This Group of Wealthy Investors Hoard Cash at Unprecedented Levels

Stock-Markets / Financial Markets 2020 Sep 03, 2020 - 09:52 AM GMTBy: EWI

Yes, stocks have been in rally mode.

Even so, a group of multimillionaires appears to be shifting from an optimistic mindset to one of pessimism about the financial future.

Their solution is hard, cold cash.

Here's an excerpt from an August 27 Bloomberg article:

A group of multimillionaire investors in the U.S. are hoarding cash at unprecedented levels.

Tiger 21, a club of more than 800 investors, reported Thursday that its members have raised their cash holdings to 19% of their total assets on concerns over the economic consequences of the covid pandemic in the U.S. That's up from about 12% since the start of the pandemic. About a quarter now expect the crisis to continue until the end of next June, the group said.

"This rise in cash is an extraordinary change -- statistically, this is the largest, fastest change in asset allocation Tiger 21 has seen," said [the] chairman of the club, whose participants typically have more than $100 million in assets. "In trying to build resources prudently, members have gained liquidity and will not immediately reinvest in those areas in order to keep and build cash to weather this storm."

The raising of cash by this group of wealthy individuals may turn out to be a very wise move.

You see, if a historic deflation develops, as Elliott Wave International's analysts anticipate, cash will be king.

Robert Prechter's 2020 edition of Conquer the Crash explains with these two charts and commentary:

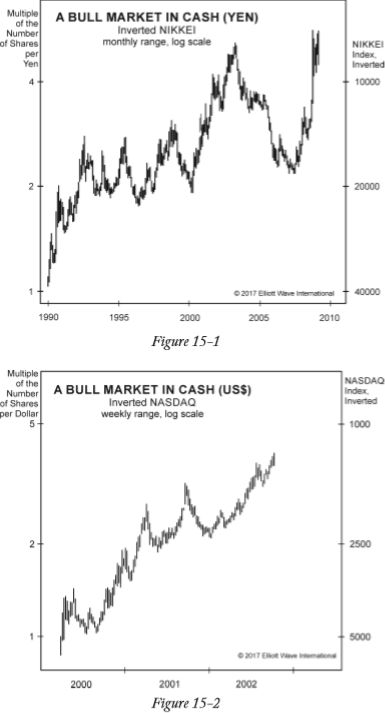

Now let's dispose of the idea that the return on cash is always "low." How would you like to own a safe asset that goes up over five times in value in nineteen years? Figure 15-1 is a picture of the soaring value of cash in Japan from 1990 through 2008. Cash appreciated over 400% in terms of how many shares of Japanese stocks it couldbuy. Figure 15-2 is one picture of the rising value of cash in the United States, which appreciated 287% from March 2000 to October 2002 in terms of how many shares of the NASDAQ index it could buy. Wouldn't you like to enjoy this kind of performance, too? You can, if you move into cash before a major deflation. Then when the stock market reaches bottom, you can buy incredibly cheap shares that almost no one else can afford because they lost it all when their stocks collapsed.

Prepare for what Elliott Wave International's analysts expect just around the corner by reading the free report, What You Need to Know Now About Protecting Yourself from Deflation.

All that's required to access this free report is a Club EWI membership. Don't worry -- joining Club EWI, the world's largest Elliott wave educational community, is also 100% free. There are no obligations once you join.

Follow this link to start reading the free report: What You Need to Know Now About Protecting Yourself from Deflation.

This article was syndicated by Elliott Wave International and was originally published under the headline . EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.