Google, Apple, Amazon, Facebook... AI Tech Stocks Buying Levels and Valuations Q3 2020

Companies / AI Aug 31, 2020 - 05:58 PM GMTBy: Nadeem_Walayat

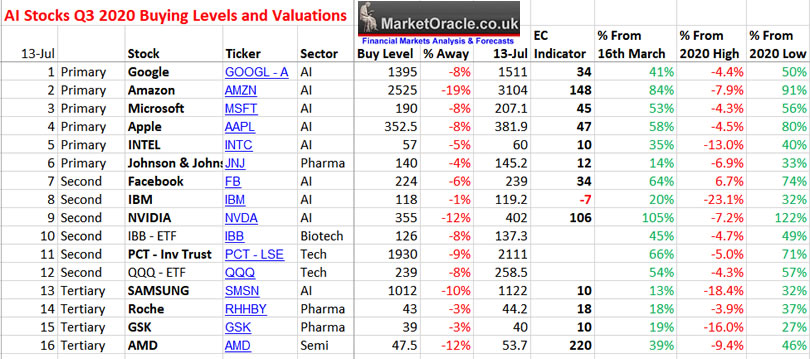

Here is the updated list of AI stocks buying levels for Q3 2020.

What are buying levels?

Buying levels are high probability technical levels that stocks 'could' trade down to during a stock market correction.

Disclaimer : I personally hold all stocks in bold

A quick take on the Dow stock market index suggests that a deeper correction could be brewing as the Dow is failing to show much follow through to the upside following Junes correction. I will cover the prospects for the Dow in-depth before the end of this month after my scheduled Gold price trend forecast update.

This analysis was first made available to Patrons who support my work AI Tech Stocks Buying Levels and Valuations for Q3 2020

Whist my latest in-depth analysis will be posted on the 1st of September 2020 to include -

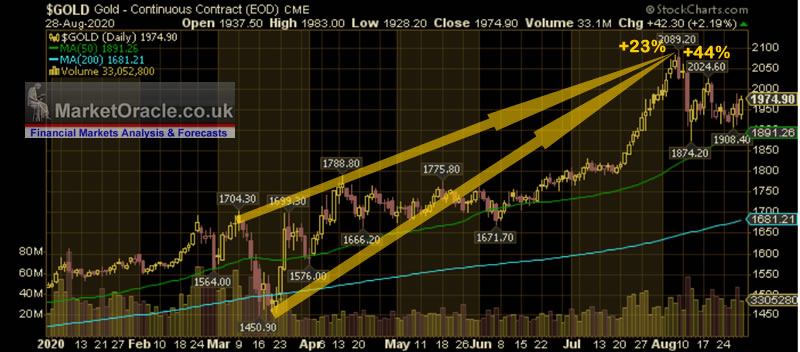

* Gold price trend forecast into 2021

* Silver New All time High Coming?

* Is Intel a dying mega corp?

* AI stocks current state

* The rise of TSMC

* Can Trump win 2020?

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

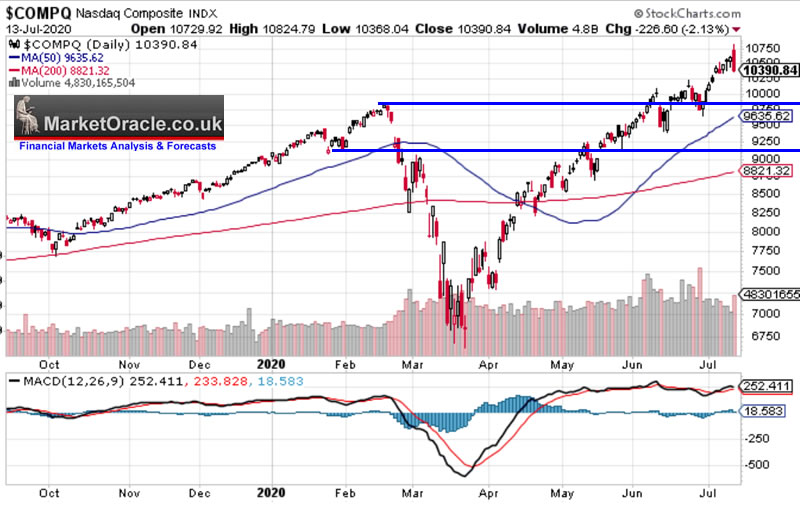

Of course it is our AI stocks such as Microsoft and Apple that have been pivotal in lifting the Dow and more so for the tech stock indices such as the Nasdaq that has been hitting new all time highs since early June. Though will likely lead any general stock market correction lower.

