Inflation Warning to the Fed: Be Careful What You Wish For

Commodities / Commodities Trading Nov 25, 2020 - 02:50 PM GMTBy: The_Gold_Report

Sector expert Michael Ballanger examines the charts for commodities like soybeans and the components used in handheld electronic devices, and reflects on what they say about the future prospects of those who hold mortgages and invest in precious metals.

As I peruse my favorite website in search of technical patterns for various commodities and stocks, I am reminded of the soon-to-be-immortal words of former stock salesman and current Fed chairman, Jerome Powell, when he announced a major shift in policy related to "inflation targeting." As the Gregorian-like chant of "Bye-bye 2%" echoes throughout the room, a second memory appears of a quote that I lifted from the pages of Yale Hirsch's timeless "Stock Trader's Almanac," where it is said that "Inflation is like toothpaste; once out of the tube, it is impossible to get it back in."

Rather than applying my obsessive-compulsive personality disorder to the same old charts of first gold and silver, then the senior and junior miners, and ending with virtually everything that is in my personal portfolio, I decided this morning to change it up. They say that "sometimes a change is better than a rest," so as the Powell-esque mantra resonated in the background, I thought of food prices and how my trusty government agencies are constantly feeding me information about how "subdued" the inflation rates are thanks to the mercurial talents of the central bankers.

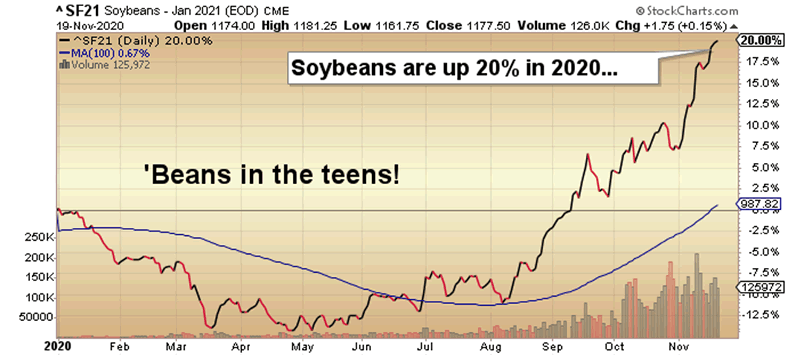

Then I saw this:

With the price of soybeans up 20% in 2020 alone, I went and looked at corn, which is now up 22% from its August lows and ahead over 2.7% year to date (YTD). In fact, the list of commodities highlighted here shows foodstuffs around the world sporting sharp increases, and the percentage change in them is not anywhere near the Fed's 2% inflation target. The majority are showing double-digit increases, and since processors will always pass on wholesale increases to the consumer, you are going to see massive increases in food prices in 2021 and beyond—and that brings to mind visions of torches and pitchforks roaming the streets in search of a banker's backside (or worse).

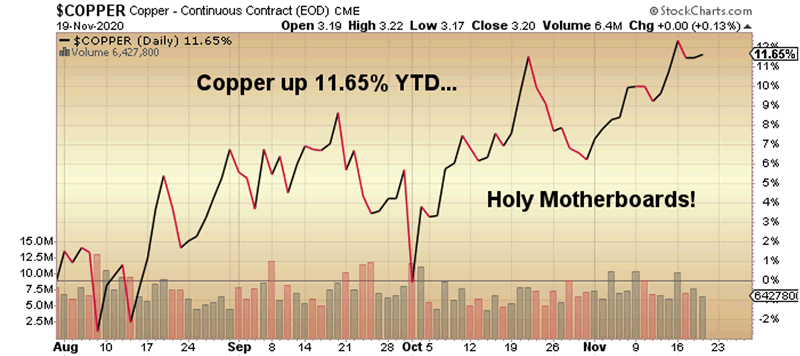

I then thought about the current generational obsession with all things electric and portable, like mobile phones and laptop computers, and the first commodity that came to mind was copper. Lo and behold, with prices up 11.65% YTD, there arises the specter of mob after mob of incensed Millennials chasing down the police using obsolete tablets as their weaponry, because the new iPhone showed a 45% increase due to the spike in the costs of "component parts."

