Who is Buying and Selling Stocks in 2021

Stock-Markets / Stock Market 2021 Jan 08, 2021 - 01:30 PM GMTBy: Troy_Bombardia

I wish you a happy and prosperous New Year. May 2021 bring you and your family good health and success.

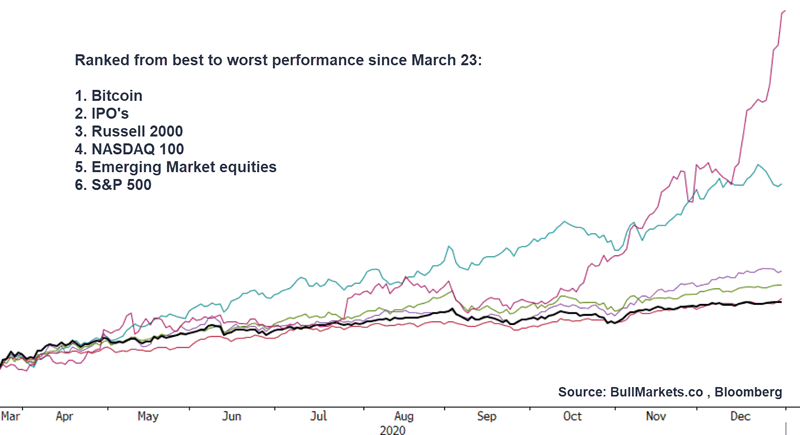

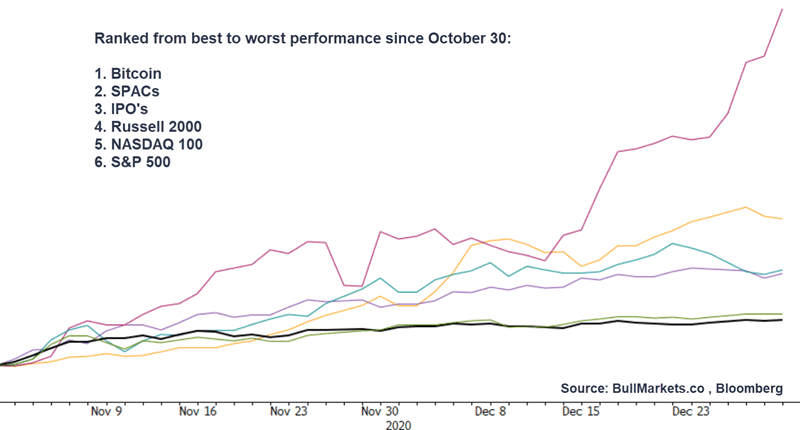

Looking back, 2020 was a year that few will forget. From a markets point of view, it was a year in which “dumb money” (traders who chase trends) was the smart money. Global central bank intervention caused a “wall of money” to flow from one asset to another, resulting in a year when “everything went up”.

Market participants can notice a dangerous trend over the past 2 months. The riskier an asset is and the less intrinsic value it has, the better the asset has performed since November. Moreover, this “wall of money” is not infinite, and is flowing into assets with smaller market caps.

Summary

Here’s my market outlook based on 3 different time frames:

- Long term investors should be highly defensive right now. The bubble may last another 6 months or even 9 months, but in 2 years time, long term investors will be glad they did not buy today.

- Medium term traders should go neither long nor short. Wait. Risk:reward doesn’t favor long positions right now, while shorting into a bubble can end in disaster.

- Short term trend followers should continue to ride the bull wave because no one knows exactly when it will end. In a “bubble”, the most profitable traders are short term trend followers who trade markets with strong animal spirits. Animal spirits generate strong uptrends and downtrends. If you are a short term trend follower, you must have tight stops.

Explanation

Several important factors suggest that we’ll see a significant correction in 2021. At the same time, I do not think we’ll get a 2000-2002 or 2007-2009 bear market.

