QE4EVER!

Interest-Rates / Quantitative Easing Sep 09, 2020 - 01:41 PM GMTBy: Nadeem_Walayat

Virtually everything that cannot be easily printed is rocketing higher which includes GOLD! It's not hard to see why as a consequence of rampant money printing by governments across the world in the wake of the Coronavirus Pandemic economic depression. For instance the UK alone looks set to print about £550 billion this year most of which will be monetized by the Bank of England so that the government can pay the wages of about 1/3rd of Britains workforce for a good 6 months with likely many more economic stimulus measures to follow over the next 6 months towards fighting the Pandemics dire economic consequences.

Whilst the United States has printed $2.2 trillion of stimulus dollars to date with at least another $1.3 trillion to come, that's $3.5 trillion which dwarfs the 2008 financial crisis bailout of $720 billion. Funneling stimulus checks on an epic scale into the back pockets of every working age citizen. Printing money has REAL consequences which is REAL inflation hence what we have been witnessing in markets across the spectrum, and whist I have yet to take a peak at the housing markets, I would not be surprised if the UK housing market at least will start to experience a money printing inflationary boom over the coming year, this despite the fact that people have less disposable income to buy housing, but more on that in a future article.

My mantra for a good decade now has been that once QE money printing starts it NEVER STOPs, instead each subsequent crisis will likely result in an acceleration in the degree of money printing and so it has been the case with the current money printing phase. To save time I can just copy and paste what I wrote over a year ago and it will be just as valid today as when last posted.

Stock Market Trend Forecast March to September 2019

So why has the the stock market soared, what is that the stock market knows that most commentators and economists fail to comprehend? We'll for one thing there are the dovish signals out of the Fed which go beyond a pause in their interest rate hiking cycle in response to a subdued inflation outlook. Similarly the worlds other major central banks have their own reasons to avoid rate hikes, most notable of which is the Bank of England that has been busy propagandising the prospects of a NO Deal Brexit Armageddon in attempts to scare Westminister into avoiding EXITING the European Union in anything other than an ultra soft BrExit.

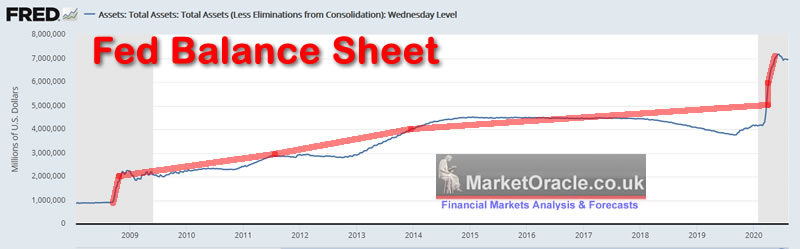

So on face value the stock market is clearly discounting not just a more accommodative interest rate environment but that QE REALLY IS FOREVER! Once it starts it DOES NOT STOP! As evidenced by the Fed's balance sheet first having exploded from about $800 billion to over $4.5 trillion, all to bailout the banking crime syndicate by inflating asset prices such as housing and stocks so as to generate artificial profits for the central bankers banking brethren. But none of this news, for I have written of it for a good 10 years now that QE will never stop as the worlds central banks will repeatedly expand QE to monetize government debt.

So I would not be surprised that WHEN the next crisis or recession materialises, QE will resume, by the end of which the Fed balance sheet will likely have DOUBLED to at least $8 trillion. And it is this which the stock market is DISCOUNTING! Just as has been the case for the duration of this QE driven stocks bull market that clearly paused during 2018 in the wake of mild Fed unwinding of its balance sheet. So forget any lingering Fed propaganda for the continuing unwinding it's balance sheet, the actual rate of of which has slowed to a trickle and thus we are probably near the point when the Fed ceases unwinding it's balance sheet because as I have often voiced that once QE starts it does NOT STOP!

So whatever form the NEXT crisis takes, the Fed will be at hand to print money and double its balance sheet, as it will periodically continue to supports asset prices such as housing which cannot be printed. We'll not until we see start seeing house building 3D printing drones emerge from the machine intelligence mega-trend that will fly around in swarms and erect designer houses anywhere on the planet.

