Economic and Geopolitical Worries Fuel Gold’s Rally

Commodities / Gold & Silver 2020 Jul 30, 2020 - 04:05 PM GMTBy: Arkadiusz_Sieron

Gold has jumped above $1,850 amid expectations of new stimulus, worries about the pace of economic recovery, and concerns about rising tensions between the U.S. and China.

Gold has jumped above $1,850 amid expectations of new stimulus, worries about the pace of economic recovery, and concerns about rising tensions between the U.S. and China.

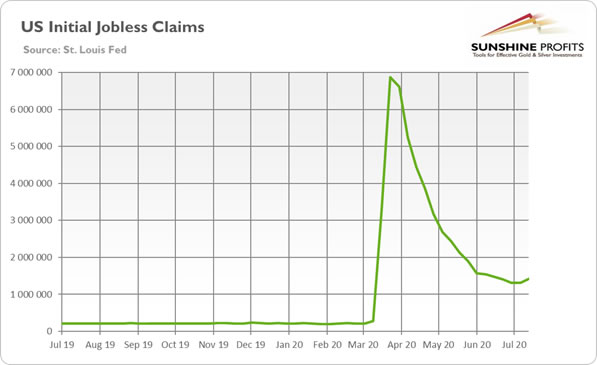

Houston, we have a problem! Please take a look at the chart below that presents the U.S. initial jobless claims. What do you see?

Yes, you are right! The number of people claiming unemployment benefits has recently risen. To be precise, in the week between July 11 and July 18, initial jobless claims increased from 13.1 million to 14.2 million. Yup, instead of falling, they went up! Surely, we should never read too much into a single report. However, the increase in the number of applications for unemployment benefits is not something we should expect during firm, V-shaped recovery. The decline in initial jobless claims was already very sluggish, and the recent reversal in trend will only add to worries that the second wave of coronavirus is slowing down the economy. In other words, the recovery could be more fragile and less vigorous than many people hoped for. As I write in the August edition of the Gold Market Overview, “forget about the V-shaped rebound – the economic recovery could look more like W or like the Nike’s swoosh.” Indeed, the spread of the Covid-19 makes the V-shaped cycle less likely, while the double-dip recession more probable. Increased worries about the pace of recovery are positive for gold prices. The yellow metal should then gain not only as a safe haven but also thanks to the expectations that sluggish rebound would force the Fed and Treasury to another rounds of monetary and fiscal stimulus.

Increased Tensions between U.S. and China also Support Gold

Geopolitical concerns are another factor that supports gold prices right now. The already heightened tensions between the United States and China have recently escalated to a new level recently. Both superpowers are at odds on almost every front, from still unresolved trade wars to Taiwan, the Covid-19 pandemic, China's human rights abuses in Hong Kong and Xinjiang, and South China Sea. The latter issue has become an flashpoint amid increasing number of naval drills and encounters. On July 13, the U.S. Secretary of State Mike Pompeo signaled a tougher stance, rejecting in a statement most of China’s claims to the South China Sea. He said:

We are making clear: Beijing’s claims to offshore resources across most of the South China Sea are completely unlawful, as is its campaign of bullying to control them (…) The world will not allow Beijing to treat the South China Sea as its maritime empire.”

And, last week, the U.S. ordered China to close its consulate in Houston, Texas, following accusations of spying. It was called by the Chinese Foreign Ministry an “unprecedented escalation” in recent actions taken by Washington. According to some analysts, the risk of an unplanned confrontation is growing as relations worsen very quickly, which could push both countries closer towards war. Such fears increase the safe-haven demand for gold.

Implications for Gold

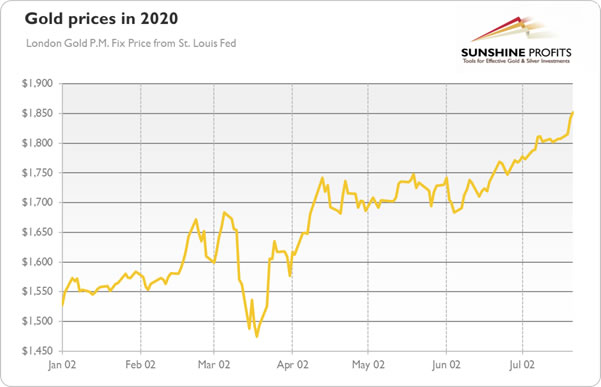

What does it all mean for the gold market? Well, both the increase in the initial jobless claims (against the markets’ expectations) and the rising tensions between China and the U.S. are positive for the yellow metal. They fueled the recent surge of momentum that pushed gold prices above $1,850, as the chart below shows.

Last week I wrote that low real interest rates, ample liquidity from the Fed and expected new round of fiscal stimulus are driving gold prices further north. The concerns about the spread of the coronavirus and the pace of the economic recovery, as well as worries about the U.S.-China relations can only add to the gold’s rally.

If you enjoyed the above analysis, we invite you to check out our other services. We provide detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.