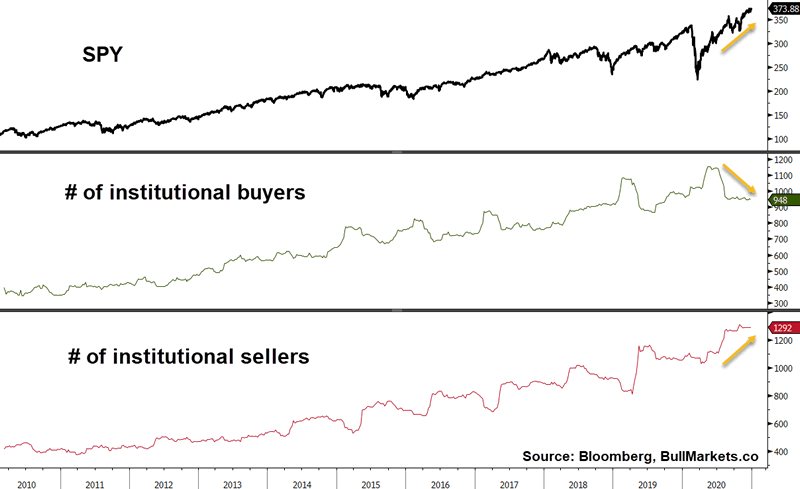

Who’s buying?

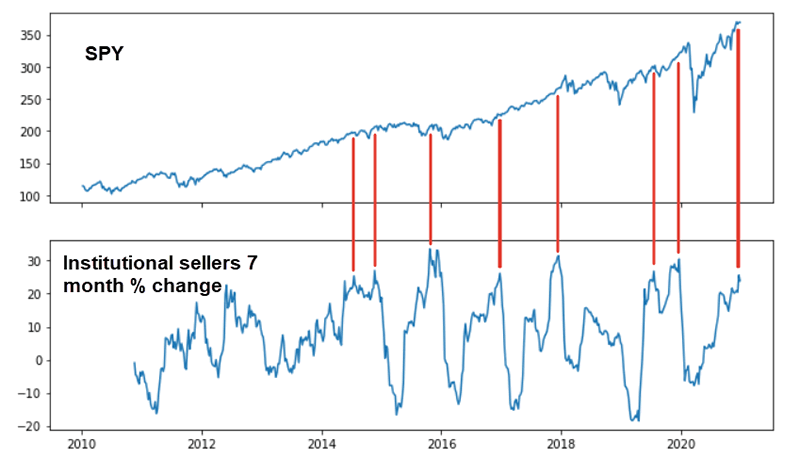

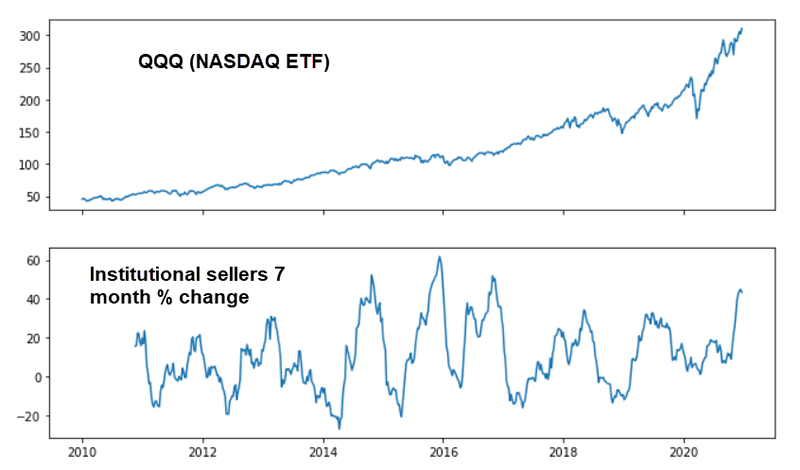

Not institutions. The # of institutional buyers for SPY (S&P 500 ETF) has fallen significantly in the past half year while the # of institutional sellers has risen significantly.

Institutional sellers can sell early, so this is more of a risk for February and March 2021.

