Global Banking: Some Sectors Look as "Precarious as Ever"

Companies / Banking Stocks Oct 28, 2020 - 03:41 PM GMTBy: EWI

"Financial flameouts" are occurring despite relief from the European Central Bank

Most people remember that the entire global financial system teeter-tottered on collapse during the 2007-2009 financial crisis due to the debacle related to subprime mortgages.

As you'll recall, even a financial institution as large as Citigroup was brought to its knees.

Of course, that was more than a decade ago and the fear of a "financial Armageddon" would seem to be a distant memory.

However, here in 2020, some European banking sectors appear to be on shaky ground, despite the European Central Bank's regulatory relief.

As a Sept. 17 Bloomberg article notes:

Banks Get More Capital Relief as ECB Wants Stimulus to Work

With a looser leverage ratio for the next nine months, banks will be able to make more loans with less capital.

Mind you, this is a fourth round of regulatory relief. Even so, some of the Continent's banks remain in a highly precarious position.

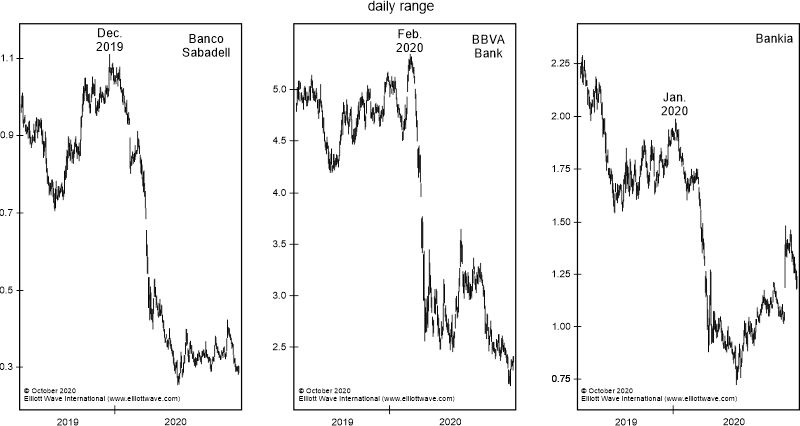

Elliott Wave International's October Global Market Perspective, a monthly publication which provides forecasts for 40-plus markets worldwide, showed these charts and said:

The ECB agreed to a fourth round of relief only because the previous three rounds failed. ... In total, the four rounds of regulatory relief equated to €73 billion, yet, for all the ECB's hard work, some banking sectors look to be as precarious as ever.

The snapshot comes from Spain, where Banco Sabadell, Spain's fifth-largest banking group, has barely retraced any of its 73% crash since December 2019. BBVA also continues to make fresh new lows, and Bankia ... is still off 33% since last year's high.

Clearly, the weakening position of these banks, even with all the financial assistance, is not a good development.

Yet, there's even more cause for concern.

The October Global Market Perspective also analyzes the "financial flameouts" of two other European banks, one of which is a global giant.

The financial woes of some European banks are just one sign of what appears to be a developing global deflation.

Prepare by reading the free report, "What You Need to Know Now About Protecting Yourself from Deflation." Here's an excerpt:

The psychological aspect of deflation and depression cannot be overstated. When the trend of social mood changes from optimism to pessimism, creditors, debtors, investors, producers and consumers all change their primary orientation from expansion to conservation. As creditors become more conservative, they slow their lending. As debtors and potential debtors become more conservative, they borrow less or not at all. As investors become more conservative, they commit less money to debt investments. As producers become more conservative, they reduce expansion plans. As consumers become more conservative, they save more and spend less. These behaviors reduce the "velocity" of money, i.e., the speed with which it circulates to make purchases, thus putting downside pressure on prices. The psychological change reverses the former trend.

The structural aspect of deflation and depression is also a factor.

Get insights into the "structural aspect of deflation," plus -- learn how to defend yourself and your loved ones by following this link: "What You Need to Know Now About Protecting Yourself from Deflation."

This article was syndicated by Elliott Wave International and was originally published under the headline Global Banking: Some Sectors Look as "Precarious as Ever". EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.