Stocks Expensive or Cheap Indicator (EC)

I am including a new indicator on the AI buying levels table that basically condenses down some 12 financial indicators I track for most stocks to determine if they are expensive or cheap (EC), as stock prices are usually not a good indicator of value.

At it's most basic the higher the number the more expensive a stock is and conversely the lower the number the cheaper a stock is. Where a reading of 20-60 is the sweet spot for most stocks as it implies earnings growth coupled with sustainable speculative interest and thus results in good trending charts with support during corrections, where value tends to be fair so as to enable stock purchases.

Whilst readings above 60 increasingly indicate high levels of speculative interest in future earnings growth. However, this does not automatically mean that a stock trading over 60 should not be bought or sold, it just means that there is a lot of speculative interest in that stock so expect greater price volatility as investors are more likely to react to news events. So I would still invest in a stocks trading over 60 if they had a good reason to justify such speculative interest i.e. such as AMD and Nvidia as higher risk smaller caps. Or Amazon of a few months ago that was set to greatly profit from covid-19 lockdown's.

Over 100 is where stocks are becoming to hot to handle where holding let alone buying more depends on the earnings growth trend trajectories they are on.

Whilst readings Under 20 suggests little speculative interest to drive stocks significantly higher, so likely trading ranges and thus tend to be sleeping giants in the AI mega-trend. Also could be signaling potential problems with the stocks i.e. such as Intel losing the CPU war to AMD which has has made Intel a disliked stock to hold whilst AMD has been heavily bid up into fever making it too expensive to buy.

1. Google (Alphabet)

Still numero uno has been a on a strong bull run since it's $1000 Mid March low, having gained more than 55% to it's recent new all time high. However, Google on an EC of 34 is still fair value. Therefore continues to be a good stock to accumulate into despite what the huge 55% swing in the price chart implies.

(Charts courtesy of stockcharts.com)

Google is retreating from just setting a new all time high, heavy support between $1350 and $1386 so downside looks limited, therefore an achievable buying level would be $1395.

2. Amazon

Amazon has soared into the stratosphere, literally doubling in price from in just 4 months. Where about 3 months ago I thought penciling in $3000 for the stock by the end of 2020 was sticking my neck out a bit far, a level that it has already been passed in July! Imagine all those who sold in March during the panic and never bought back!

However, valuations and growth expectations do not support Amazon trading at over $3000 right now and thus I flagged ahead of time in Patron comments that I was about to sell 50% of of my Amazon holdings and looking at the AI table it should not come as much of a surprise why. Amazon is a primary AI stock with a market cap of well over $1 trillion, and thus should not be trading on an EC of over 100, that's what smaller cap more speculative growth stocks do! Whilst I would still have held Amazon had it been trading at around 100, but not at over 150! Which is where it was Monday morning prompting me to SELL. I ended up selling 60% of my Amazon stock holdings during the first hour of trading (13th July) and was tempted to sell ALL were it not for the fact that one of my key rules is to always be invested in primary AI mega-trend stocks.

Amazon is a one stock bubble that logic suggests should pop. In terms of a buying level there is support at $2700 and then $2500, which is quite a distance from $3300! Therefore an achievable buying level should be $2525. This also illustrates what can happen to ANY AI Mega-trend stock! They are all primed for such trends given the mountain of speculative money wanting a reason to start piling into a AI mega-trend stock regardless of it's size. This also illustrates one of the flaws of being invested in funds, rather than individual stocks i.e. no ability to sell a stock in the fund that one deems to have run too far.

3. Microsoft

The good thing about Microsoft is that it tends to trend well, steady as she goes when compared to the likes of Amazon. In terms of value, at 45, the stock is neither cheap nor expensive.

In terms of a buying level, a correction to 190 should be achievable.

4. Apple

Apple has soared by over 60% to a series of new all time highs all the way to $400. With a trend chart very similar to that of Amazon. However, that's where the similarity ends as Apple has far more in common with Microsoft than Amazon in terms of a EC of 47. The stock price has been driven higher by a series of good news events most notable of which is the plan to shift to making their own ARM based RISC processors at Intel's expense and may even switch from Nvidia to make their own GPU's.

Given that Apple is reasonably valued then downside should be limited. Chart support exists in the range of $351 and $360. Therefore an achievable buying level would be $352.50.

