The Big Short 2020 – World Pushes Credit/Investments Into Risk Again

Stock-Markets / Financial Crisis 2020 Jul 11, 2020 - 07:53 PM GMTBy: Chris_Vermeulen

One thing is very certain right now – we live in very interesting times. As the world rushes head-first into the 21st Century, it appears one of the most pressing issues before all of us is to navigate the risks and opportunities that continue to stack up ahead of us. Within the first 20 years of this century, the global markets have experienced many shifts and big price rotations. Emerging markets, Oil, Technology, Bio-Tech, Miners, Metals, Currencies, Cryptos – we can look at all of these on a longer-term basis and see a boom cycle and a moderate bust cycle event.

The current trends suggest global investors are pouring capital into the US technology stocks which is what is driving the NASDAQ to new all-time highs. We published this article in late June suggesting a parabolic top pattern may be setting up in the global markets – which may be very similar to the DOT COM peak in 1999~2000 explained here.

Our researchers believe the global shift away from risk and into hot sectors are driving capital investments into a frenzy right now. It reminds us of the frenzy in the US in the late 1990s when housing, technology stocks, and credit expansion rolled into a frothing expansion phase – then burst suddenly in 1999. There were plenty of signs in 1997 and 1998 that the frenzy buying was a huge risk – but traders and consumers simply ignored the risks and kept buying.

Similarly, this same type of bubble mentality happened in 2017 with Bitcoin. In less than 24 months, Bitcoin rallied from $370 in early 2016 to $19,666 near the end of 2017 – a massive 8000%+ rally. The similarities of the Bitcoin rally and the rally of the US stock market in the late 1990s is the mentality of the investors throughout these bubbles – the “no fear” mentality that it will keep going higher and higher. The same type of mentality appears to be happening in the US stock markets right now and the data suggests something vastly different is really taking place.

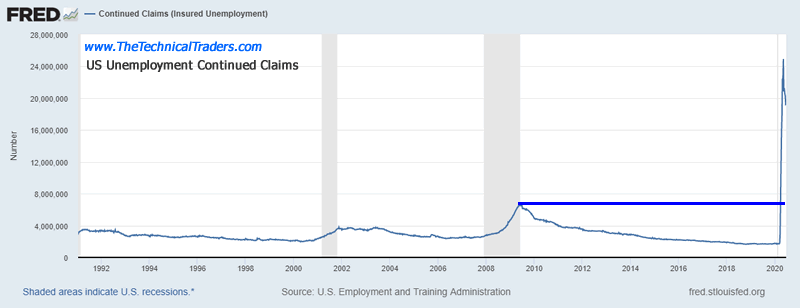

Unlike what happened throughout recent history, the globe has recently experienced a massive disruption event – the COVID-19 virus. This disruption has displaced economic output and consumer earnings on a massive scale – and we are just starting to learn how disruptive these economic factors may be. One item we believe is severely under-estimated is “consumer earning capabilities”. The number of jobless in America has risen to well over 35 million (over 10% of the population). If the COVID-19 virus continues to disrupt consumer’s ability to earn income and engage in the economy over the next 6+ months or longer, there is a very real possibility that the V-shaped recovery everyone believes is happening will simply not happen at all.

