Precious Metals Are in the Danger Zone, 2020 Forecast Issue Revisited

Commodities / Gold & Silver 2020 Aug 16, 2020 - 07:15 PM GMTBy: The_Gold_Report

Sector expert Michael Ballanger runs the numbers on current and future values of gold and silver given current economic conditions.

"I'd rather be a gold bug then a paper worm." —Anonymous

In late 2019, as I was laying out the framework for the 2020 GGMA Forecast Issue, there was only one four-letter word that kept cropping up and that word was D-E-B-T (actually there were two, but one was what I mutter every time the auto spellcheck completes a word I do not intend to type).

Long before COVID-19 and government-imposed lockdowns cratered the global economy, I was formulating the future price of gold based upon the layers upon layers of sovereign, corporate and household debt sloshing around the world. I deduced that since faith in fiat currencies was rapidly evaporating, then the only remaining collateral left carrying the ability to underpin the gargantuan sovereign debt beast was gold.

Long before COVID-19 and government-imposed lockdowns cratered the global economy, I was formulating the future price of gold based upon the layers upon layers of sovereign, corporate and household debt sloshing around the world. I deduced that since faith in fiat currencies was rapidly evaporating, then the only remaining collateral left carrying the ability to underpin the gargantuan sovereign debt beast was gold.

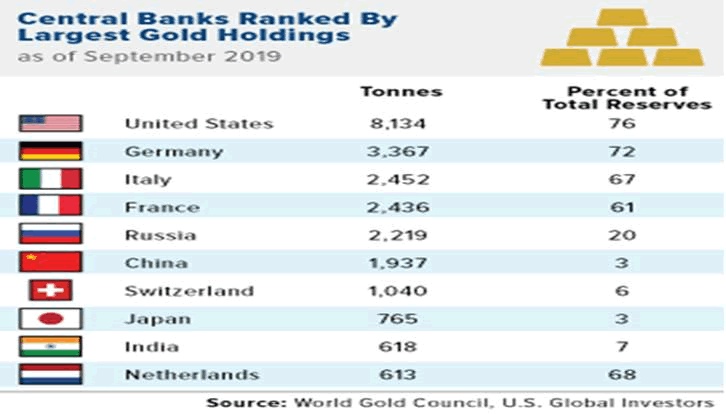

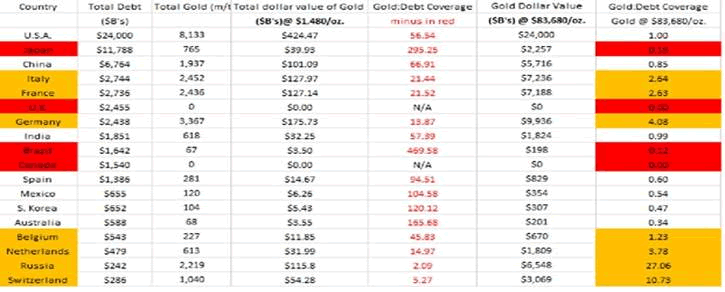

In the 2020 GGMA Forecast Issue, I showed the world how, by using the United States as an example, one could actually put a U.S. dollar "fair value" on the price of gold by turning to the official stated reserves held by the world central banks (shown below) as measured against total national debt (which stood at approximately US$25 trillion in late 2019).

This calculation does not tackle the conspiratorial question of, "Is the gold really there?", which dogs discussion groups constantly, citing multiple hypothecations of the U.S. reserve over the past five decades.

For purposes pertinent to this discussion, I assume that the U.S. owns the 8,134 metric tonnes of gold, which represents 17,927,336 pounds, or 286,837,376 ounces, of the shiny metal.

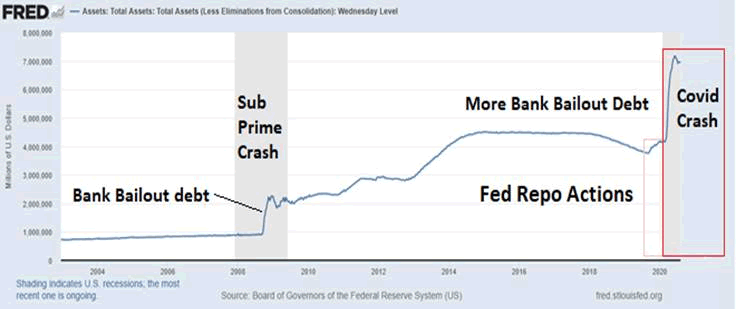

Fed Balance Sheet July 2020

Using pre-Repo and pre-COVID numbers for U.S. total national debt of US$25 trillion, that figure represents US$87,157. Using the same ratio of minimum debt to equity demanded by the mortgage industry of 10%, for U.S. debt to be properly collateralized, you would need a gold price of US$8,715.70 per ounce.

Now, here are a couple of items to consider:

1. Since Fed REPO operations commenced a tad over a year ago, the Fed balance sheet, which had "normalized" from US$4.5 trillion to US$3.8 trillion in 2018 and 2019 until the Powell REPO "pivot," has exploded higher here in 2020 and stands at around $7 trillion, an 84% increase in one year.

2. Total U.S. debt, while impossible to get a reliable figure, has added a minimum of US$10 trillion and a maximum of US$20 trillion in that same one-year timeline, bringing us to an estimated US$35–45 trillion, thanks largely to the actions of both the U.S. Treasury and the Fed.