Similarly, the # of institutional sellers in QQQ (NASDAQ ETF) surged:

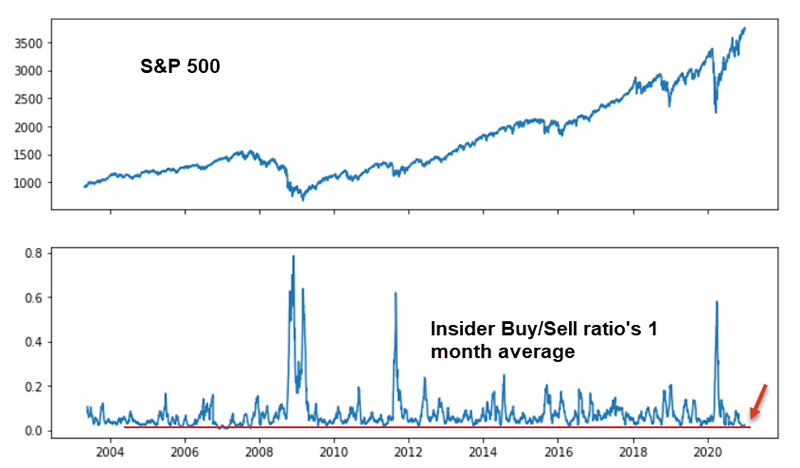

Insiders aren’t buying either. Our Insider Buy/Sell ratio’s 1 month average remains in the bottom 4 percentile of all readings.

This is a bearish reading.

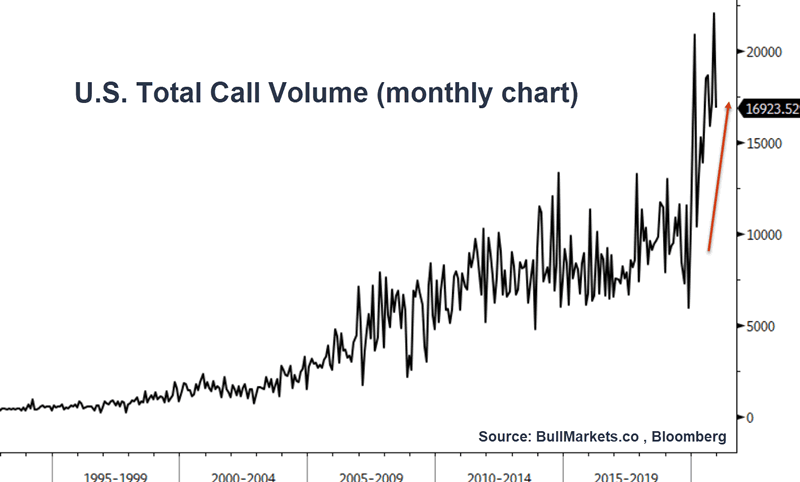

Record call buying

So who is buying? A lot of retail money. Call volume surged in 2020:

