Stock Market Recovery from the Sharp Correction Goes On

Stock-Markets / Stock Markets 2020 Sep 14, 2020 - 05:43 PM GMTBy: Paul_Rejczak

The bulls responded with an upswing, which I saw as probable to happen. Is the sharp correction over now? Thus far, my answer remains the same as yesterday – in terms of prices, the worst is likely behind us, in terms of time, we have a way to go still.

So, what about the key juncture stocks are at? Let's get and feel the pulse via a few selected charts.

As for narratives, the tensions around China are back in the spotlight. Otherwise, my yesterday's comments still apply:

(…) Unless the Democrats raise up a notch their existing calls for Biden not to concede defeat under any circumstances, unless rioting ramps up, unless the Fed takes away the punch bowl, and finally unless Americans happily march into another lockdown that who knows when it would really end and on what terms (Cuomo's conditions serve as a great, sorry, terrible example), the stock bull run can go on in September before meeting the October headwinds.

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The rebound from the proximity of 50-day moving average came yesterday, yet with an upper knot and lower, but still respectable volume. That's not entirely bullish, also given the fact that the upswing stopped at the Feb highs level approximately. More work ahead for the bulls.

The Credit Markets’ Point of View

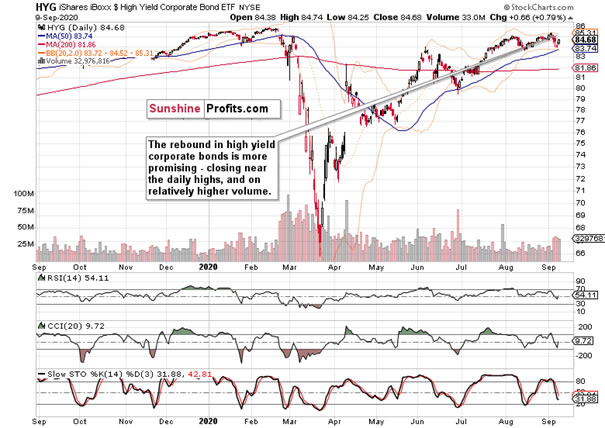

Yesterday's upswing in high yield corporate bonds (HYG ETF) is more optimistic – the lack of upper knot and sizable volume bring about a more bullish interpretation than has been the case with the S&P 500 rebound.

The investment grade corporate bonds (LQD ETF) performance is a mixed bag (please see this and many more charts at my home site) – all intraday gains were erased. That takes away from the HYG ETF bullish performance unless Treasuries are considered.

Long-dated Treasuries (TLT ETF) keep on trading sideways to down in recent weeks. Clearly no margin call here, and instead the realities of a slow economic recovery and the aftermath of Fed's move on inflation, rule.

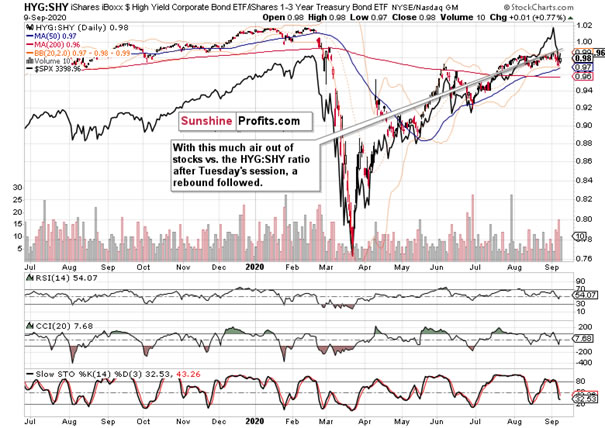

As stocks found themselves at the rock bottom relative to the high yield corporate bonds to short-term Treasuries (HYG:SHY) ratio, their rebound followed yesterday. The overextension in the runup to the Fed inflation announcement, has been "worked off" entirely, and the stock upswing can continue on less mouth salivating hype now.

