1929 Style Financial Markets Panic: The De-leveraging Margin Debt

Stock-Markets / Financial Crash Oct 10, 2008 - 11:31 AM GMTBy: Marty_Chenard

Panic levels are reaching levels not seen since 1929. We are now in the 3rd. Phase of a de-leveraging process.

Panic levels are reaching levels not seen since 1929. We are now in the 3rd. Phase of a de-leveraging process.

Some of you may remember the NYSE Margin chart I posted in late 2007. Basically, it showed that 2007 margin levels were starting to drop from an "extreme" level. Historically, every time we have reached extreme margin levels, they always got unwound . That is where we are now, in an accelerating Phase 3.

The hottest hedge fund sectors were leveraged 30 to 1 last year ... definitely an over leveraged condition. In this kind of environment, prices fall as fast as positions are unwound to meet margin calls.

The only good news right now, is that we are getting closer to the end than the beginning of the market's falling ... with the end being after enough leverage has been unwound.

Now, let me now share our NYSE Margin chart from last year, and the most current chart.

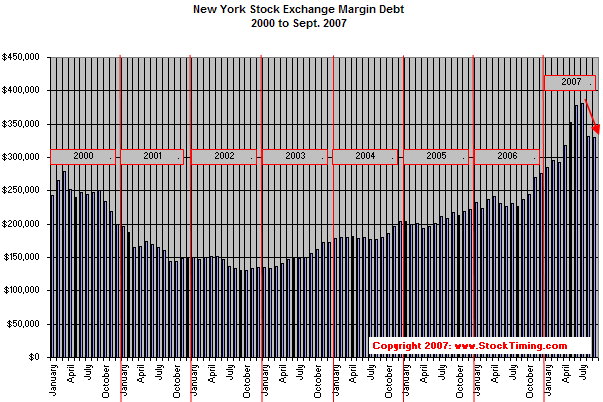

This is the chart we posted late last year. Note, that it showed margin peaking in July 2007 and then falling two consecutive months into September. That sizeable drop caused us to be concerned that we could be starting an unwinding process on excess margin levels. See the next chart ...

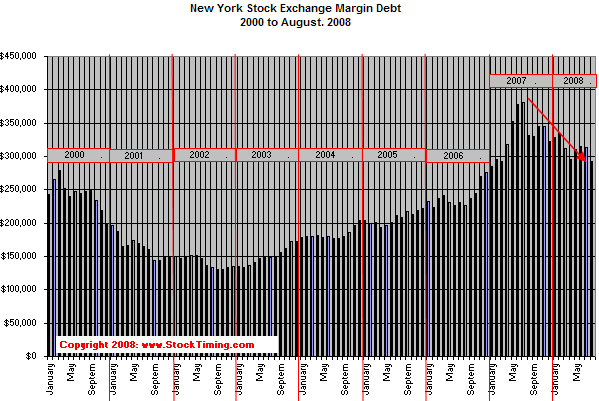

This is the current chart with the last margin update ... August, 2008.

Note that the margin debt has continued in a down trend, and an unwinding process since the July 2007 peak.

The release of NYSE margin numbers are delayed so we don't have up to the minute official numbers.

What I can tell you is that the unwinding of margin has accelerated this week, and when that happens, prices fall as fast as positions are being unwound to meet margin calls. Those who invest using extremely high leverage are speculators , and these kind of market conditions end up squeezing speculators out of the market.

(A more extensive discussion on the de-leveraging phases and the use as CDSs as a hedging tool by Institutional Investors is discussed on our paid subscriber site.)

*** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

______________________________________________________________________

*** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.