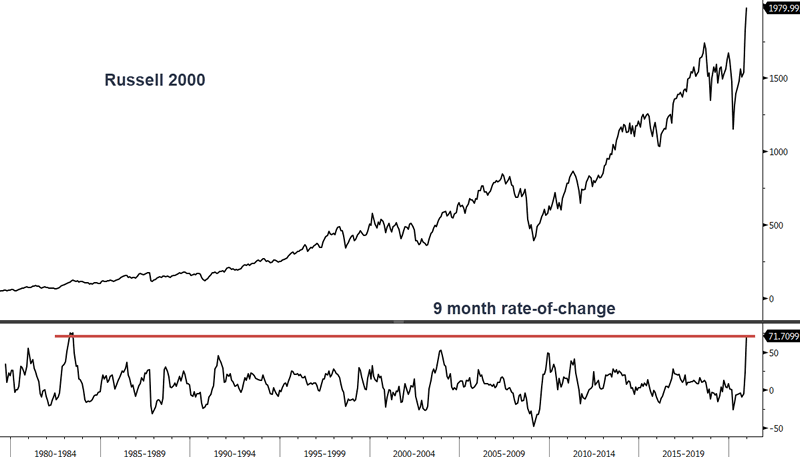

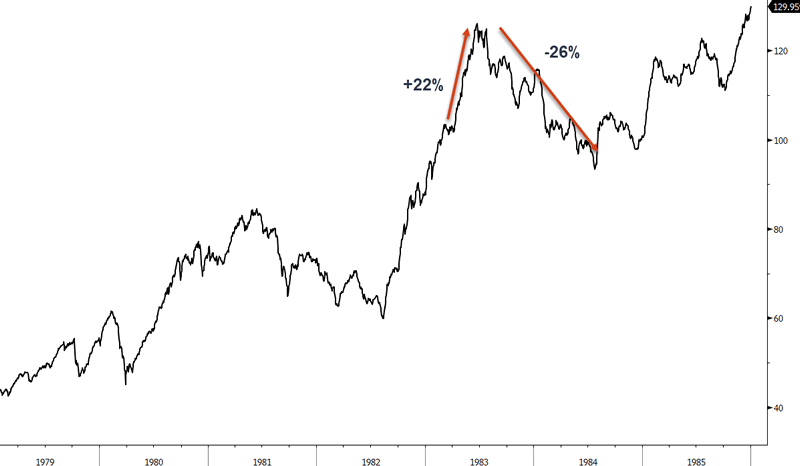

Biggest small caps rally in almost 40 years

The Q4 catchup in small cap stocks pushed the Russell 2000’s 9 month rate-of-change to its 2nd highest level ever:

The last time this happened was in 1983. Back then, the Russell surged another 22% before completely giving back all gains. This is why going long and short right now is dangerous, unless you do so with a short term trend following strategy. Shorts can face serious losses if the euphoria extends further. Longs will face serious losses when the euphoria eventually bursts.

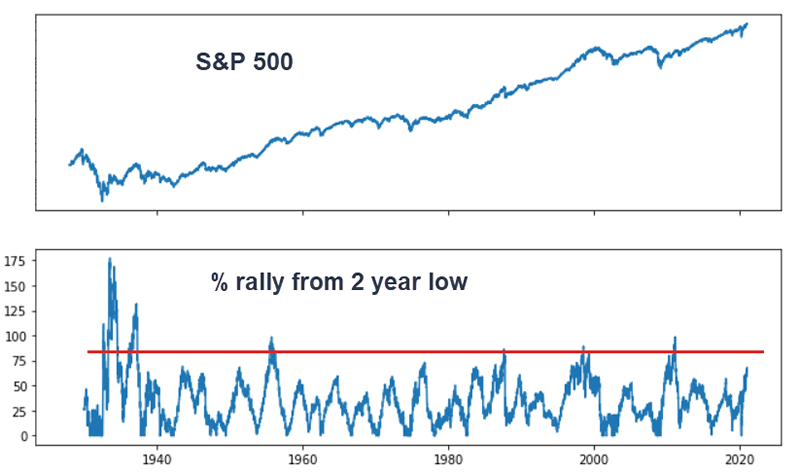

2 year rally

The S&P is now up 67% from a multi-year bottom. As I noted earlier this month, “dangerous territory” is when the S&P rallies 75% from a 2 year bottom. That’s 4% higher from where the S&P is today (3915).

