Google and Amazon, Top 10 AI Tech Stocks Buying Levels Analysis

Companies / AI Dec 27, 2020 - 06:17 PM GMTBy: Nadeem_Walayat

This is a continuation of my in-depth analysis into the buying levels for the Top 10 AI stocks to ride the electron mega-trend the whole of which was first made available to Patrons who support my work so immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month.

- US Presidential Election 2020 Forecast Review

- Seeing Stock Market New Highs Through the Prism of AI

- Stock Market Dow Quick Take

- AI Stocks Buying Levels and EC ratio Explained

- Top 10 AI Stocks individual analysis i.e. for Google, Amazon, Apple etc.

- AI Stocks Buying Levels Q4 2020

- The Next IMMINENT Global Catastrophe After Coronavirus

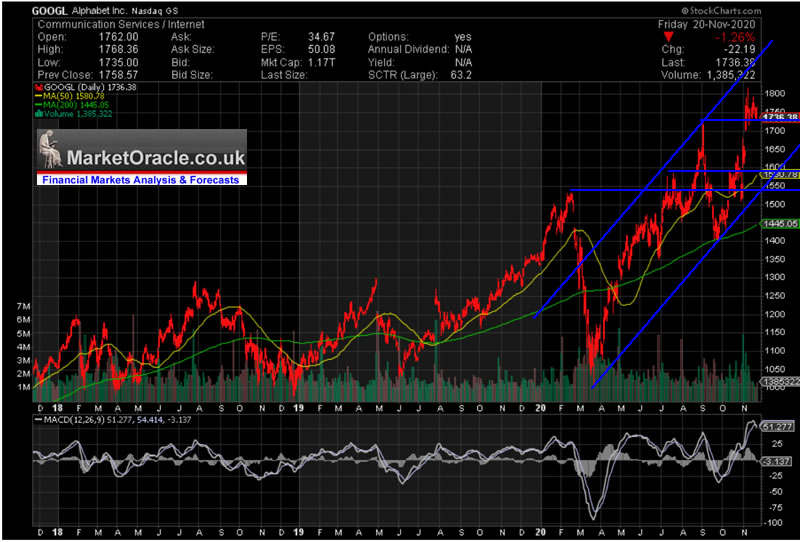

1. Google (Alphabet) $1742

The key thing about primary stocks is that we don't want them to give us shocks and surprises instead we want them to gradually trundle along their exponential trends so basically all we should be concerned with is whenever an opportunity occurs to add to holdings as was the case during the March pandemic panic crash.

So Google is primary because it is SAFE, it does not warrant much attention as long as the valuations remain sensible in which respect Google is a tad bit more expensive today than in my last update, trading on an EC of 48 (37), though still within it's accumulate range. So on the EC metric Google remains in it's BUY zone.

A safe trillion dollar corporation that is up by over 70% on it's March low makes you wonder why people waste their time gambling on penny stocks, the next big thing that usually turn out to be a flop when safe stocks such as Google deliver such gains without much long-term risk.

Google delivered it's buying opportunity late September, so if you were looking to buy but failed to act to pull that trigger when Google traded down to $1400 then you only have yourself to blame!

Google's break above it's previous high of $1530 is propelling the stock towards the next major milestone / resistance area of $2,000 as Google continues to trade within it's post pandemic crash channel. Currently retreating from the upper end of the channel and eyeing filling the gap at $1675. In terms of the lowest Google could trade down to during a correction then $1600 is possible which would thus be Google's next achievable buying level.

2. Amazon $3099

Amazon had soared into the stratosphere, literally doubling in price from its March low, breaking above $3400 early July putting Amazon on an eye watering EC level of 148, prompting me to sell over 50% of my holdings which I flagged ahead of time in the comments, following which Amazon did correct down to $2900 though not to anywhere near it's buying level of $2525. Following which Amazon did manage to break to a new high of $3552, but again it was not able to hold the levels due very high valuations which currently has Amazon trading down to $3099 and it looks like I'm not the only one who thought Amazon had become a bit too expensive as Jeff Bezos sold another $3 billion of Amazon stock early November bringing his total sales for 2020 to $10 billion.

(Charts courtesy of stockcharts.com)

Clearly the Amazon stock price has been marking time as valuations play catchup, in respect of which the current EC for Amazon is 91, which is huge improvement on 148 and which implies that downside should be very limited and thus Amazon now warrants a higher buying level.

Amazon is in a converging triangle with the resolution likely to be to the upside. Though I doubt we are going to see the Amazon stock run higher at it's earlier pace of going from $1700 to $3400, Instead a gradually rising trading range is more likely. In terms of a buying level, the best the chart implies is $2960. i.e Amazon has rising support from $2871 to $2950. So in a best case scenario for buyers is a fleeting dip into this area that could be possible if not probable. So unlike Google, I am not seeing much downside for Amazon, at best 4% off the last close.

Top AI Tech Stocks Buying Levels and Valuations Analysis

The rest of this analysis has first been made available to Patrons who support my work so immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

AI Stocks Portfolio Buying Levels Q4 2020 Analysis

- US Presidential Election 2020 Forecast Review

- Seeing Stock Market New Highs Through the Prism of AI

- Stock Market Dow Quick Take

- AI Stocks Buying Levels and EC ratio Explained

- Top 10 AI Stocks individual analysis i.e. for Google, Amazon, Apple etc.

- AI Stocks Buying Levels Q4 2020

- The Next IMMINENT Global Catastrophe After Coronavirus

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.