Trade Any Liquid Market, Any Timeframe: Know How to Spot New Opportunities

InvestorEducation / Learn to Trade Oct 04, 2020 - 06:54 PM GMTBy: EWI

Learn simple techniques in this on-demand webinar, free ($129 value)

One positive development to come out of the 2020 pandemic is a widespread desire for financial independence. It's led everyone from retirees to Generation Z's to consider stock trading as a "cushion" against job uncertainty.

That's the good news! The bad news is, much of this new investment craze is being fueled by emotions and endorphins (hey -- all new traders have them!) rather than objective criteria. One leading economist coined the term "day-trading pandemic" in June to describe the "legions of participants pouring money into stocks without a care for the risks involved." (June 17 MarketWatch)

An August 11 NPR report confirmed the "addictive," "playing-with-fire" nature of this wave of new investing interest, in which first-time traders use free apps to impulsively jump into popular markets -- sometimes, only to meet ruinous ends.

Our friends at Elliott Wave International have been observing and forecasting markets and investor behavior for over 40 years. They believe that in order to succeed in this tough game, one must have a solid understanding of the market's patterned nature -- before safely stepping through that door.

EWI's chief instructor Jeffrey Kennedy is one of the world's leading practitioners and educators of the Elliott Wave Principle. If you are one of those new traders -- or maybe a seasoned veteran with more to learn -- his classic on-demand webinar "Introduction to Spotting Elliott Wave Opportunities" is your first step.

This 2-part, 2+hour course combines the best of Jeffrey's hard-won tips, tools, and techniques for using the Wave Principle to identify high-confidence trading opportunities -- on any market and any time frame.

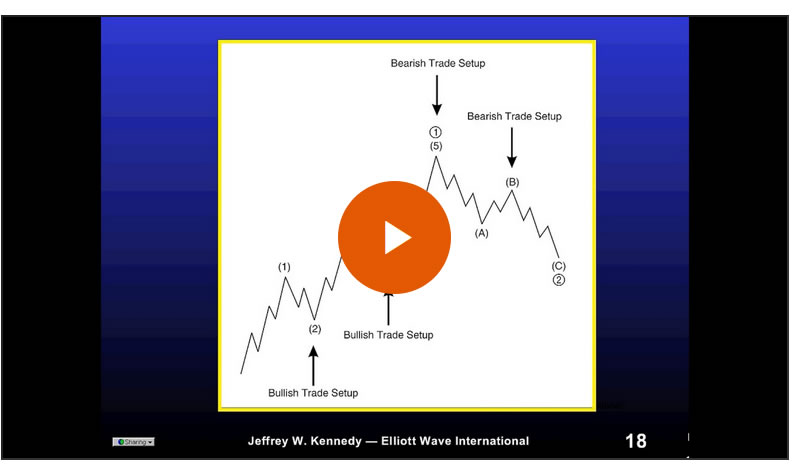

But if there were only one part his students could take away from this course, it would be this chart described by Jeffrey in Part 1.

And now, let's take that idealized bearish setup and see how it plays out in real world markets.

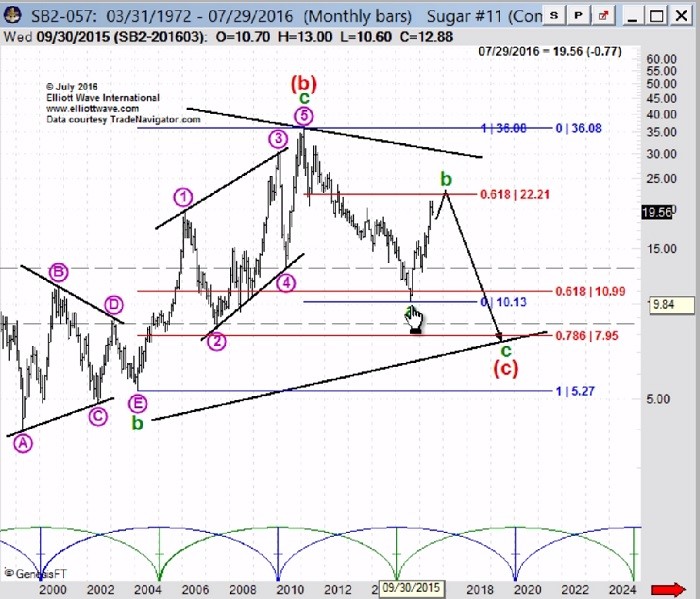

Here, we turn to this chart of sugar prices in 2015-2016, when an 80% rally earned sugar the title of "best-performer of all commodities that trade on U.S. exchanges." (Oct. 3, 2016 Seeking Alpha)

Said one August 15, 2016 Seeking Alpha:

"The multiyear sugar bear turns bull. The second year of deficit can launch the sweet commodity even higher."

Yet at the same time, Jeffrey Kennedy recognized a long-term bearish Elliott wave setup on sugar's chart:

"I wouldn't be surprised to see this advance continue into September or even October of this year ... to an objective of 22.89.

"I will then look for a significant decline that should last for a number of years and easily push prices well below the low we experienced in 2015 at 10.13."

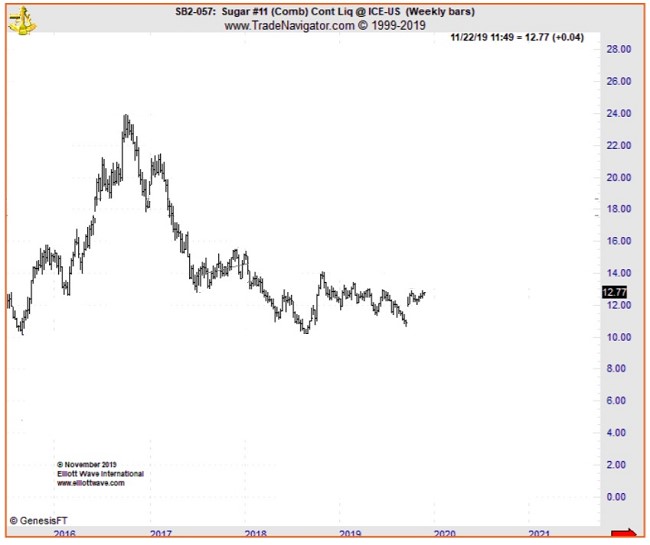

The next chart captures what happened next: After rallying into Jeffrey's cited target, sugar prices collapsed to become the "worst-performing commodity" of 2018.

The real-world applicability of the Wave Principle is undeniable. Imagine what else you can learn from Jeffrey's webinar.

How about:

- 3 core rules of Elliott wave analysis

- 5 core Elliott wave patterns

- What is Jeffrey's favorite Elliott wave pattern and why

- Easy signs to identify a market's trend

- Tricks for setting specific entry points, exit points and protective stops

-- and more!

When it comes to investing or trading, you can either "play with fire" -- or, you can arm yourself with an arsenal of objective tools and techniques to minimize risk and magnify high-confidence setups.

So, take Elliott Wave International's webinar "Introduction to Spotting Elliott Wave Opportunities" now -- a $129 value, it's yours 100% FREE with a fast, free Club EWI setup.

This article was syndicated by Elliott Wave International and was originally published under the headline Any Liquid Market, Any Timeframe: Know How to Spot New Opportunities Today. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.