Why Bill Gates Is Betting Millions on Synthetic Biology

Companies / BioTech Sep 14, 2020 - 06:11 PM GMTBy: John_Mauldin

By Justin Spittler: Beyond Meat (BYND) was one of last year’s hottest stocks. Shares of the plant-based meat company exploded 859% during its first three months out of the gate.

“Fake meat” was all the rage: an instant favorite with Millennials (I personally prefer the real thing). And the industry’s still booming today. It’s already worth $12 billion. By 2025, it’s projected to double again!

But here’s the thing: While most people have heard of Beyond Meat and the plant-based meat mania by now, they don’t realize that this is all part of a much bigger opportunity. In fact, many of the wealthiest investors on the planet have been going “all in” on this obscure megatrend.

Synthetic Biology Is the Biggest Opportunity That No One’s Talking About

Synthetic biology involves reconfiguring the DNA of an organism to create something entirely new. It allows scientists to design living things with attributes and characteristics we desire. In short, it allows you to “program” biology just like you would a computer!

It’s a way to create just about any product in the world. This is HUGE. Consider Beyond Meat and competitor Impossible Foods. These companies use a DNA coding sequence from soybeans to create meat that looks and tastes like beef but is actually made of vegetables.

But that’s just one thing you can accomplish with synthetic biology. Synthetic biology has also been used to naturally replicate rubber for tires, create “green chemicals” from agricultural waste, and engineer low-cost sugars.

Biotech company Moderna Therapeutics (MRNA) is even using synthetic biology to develop a vaccine for COVID-19! The vaccine is already in Phase 3 clinical trials.

Outside of artificial intelligence (AI), synthetic biology has the most potential to radically reshape our world. The possibilities are truly endless.

And yet, most investors haven’t even heard of synthetic biology. But those who do recognize the incredible potential of synthetic biology stand to make fortunes. It’s like investing in cloud computing years before it became a buzz word.

The World’s Brightest Tech Founders Are Betting Big On Synthetic Biology

Microsoft (MSFT) founder Bill Gates, who was an early investor in Beyond Meat, is pouring money into synthetic biology. He helped fund Ginkgo Bioworks, which is developing custom-built microbes, as well as Pivot Bio, a sustainable agriculture company.

Gates isn’t the only big tech founder who sees the potential of synthetic biology. Eric Schmidt—a co-founder of Google (GOOG)—has invested in several synthetic biology companies through early-stage venture capital firm Innovation Endeavors. His synthetic biology portfolio includes Zymergen, Bolt Threads, GRO Biosciences, and Ukko—a company that’s working to improve the lives of millions of people living with food allergies.

Peter Thiel is investing heavily in synthetic biology. Thiel, as you may know, is a co-founder of PayPal (PYPL), Palantir Technologies, and Founders Fund, a world-renowned VC firm. The billionaire was also the first investor in Facebook (FB). Thiel is invested along with Schmidt in Bolt Threads, and is also backing Synthego and Emerald Cloud Lab.

Marc Andreessen is another high-profile investor in synthetic biology. Andreessen founded Netscape and Andreessen Horowitz, another prestigious VC firm. Andreessen is invested in Benchling—a company that offers tools to engineer DNA digitally so scientists can perform experiments without picking up a test tube.

Other high-profile investors in synthetic biology include Vinod Khosla (Sun Microsystems), Jerry Yang (Yahoo!), Bryan Johnson (Venmo), and Max Levchin (PayPal).

Serious Money Is Pouring Into Synthetic Biology Companies

According to SynBioBeta, the industry has raised over $12 billion over the past decade, including $3.8 billion last year. That’s nearly 10 times as much as was raised in 2009.

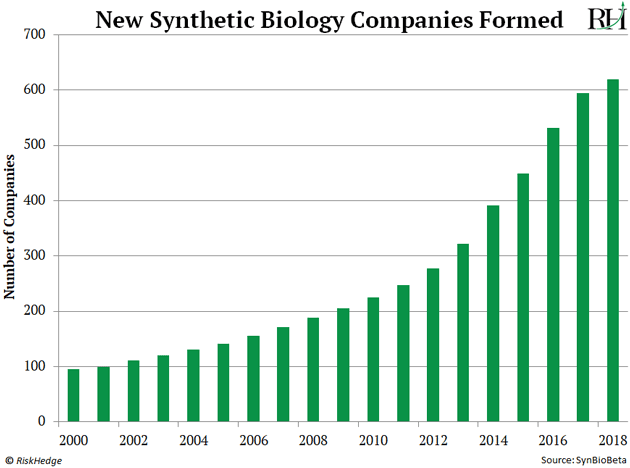

The number of new synthetic biology companies has also skyrocketed over the past two decades. In fact, there are now over 600 companies in the space. That’s up from less than 100 in 2000.

The industry is quietly exploding for two reasons. First, the cost of reading and writing DNA has fallen exponentially in recent years. Second, synthetic biology is unique in that it can revolutionize practically every industry on the planet.

It’s already creating foods once thought impossible, accelerating drug discovery to treat diseases, and much more.

This is why synthetic biology needs to be on your radar. It doesn’t matter if you’re a long-term investor or day trader. Huge profits are at stake.

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.

By Justin Spittler

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.