5. Intel

The chart shows Intel is suffering the PAIN of losing in the CPU war to AMD, and where that war is concerned there is much worse news to come with the release of AMD's Zen 3, 4th gen processors in about 2 months time. And then we have Apple planning to shift to using it's own ARM processors. However, before you all rush to sell, in financial terms Intel is cheap on an EC of just 10! So it looks like the market is discounting all of the bad news out there, which means downside price wise should be very limited.

There is heavy support in the $56 to $57 area i.e. just below the current price of $60. Add to the fact that Intel on an EC of 10 has the market already discounting a lot of bad news which means downside is very limited and so Intel could surprise to the upside on an good news event that the market is not expecting. In terms of a buying level, anything less than $57 has a low probability of being achieved.

6. Johnson & Johnson

The first big pharma stock on my list, a sleeping giant pending the revolutionary AI mega-trend rewards that sits on a low EC of 12.

The stock price has been trending lower since setting a March high of 155.9, if this trend persists than J&J could wind its way down to $130. However the pattern is corrective so JNJ should be viewed as a good value stock in a corrective downtrend. In terms of buying level, the support zone of $140 to $137 stand out resolving to a buying level of $140, about 4% away from the current price, though a downtrend could see J&J trade down to $132, so 2 buying levels, $140 and $132.

7. Facebook

Reasonable valuation on an EC of 34. Very similar to Google in terms of trend. High probability buying level at $224.

8. IBM

EC of MINUS 7! Appears Dirt CHEAP! IBM is out of favour with investors! What do I do when a stock is dirt cheap, BUY! Unless I am missing something obvious. Can't get much cheaper than an EC valuation of -7! Though it's also saying don't expect IBM to do an Amazon anytime soon, a case of accumulate when cheap and let the AI mega-trend do it's magic.

In terms of a buying level, well any price around where it is currently trading is good, 117, 118, one could get lucky with a spike lower. But 118 is achievable.

9. NVIDIA

Which stock has performed the strongest since the great corona crash? NVIDIA! Up over 100%! Far more than even Amazon (84%). In fact NVIDIA today has a higher market cap than Intel, $249bn vs $248bn! Nvidia trades on an EC of 106, yes that IS expensive but not on the scale of for instance Amazon or AMD. But it does have the scope for a sell off of sorts to bring the price down towards fairer value i.e. to around an EC of 75-80.

The Nvidia stock chart also illustrates the point of being very careful when selling out of AI stocks as the pre corona crash peak of $316 is fast being becoming a minor blip on the chart. Nvidia stock tends to trend well which is a sign of a corporation that delivers consistently strong earnings growth so definitely an AI stock to have exposure to. In fact in light of the fact that Intel and Nvidia are now neck and neck in terms of market cap, I am elevating Nvidia to a secondary stock from tertiary. So jumps from No 13 to No 9 on my list.

Buying levels for Nvidia would rage between $320 and $350. Therefore a correction should resolve in a high probability of $345 being achieved.

16. AMD

AMD is on a roll, thrashing Intel in the CPU market which looks set to continue into at least the end of 2021! BUT it is darn expensive, trading on an EC of 220! That is a lot of speculative interest betting on AMD. Looking at what the likes of Apple and Amazon have done this year those expecting a similar surge by AMD will have been badly disappointed because AMD is so over priced.

Investing in AMD is a long play because it is going to take a lot of good years of earnings growth to bring the excessive valuation down to a level where the stock can trend. That's why AMD is right at the bottom of my list. A good growth stock with a lot of potential but expensive to get on board! I suspect AMD could spend several years trading in a range of $46 to $58.

In terms of a buying level for some exposure then 49.5 stands out where it has traded down to several times during the past few months.

So what am I doing during Q3?

Looking to buy more Google, Microsoft, IBM, Facebook and NVIDIA. And already sold 60% of Amazon holding.

Also make sure you have read my 2 recent stock market investing articles:

- How to Get Rich Investing in Stocks by Riding the Electron Wave

- Machine Intelligence Quantum AI Stocks Mega-Trend Forecast 2020 to 2035!

This analysis was first made available to Patrons who support my work AI Tech Stocks Buying Levels and Valuations for Q3 2020

Whist my latest in-depth analysis will be posted on the 1st of September 2020 to include -

* Gold price trend forecast into 2021

* Silver New All time High Coming?

* Is Intel a dying mega corp?

* AI stocks current state

* The rise of TSMC

* Can Trump win 2020?

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.