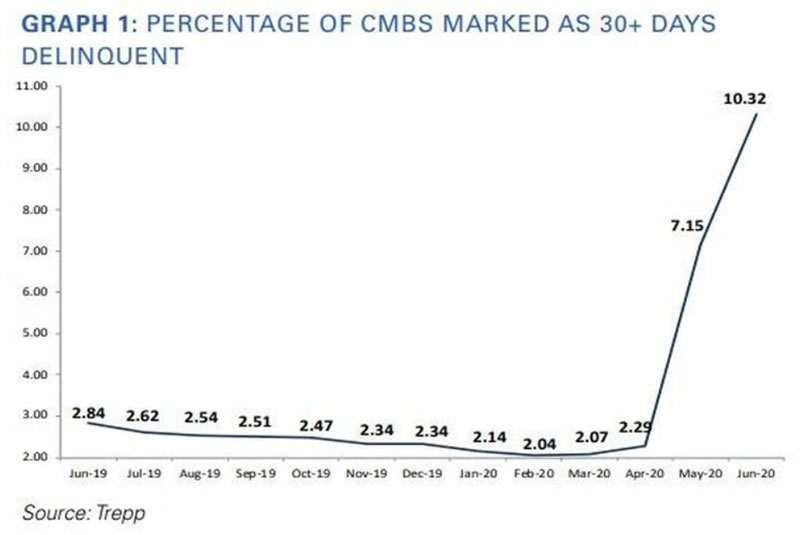

One of the most ominous signs of a broader consumer and commercial contraction happening in the US markets is the skyrocketing delinquency rates for commercial real estate. Trepp recently published new data suggesting the commercial real estate market is experiencing a massive increase in delinquencies of 30+ days which may lead to a wave of high-value defaults. Other research suggests US Banks may face $48+ Billion in commercial real estate loan losses.

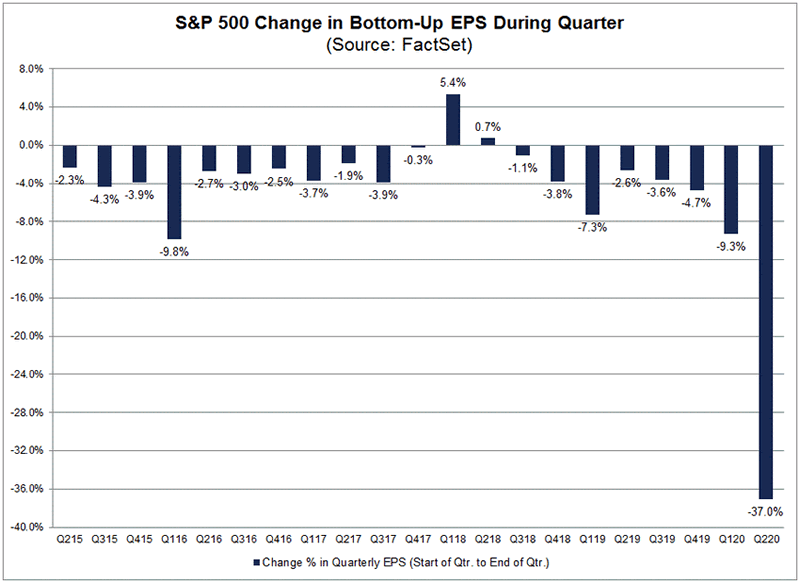

The Q2:2020 earning estimates have decreased by such a large amount that all investors should prepare for a shocking series of data over the next 30+ days. Nike surprised everyone with a nearly $800 million loss for their Q4 ending May 31, 2020. We just read that PizzaHut parent, NPC, filed for bankruptcy recently. This recent Bloomberg article suggests a massive wave of US corporate bankruptcies could continue throughout 2020 and well into 2021 and extended economic pressures erode the foundations and operations of hundreds or thousands of US businesses ().

What is happening in the US markets right now is that foreign and US investors are piling into this deep price rotation expecting the US Fed to do whatever is necessary to support the markets throughout the COVID-19 virus event. We believe the risks for investors have never been higher as the global markets teeter on the edge of a partial recovery while the COVID-19 virus surges again throughout the US.

We’ve kept our clients actively protected from the risks within the markets and continue to advise them on how to identify profitable trades within the current market trends.

In the next part of this article, we’ll explore more data facets related to the Q2:2020 and the future expectations of the US and global markets. Our biggest concern is the destructive capabilities of the general consumer. At some point, we have to understand the consumer drives 85% of the US GDP and future expectations. If this event destroys the consumer, then it will destroy future expectations.

Keep in mind, we do not trade or invest on fundamentals or economic cycles because we know they can lead or lag stock prices by several months at times. Our focus as technical traders is to follow the price trend and trade accordingly. Stay tuned for part II.

Get our Active ETF Swing Trade Signals or if you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Passive Long-Term ETF Investing Signals which we are about to issue a new signal for subscribers.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.