Derivatives Crunch Means Savings Is the New Investing

Stock-Markets / Credit Crisis 2008 Oct 15, 2008 - 06:21 AM GMTBy: Mick_Phoenix

Welcome to the Weekly Report. As I write this on Saturday afternoon, I see nothing from the G7 statements that can be taken as co-ordinated action. Indeed all I see is a repeat of what is becoming a tired mantra:

Welcome to the Weekly Report. As I write this on Saturday afternoon, I see nothing from the G7 statements that can be taken as co-ordinated action. Indeed all I see is a repeat of what is becoming a tired mantra:

- At the White House, Mr Bush pledged the G7 most industrialised nations would take robust action together.

On Friday, G7 finance ministers agreed to take moves to free the flow of credit, back efforts by banks to raise money and revive the mortgage market.

Announcing no new policies, Mr Bush said: "We must ensure the actions of one country do not contradict or undermine the actions of another. "In an interconnected world, no nation will gain by driving down the fortunes of another. We are in this together. We will come through it together." (BBC)

- Meanwhile, French President Nicolas Sarkozy and German Chancellor Angela Merkel said there would be no common financial rescue fund for Europe, like the US bail-out of Wall Street.

The two spoke on Saturday in eastern France where they were commemorating the 50th anniversary of Franco-German reconciliation after World War II. Chancellor Merkel said "there is no question of a European fund", while Mr Sarkozy said such a move would pose "gigantic problems" in terms of co-ordination between European nations.

The German leader said governments must "redirect the markets so they serve the people, and not ruin them."

The two leaders said a common approach to the financial crisis would emerge from a Paris summit on Sunday of 15 eurozone leaders.

The will be no common European Bail out Fund because the ECB doesn't have the remit to carry out such an operation. The ECB can do discount window type operations to European Banks but it does not have the powers of the Federal Reserve, US Treasury or the Bank of England. It shows the weakness of a Federal system in the full glare of examination and need.

It also shows why Iceland was left to go bankrupt, the ECB has no authority to intervene or "help" those banks outside of the Euro system. Iceland is not alone, many countries in Europe do not belong to the Euro and will have to survive on their own abilities or, in a move reminiscent of earlier decades, become reliant on intervention from the International Monetary Fund (IMF). The only country I saw helping Iceland was Russia who lent them $8Bn. Iceland will be the first of quite a number of countries that will be unable to guarantee the obligations of domestic banks, a pointer is to look for low GNP countries with a high density of domestic banks operating across international borders.

- "The world financial system is teetering on the "brink of systemic meltdown", the head of the International Monetary Fund (IMF) has warned in Washington. Dominique Strauss-Kahn said rich nations had so far failed to restore confidence, but he endorsed a new action plan by the G7 group." (BBC)

- "Directors considered that there are large uncertainties surrounding the near-term outlook, with significant downside risks. At the same time, they noted that the long-term prospects for the economy remain promising-even enviable-given Iceland's sound governance and stable institutions, open and flexible markets, large and well-managed renewable natural resource base, and the authorities' long track record of resilience and adaptability to changing circumstances.

- Directors observed that the authorities face the challenge of facilitating an orderly rebalancing process, while mitigating risks. They welcomed the authorities' efforts to bolster confidence, including by entering into currency swap arrangements with other Nordic central banks, and by committing to maintain tight macroeconomic policies and boost international reserves. Effective coordination between monetary policy and fiscal policies, and actions to reduce financial sector vulnerabilities, will be key to achieving orderly adjustment."

(IMF Executive Board Concludes 2008 Article IV Consultation with Iceland September 19th)

Three weeks or so later and Iceland is bankrupted even when using the methods outlined in the second paragraph. Boosting confidence is one thing, trying to do so whilst your liabilities are 10 times greater than your earning power is another.

The fallout is stories like this:

- "....mints are struggling to keep up with demand, including the Austrian Mint, which produces the Vienna Philharmonic - one of the best-selling bullion coins worldwide. Sales of Vienna Philharmonic gold coins have gone up by more than 230% since last year.

Kerry Tattersall, the director of marketing at the mint, says production has gone into overdrive.

"We are running at present something like three shifts on all of the machines, on the presses, producing both gold and the silver bullion coins."(BBC)

Yet gold exhibits the action of an asset coming off a parabolic rise notice, just like the Dow, the increase in volatility and the downtrend forming after the top in March '08.

Although the UK is not part of the Eurozone, PM Brown will be attending by invitation to showcase his latest "idea" of part nationalization of some UK banks. It seems that after repeating the mistakes of the past, he is about to try the cures of the past. As I have said before we are unlucky with the timing of this depression, there is a distinct lack of innovation and original thinking among those who rule.

It is also very clear that the global cure is directed at Banks to "strengthen the reserves". This innocuous looking phrase means a depression is guaranteed in economies reliant on credit for expansion. The banks will hoard cash and close down the lending desks. The unwinding of margin levels, margin calls and de-leveraging coupled with outright selling to raise cash is more than evident in world wide stock markets. The failure of Lehman cost $270Bn (so far) but it may not be the Broker/Banks that bring down the markets. I am extremely wary of the consequences if the likes of GE, Ford and GM go bankrupt. The CDS obligations on these 3 if a default event occurs would dwarf the cost of Lehman going under. Notice the concentration of risk in the Industrial/Financial sectors by using these 3 companies as examples.

