How to Stay Ahead of Price Turns in the U.S. Long Bond Market

Interest-Rates / US Bonds Nov 04, 2020 - 04:45 PM GMTBy: EWI

This method of analysis applies to any widely traded financial market

Back in August, the volatility index for Treasury debt was at an all-time low, indicating record commitment to the idea the markets would continue to calmly rise.

Indeed, here's a July 27 Bloomberg headline:

Bond Investors Are Getting Fresh Reasons to Stay Record Bullish

Bloomberg mentioned U.S.-China tensions as a reason that investors would seek a safe haven in bonds, hence, pushing prices higher.

Then, a week later (Aug. 3), Reuters quoted the co-head of global bonds for an asset management group:

"I think the downward pressure on yields will continue for the foreseeable future."

Of course, as you probably know, a "downward pressure on yields" correlates with higher bond prices. Yields and prices move inversely to each other.

But, it's best to look beyond "fundamentals," such as the chilly relationship between the U.S. and China, and focus on the price pattern of bonds.

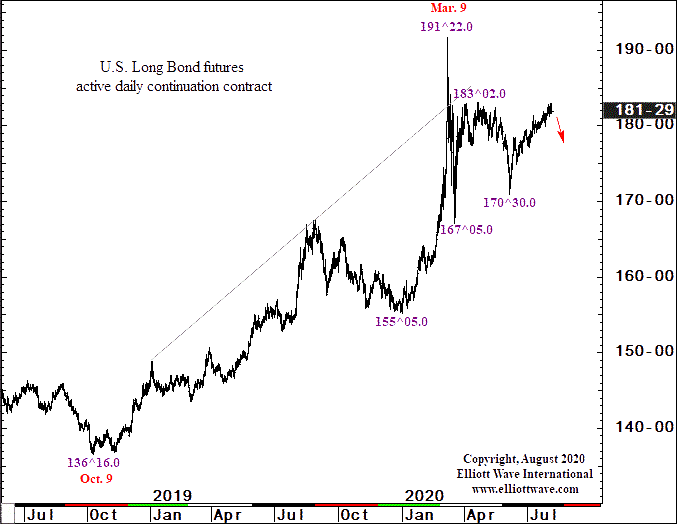

That's what Elliott Wave International's Aug. 5 U.S. Short Term Update did (the U.S. Short Term Update is a thrice weekly publication which provides near-term analysis and forecasts for major U.S. financial markets). Here's a chart and commentary:

Last night, [U.S. Treasury long bond futures] met the wave ... high from April 21, with a rally to 183^00.0. Prices could modestly exceed this high, but the pattern does not require it.

In other words, the wave pattern suggested that the next move would be down, as indicated by the red arrow at the end of the price line.

Well, the long-bond high was reached the very next day (Aug. 6), and prices have been trending downward since.

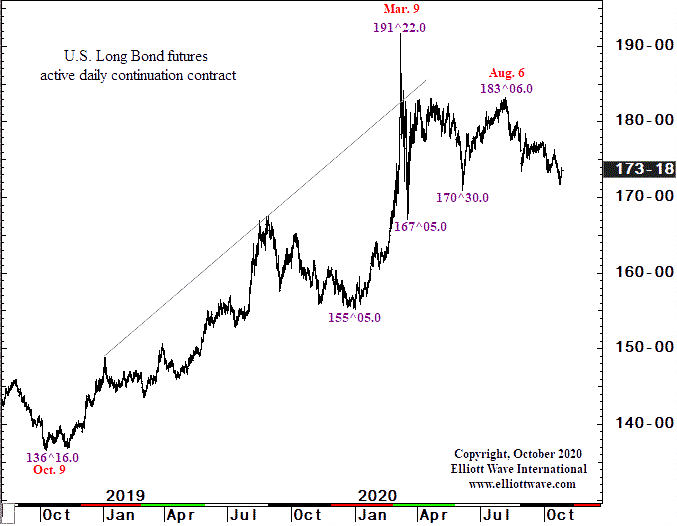

Here's a chart from the Oct. 26 U.S. Short Term Update:

You can see that high notated on the chart and the subsequent slide. Since that slide began, prices have tumbled by about 5.5% (as of Oct. 26) -- and yields, they've been rising.

So, the way that investors can stay ahead of turns in the bond market is by using the Elliott wave model. This method works with any widely traded financial market.

Here's a glimpse into the Wave Principle from Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter:

The primary value of the Wave Principle is that it provides a context for market analysis. This context provides both a basis for disciplined thinking and a perspective on the market's general position and outlook. At times, its accuracy in identifying, and even anticipating, changes in direction is almost unbelievable.

Would you like to learn more about the Wave Principle?

If your answer is "yes," then you may be interested in knowing that the online version of Elliott Wave Principle: Key to Market Behavioris available to you free when you become a member of Club EWI, the world's largest Elliott wave educational community. Membership is free -- and you'll gain instant access to a wealth of valuable resources on investing and trading from an Elliott wave perspective once you join. Club EWI has about 350,000 members.

Gain instant, unlimited and free access to the Wall Street classic book by following this link: Elliott Wave Principle: Key to Market Behavior.

This article was syndicated by Elliott Wave International and was originally published under the headline How to Stay Ahead of Price Turns in the U.S. Long Bond. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.