Technical Analysis Points to US Dollar Upside Potential

Currencies / US Dollar Aug 20, 2020 - 03:13 PM GMTBy: Chris_Vermeulen

Article Highlights:

- The US Dollar Presidential Price Cycle indicates rising US Dollar

- The US Dollar is not the best asset, but rather the best of all currencies

- Price Relationships Suggest The US Dollar Is Currently Undervalued

- How The Presidential Price Cycle May Create Opportunities in Precious Metals and the US Stock Market

It’s been a while since we published an article about the US Dollar and this is the perfect time to discuss that is likely to happen over the next 6 to 18+ months. The US Presidential Election is just around the corner and traders/investors are certain to interpret the uncertainty of the US Presidential Election cycle, and the pending policy and liability related changes, as a warning that equities and the US Dollar may be in for a wild ride over the next 6+ months.

UNDERSTANDING GLOBAL CURRENCY “SHININESS”

Typically, the US Dollar declines over the 6 to 12+ months prior to a major US Presidential election cycle. Whenever there is a major contest for a new US President or an active and aggressive campaign between two individuals, there is a lot on the line. A US Presidential Election is not just about electing a President – it is about setting US, Foreign, Social, Economic, and Taxation polities well into the future. How businesses and voters interpret the benefits vs. risks usually decides the outcome fairly openly. Yet, global traders vote by deciding how much they believe in the policies and leadership in the new US President and/or how they interpret the risks related to new policies, laws, and regulations.

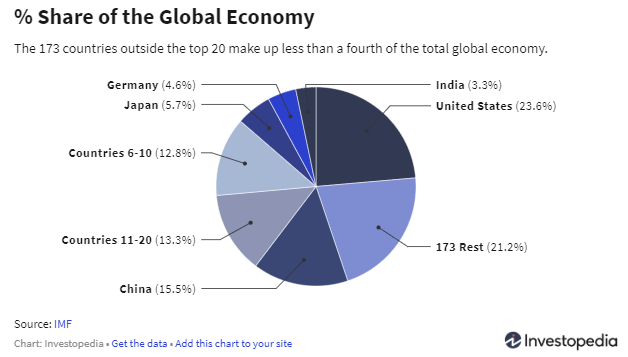

The US is a major driver of global economic growth throughout the world. The US leads the four other large mature economies by 8.5% to over 20% when compared by global GDP. China is the closest economy to the US, yet it still falls nearly 8.5% behind the US economy annually. Even if we were to combine China, Japan, Germany, and India into one economic block, it would beat the US economy by only 5.5% annually.

This is why, at least for now, unless some other global economy rises to the level to dramatically threaten the US economy, the US Dollar will likely continue to sustain value and dominance throughout the world. It also aligns with my “Shiniest Pile Of Poop” theory. Yea, I know that is a horrible name for a currency valuation theory – but it helps us understand how currencies (and other commodities) are processed in the minds of consumers and traders.

A simple example is that of having to dig through the garbage trying to find something to eat (again, a horrible example). Yet, within this example, any human would automatically start ranking the quality of the garbage attempting to determine which items were the “best quality” – even though they are all trash. This process comes naturally for anyone in this position – you simply must select the best items in the pile of trash as potential food items.

How does this relate to currencies? Even though certain currencies may become more attractive from time to time, as traders find value in them and perceive stronger future prices, the reality is that major global currencies will always be considered “shinier” than others. Keep this in mind as we explain our thinking related to the US Dollar going forward.

REPEATING US DOLLAR CYCLES

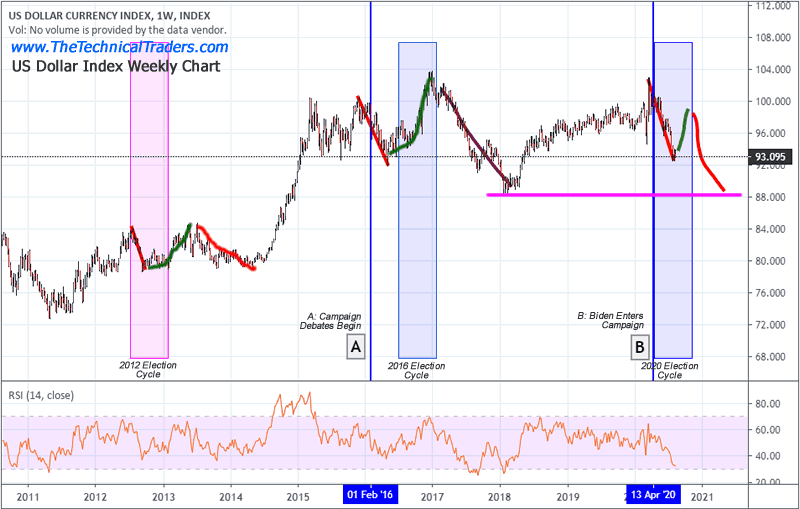

As we can see from the chart below, the US Dollar reacts to US Presidential Election cycles by typically weakening 6 to 12+ months prior to the election date. Each of the last three US Presidential Elections was predicated by a declining US Dollar value and a rise in the US stock market. In 2012, there was virtually no active challenger to Obama’s second term – the expected US Dollar price rotation was rather muted. In 2016, the US experiences once of the most heated and aggressive Presidential campaigns between Hillary Clinton and Donald Trump – the expected US Dollar price rotation was much larger. Currently, as the Presidential Election cycle heats up, we expect a similar range to the 2016~2018 US Dollar price range.

The initial downside selloff in the US Dollar appears to be nearly complete. The second phase of the US Dollar Election cycle should prompt a moderate upside price move in the US Dollar while the US Stock market stalls ahead of the 2020 US Presidential Elections. Our researchers equate this to the uncertainty and potential liabilities of a change in the Office of the US President and the implications related to new policies, taxation, regulation, and other future changes. Traders move into safety within the US Stock market while higher-risk sectors weaken. Essentially, everyone attempts to “place their bets” as to the outcome of the US Presidential Election cycle.

Isn’t it time you learned how I and my research team can help you find and execute better trades? Our incredible technical analysis tools have just shown you what to expect 6+ months into the future. Do you want to learn how to profit from these huge moves? Sign up for my Active ETF Swing Trade Signals today! If you have a buy-and-hold account and are looking for long-term technical signals for when to buy and sell equities, bonds, or cash, be sure to subscribe to my Passive Long-Term ETF Investing Signals.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.