Global Speculation Gone Amok - Stocks Buffett Indicator and Bitcoin

Stock-Markets / Financial Markets 2020 Dec 22, 2020 - 06:06 PM GMTBy: The_Gold_Report

Sector expert Michael Ballanger employs the Buffett Indicator and Bitcoin in his latest analysis of the precious metals markets.

"Gambling is a venture without calculation; speculation is a venture with calculation." — Dickson G. Watts

Being a self-professed speculator in the junior mining space for the past forty-odd years, I used to include that quote in every client letter and in every research piece as a means of reminding readers that the art of speculation involves weighing many different but converging data points. That quote was the brainchild of Dickson G. Watts, an exceedingly successful speculator from the late 1800s and former president of the New York Cotton Exchange, whose book "Speculation as a Fine Art and Thoughts on Life" is a must-read for anyone involved in the financial markets.

With today's credit markets trading on the razor's edge of leverage, never has there been a greater need for us to understand a number of critical realities: 1) that the credit markets are the ultimate arbiter of valuation and risk and stocks merely follow; and 2) that historical measurements used to carry predictive value have today been rendered ineffective due to central bank interventions.

With today's credit markets trading on the razor's edge of leverage, never has there been a greater need for us to understand a number of critical realities: 1) that the credit markets are the ultimate arbiter of valuation and risk and stocks merely follow; and 2) that historical measurements used to carry predictive value have today been rendered ineffective due to central bank interventions.

For the past two decades, global central banks have been trying desperately to stay ahead of this tsunami of debt growing closer and closer in the rear-view mirror as it gathers momentum. Each time it threatens to scuttle the ship, they put on a burst of "QE" or "REPO" or "stimulus measures," always in response to a real or imagined crisis, the nature of which is never allowed to go to waste.

In 2000, it was the dotcom bubble's pop that set the financial industry back on its heels and the globe into recession, until a crisis called 9/11 allowed the central banks to save the day with interventions. Then it was shoddy lending practices fueled by banker avarice that led to another crisis, this time in the banking industry, which they called "The Great Financial Crisis," resulting in yet another massive injection of counterfeit money aimed directly at the retained earnings and bonus pools of the major banks.

Ten years later, with the debt monster snapping its fangs at our backsides, there arrives yet another crisis, the magical creation of a global health crisis, whose arrival came so conveniently after the U.S. Fed did a Michael Jackson pirouette and went from "balance sheet normalization" to "balance sheet AB-normalization" (liquidity injections), as if it were no more important than changing one's sheets.

Fast forward to December 2020. Half of North America is now in a second full lockdown; these genius politicians have just shut down the Great Toronto Area in the heart of the Christmas shopping season. The downtown core of Toronto is already a ghost town with the seasonal office parties (formerly called "Christmas" parties, but that term is now politically incorrect and, in fact, against the law) a remnant of past celebrations. Heck, you can't even do the liquid lunch routine anymore because the politicians have determined that you might breathe on someone, despite your blood alcohol level destroying every microbe in its wake.

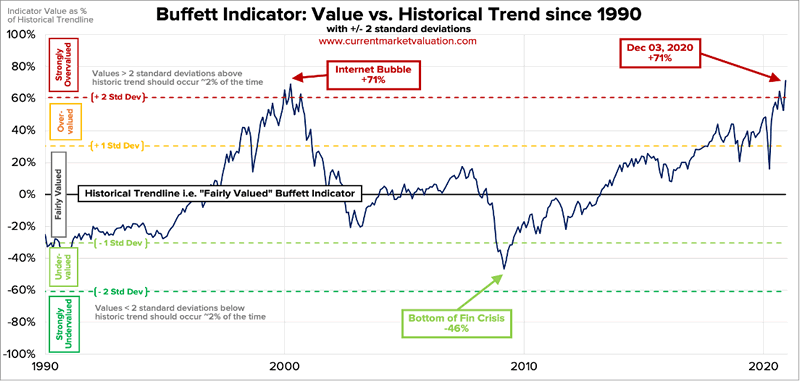

The chart above is the legendary "Buffett Indicator," which compares market capitalization of the securities markets with gross domestic product (GDP), and it is a glaring study in crowd psychology, central bank interference and investor apathy. It also dovetails perfectly with the title of this missive: this is, indeed, global speculation gone amok, where the word "amok" describes "a murderously frenzied state."

