Five Post-Covid Trends and Gold Price

Stock-Markets / Financial Markets 2020 Aug 19, 2020 - 03:15 PM GMTBy: Arkadiusz_Sieron

The disruptions caused by the pandemic of Covid-19 forced people, companies, governments, and organizations to challenge their basis assumptions about their ways of life and conduct. Some of them might be trivial such as more frequent and thorough hand-washing, but others are much more important, amongst them putting more emphasis on health that came suddenly under threat and social relationships that were so missing during the quarantine. So, the key question is when the epidemic is fully contained, what will be the “new normal” – and how it will affect the gold market?

The disruptions caused by the pandemic of Covid-19 forced people, companies, governments, and organizations to challenge their basis assumptions about their ways of life and conduct. Some of them might be trivial such as more frequent and thorough hand-washing, but others are much more important, amongst them putting more emphasis on health that came suddenly under threat and social relationships that were so missing during the quarantine. So, the key question is when the epidemic is fully contained, what will be the “new normal” – and how it will affect the gold market?

The first characteristic feature of the post-pandemic world will be more people working and getting things done from home. The digital transformation has already started before the coronavirus jumped on human beings, but the Covid-19 epidemic has accelerated its pace, with further expansion in videoconferencing, online teaching, e-commerce, telemedicine, and fintech. After all these long years, it turned out that all these boring meetings really could have been e-mails or chats via Zoom, Skype or Teams. What does it mean for the economy and society? Well, working from home implies more flexibility and less commuting for the employees. So, they can work from any location and spend more time with their families. Improved work-life balance translates into happier workers, which can make them more productive. And the most important thing: people can work in sweatpants or pyjamas all day, hurray! There are also benefits for the companies – just think about all the cost savings from less space needed and less business travels! Hence, although working from home has also some negatives (possible miscommunication, loneliness, and difficulties with unplugging after work, decreased knowledge flows and managerial oversight), it should increase productivity in the long-run, especially if not overdone. Improved productivity thanks to telework is positive for the corporate margins and equities, but it is bad news for the gold prices.

Second important trend is deglobalization. The pandemic showed that just-in-time supply chains relying on foreign suppliers are not resilient in times of global crises and border closures. So, many Western companies will re-shore some of their production, or reallocate it closer to their major markets in ways that favor national and regional supply chains. The growth of nationalism will counteract the first change and hamper the productivity growth, which is positive for the yellow metal. However, making the supply chains and manufacturing more resilient diminishes the long run threats to the economies and the risk of economic collapse, which could reduce the safe-haven demand for gold.

Third, the pandemic will affect the geopolitics. For example, it can aggravate the fragile trade relations between China and the United States. Moreover, the epidemic and the following economic crisis make more and more people question the liberal internationalism and America’s leadership role. On the contrary, China’s geopolitical role could increase in the aftermath of the pandemic. The rising geopolitical tensions and protectionism, as well as diminished confidence in the U.S. global leadership and the greenback could increase the appeal of gold.

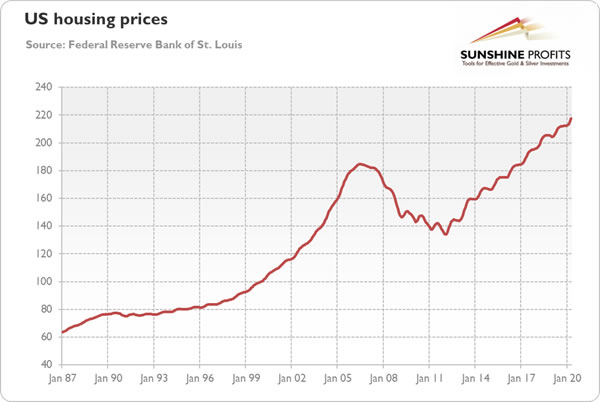

Fourth, could be a shift toward lower population density and less crowded places. It may lead to a complete rethinking or redesigning of living in big cities – or a move from metropolises to smaller cities, towns or even to the villages. After all, when people need only Wi-Fi to work or educate, they don’t have to live in big cities anymore. The consequences are not clear, but it’s possible that the real estate prices in the biggest cities could correct somewhat, as people and companies could cut costs and move away from high-priced, centrally located areas (however, there might be higher demand for larger houses with offices for telework). If we really see such a correction, the repercussions may be significant, also for the gold market, as the burst of the 2000s’ housing bubble demonstrated. As the chart below shows, the S&P/Case-Shiller U.S. National Home Price Index is now much higher than in 2007, before the global financial crisis started.

Last but not least, the role of governments will increase in the post-pandemic world after generously supporting companies and households during the crisis. Compared to the Great Recession, when both the Fed and the Treasury acted more gradually and with some fear of public anger, their recent actions were unprecedentedly swift and aggressive. Hence, the public debt will balloon all around the world, creating significant challenges, increasing the risk of sovereign-debt crisis and putting more downward pressure on the central banks to maintain the dovish monetary policy with ultra-low interest rates. This important macroeconomic trend should be positive for gold.

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.