Credit Default Swaps were meant to spread risk and avoid concentration of exposure. Clearly this has not happened, the CDS situation has played out the way I thought it would. If you sell insurance you need to ensure you are able to pay when an "event" occurs. If you ignore this rule or used "assets" to show you could pay up then when a day of reckoning arrives you have to either hold your hand up and go broke or sell assets. If the sellers of insurance are now facing the possibility of a widening of credit tightening to the industrial and service sectors of the economy the selling of assets will continue. Eventually we get a default on a default event. I suspect that day is not far off.

Consequently the Collection Agency is now positioning for an imminent systemic global meltdown of banking, credit and insurance liabilities and the destruction of the ability to carry out normal trade.

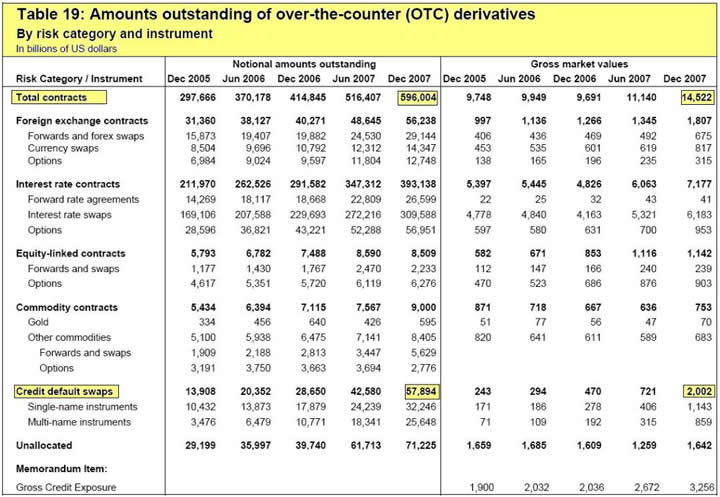

Why so dramatic? Because the World's Central Banks combined are no better off the Iceland. They do not have the reserves or "assets" to cover the total liabilities of the CDS market, let alone the total of outstanding OTC derivatives:

Bank of International Settlements

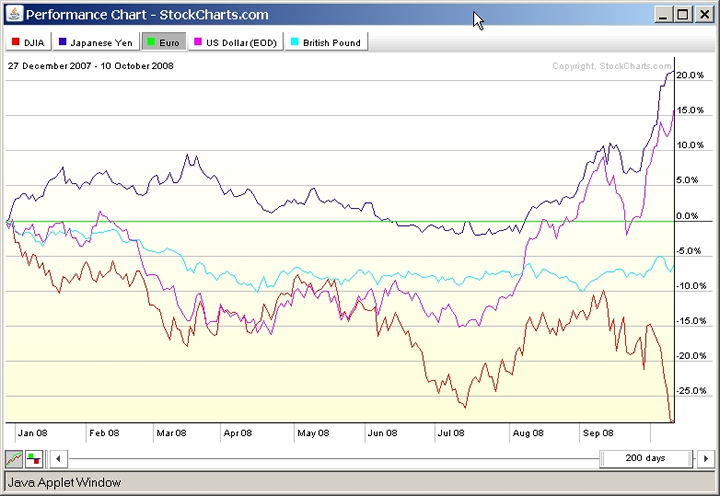

Remember these are liabilities that belong to the Banks; a failure of one market will automatically cause a collapse in all the others. The 2 currencies that dominate the world are the Yen and the Dollar:

Courtesy of Stockcharts.com

The chart above uses the Euro as a baseline and shows the movement of the Dollar, Yen, Sterling and the Dow. I fully suspect the current moves are preparation for a currency crisis and shows demand for the 2 most liquid currencies in the world as the unwinding and de-leveraging of global trades intensifies. I expect this trend to continue until the "credit crisis" is resolved. Indeed as far as I am concerned the term credit crisis no longer accurately describes the current situation. We are facing the recentralization of wealth, away from the global economy and back to the Government/Banker complex. Why do they need cash? To pay liabilities and ensure enough cash is at hand to avoid using credit in the future. In a deflationary depression those holding cash need not invest to get wealthier, the asset itself appreciates.

Finally for this week I continue to see calls for massive intervention to over-ride free market mechanisms. Such calls are justified because "its different this time" the events are so big, the fallout so enormous that Governments must act in a coordinated manner to overcome the threat. So just to remind readers, this is not different this time, we are seeing the same results from an over-expansion of credit and lax lending as the US did in '29-39. We are seeing the same attempts using the same methods to fix the problem as we did back then. The only difference is the size of the current crash when compared to the '30s.

It didn't work then and it will not work now. The only reason the US pulled out of the depression in the '30s was thanks to WW2 and the increase in demand that caused. Whilst I am not advocating WW3 as a cure, it will take a similar large scale, global increase in demand to allow business to recover. The hope would be that by the time of the next recovery the use of credit for expansion and consumption will no longer be tolerated.

In the meantime, get rid of debt, save cash and stop spending on anything that is not essential. The Governments of the world and their shills will try and tell you to do otherwise, as they did post 9/11, in an attempt to encourage profligate consumer spending. We are now living with the results of that wish, that patriotic demand. Now is not the time to fall for such rhetoric again.

Saving is the new "investing". Just make sure the savings are safe.

By Mick Phoenix

www.caletters.com

An Occasional Letter in association with Livecharts.co.uk

To contact Michael or discuss the letters topic E Mail mickp@livecharts.co.uk .

Copyright © 2008 by Mick Phoenix - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Mick Phoenix Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.