump but the Democrats who are behaving in a totalitarian manner! Trump was an amateur compared to the likes of Nancy Pelosi and Chuck Schumer, democracy is dieing in the US if this is the response to those one does not agree with.

Another sign of the drift towards totalitarianism in the US and UK is the silencing of all those who criticise the vaccines i.e. the anti-vaxers. Whilst I don't agree with their point of view nevertheless they should be heard and NOT silenced, for instance I recall some of my Vitamin D videos being deleted by youtube in March because they went against that which the medical establishment was spouting at the time, only for them to turn on a dime some 6 months later which illustrates the consequences of internet censorship underway as who knows, there could be some truth in what the anti-vaxers are saying which is busy being deleted by the tech giants as it goes against the wishes of Big Pharma and the politicians in their pockets.

At the end of the day the Covid crisis is just the current phase of the ongoing FINANCIAL CRISIS that has NOT ENDED! The evidence for which is staring you in the face when you look at the balance sheets of the Federal Reserve Bank and Bank of England etc, and the exponentially expanding public debt mountains. Where my response to which has remained consistent which is to leverage oneself to MONEY PRINTING INFLATION by holding assets that cannot be easily printed. I had my wake up call following the 1987 Crash that saw the Fed soon inflate stock prices back to their pre crash highs, all whilst the perma fools continued with their mantra of the Dow heading to the 1930's low of 40. I hope all of you reading this are also fully awake to the consequences of the money printing inflation mega-trend!

South African Strain

And then there is the nightmare scenario of the South African strain that has 3 significant mutations compared to the London strains. Which means that the vaccines are going to prove less potent against the SA strain, which I am sure much testing is underway to quantify but at this time my best guess is for a 50% response of the vaccines instead of 90%. However on the plus side it appears that the vaccines can be adjusted to counter the SA variant as well as other strains that definitely will materialise over the coming months.

This article was an excerpt form the latest extensive analysis that concludes in a detailed trend forecast for US house prices.

US Housing Market Trend Forecast 2021, AI Stocks and Coronavirus Pandemic Finale Catastrophe

- UK Coronavirus Catastrophe at Start of 2021

- US Coronavirus Catastrophe at Start of 2021

- US House Prices Trend Forecast Review

- The Inflation Mega-trend QE4EVER

- US House Prices Trend Forecast 2021

- General Artificial Intelligence Was BORN in 2020!

- How AI will come to rule the world

- Intel Fights Back!

- AI Stocks at Start of 2021

The whole of which was first been made available to Patrons who support my work so immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Analysis Schedule :

My analysis schedule for the rest of January and into Mid February to include:

- UK house prices trend forecast

- Stock market trend forecast for 2021

- AI stocks buying levels update

- Bitcoin price trend forecast

- US Dollar and British Pound analysis

* UK Housing Market Trend Forecast 2021

Will the UK follow the US inflationary lead or has Brexit and Covid combined to press the pause button on the UK housing bull market for 2021?

* Stock Market Trend Forecast 2021

In respect of which how did my forecast at the start of the year for 2020 fair?

31st Dec 2019 - Stock Market Trend Forecast Outlook for 2020

Dow Stock Market 2020 Outlook Forecast Conclusion

Therefore my forecast conclusion is for the Dow to target a trend to between 30,750 and 31,000 by the end of 2020. For a likely gain of 8% to 9% for the year (on the last close of 28,642).

My series of 2020 stock market analysis will seek to map out multi-month detailed trend forecasts as was the case for 2019. With the first to be completed during January, going into which my expectations are for a correction early 2020. Which given my bullish outlook implies should prove to be a buying opportunity.

Here is how the Dow trended during 2020 and where it ended the year.

* AI Stocks Buying Levels for Q1 2021

If possible before the end of January 2021, if not early February.

* Bitcoin trend forecast 2021

Last two updates forecast conclusions -

17th Sept 2019 Bitcoin Price Analysis and Trend Forecast

Forecast Conclusion

Therefore my forecast conclusion is for the Bitcoin price to hold support at $9,400 in preparations for an assault on $12k, a break of which would target a break of $14k. However if support at $9.4k fails than Bitcoin could trade down as low as $6k BEFORE heading higher.

31st March 2020 - Coronavirus Parabolic Pandemic, Bitcoin Price Trend Forecast

Forecast Conclusion

My forecast conclusion is for the Bitcoin price to mark time by trading down to as low as $7,500 before basing for a run higher to resistance of $10,500 that 'should' break to propel the Bitcoin price towards the next resistance level of $12,000. Thus the bitcoin price could drift lower for the next couple of months or so before resuming a bullish trend as illustrated by this chart.

Your analyst wishing all my Patrons a happy and prosperous covid free 2021

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.