Dow Jones E-Mini Futures Tag 30k Twice – Setting Up Stock Market Double Top

Stock-Markets / Stock Markets 2020 Nov 18, 2020 - 03:33 PM GMTBy: Chris_Vermeulen

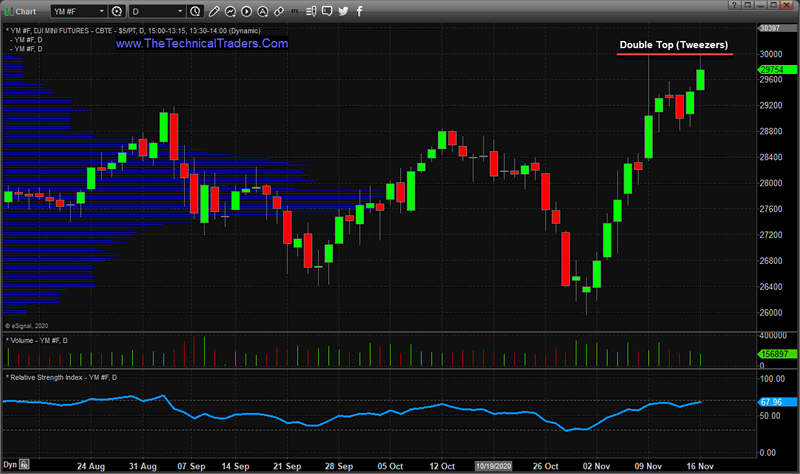

Sometimes the markets telegraph a key level or future target level in pre-market or post-market trading. Other times these telegraphed price targets happen during regular trading hours. Recently, the Dow Jones E-Mini Futures Contracts (YM) generated two unique high price levels near $30,000 over the span of about 6 trading days.

My research team and I believe this “telegraphed high price target level” is a warning of major resistance for traders. These types of broad market patterns are not very common on charts. They happen sometimes, but very rarely like this example on the YM chart below. This Double Top (Tweezers) pattern may be warning that the $30,000 level on the YM could become a major market peak/turning point. Additionally, the post election rally reached this $30,000 level on the day Pfizer announced the vaccine data, then sold off quite consistently throughout the regular trading session.

TWEEZER TOPS NEAR $30,000 WARN OF STRONG RESISTANCE

Obviously, traders are attempting to redeploy capital into sectors they believe present real opportunities for growth and appreciation. As we can see from the chart below, the Dow Jones and Mid-Cap sectors appear to be the leading sectors at the moment. We’re not calling for a major top in the market based on this pattern (yet). We are just bringing it to your attention so you can be aware of the resistance level that appears to have setup near $30,000 on the YM.

The market could blow through this $30,000 level and continue to rally higher or it could stall near the $30,000 level and retrace lower. Given the situation with the US election and the surging COVID-19 cases throughout the world, it doesn’t take much of an imagination to consider another shutdown related market decline setting up.

If you read our recent article about the US stock market and gold price appreciation/depreciation phases, you will see how my team believes the US stock market entered a depreciation phase in mid-2018 and the current rally in the markets (2019 till now) is an excess phase “blow off” rally in the works. If our research is correct, we expect the excess phase to end at some point in the near future, setting up a broad market correction and/or broad sideways rotation. In the meantime, the rally appears to continue with a near-term target of $30,000 (only 250 points away).

Learn how I can help you find and execute better trades. I can help grow your trading account with my Swing Trading service and protect your investment account with my long-term market signals service. Visit www.TheTechnicalTraders.com today to learn more!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.