So, based on my formula of 10%, the new figure is found in a range between US$12,202 and US$15,688 per ounce. With gold at $2,048.90, it today trades between 13.06% and 16.8% of levels required to collateralize the total U.S. debt load at 10% equity. Conclusively, gold remains one of the least expensive assets on the planet relative to the mountains of debt that has been manufactured out of thin air by the U.S. banco-politico alliance.

Using a gold-to-silver ratio of 50, silver would be considered "fair value" in a range of US$244–314 per ounce, which says that silver today trades at between 9.16% and 11.78% of the number deemed "fair value."

In past years, whenever my pet Rottweiler, Fido, has heard me talking on the phone about $2,000 gold and $30 silver, he has bolted out the door and taken refuge under the toolshed. He dug a hole there back in August 2016 after I hummed one of those crystal balls filled with phony snow at a TV screen full of Larry Kudlow and missed, only to have it explode against a wall directly above where the poor canine was sleeping. Just prior to that highly immature outburst, I had been speaking to a colleague about price targets, and had mentioned $2,000 gold and $30 silver, and when the bullion banks came in and capped the rally that day with an avalanche of fictitious "sell" orders, I snapped and poor Fido paid the price. It took a slab of tenderloin and a couple of pork bones to coerce the terrified creature out of hiding.

But the point remains that he is acutely aware of my mood swings and how elation can turn to outrage at the most unexpected of times.

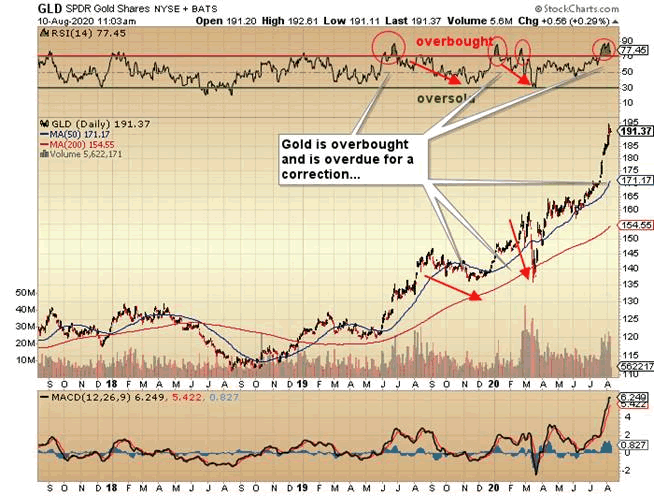

Accordingly, I too am "acutely aware" of the current state of bullish enthusiasm over gold and silver, and wish to convey temperance in light of my earlier analysis. The chart of SPDR Gold Trust (GLD:US) shown here has the RSI (relative strength index) more stretched than any time in the past three years. As I have written countless times over the years, RSI is not a timing tool; it is a risk management tool. New gold purchases are to be avoided in the near term.

Silver, as shown by the IShares Silver Trust (SLV:US), is also getting into the "danger zone," with RSI north of 80 and the DSI now touching 98. These are extreme readings and consistent with tops but, and I need to repeat this with force, it does not mean that prices are guaranteed to collapse.

I am hedged from few days back, with a relatively modest position in the SLV October $23 puts. The reason I use put options is that in a crazy market like silver (other notables being soybeans in August and OJ in January), absolute insanity has been known to prevail, so I always prefer positions with finite risk. If silver goes to $100, I lose all the put premium, but it is more than offset by my gold and silver developers, which can double or triple on any type of move like that.

I am on the record as now being in full "bunker mentality" relative to the bigger names, as I think we are rapidly approaching harvest time for the seeds we planted back in March. I am holding and adding to the developers, as many are dramatically undervalued in terms of value per ounce. Any junior developer trading under $80 per ounce of gold in the ground (and deemed a "resource," preferably NI43-101 compliant) is considered "cheap," and I offer as an example (of "shameless book-talking") Getchell Gold Corp. (GTCH:CSE), trading at US$18.17 per ounce of historical resource located at their Fondaway Canyon property. (The company recently released an excellent video of the project that is a must-see for all existing and prospective shareholders.)

I could name about two dozen other gold and silver names that are not yet in production but whose resource will soon have them front and center on the investment radar screens of this entirely new generation of gold and silver players, salivating over their iPhones, holding extra-hot-no-foam lattes as they dial up their Robin Hood accounts to see which names they (and their five million colleagues) are going to jump on.

Last point: If the gold market inevitably undergoes a coordinated price-pegging exercise designed to collateralize global debt, a US$12,202 gold price would move the value-per-ounce benchmark sharply higher. At US$2,000 gold, the 20:1 ratio that is today deemed "fair value" for in-ground gold ounces places the number at US$100 per ounce.

However, if you apply that ratio to the new peg, it will move the value-per-ounce benchmark to $610 (US$12,202 divided by 20). A 1,000,000-ounce resource would carry an expected value of US$610,100,000.

This is precisely why the junior developers, largely unknown to these legions of new precious metals investors, represent the lowest risk and highest potential reward, and why any corrective behavior in the space will have minimal effect on them.

I am doing my utmost to keep my bullish views to a mere whisper because to do otherwise is a major-league jinx, causing wives and large Rottweilers to flee. . .and we would not want that.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver Ltd., Great Bear Resources, Western Uranium, Stakeholder Gold, Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. and Western Uranium & Vanadium Corp. My firm no longer does consulting work for Stakeholder Gold.. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium and Aftermath. Please click here for more information. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports (including members of their household) own securities of Getchell Gold, Western Uranium and Stakeholder Gold and Aftermath, companies mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.