Central Banks Throwing Trillions to Save Burning Banks

Commodities / Gold & Silver Oct 15, 2008 - 09:27 AM GMT Sean Brodrick writes: If the Central Banks were our kids, we'd be taking their credit cards away. They are spending us into the poor house!

Sean Brodrick writes: If the Central Banks were our kids, we'd be taking their credit cards away. They are spending us into the poor house!

Sure, Wall Street is at the rotten root of this crisis. Their toxic debt is poisoning the global economy and financial system. But there's plenty of blame to go around.

On Monday morning, I just about choked on my coffee when I read the latest announcement from the Federal Reserve. They bluntly stated that the sky's the limit on how much money banks can borrow. And other central banks, including the Bank of England, European Central Bank, Swiss National Bank and Bank of Japan are joining in to basically give away money. The Fed said …

Counterparties in these operations will be able to borrow any amount they wish against the appropriate collateral in each jurisdiction. Accordingly, sizes of the reciprocal currency arrangements (swap lines) between the Federal Reserve and the BoE, the ECB, and the SNB will be increased to accommodate whatever quantity of U.S. dollar funding is demanded.

That's right, no limit! It's like the Central Bankers are running a casino, and the big banks — the same jokers who blew it all on toxic debt — are being given endless lines of credit to keep on gambling.

Many investors think that the worst is over. Maybe so … if we're really lucky. On the other hand …

- Fannie and Freddie just committed to wasting $40 billion a month in taxpayer money buying up toxic debt. Each agency is going to buy $20 billion a month in mostly subprime, Alt-A, and non-performing prime mortgage securities. This is in addition to the $700 billion bailout plan.

- On the other side of the Atlantic, European governments are putting $2.3 trillion on the line in guarantees and other emergency measures to save their banks.

- The Fed is vastly expanding swap agreements with other banks to push dollars into the global system. What began last December as a $24-billion arrangement between the Fed, the ECB and Swiss central bank was boosted over the past year to $620 billion, expanded to other countries, and now they say the sky's the limit!

Do these sound like the actions of Central Banks that think the worst is over?!

It makes you wonder just how big that $700-billion bailout package will be, now that they've expanded it from buying toxic debt to buying preferred shares in banks.

All this new spending is in addition to the $1.8 trillion in total government bailout money since the financial crisis started that I told you about 3 weeks ago .

And still, there's one thing that all this spending is good for — higher prices in precious metals.

Maybe we won't get those higher prices right away, because investors are scared of deflation. And I'm not ruling that out in the short-term as the global financial crisis continues to unfold.

|

On the other hand, throwing trillions and trillions of dollars at the system is inherently inflationary. I'm not saying the government shouldn't bail out the banks in one form or another. Central Banks around the world are throwing everything AND the kitchen sink at the markets in a desperate bid to stop the sell-off caused by the global credit crisis.

However, I think we're going to regret the “squirt money at the problem through a firehouse” approach, because that money they're flooding into the system belongs to you and me.

I mean, let's say that the bailout firehose dries up soon and we end up spending “only” $2 trillion. That's over $6,550 for every man, woman and child in America — on top of the already staggering national debt.

Inflation means your dollars will be worth less. And if the value of the dollar goes down, the value of gold, which is priced in dollars, usually goes up.

Pressure Is Already Building Up In The System!

|

Take a look at the adjusted monetary base of the U.S. You can see that it is exploding higher.

Now, this isn't just the Fed's handiwork. Investors around the globe are fleeing risk. They're liquidating everything and running toward cash. Overseas markets sell off, domestic markets sell off, and capital moves into T-Bills.

All this cash has to go somewhere, and I think comparatively rare gold — you can't make it in a printing press — is going to soak up that liquidity.

There is approximately $2 trillion of gold available for sale.

And there is $15 trillion in U.S. stock markets, about $54 trillion in U.S. credit markets, and trillions more in assets throughout the world.

Meanwhile, the fundamentals for gold continue to look good. Here are some forces I haven't mentioned recently …

Global gold reserves in the ground are being mined out. They are declining by 70 million ounces a year — a rate that far outstrips new discoveries and significantly contributes to the growing scarcity of the metal.

Gold mine production continues to fall. Gold supply from mines keeps going down year after year — down 13% in 2005, 7.5% in 2006, and 3% in 2007, according to World Gold Council data. The cost of mining gold keeps rising, making miners think twice about smaller projects, and the credit crisis is already forcing some gold explorers to shut down. This could really crimp future supply.

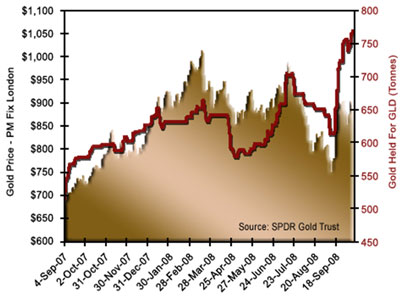

Gold ETFs continue to load up. While I did mention this one recently, ETFs have snapped up even more gold since then!

The leading gold ETF, the SPDR Gold Trust (GLD), has seen its assets soar to over 24.7 million ounces. And all gold ETFs tracked by the World Gold Council now hold 29.9 million ounces.

|

It used to be that ounces in the GLD and the price of gold moved in tandem. Now, the price of gold is flat to down, and the GLD and other gold ETFs are adding more gold furiously.

This is a disconnect, and it could be corrected by gold roaring higher.

So, while gold prices might go lower for a little bit more, probably not much lower and not much more. The Federal Reserve and Central Banks around the world are flooding the system with your hard-earned tax dollars, and the politicians in Washington are in no hurry to cut up their credit cards.

All those dollars have to go somewhere. The credit crisis, a bubble-icious monetary base and rock-hard fundamentals all point to higher gold prices longer-term.

Yours for trading profits,

Sean

P.S. Just yesterday, I released my new report, “Your Golden Parachute for 2009,” which will tell you exactly how to use powerful investments to play the gold move to the hilt. And you can download your copy right now.

My exclusive special report, plus a minimum of four follow-ups over the course of the year, is just $199. Order now and you'll get …

![]() My analysis of the forces driving precious metals higher .

My analysis of the forces driving precious metals higher .

![]() My top 7 picks for gold, and my top 2 picks for the coming silver boom.

My top 7 picks for gold, and my top 2 picks for the coming silver boom.

![]() Plus, one investment you absolutely want to avoid!

Plus, one investment you absolutely want to avoid!

Are profits guaranteed? Of course not. As with any investment, you CAN lose money. But I'm convinced each of my picks is loaded with value on the launch pad.

Don't wait. Get your copy now by calling 1-800-291-8545. Just say you want “Your Golden Parachute for 2009,” plus all my follow-up reports on all my picks. Or, order online here .

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.