It’s Time to Dump Argentina’s Peso

Currencies / Argentina Sep 28, 2020 - 10:49 AM GMTBy: Steve_H_Hanke

In addition to facing an acute COVID-19 crisis, Argentina’s deadbeat economy is collapsing, and, as usual, the inflation noose is around Argentines’ necks. Argentina’s official inflation rate for August 2020 is 40.70 percent per year. And, for once, Argentina’s official rate is fairly close to the rate that I calculate each day using high-frequency data and purchasing-power-parity theory, a methodology that has long proved its worth when compared with official statistics. Today, I measure Argentina’s annual inflation rate at 37 percent, but probably not for long — the noose is generally followed by the trapdoor.

As Milton Friedman put it in his 1987 New Palgrave Dictionary of Economics entry “Quantity Theory of Money” (QTM), “The conclusion (of the QTM) is that substantial changes in prices or nominal income are almost always the result of changes in the nominal supply of money.” The income form of the QTM states that: MV=Py, where M is the money supply, V is the velocity of money, P is the price level, and y is real GDP (national income).

Let’s use the QTM to make some bench calculations to determine what the “golden growth” rate is for the money supply. This is the rate of broad money growth that would allow the Central Bank of Argentina (BCRA) to hit its inflation target. I calculate the “golden growth” rate for the past decade.

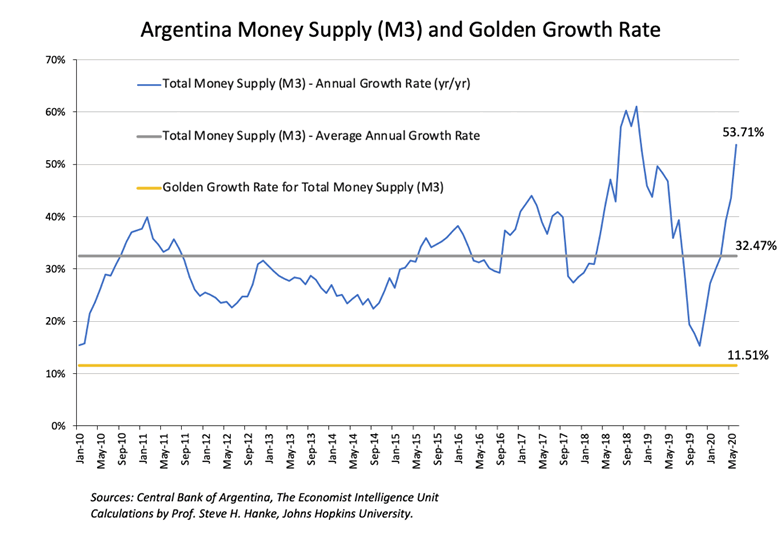

According to my calculations, the average annual percent real GDP growth over the past decade is 1.38 percent, the average annual growth in Total Money Supply (M3) is 32.47 percent, and the average annual change in the velocity of money is 0.87 percent. Using these values and the BCRA’s inflation target of 11 percent (the average of the BCRA’s inflation targets for 2010–2020), I calculated Argentina’s annual “golden growth” rate for Total Money Supply to be 11.51 percent.

Golden growth rate = Inflation target + Average real GDP growth – Average percent change in velocity

Golden growth rate = 11% + 1.38% – (0.87%) = 11.51%

The “golden growth” rate is depicted in the chart below. Also included are the annual growth rates in the total money supply over the past decade, as well as the average, which is 32.47 percent. It is clear that the BCRA has wildly overshot the “golden growth” rate in the past decade. At present, the annual growth in the money supply is soaring at 53.71 percent — over 40 percentage points higher than the “golden growth” rate.

With money growing at over 50 percent per year, it’s no surprise that Argentines treat their pesos like hot potatoes — they attempt to exchange them for U.S. dollars as fast as they possibly can. In typical Argentine fashion, the BCRA on September 15 decided to further restrict Argentines’ access to U.S. dollars in the foreign-exchange market by keeping the dollar-purchase limit for savings at $200 per month, while increasing taxes that citizens pay on purchases of dollars to pay off credit-card debt or for saving to a whopping 35 percent.

Instead of limiting the liberty of Argentines to use their preferred currency, namely, the greenback, Argentina should mothball the BCRA and the pathetic peso and put them in a museum. It’s time for Argentina to officially dollarize. This would be an easy task to accomplish. At the request of then-president Carlos Menem, Dr. Kurt Schuler and I prepared “A Dollarization Blueprint for Argentina,” first published in Friedberg’s Commodity and Currency Comments Experts’ Report (February 1, 1999).

Although Menem failed to pull the trigger on dollarization in Argentina, it was feasible in 1999 and would have worked well, just as it would today. Indeed, it would allow Argentina to avoid the currency chaos, sky-high inflation, and ensuing devaluations and defaults that have wrecked Argentina since 1999.

Follow me on Twitter.

By Steve H. Hanke

www.cato.org/people/hanke.html

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2020 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.