Dow Stock Market Trend Analysis

Stock-Markets / Stock Markets 2020 Nov 25, 2020 - 06:36 PM GMTBy: Nadeem_Walayat

THE STOCK MARKET BIG PICTURE

The starting point for this analysis is to remind my Patrons of the BIG PICTURE, the general trend trajectory for AI stocks as illustrated by my following concluding graph from June 2020. (Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!)

Which would roughly convert into the Dow trading at 100k by the Late 2030's.

THAT IS THE BIG PICTURE!

So the primary objective is to KEEP CALM AND REMAIN INVESTED IN AI STOCKS, a message I have been iterating since soon after the Dow bottomed in March 2009 (Stealth Bull Market Follows Stocks Bear Market Bottom at Dow 6,470)

"The greater the deviation from the bull market high then the greater the buying opportunity being presented"

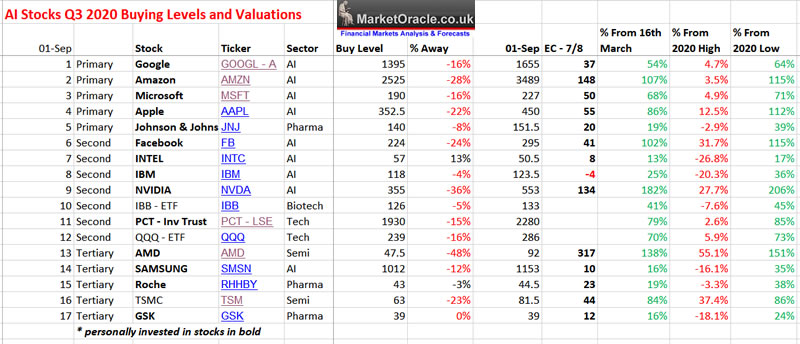

At my last AI stocks update many stocks had run way ahead of valuations on my EC metric, for instance Amazon was trading at $3300 on an EC ratio of 148 (objective is to buy Amazon at levels below 100). Of course the revenues and profit bonanza from the lockdown's and the work from home demand surge should ensure that most AI stocks see their EC levels moderate as earnings reports come in, especially for the likes of Amazon and AMD which is literally on FIRE! KILLING Intel and now also giving Nvidia a run for its money! AMD is definitely NOT a stock that any investor should contemplate selling out of regardless of how high it trades because this stock is literally on FIRE!

I will update the AI stocks buying levels in due course, but just a reminder to be aware of the big picture and not get lost in short-term noise that is the the US presidential election is, and which ever way the stocks trend over the next couple of months which are unlikely to deviate much to the downside against the bull market highs given the fundamentals of the AI Mega-trend.

Note this analysis is part 2 of 3 of in-depth analysis that concludes in a detailed trend forecast for the stock market into January 2021.Stock Market Trend Forecast into End December 2020, Final Election Forecast Matrix

- Stock Market Big Picture

- Dow Short-term Analysis

- Dow Long-term Trend Analysis

- VIX Analysis

- 2020 vs 2016 and 2012

- ELLIOTT WAVES

- Seasonal Trend / Election Cycle

- Dow Stock Market Trend Forecast Conclusion

- US Presidential Election Forecast Matrix Final Update

- AI Stocks - AMD is Killing Intel

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Also gain access to my latest analysis (AI Stocks Portfolio Buying Levels Q4 2020 Analysis) that covers:

- US Presidential Election 2020 Forecast Review

- Seeing Stock Market New Highs Through the Prism of AI

- Stock Market Dow Quick Take

- AI Stocks Buying Levels and EC ratio Explained

- Top 10 AI Stocks individual analysis i.e. for Google, Amazon, Apple etc.

- AI Stocks Buying Levels Q4 2020

- The Next IMMINENT Global Catastrophe After Coronavirus

Whilst part 3 of 3 of this analysis will follow in about 1 weeks time.

DJIA Stock Market Technical Trend Analysis

Dow Short-term Analysis

The stock markets recovery from the Chinese Coronavirus catastrophe has been spectacular. Remember the Dow traded down to a low of just 18,213 on 23rd of March 2020 and then over the next 6 months recovered to a high of 29,200, just 400 points shy of making a new all time high! That is a spectacular bull run! So given that we have entered the weakest period of the year (October) AND that there is an election on the 3rd of November then the least surprising thing should be that the stock market has entered into the correction. In fact the only surprising thing is that the Dow did not start correcting earlier in the month, instead it even tried to break towards a new post crash high Mid October, which was a little puzzling at the time as it implied the market was discounting a Trump election victory that was invisible to most including me. Nevertheless it was ringing the alarm bells that Trump could even win, why else is the stock market soaring.