And here's the updated current state of the Fed's balance sheet, QE money printing primarily to monetize US government debt so that interest rates are artificially forced lower to give the illusion of price stability instead real inflation is rampant.

You know what's coming next, $8 trillion, then 9, $10 trillion+ All to monetize US government debt.

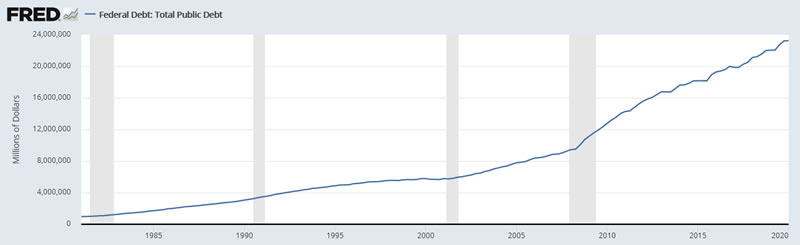

Ask yourselves what are the consequences of artificially depressing interest rates on $24 trillion of US federal debt by means of £7+ trillion of quantitative easing.

The answer is accelerating the Inflation Mega-trend, something that I have been writing about since I first started the Market Oracle way back in 2006 and why the only way to survive rampant government money printing is to leverage one selves to assets that cannot be easily printed or that are leveraged to money printing such as housing and revenue growing stocks as illustrated by my January 2010 100 page ebook "The Inflation Mega-trend". Imagine reading it back then and then going on to buy Google at $300 and Microsoft at $25 amongst other leveraged to inflation tech stocks, and the next 10 years should yield similar returns, if not more.

The rest of this extensive analysis whose primary focus ia a Gold Price trend forecast has first been made available to Patrons who support my work -

Gold Price Trend Forecast into 2021, Is Intel Dying?, Can Trump Win 2020?

- Gold Trend Recap

- QE4EVER

- Inflation Mega-trend going Hyper!

- The End of Capitalism?

- Gold Price Analysis and Trend Forecast

- Silver New All time High Coming?

- Is Intel a dying mega corp?

- Nvidia Ampere Blast off!

- TSMC

- AI stocks current state

- Can Trump win 2020?

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And access exclusive to Patrons only content:

How to Get Rich Investing in Stocks by Riding the Electron Wave.

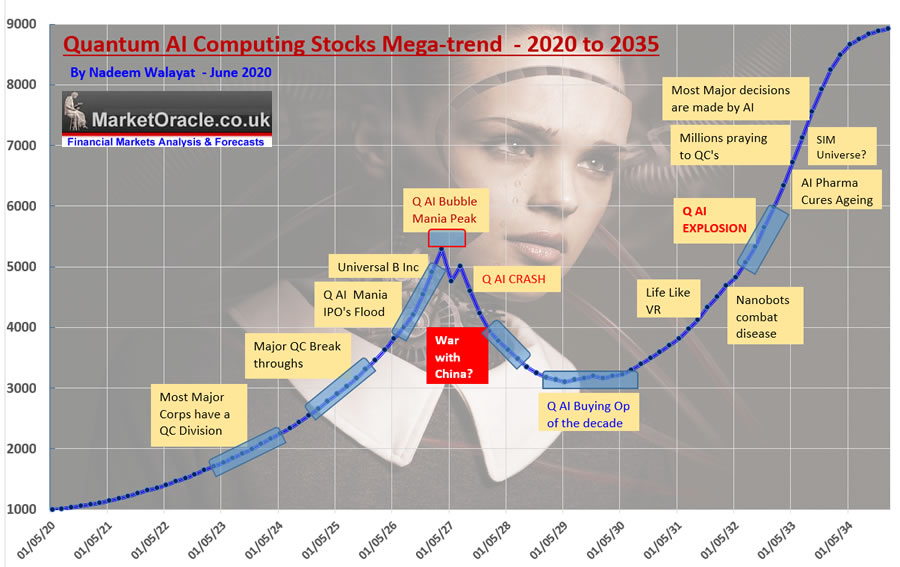

Not to mention trend forecasts such as - Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.