If you think that I am perhaps overreacting and that "amok" unfairly characterizes the state of the capital markets, consider this: Over US$18 trillion, or 27%, of the world's investment-grade debt is yielding less than zero (meaning "negative"). Over a quarter of all investment-grade debt now forces the bondholder to pay the issuer to own them! "Murderously frenzied" is the only way to describe the thought process of anyone owning these pieces of toxic excrement.

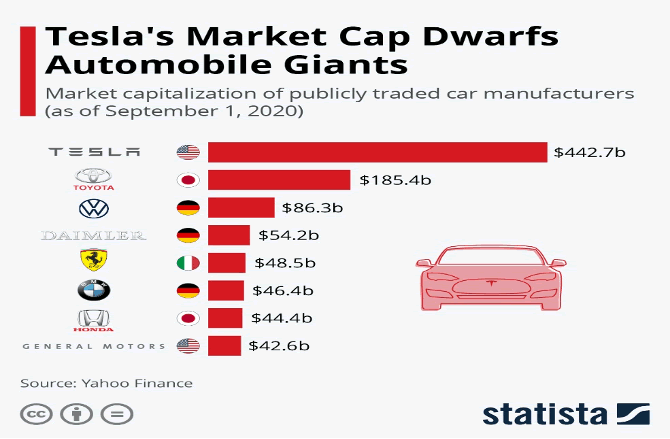

And then there is Tesla Inc. (TSLA:NASDAQ). Observe this next graphic. As you gaze upon the magistery of momentum chasing, does it appear logical to assume that in the latest 12-month period, Tesla's 400,000 sold vehicles earned its ascent to the Throne of Market Cap Royalty, when Toyota Motor Corp. (TM:NYSE) sold 10,500,000 vehicles in the same time period? Tesla is valued at 2.39 times the value of Toyota, which most surely must have executives at the Japanese automaker scrambling for the tanto knives.

Lest one assumes that I have been vaping with copious quantities of Elmer's glue, I must confess that the kids in the control room of the global intervention initiative are doing a marvelous job of maintaining the elevation of all asset classes deemed to represent bank collateral. Whether it is commercial or residential real estate, stocks, corporate bonds or empty shopping malls and skyscrapers, coordinated interventions have made damn sure that these assets underpinning the bank balance sheets hold their "marks." It is like the great Michael Lewis book, "The Big Short," where Goldman Sachs called the shorts against the housing market "unchanged" even as evictions and defaults were everywhere. (Only when Goldman had dumped their positions and joined the short parade did they start calling a proper market.)

To wit, there was a rumor that the owners in Toronto were considering demolishing the Rogers Centre and replacing it with condominiums, office and retail space, but when you really think through that, it would be the only way that the "mark" for an empty baseball and football stadium could be maintained. The number "CA$5 billion" is only relevant if someone is willing to pay that amount, versus what someone would pay in a forced sale scenario.

Now, the point I am trying to get across here is that if you look at the assets that the banks do not have as collateral against loans, first and foremost are gold and silver and the miners. In the past four months, real estate investment trusts, junk bonds (usually issued by companies engaged in share repurchase programs) and copper (big in electric automobile technology and housing)—all closely correlated with bank collateral—have been on a tear. Gold and silver—considered to be a banker's mortal enemies and considered kryptonite to the Central Bank Ponzi initiatives—have all been orchestrated lower by way of their exclusion from the pool of bids designated for bank collateral courtesy of the "Stimulus Programs" conjured up by central bankers and politicians the world over.

