Stock Market Congestion Top Forming?

Stock-Markets / Stock Markets 2020 Dec 28, 2020 - 11:16 AM GMTBy: Andre_Gratian

Current Position of the Market

SPX Long-term trend: There is some good evidence that we are still in the bull market which started in 2009, and which could continue into the first quarter of 2021 before coming to an end.

SPX Intermediate trend: New intermediate uptrend underway since 2234.

Analysis of the short-term trend is done daily with the help of hourly charts. They are important adjuncts to the analysis of daily and weekly charts which determine longer market trends.

Daily market analysis of the short-term trend is reserved for subscribers. If you would like to sign up for a FREE 2-week trial period of daily comments, please let me know at anvi1962@cableone.net

Congestion Top Forming?

Cycles: Looking ahead! 90-yr cycle – last low: 1932. Next low: 2022

7-yr cycle – last low: 2016. Next low: 2023

Market Analysis (Charts courtesy of QCharts

SPX-IWM weekly charts

There are two indexes which regularly give us advance warning of a market top. One is IWM and the other is TRAN. They both have an excellent track records but currently, they are out of sync with each other! TRAN is warning of an imminent top while IWM is still exhibiting relative strength to SPX. This could be because TRAN is more reflective of the DJIA’s action which has been sluggish. We’ll soon know which of the two is correct but even if we are due for a correction, worst case scenario would be an intermediate top.

SPX daily chart

After making a new all-time high in mid-November, SPX has continued to advance, but reluctantly, forming a wedge pattern which has settled into a trading range over the past two weeks. The parameters of the diagonal are marked by the two converging heavy lines. The lower line was breached on Monday, but a rebound averted more immediate selling.

Since we are in the vicinity of a cycle which has regularly defined a top every 40 calendar days, it is unlikely that we can remain afloat much longer. If this indeed proves to be a wedge pattern, any decline starting from here could continue down to the level where the diagonal started or, in this case, 3485. This would be normal market action and the decline could be rapid – also normal market action after an ending diagonal – and it would take the index down to the dashed red line, corresponding to an exact 50% retracement of the move from 3234.

All that sounds reasonable! Perhaps too much so. Therefore, let’s keep it in the back of our minds and see what the market actually does. Enough congestion has already formed to give us a P&F count down to that level. In fact, there may be enough for a move down to 3420. This is why I don’t want to opt for anyting specific right now.

Needless to say, a move beyond 3725 would negate this entire formation, or at least delay its implication.

SPX hourly chart

I like to find relevant trend lines down to the micro level, and this is what I have done on the hourly chart, below. This identifies near-term patterns which can give the trader an early warning that the index is beginning to move out of a consolidation. I will simply point out a couple of them in this chart:

First, the sideways move of the past few days has brought the moving averages that I use into close-proximity, and during the last three days, SPX has been rotating in a narrow range around the 9-hr MA and 50-hr MA. About 15 points below, the 200-hr MA provided support for the last short-term low. If the index should fall below the 200-MA, it would undoubtedly mark the start of the anticipated correction. A warning would come sooner if the index broke below the trend line cluster coalescing around 3670. At the same time, the three oscillators would most likely go negative, suggesting that a sell signal had been given. A confirmation would follow with a move below 3630.

- UUP (dollar ETF) WKLY ($USD chart not available from this data provider)

- UUP has found temporary support on its long-term channel line and held for the past week. It does not show on the weekly chart, but the daily chart oscillators may be about to give a buy signal, which would suggest that UUP could rebound from this level.

-

- GLD (gold)-WKLY

- GLD has rallied across the width of its consolidation channel but does not look willing to push through right away. This means that more consolidation is needed before it resumes its uptrend.

-

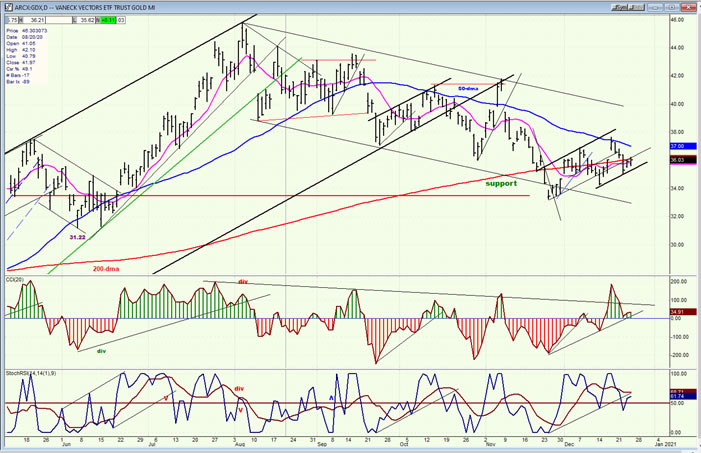

- GDX (gold miners)-DLY

- GDX is also hesitating after a bounce from its low. Until it has a clear break-out above its 50-dma, it should continue to consolidate.

-

- SIL (silver)-WKLY

- Like GLD, SIL rebounded and stopped at the top of its correction channel. It will probably need more consolidation before moving out of it to resume its uptrend.

-

- PAAS (Pan American Silver Corp-DLY)

- PAAS may have gone as far as it can for now and will need more consolidation, especially if there is a retracement in stock prices.

-

- BNO (U.S. Brent Oil fund)

- BNO has started a small consolidation pattern which could extend down to the dashed line support before it can continue its uptrend. The short-term projection remains 14+.

-

- SUMMARY

- SPX has now built a significant congestion pattern at its recent high which is more likely to be short-term distribution than re-accumulation. It should not take too long before we find out which it is.

Andre

NOTE: You may now view our new website at https://marketurningpoints.com

FREE TRIAL SUBSCRIPTON

For a FREE 4-week trial, send an email to anvi1962@cableone.net, or go to www.marketurningpoints.com and click on "subscribe". There, you will also find subscription options, payment plans, weekly newsletters, and general information. By clicking on "Free Newsletter" you can get a preview of the latest newsletter which is normally posted on Sunday afternoon (unless it happens to be a 3-day weekend, in which case it could be posted on Monday).

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.