$10,000 Gold – Or A Triple Top?

Commodities / Gold & Silver 2020 Aug 27, 2020 - 10:25 AM GMTBy: Kelsey_Williams

Predictions for gold’s price are based on seemingly sound fundamentals and logic; but the fundamentals are incorrect and presented in unrealistic context. Here are some things to keep in mind when you see any predictions for the price of gold.

GOLD IS NOT AN INVESTMENT

Gold, itself, is not an investment. Gold is real money and the original measure of value for everything else.

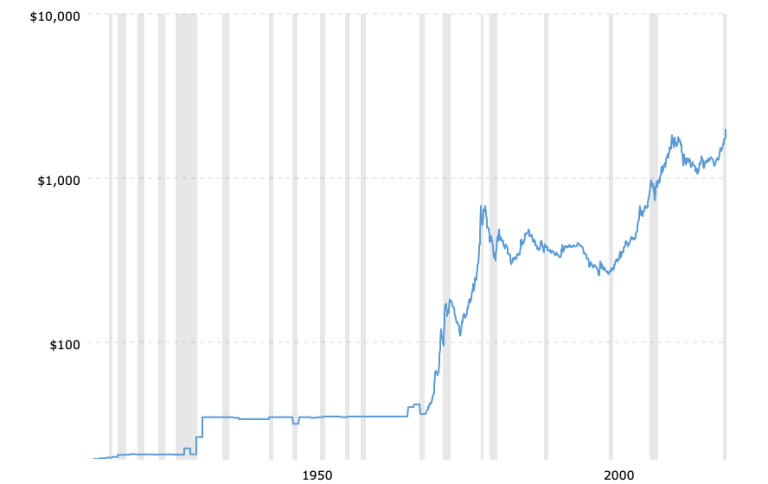

A higher gold price is inversely correlated to a decline in the purchasing power of the US dollar. This, can be seen historically on the chart (source) below…

Over the past century, the price of gold in US dollars has increased one-hundred fold; from $20.67 per ounce to its recent high of $2061.00. That correlates, inversely, to a ninety-nine percent drop in the purchasing power of the US dollar.

Another way of saying this is that one dollar a century ago is now worth only a penny. Or, it takes $1,000,000 today to match the purchasing power of $10,000 in the 1920’s.

GOLD IS NOT FORWARD-LOOKING

Increases in the price of gold come “after the fact”. Gold’s price action is not anticipatory of future conditions, events.

In the chart above, there are two distinct periods of rising gold prices. Both of those periods were a decade in length: 1970-80 and 2000-2011. And both of those periods followed longer periods of time – forty years and twenty years – during which gold’s price was not increasing.

In both instances, the price of gold was playing ‘catch-up’:

“The 1970s were a catch-up period for the price of gold relative to the U.S. dollar’s loss in value over the previous four decades. That, and the anxiety and anticipation created by the realization that things were far worse than we had previously known, led to outsized gains.” (see Gold And The Elusive Chase For Profits)

The period from 2000-11 was similar in that gold’s increasing price from a low of $250 to its then all-time high of $1895 reflected reaction to the cumulative effects of inflation that had continued to erode the value of the US dollar after 1980.

During the period 1980-2000, real growth rates for stocks and other investments were the best ever seen in the US and most of the world; the economy boomed. Also, considerably mild effects from ongoing inflation kept the US dollar stronger. Again, inversely reflecting the dollar’s strength, gold’s price declined for nearly twenty years; before turning up again.

GOLD AT $2060 TODAY IS CHEAPER THAN IN 1980

The surge to recent new all-time highs for gold was also a catch-up period. The move from a low of $1060 four years ago to $2060 a couple of weeks ago reflected depreciation, i.e., an actual loss in purchasing power, of the US dollar since 2011.

While the price of gold is higher in dollar terms than in 2011, and much higher than in 1980, the fact remains that one ounce of gold today at $2060 is no more valuable than it was at $850 in 1980.

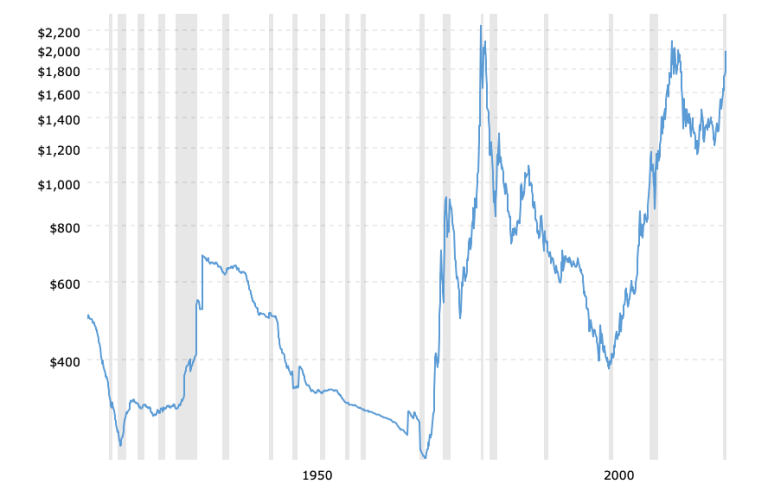

Here is what that looks like on the same chart from above, but adjusted for the effects of inflation…

Looking at this chart, it should be apparent that gold at $2000 is fully-priced. Unless you are convinced that the US dollar is going to crash soon, then expectations for much higher gold prices at this point are unwarranted.

If, on the other hand, you expect the US dollar to drop in value “horrendously”, as some have said, then can gold’s price go higher than $2100? Yes, absolutely; but that will only happen after that further deterioration becomes evident and you find yourself paying more and more for the things you need.

This means that no matter how high the price of gold goes, it will only be indicative of how weak the US dollar gets. And, on an inflation adjusted basis, the price of gold will still not exceed its previous peaks of 1980 and 2011.

For example, let’s say that over the course of the next year that the value of the US dollar drops in half. A fifty percent loss in purchasing power means that it would cost twice as much for ordinary goods and services a year from now, and people would be very reluctant to accept US dollars in payment.

Gold’s price would double to approximately $4000 per ounce; but you wouldn’t have any real profits. You would need the increase in gold’s price just to stay even with the decline in purchasing power of the US dollar.

The worse the decline in the dollar, the greater the loss in purchasing power. The more violent the decline, and the more rapidly it occurs, even to the point of complete repudiation, could take the price of gold to absurdly high levels in dollar prices. But it’s price won’t matter.

Think of it this way. If you wake up tomorrow morning and find that gold is quoted at $10,000, what would you do?

In order for that to happen, the US dollar would have to be virtually worthless. No vendor will accept dollars, so what difference will it make that someone -anyone – says that gold is then worth $10,000? Would you sell it? If you do sell it, what would you use to pay for things you need?

If gold were priced at $10,000 per ounce tomorrow morning, accompanied by a crippled US dollar at death’s door, gold’s price in inflation-adjusted terms won’t be any higher than it is now. And the symmetry of the three tops in the second chart above will still be identical.

Gold’s value is constant. It is real money and a store of value. A higher price for gold is only indicative of a corresponding decline in in the value of the US dollar.

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2020 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.