Metals, Oil and Technology

Gold is holding up still pretty well. I view its latest white candle as a sign of support for risk-on assets. Should the bearish implications of relatively low volume overpower the bulls and sink the yellow metal to levels below the September intraday lows, that would change the short-term outlook.

Copper keeps its breakout above $3 alive, and the chart posture remains bullish. Again though, the low volume is a sign of short-term caution.

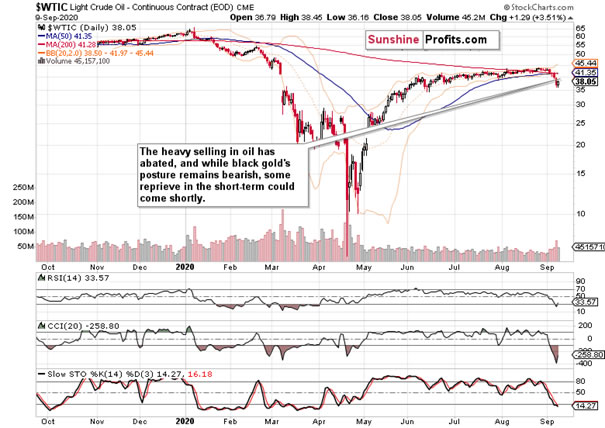

The oil ($WTIC) chart looks distinctly bearish, and the downswing has gathered steam over the recent sessions. Yesterday's reprieve looks as a short-term pause, and doesn't appear to dent much the selling pressure. Black gold's prices look to be underperforming stocks early on (canary in the coal mine) – just as they were at the beginning of 2020 – which highlights the very real possibility of a stormy not merely September, but also October.

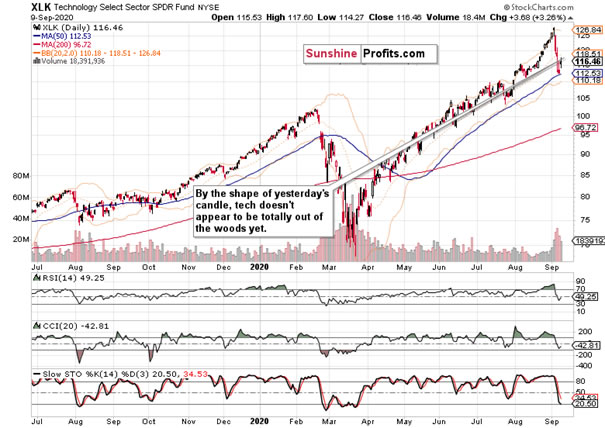

Technology (XLK ETF) rose, but not before having to defend against selling pressure first. The upswing could have been stronger, and the fact that it wasn't, highlights the relatively weakening position of this leader as other sectors experience growing interest, relatively speaking.

Yes, that's what rotation is about, and the fact that it's happening, and money isn't moving out of tech to the sidelines or into Treasuries, but instead to value plays, attests to the stock bull being alive and well.

Summary

Summing up, stocks sprang to life yesterday, and despite giving up quite some intraday gains, the advance-decline line moved strongly higher, in a testament to its Friday's relative strength. Volatility as measured by the VIX, relented yesterday, and a period of relative calm and base building (also in the 500-strong index) could be ahead.

The missing piece of the puzzle is the financials (XLF ETF) performance as they "should" have taken kindly to rising yields, yet they continue struggling due to hefty bad loans provisions (anticipated corona fallout). This effect could be gone once meaningful stimulus is in. Technically speaking, financials remain more likely to break above their 200-day moving average than to break below their 50-moving average next, but the move is likely to take quite some patience to see.

We encourage you to sign up for our daily newsletter - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Monica Kingsley

Stock & Oil Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

Monica Kingsley is a trader and financial markets analyst. Apart from diving into the charts on a daily basis, she is very much into economics, marketing and writing as well. Naturally, she has found home at Sunshine Profits - a leading company that has been publishing quality analysis for more than a decade. Sunshine Profits has been founded by Przemyslaw Radomski, CFA - a renowned precious metals investor and analyst.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.