So clearly the stock market and the polls and betting markets are gyrating towards trying to divine the outcome oft he US presidential election, where it looks like the stock markets early October was WRONG, hence the recent plunge to recent lows. Maybe it was wishful thinking amongst wall street traders exposed to too much Fox News and thus started to believe the hype, anyway reality has now started to dawn on market participants that Trump is not the favourite to win this election hence this weeks 900 point Dow nose dive.

(Charts courtesy of stockcharts.com)

Dow Long-term Trend Analysis

The stock market is having its first significant correction since the start of it's bull run following the corona crash into March 2020. Failure to hold support at 26,500 is eyeing a trend to next support at 25,000. Though MACD is oversold so implies limited downside. Of course price action is heavily influenced by election uncertainty.

TREND ANALYSIS:- The Dow came within a whisker of trading at a new all time high in September before turning lower, this implies to expect a significant correction, i.e. the Dow could retrace as much as 50% of the advance off the March low, though which at this point in time is a low probability outcome.

RESISTANCE: There is heavy overhead resistance art 29,000 to 29,400 which means its going to take several assaults before a breakout to new all time highs, so unlikely this year.

SUPPORT: The Dow has broken immediate support at 26,500 below which is support at 61.8% 25,000 and then 50% at 23,700.

TRENDLINES: The Dow has gapped below trendline support so signals a change in trend i.e. it looks like the bull run is over for now, thus lower prices are more likely than not.

MACD: MACD has unwound its overbought state and is basically neutral, which means that any trend lower should be measured rather than severe.

VIX

(Charts courtesy of stockcharts.com)

VIX is spiking to levels inline with recent spikes so suggests that further downside should be limited, i.e. we may have reached max volatility.