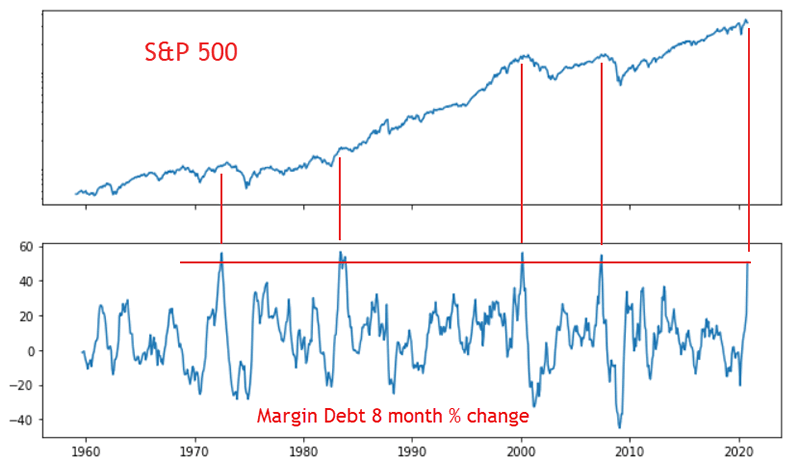

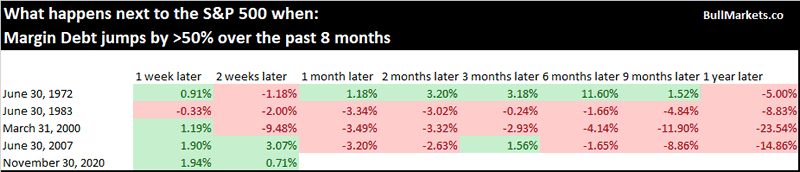

Surging margin debt

The stock market’s massive rally has been accompanied by surging margin debt, which jumped over 50% in the past 8 months (since March 2020 bottom).

All historical cases of such aggressive positioning occurred near 1-2 year market tops. This happened near the start of the 1973-1974, 2000-2002, and 2007-2009 bear markets. The June 1983 historical case was followed by a 1 year-long stock market correction:

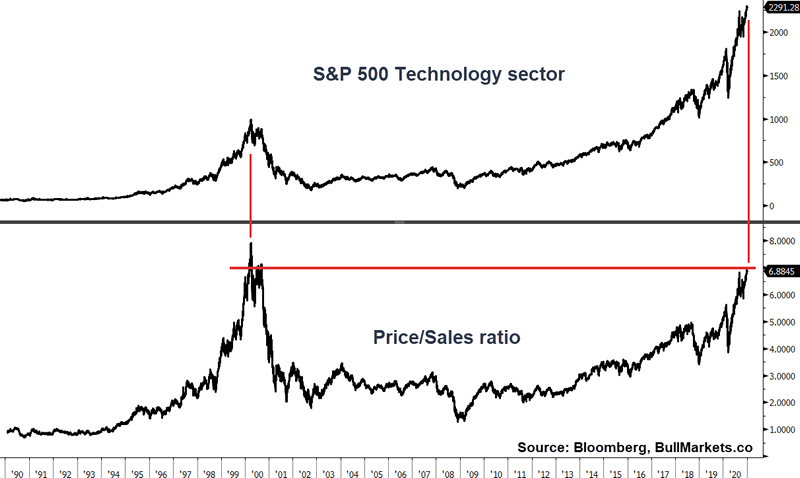

Tech valuations

Valuations are elevated, particularly in the tech sector. Price/Sales ratio is near 2000 levels. This doesn’t mean that we are doomed with a 2000-2002 crash. It just means that tech investors need to be careful in 2021. History doesn’t repeat, but it does rhyme:

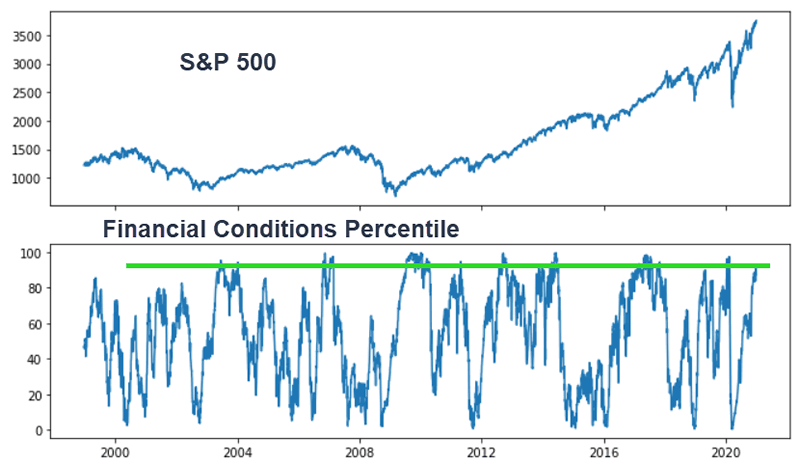

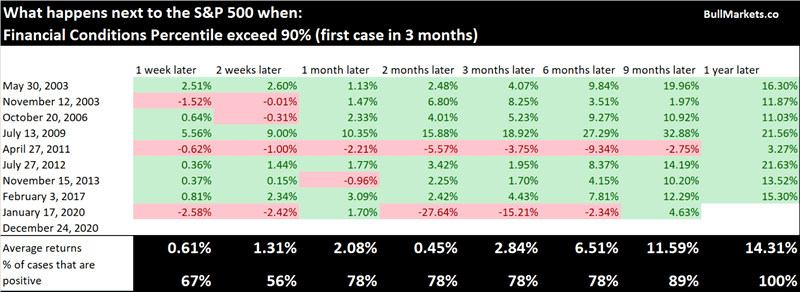

Financial Conditions

On the bullish side of things, financial conditions are improving. The Fed’s massive intervention has caused practically every financial conditions-related indicator to improve. I took 5 financial conditions indicators (from Bloomberg, Chicago Fed, Citi, Westpac Goldman Sachs), calculated where each indicator was compared to its 1 year range, and averaged the 5 indicators.

When financial conditions were this loose and improving in the past, the S&P pushed higher in the next year. This is a bullish reading.

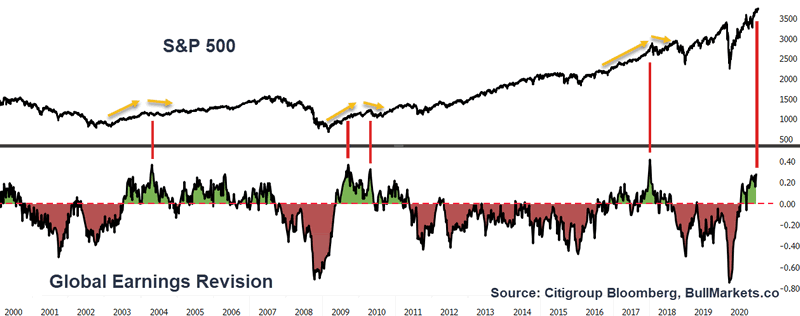

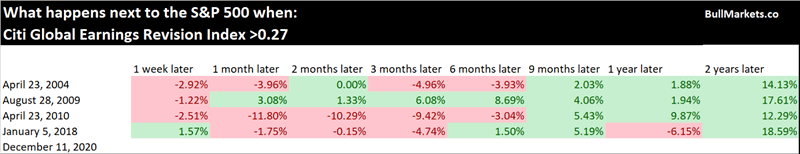

However, it’s important to remember that the 2nd year after a bear market bottom is usually when problems begin because markets are forward looking (buy on the rumor, sell on the news). Corporate earnings are sharply revised upwards:

This happened after the 2003 bull market start and the 2009 bull market start. Keep in mind that stocks performed much worse in 2004 and 2010 (2nd year of the bull market).

Conclusion

- 2021 will be a dangerous year for long term investors (2+ years time frame).

- Medium term traders should remain defensive in Q1 2021.

- Short term trend followers should remain long but heed their stops when the market does eventually correct.

In a time of off-the-charts speculation, you may decide to put less emphasis on research, analysis, and indicators. “This time” is always somewhat different. But one thing must always remain: common sense. Ask yourself this. If making money was this easy (just buy the riskiest asset you can find!), wouldn’t everyone be making 100% every year? And if getting rich was that easy, wouldn’t everyone in the world become rich?

That is not how the world has ever worked. Becoming rich and keeping yopur wealth is never easy because it involves adequate risk management. Investors should place more emphasis on protecting their portfolios in 2021.

Thank you for reading this market report and Happy New Year! If you enjoyed it, please subscribe below and share. Email me at contact@bullmarkets.co if you have any questions.

By Troy Bombardia

Copyright 2019 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.