Stock Markets Bounce– A Reversal of Fortune?

Stock-Markets / Financial Crash Oct 14, 2008 - 02:34 PM GMT

My first day back in office after a visit to Geneva and Dublin coincided with the best day ever for European stock markets and the biggest points increase in the Dow Jones Industrial Average's history. A pattern has started developing that the good days occur when I am in the office, whereas the sharp sell-offs tend to happen when I am travelling. I will keep you posted on my travel plans in case you want to factor that into your trading models!

My first day back in office after a visit to Geneva and Dublin coincided with the best day ever for European stock markets and the biggest points increase in the Dow Jones Industrial Average's history. A pattern has started developing that the good days occur when I am in the office, whereas the sharp sell-offs tend to happen when I am travelling. I will keep you posted on my travel plans in case you want to factor that into your trading models!

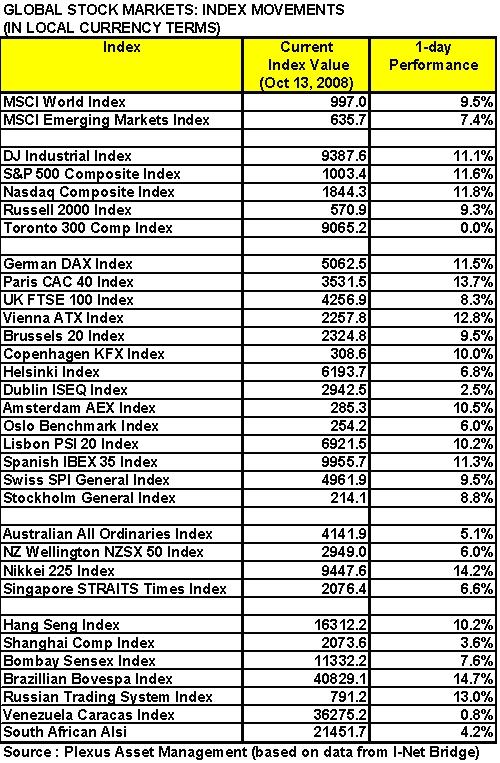

The table below shows yesterday's strong movements on a number of global stock markets.

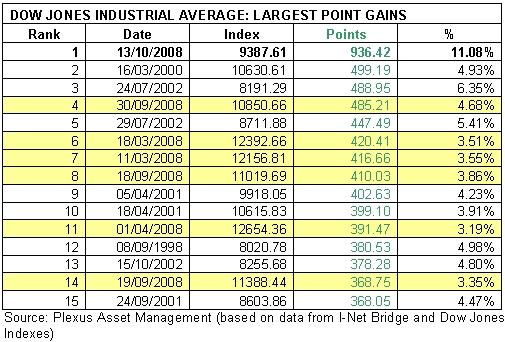

The sheer magnitude of yesterday's rally makes for interesting reading when put in historical context. Considering the entire history of the Dow Jones Industrial Average since 1986, yesterday's surge of 936 points ranks as the largest points increase ever (see top table). Seven of the top 15 points increases have occurred in 2008 (one in October, three in September, one in April and two in March).

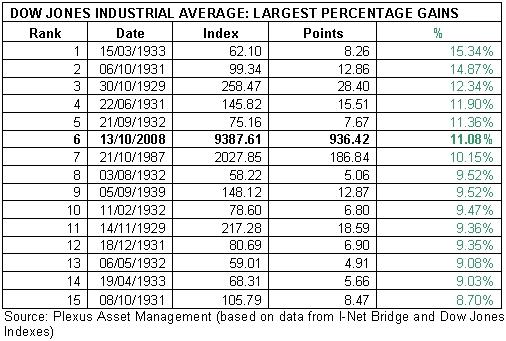

Yesterday's percentage increase of 11.1% ranks sixth in history (see bottom table). Besides yesterday's rally, and the large increases in October 87 and September 1939, the remaining 12 of the 15 largest increases all occurred in October 1929 and April 1933.

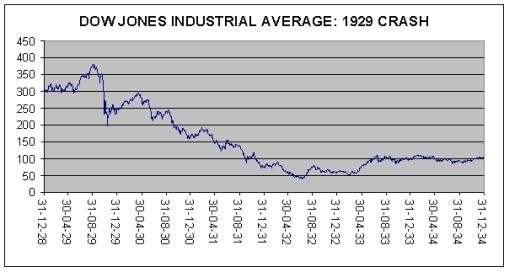

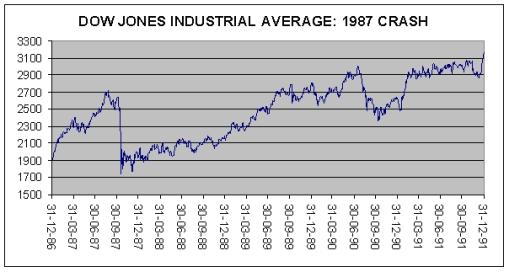

Interestingly, after the 1929 crash (October 28 and 29) the Dow's movements over the following five days were: +12.3%, +5.8%, -5.8%, -9.9% and +2.6%). Subsequent to 1987's Black Monday (October 19), the Dow's changes were as follows: +5.9%, +10.2%, -3.8%, +0.02%, -8.0%. The stock market, of course, behaved quite differently during the years following these two crashes.

Source: Plexus Asset Management (based on date from I-Net Bridge and Dow Jones Indexes)

Source: Plexus Asset Management (based on date from I-Net Bridge and Dow Jones Indexes)

Have we seen the bear's corpse? Will October live up to its promise of being a “bear killer” (as has happened in 11 post-WWII bear markets according Stock Trader's Almanac )?

I mentioned in a post on Sunday that I was looking for a 90% up-day as a signal of the completion of the selling climax. That did not happen yesterday, with upside volume only 73% of up plus down volume. One swallow does not make a summer, but a better performance on this front, together with a retracement in the Ted spread (i.e. three-month dollar Libor less three-month Treasury Bills), a measure of risk aversion and illiquid repo conditions, could indicate that stock markets have reached important lows of at least medium-term significance.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.