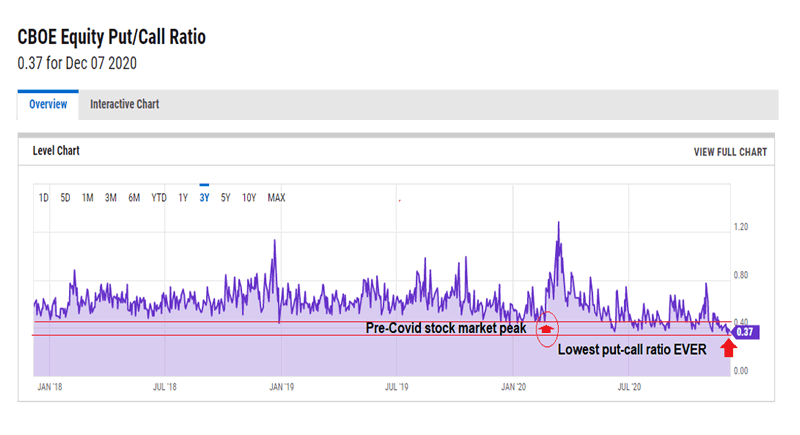

Before I swing around the year-end prognostications for the precious metals, I wish to put up two more charts. The first one is the CBOE (Chicago Board Options Exchange) Put/Call Ratio; the second is a four-year chart comparing Bitcoin to the S&P 500. I must have had two hundred or more emails asking my opinion of Bitcoin, and if there is one crumb of wisdom I have retained after forty years it is this: If you do not have the answer to a question, do not try to "wing it." So, I will reserve judgement on the merits of owning Bitcoin, but I will offer as fact the following:

- Bitcoin and the S&P 500 are almost perfect correlated. They track one another and it stands to reason that excessive speculation in the stock market will be accompanied by excessive speculation in Bitcoin.

- The CBOE Put/Call Ratio is at the lowest level ever (not a typo—ever). When the ratio of puts being bought to calls being bought drops to an extreme, it is a sign of excessive bullishness and is normally associated with a top in equity prices.

If I revert back to the commutative properties of arithmetic, I know that if A = B and B = C, then A = C, right? If the CBOE Put/Call Ratio is flashing a "sell" signal for stocks, and if the S&P 500 and Bitcoin are almost perfectly correlated, then the CBOE Put/Call Ratio is flashing a "sell" signal for Bitcoin.

Furthermore, if it was the torrid performances of stocks and Bitcoin that stole the thunder from the precious metals since early August, then the inverse correlation between the precious metals (PMs) and stocks/Bitcoin suggests that the former is due to advance and the latter is due to decline. Again, all based upon the CBOE Put/Call Ratio being at all-time record lows.

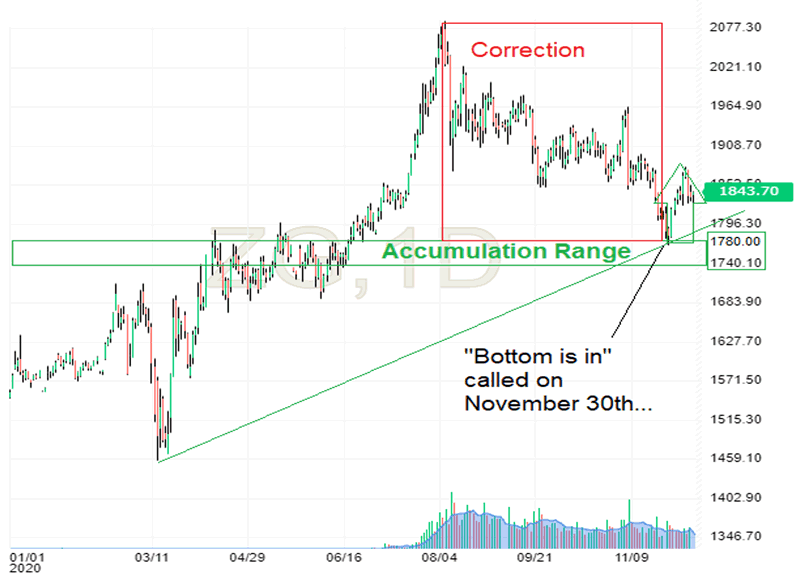

To conclude this week's longwinded dissertation, since the lows I called on Nov. 30 at around $1,767/ounce Au, gold has advanced around $75/ounce, so purchases made on that day are now marginally higher but still resisting the forces of tax-loss selling and portfolio rebalancing. This choppiness can continue right into the New Year, but I suspect that the big rally may begin after Boxing Day. In the interim, US$1,740–1,780 should be a safe entry level for gold and around US$23.50/ounce for silver.

I will continue to accumulate the names in the GGMA 2020 portfolio (e-mail me at miningjunkie216@outlook.com if you want more info) as I continue to look out to 2021 with great anticipation. Remember that any time someone tries to tell you that stocks and Bitcoin will continue to ignore fundamentals and keep on rising forever because "the Fed's got our backs," tell them that fundamentals never matter until they do matter, and then they crash.

Follow Michael Ballanger on Twitter ;@MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver Ltd., Great Bear Resources, Western Uranium, Stakeholder Gold, Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. My firm no longer does consulting work for Stakeholder Gold.. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium and Aftermath. Please click here for more information. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of Getchell Gold, Western Uranium and Stakeholder Gold and Aftermath, companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.