The United Floor in Stocks

Stock-Markets / Stock Markets 2020 Sep 19, 2020 - 10:13 AM GMTBy: Doug_Wakefield

If you have pondered HOW stock markets could act like they were totally ignoring everything that has happened since the first of the year, let me share a few thoughts and pictures with you.

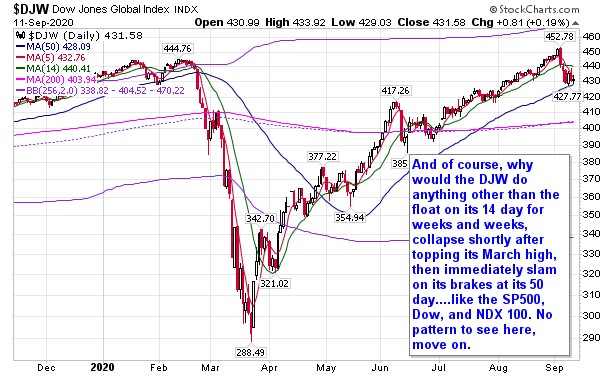

First, this is a picture of the Dow as it closed last Friday. This is the stock index most people refer to as “the market” when discussing stocks climbing or falling.

What do you notice? I want you to look at the 14 day, the 50 day, and the 200 day moving averages. As we can see, the 50-day line provided a floor several times after the Dow rose above this level at the end of April. If we look at the end of June, we notice that the 14 and 5 day MA lines were the floor for the majority of days in the last 3 months. News? Who cares? The computers don't.

Does this look like a random crowd of investors waiting with bated breath for the next "news headline"? Or does it look more like a game computers have played so much that their intelligence systems are repeating it over and over again, and "big computer" is occasional "assisting" the rally.

Yes I know the Fed has been buying up every form of debt instrument known to man since March, but how does that explain a pattern in stock indices that works almost like clockwork for weeks as it produces "all time high" headlines once again, ignoring the larger economic, political, and societal patterns.

Let us return to the “united market” theme inferred by this article's title.

Look at the NDX 100. See something familiar?

While different from the Dow and more bullish, we can see that since the middle of April the NDX 100 has repeatedly bounced at its 14 or 5 day moving averages. When it dropped last week, we see that almost immediately, it stopped at its 50-day moving average like the Dow.

How about the S&P 500, the most traded equity market in the world? See the same pattern?

Why are investors across these three major world equity markets repeatedly following a very similar pattern? Why does it appear “investors” are not the least bit concerned about COVID or riots or the upcoming election? Could it be because humans are merely following the "perfect" market they have come to believe will never change? Has the Fed fostered this "hope eternal" from their actions since they launched QE in 2009, and more recently, the "Buying All Bonds" extravaganza? Could it because computers seeking patterns create an illusion that does not reflect true price discovery and the workings of a free market?

If we go to the Dow Jones World Index we see a similar pattern as well.

And of course, the VIX continues to be the whipping boy of this computer game, rising swiftly to reflect the real risk underneath the "united floor" seen in equities, then being dumped just as fast so that the index returns to its “sub 200 day” level.

As many have said, “This is not your father’s market.” I would go further. I ask you, with central banks already developing their own crypto currencies, have we given up on the last vestiges of anything known as “free markets” or whatever is left of it?

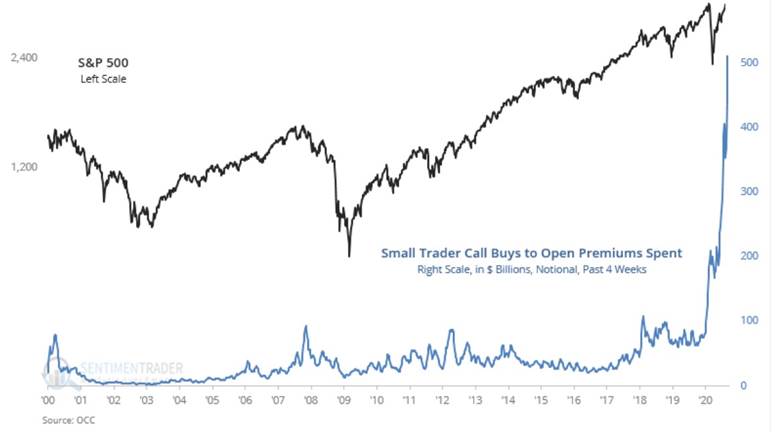

As one of sentimentrader’s recent charts from Twitter reveal, for those looking below the smooth floor, or underneath the iceberg, there are plenty of signs that this market bubble is extremely dangerous. I believe EXPECTING change is perfectly rational, even while group think accepts the idea that central bankers have unlimited powers to save the "eternal rally".

Doug Wakefield

President

Best Minds Inc. a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

http://www.bestmindsinc.com/

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.