Nasdaq Retests 11,735 Support

Stock-Markets / Stock Markets 2020 Oct 23, 2020 - 05:11 PM GMTBy: Chris_Vermeulen

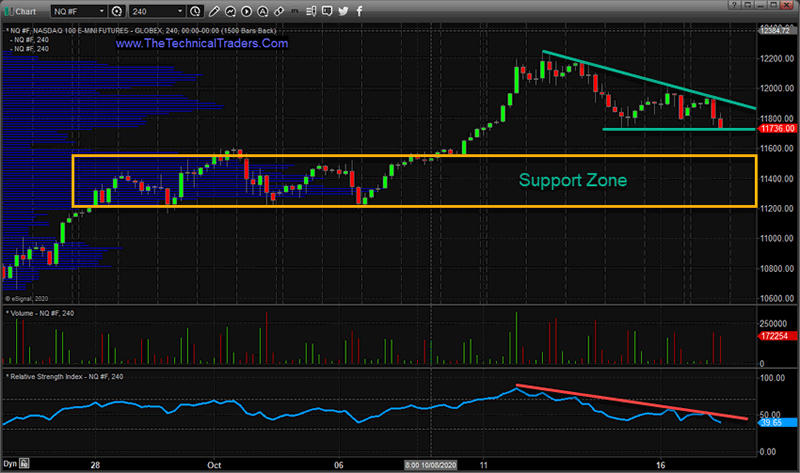

Today, we are going to examine what I believe is a sideways price FLAG in the NASDAQ E-Mini Futures (NQ) that should begin a breakdown move. We believe this breakdown trend will prompt a retest of the broad support zone between 11,200 and 11,500 over the next few days and weeks. Our research team believes the current APEX formation of this FLAG formation could complete before the end of trading on Tuesday, October 20, 2020, with a very tight upward price move followed by a breakdown price move completing the Pennant/Flag formation.

Lower Support Zone May Become Price Floor For NASDAQ

The following 120 Minute NQ Continuous Contract chart highlights the Pennant/Flag Formation setting up currently. A hard support level near the 11,735 level acts as the bottom channel of the Pennant/Flag setup. A downward sloping level off recent highs sets up the contracting upper channel of the Pennant/Flag setup. Within this range we watch price move between the upper and lower channels before a breakout or breakdown move initiates. Our researchers believe a breakdown move in the Technology Heavy NASDAQ is likely just before the US elections and with all the new pressure on Social Media firms (Facebook, Twitter, Google, Microsoft, and others) recently.

We do believe a lower support level between 11,200 to 11,500 will offer some immediate support for a potential price floor. This is the most recent level at which price has shown heavy trading volume and a history of price consolidation over an extended period of time.

This next 240 Minute NQ chart shows a longer-term perspective of the same setup. We still have the Support Zone just above 11,200 to act as a barrier if price begins to breakdown from the pending Pennant/Flag setup. This Support Zone will likely provide some type of attempting price basing before any new trends initiate. We can see the heavy volume and sideways trading that created this Support Zone which took place near the end of October 2020.

Pay attention to the Technology Sector as renewed negative focus has recently pushed this sector into the cross-hairs of many in Washington DC. The issue at hand directly involves greatly expanding the liabilities these Social Networking companies are currently immune from under the law. The perceived bias and censorship which appears to be taking place on these platforms have raised more than a few eyebrows in Washington DC. We believe the current environment for these types of high-flying technology firms could deteriorate quickly.

Traders and Investors should be very cautious of any risk exposure they may have in these sectors. If the 11,200 level is eventually broken to the downside, we will revisit these charts to provide a clearer picture. As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities.

I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders. If you want to learn how to become a better trader and investor, visit www.TheTechnicalTraders.com to learn how we can help you make money with our swing and investing signals. Don’t miss all the incredible trends and trade setups.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.