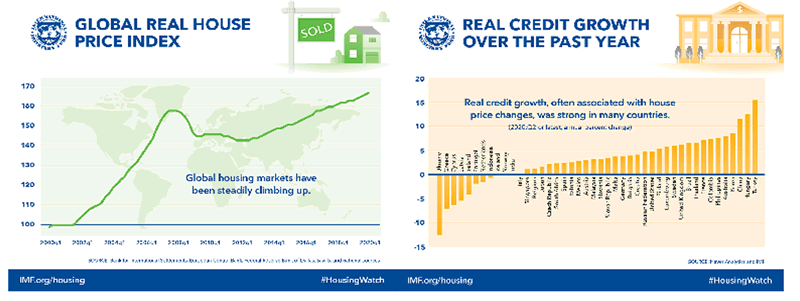

So now that we have covered food and communications, how about lodging? No analysis of the "Hierarchy of Needs" is complete without a study of housing and rents and property taxes, so I searched out the two charts shown below.

There was a time, not so many years ago, that people in Canada used to throw "mortgage-burning parties" to celebrate the day that they made the final payment on their banker-owned mortgage. Thirty-year mortgages were easy to retire in the post-war era as rising living standards (including wages) made one's monthly mortgage payment a "must-pay" item in the household budget, as opposed to revolving items like the Eaton's bill or Visa/Mastercard.

However, thanks to the flawed policies of bankers and their political flunkies in charge of immigration and Bank of Canada policies, housing has been priced into the ionosphere, and if it is not owned or controlled by immigrant oligarchs, it is controlled by the banks.

Since incomes are struggling (and were so long before the pandemic arrived) to keep pace with asset inflation, bankers keep lowering rates to allow consumers to qualify for mortgages that represent a twentieth-century version of indentured servitude, a system of sanitized slavery that encumbered over half of the white settlers in sixteenth-century North America.

Of utmost importance is the reality that mortgage-burning parties are today but remnants of a cultural and socioeconomic past that was symptomatic of the incredible strength and influence of the North American middle and working classes. With three-bedroom homes fifty kilometers from downtown Toronto now commanding upward of CA$1,000,000, the only celebrating one can expect is the sale of one's property to retire the mortgage debt the morning after one's retirement party at age 71.

I have to constantly remind not only followers and subscribers, but also myself, of the one glaring truism of modern banking and politics: Central banks (especially the U.S. Fed) were created by the banks for the banks, and no one else. Once citizens understand that the growth of the banking sector is directly dependent upon the growth of the money supply and credit, they will come to grips with the method to the madness of Jerome Powell & Co. The reason that politicians bend over and acquiesce to every tiny whim of a central banker is because, without the campaign generosity of the pork providers, politicians could not survive. The graft and corruption we see everywhere is all part of a political process that is the ebb and flow of favors asked and favors returned.

So, the next time you see Chairman Powell up on his podium discussing "inflation targets," he is not talking about one of the two stated goals of the Fed, the first being "price stability" and the second being "maximum full employment." Powell's goal is to protect the collateral held by the banks at all cost and has nothing to do with the living standards, job security, or peace of mind of the citizenry.

As I have chirped about loudly since 2018, the current global economic malaise should be laid directly at the feet of the debt creators, and while the central banks are the creators, government bureaucrats are the enablers, most of whom have never had to sell personal assets to make a monthly payroll. What strikes me on the side of my sexagenarian forehead is that while the global debt levels were already unsustainable in 2019, the money-printing, MMT-sanctioned largesse of the post-REPO, post-pandemic period has all of the earmarks of a drug-and-alcohol-fueled binge, the likes of which would make the most outrageous behaviors of rock stars resemble the moribund habits of choir boys.

If I did not have my trusty Rottweiler Fido asleep at my feet while I compose these weekly missives, I would fill twenty or thirty pages with this outrage that resembles a snowball coming down a mountain, growing larger and more menacing every moment. Fortunately, Fido needs to be let outside on a regular basis, sometimes to heed the call of Mother Nature but also to chase unwary postmen up into trees. Either way, the whimper of an 80-lb. attack dog, or the screams of a unionized postal employee, serve to smack me back on task to the problem of the precious metals markets and their producer/developer/explorer offspring.

