Stock Market S&P 500 Downswing Staring Us in the Face?

Stock-Markets / Stock Markets 2020 Aug 24, 2020 - 06:45 PM GMTBy: Paul_Rejczak

After flirting with new all-time highs, stocks reversed on the Fed seeing slowing labor market and planning no yield control for now. Volume is slowly returning, prices aren't making material headway, which is lending the stock market a tired look.

Just as I wrote yesterday before being yet again profitably taken out of the earlier long position, it's one thing to be building a base, and lacking the strength to break higher with resounding force.

That's exactly the case with stocks, and the absence of bulls' strong conviction. Each passing day that lacks clues hinting at their return, is leaving the S&P 500 progressively more exposed and vulnerable to broad weakness or even a takedown without much in terms of an advance warning. That's certainly the case with no hints at a new punch bowl on the nearest horizon.

Starting tomorrow, I'll be adding again to the length of Stock Trading Alerts as they return to the usual gold standard you're used to from me, but rest assured that behind the scenes, I am looking at the very same broad set of charts that power my trading decisions.

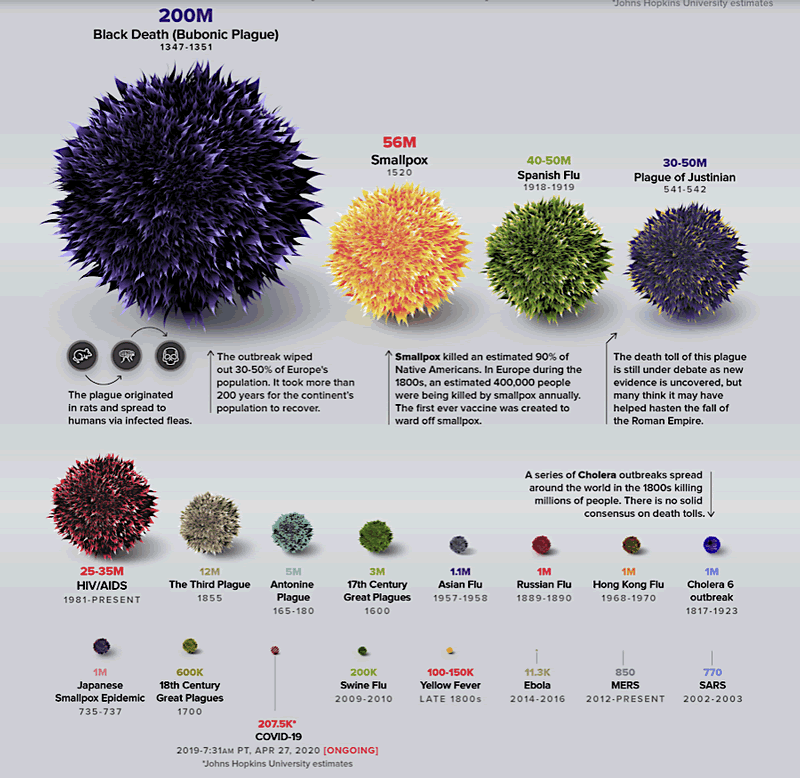

Thank you for your patience also today, and please find below a gift of broader corona perspective courtesy of Armstrong Economics. This is how the Covid-19 casedemic compares to the real and mortal challenges faced by mankind (as opposed to fear-driven self-inflicted wounds, which is what more than a few would say):

Back to finance – the key financial charts for today follow.

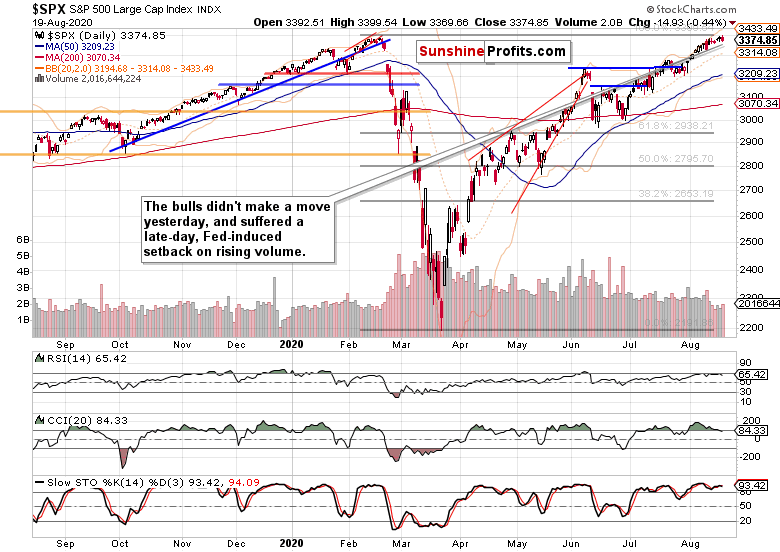

S&P 500 in the Short-Run

First, it's the daily chart perspective (charts courtesy of http://stockcharts.com ):

When prices just can't move in one direction, they become apt to turning the other way eventually. That's exactly what we have seen yesterday in the S&P 500, and the price action just in has the power to turn into more than a one-day event.

