Corporate Earnings Season: Here's What Stock Investors Need to Know

Stock-Markets / Corporate Earnings Oct 25, 2020 - 06:41 PM GMTBy: EWI

Many investors and financial journalists believe that corporate earnings play a large role in driving stock market prices.

Here's just a couple of headlines from Oct. 13:

- Stocks open mixed on first day of earnings season (MarketWatch)

- U.S. Stocks Drop as Earnings Season Begins (Wall Street Journal)

The idea that earnings drive stock market prices seems to make sense. After all, corporations exist to make money, and if they exceed expectations, it seems logical that their share prices should skyrocket. If earnings disappoint, logic suggests that stocks should tank. And, in all fairness, when it comes to individual companies' earnings, they can and do affect prices -- although not always, and not always logically. But when you compare broad market performance with trends in earnings, you start to see a glaring disconnect. Why?

Because investors are not governed by pure logic. They are governed by collective psychology -- which swings from optimism to pessimism and back again, regardless of factors like GDP numbers, unemployment or -- yes, earnings.

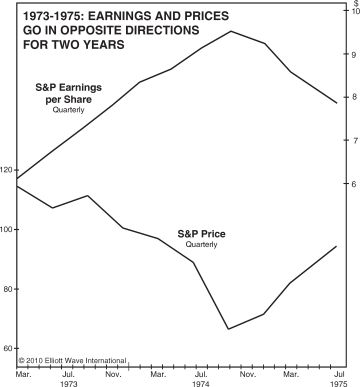

Let's make the point by using a historical example from Robert Prechter's 2017 book, The Socionomic Theory of Finance. Here's a chart and commentary:

... in 1973-1974, earnings per share for S&P 500 companies soared for six quarters in a row, during which time the S&P suffered its largest decline since 1937-1942. This is not a small departure from the expected relationship; it is a history-making departure. ... Moreover, the S&P bottomed in early October 1974, and earnings per share then turned down for twelve straight months, just as the S&P turned up!

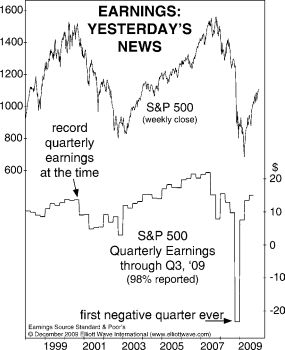

A more recent historical example is from the December 2009 Elliott Wave Financial Forecast, a monthly publication which provides forecasts for major U.S. financial markets:

... quarterly earnings reports announce a company's achievements from the previous quarter. Trying to predict future stock price movements based on what happened three months ago is akin to driving down the highway looking only in the rearview mirror.

You'll notice on the chart that in Q4 2008, the S&P 500 had its first negative earnings quarter ever. According to conventional logic, stocks should have crashed afterwards.

Instead, a rally started in March 2009, which stretched all the way into 2020.

If earnings and other factors outside of the market do not determine the trend of stock market prices, what does?

The answer is the Elliott wave model.

You can get important insights into how it works by reading the online version of Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter.

Here's a revealing quote from the Wall Street classic:

In markets, progress ultimately takes the form of five waves of a specific structure. Three of these waves, which are labeled 1, 3 and 5, actually effect the directional movement. They are separated by two countertrend interruptions, which are labeled 2 and 4 ... . The two interruptions are apparently a requisite for overall directional movement to occur.

At any time, the market may be identified as being somewhere in the basic five-wave pattern at the largest degree of trend. Because the five-wave pattern is the overriding form of market progress, all other patterns are subsumed by it.

All that's required for free access to the online version of the book is a Club EWI membership. Club EWI is the world's largest Elliott wave educational community and is free to join.

Just follow this link to get started: Elliott Wave Principle: Key to Market Behavior -- free access.

This article was syndicated by Elliott Wave International and was originally published under the headline Earnings Season: Here's What Stock Investors Need to Know. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.