Monitoring the SPX Rally

Stock-Markets / Stock Markets 2020 Oct 05, 2020 - 02:24 PM GMTBy: Submissions

I trade for myself and my members. The people who use the service know what to expect, but from new members I do get some questions about how often I trade, what kind of monthly returns do I expect, etc. Normal questions to ask, but they are also the wrong questions as well. Many of you have been conditioned to think this way- just as some of you may think that indicators are necessary for trading. Feeling the necessity to trade is not good for your performance, period. Instead of calling me a professional trader, I could just as easily be called a professional waiter. I go through what may seem like long periods of time of doing nothing, but then may place more trades in 2 weeks than I did the prior month. My customers benefit from this patience- but they have to get over the idea that something has to always be ‘happening’, or that you need X amount per day/week/month, etc. The performance will take care of itself if you do things the right way, which leads to the current form of stasis in the SPX.

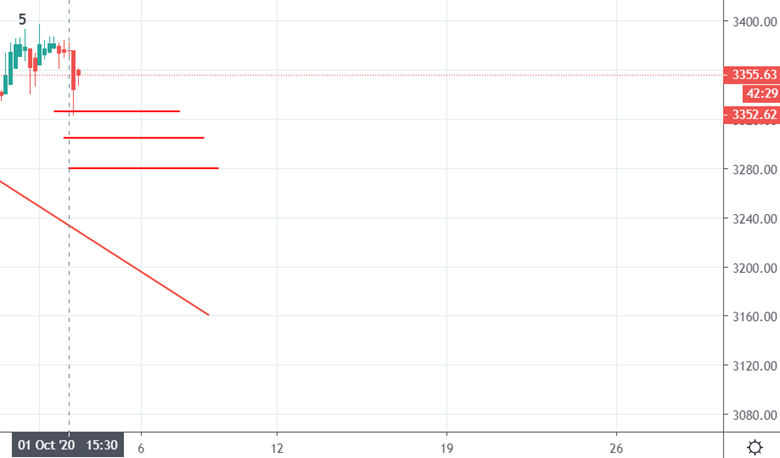

Over the years, I have grown less comfortable with relying on wave patterns. They are just too subjective and frankly unreliable. Still, there are times when they provide insight into a signaling mechanism worth paying attention to. No, I’m not saying someone is manipulating the market to form a wave pattern- but it has extra weight when a pattern forms in a specific position. That’s where we are with the SPX. Earlier this week I mentioned in my blog that the rally off the low appeared to be an impulse pattern in the making, and that’s what we got.

So not only did we break the declining trendline, we also completed an impulse from 3210. Then, overnight we got the news about Trump contracting the virus. From there, we can plot the fibonacci support levels and make decisions moving forward.

On one hand we have the bullish backdrop of the TL break and impulse pattern, but on the other, we have the fact that the SPX has not yet broken resistance on the larger time frame. This puts bulls in a predicament because any perceived bullish scenario might actually be the end of the retracement off the low at 3210. Personally, I prefer not to make long trades in this scenario. My style is a trap trader-I’m looking to capitalize on mistakes made by reversal traders who get caught wrong-footed. So I’m reminded that cash is a position as I find myself in no-man’s land. And that’s fine.

Chris Wilson

Wilson Speculations

Join our free blog or sign up for our options service CycleETF, up nearly 200% this year.

Chris Wilson owns and operates Wilson Speculations, a blog and

paid options advisory that specializes in swing trades on the S&P 500,

the E-mini futures contract as well as the cash index, and gold.

© 2020 Copyright Chris Wilson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.