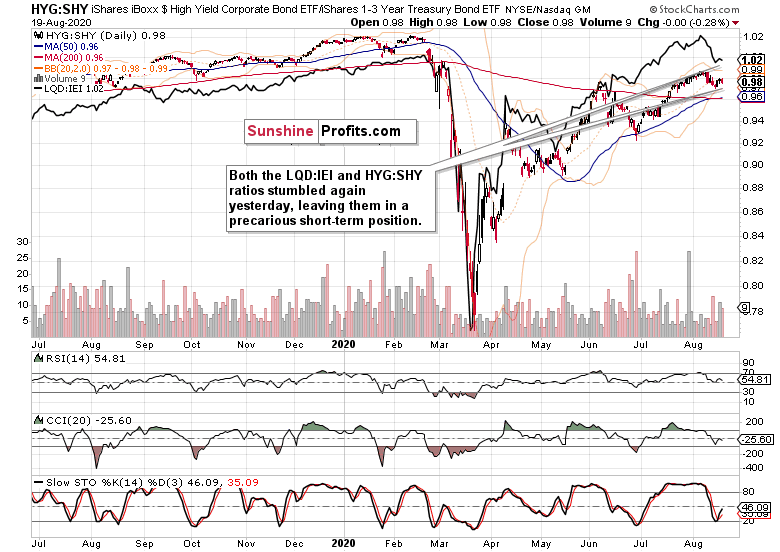

The Credit Markets’ Point of View

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – wavered yesterday.

The individual moves in both corporate bonds ETFs (HYG and LQD) highlight the vulnerability to another leg lower after the preceding two-day stabilization.

I look for the cautious tone the Fed struck yesterday, to carry over to the regular session's trading just ahead – that's more likely to be the case than not. See for yourself on the below chart how the table is set.

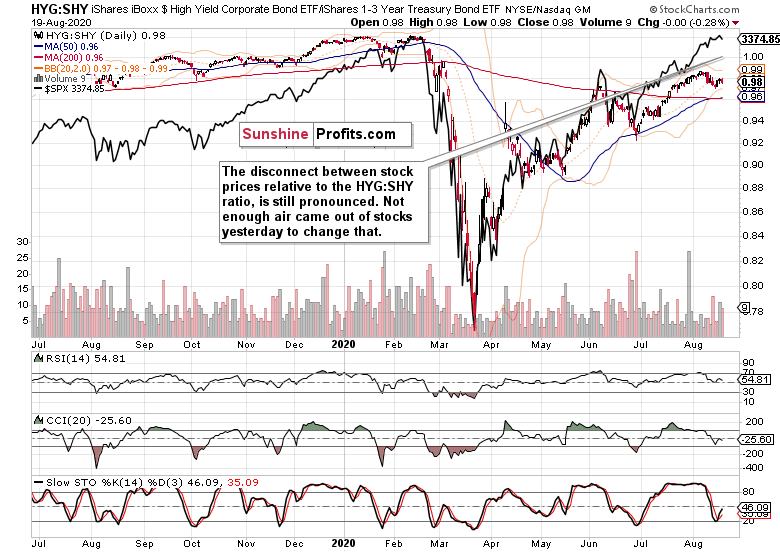

Both stocks and the HYG:SHY ratio have been unable to push higher in tandem over so many recent days. Prices, that's just one dimension of the market moves – time elapsed, that's the other side of the coin. A meaningful correction that would scare the bulls, might be drawing near.

Summary

Summing up, the S&P 500 reversed from new all-time highs, and signs are that the latest weakness has some more to go. It's a precarious position stocks are in – even technology (XLK ETF) has seen a daily reversal candle on rising volume, and semiconductors (XSD ETF) led with steeply rising volume and prices reversing to the downside.

In short, the tech leadership is weakening, and once it sets in more visibly (as in taking the Russell 2000 along), the 500-strong index would be in for quite some trouble. The S&P 500 sectoral view (healthcare, financials, consumer discretionaries) confirms the cautious tone with subtly bearish overtones.

Last but not least, there is the dollar and my yesterday's question whether its break below the July and August lows was for real. Regardless of copper closing near its daily highs, I think we're in for a risk-off turn (or whiff, have your pick) in the markets.

Thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter - it's absolutely free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Monica Kingsley

Stock & Oil Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

Monica Kingsley is a trader and financial markets analyst. Apart from diving into the charts on a daily basis, she is very much into economics, marketing and writing as well. Naturally, she has found home at Sunshine Profits - a leading company that has been publishing quality analysis for more than a decade. Sunshine Profits has been founded by Przemyslaw Radomski, CFA - a renowned precious metals investor and analyst.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.