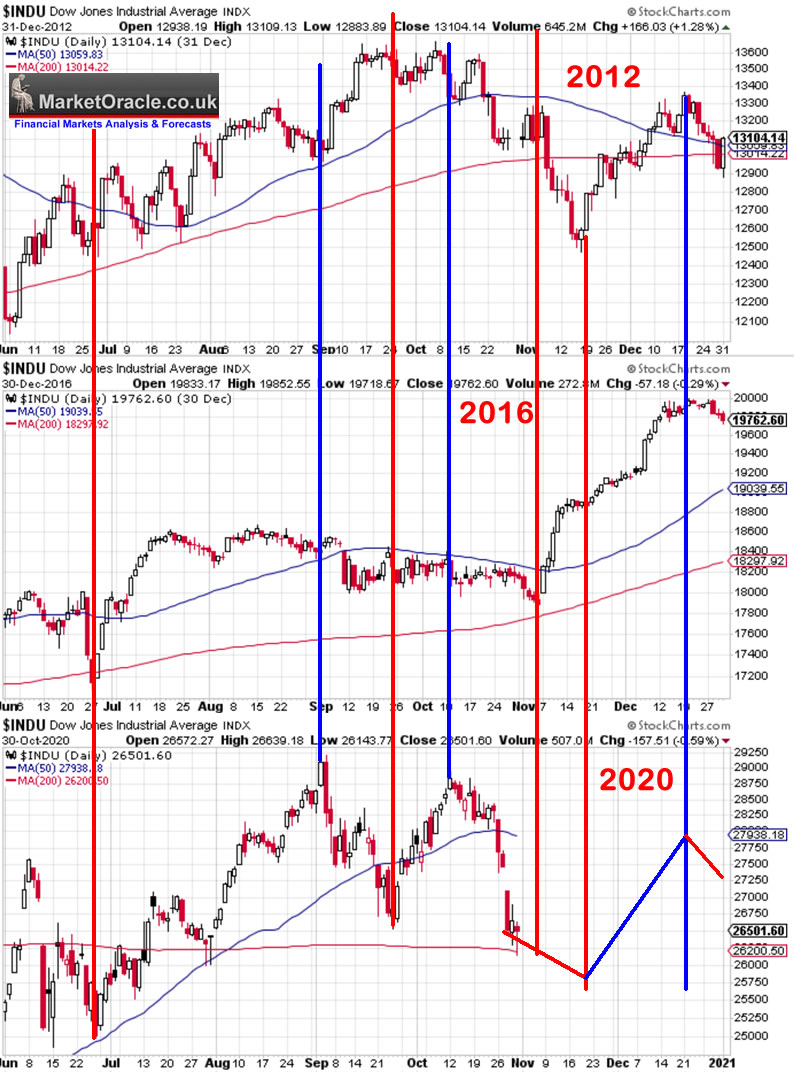

Stock Market 2020 vs 2016 and 2012

How does 2020 compare to the last 2 presidential elections in terms of stock market trend.

Well there is a tendency for stock markets to weaken from a September high into a post election low before running higher into the Christmas followed by a corrective dip into the new year.

Republican wins tend to be better for the markets than Democrat, so if the pattern repeats and Biden wins then we are likely to see a subdued stock market into Christmas, likely below the Mid October high as the market marks time ahead of inauguration day. So no all time high anytime soon. Whilst if Trump wins then it's off to the races, Dow 30k by Christmas!

ELLIOTT WAVES

My commonsense interpretation of EWT resolves in a clear cut 5 wave advance into the Mid September peak with subsequent price action resolving in an ABC corrective decline.

The decline off the September high looks corrective thus an ABC which suggests that we should soon see an end to the downtrend, perhaps by the end of next week, that should sow the seeds for the next 5 wave advance to take us into 2021. So elliott wave matches very closely to what the 2020 vs 2016/12 analysis suggests i.e. an end to the decline soon followed by a post election rally that should set the stage for the Dow to rally into Christmas.

SEASONAL TREND / ELECTION CYCLE

Stock market seasonal trend is usually for a weak October followed by strong November and December, which this year is being disrupted by the election. So where the election cycle is concerned the first few months of a new presidency tends to be subdued, following which the bull market settles in and continues it's business as usual. So we could be heading for a subdued 5 to 6 months.

What happens when an Incumbent Republican President loses ?

Answer - Little movement in price for the remainder of the year. Given that Biden looks like he is heading for a win then that suggests to expect sideways price action into the end of the year, which means we are unlikely to see a surge to new all time highs.

What happens when an Incumbent Republican President Wins ?

Answer - A strong bull run. So if Trump pulls off another election miracle and wins then the Dow should soar to a new all time high by the end of December.

If there is no clear Winner on November 3rd?

Stock markets going to drop like a stone, how much? Easily 10%. The worst outcome, though I see as a very low probability event.

Stock Market Implications for US Presidential Election

The stock market's impact on the US Presidential election in terms of percent swing is pretty straightforward.

Q1. Are the stocks in a bull market ?

A: Yes, Add 1% swing in Trumps favour

Q2 - What is the deviation from 1st September when the election campaign proper began?

A: 26581 divided by 28,646 = 7.8% divided by 2 = 3.9%. Capped at 1.5%. Where in my update of a week ago on 23rd October it was 0.55%.

So basically the stock market trend of the past week acts to work against Trumps electoral chances for if he had little chance of winning a week ago, then the 7% drop during the past week has all but ended his electoral chances. Of course if the stock market had risen by 7% then that would have put Trump and Biden near neck and neck, but that is not what happened.

Whilst there will be some variance with Monday and Tuesday's trading, I doubt it's going to change the outcome now for what is likely to come to pass given that so much of the electorate has already voted early.

Formulating a Stock Market Trend Forecast

.....

Dow Stock Market Forecast Conclusion

.... Part 3 will follow in about 1 weeks time. However for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Incluidng access to my my latest analysis (AI Stocks Portfolio Buying Levels Q4 2020 Analysis) that covers:

- US Presidential Election 2020 Forecast Review

- Seeing Stock Market New Highs Through the Prism of AI

- Stock Market Dow Quick Take

- AI Stocks Buying Levels and EC ratio Explained

- Top 10 AI Stocks individual analysis i.e. for Google, Amazon, Apple etc.

- AI Stocks Buying Levels Q4 2020

- The Next IMMINENT Global Catastrophe After Coronavirus

Your analyst.

By Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.