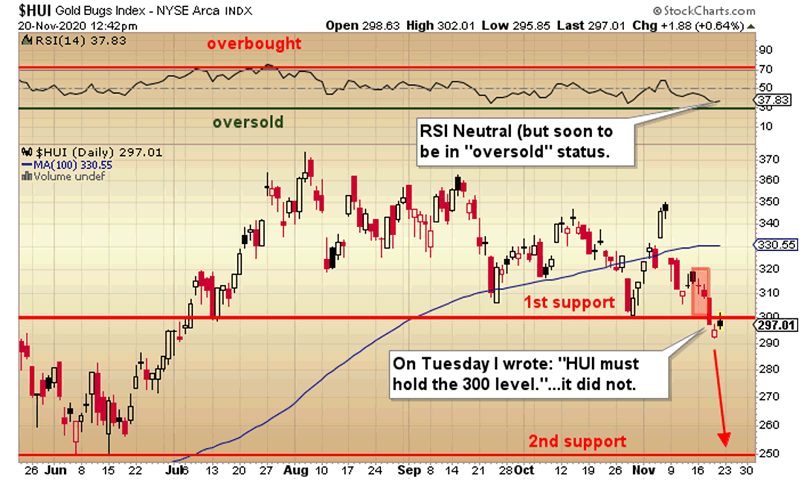

The Twitterverse is ablaze this week with the boringly predictable onslaught of grave-dancing precious metals bashers who are all singing the Battle Hymn of the Repugnant as talk of $1,400/ounce gold amid 95%-effective vaccine results dominates the space. Likewise, talk of gold now being "egregiously oversold" is being espoused by panicking newsletter cronies and latecomers from the summer precious metals (PM) lovefest. The truth is that the arrival of a 95%-effective vaccine is going to be powerless to put that toothpaste back into the tube, but with a relative strength index (RSI) at 42.64, gold is certainly a far cry from oversold status.

As for the gold and silver miners, the chart of the HUI is about as ugly as it gets if you own a basket of the Senior or Junior producers. If you own instead a basket of the developers, the bulk of which trade on the TSX Venture exchange, you are faring a great deal better than the HUI, off 1.5% versus the HUI's minus 19.5% in the same time period.

Alas, the only sheet that matters as we move into the final six weeks of 2020 is the one that shows the percentage gains for the companies in the GGM Advisory portfolio. The four companies comprising 80% of the portfolio are Getchell Gold Corp. (GTCH:CSE) (39.8%), Norseman Silver Ltd. (NOC:TSX.V) (19.23%), Goldcliff Resource Corp. (GCN:TSX.V; GCFFF:OTCBB) (11.25%), and Megastar Development Corp. (MDV:TSX.V; MSTXF:OTC; M5QN:FSE) (10.77%), with the biggest gain in Getchell at 86.43% and the lowest in Megastar at 34.84%. Considering that the HUI is down 19.5% and silver down 21.38% from their respective highs, it is apparent that the developers have—at least thus far in this correction—done their jobs as good places to "hide out" in this difficult market.

We have forty-one days, or thirty trading sessions, left in 2020, which means that a great many portfolio managers will be babysitting their positions tooth and nail, but not me. I look for a resumption of the bull market in precious metals in 2021, and continue to view the developers as "leveraged leviathans" whose percentage gains will dwarf the Senior and Intermediate producers. I was around in the mid- to late Seventies, and while I was a relative rookie, those gargantuan gains seen in the "penny dreadfuls" have never left my consciousness.

And that is what everyone should expect in the next wave...

Be there.

Follow Michael Ballanger on Twitter ;@MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver Ltd., Great Bear Resources, Western Uranium, Stakeholder Gold, Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. My firm no longer does consulting work for Stakeholder Gold.. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium and Aftermath. Please click here for more information. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of Getchell Gold, Western Uranium and Stakeholder Gold and Aftermath, companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.