Gold Stocks Correction and Upcoming Opportunity

Commodities / Gold and Silver Stocks 2020 Jun 16, 2020 - 02:14 PM GMTBy: Gary_Tanashian

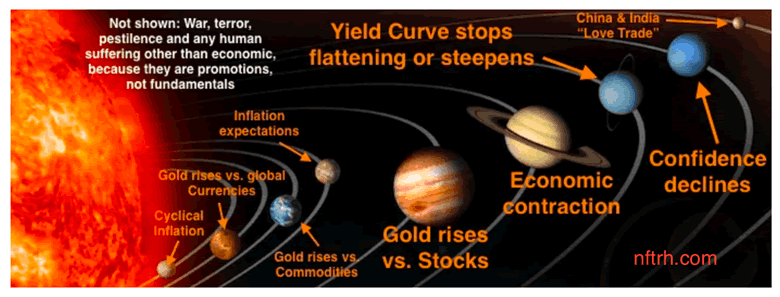

Before updating the status of the gold miner (HUI) correction, let’s take a quick review of the Macrocosm, because it’s always a good time to be clear on important macro considerations.

The graphic makes the following points that are the foundation of the NFTRH view on the right/wrong times to be fundamentally bullish on the gold stock sector. In order of priority, a bullish view needs:

- A contracting economy, which…

- Drives counter-cyclical gold higher vs. stock markets (and many other assets), and…

- By extension, sees a general decline in economic and market confidence.

- When an economic boom phase ends, yield curves bottom and start to steepen.

- Gold rises vs. commodities and materials, some of which represent mining costs.

- Gold rises vs. all major currencies, which is also a sign of declining systemic confidence.

- Inflation expectations can be constructive for gold and especially silver, which drives ‘inflationist’ bugs into gold stocks, but this is not fundamentally positive if the inflation is cyclical and drives commodities like energy and materials more than gold. This is when gold stocks rise against their proper fundamentals. *

- Cyclical inflation, as in 2003-2008 can see the sector rise strongly (HUI was approximately +300% in that period) but the end will be bloody, as per the Q4 2008 sector clean out.

- China/India “love trade”: Ha ha ha… when you see this in writing, run away from it.

* The reason I am writing this article is because as the gold sector moves along in its correction, the fundamentals and macro indicators look to regenerate a positive backdrop for the counter-cyclical gold stock sector, which will leverage gold’s performance vs. economically correlated cyclical assets.

HUI Daily Chart Situation

The correction has been on for a few weeks now and has only tested the 50 day moving average. Despite the big pop and big drop on this hype filled FOMC week, we noted in a subscriber update that HUI will not be indicated to exit its short-term correction unless it takes out a key level. I’ll have to reserve that level for the update, but I’d like to review many other parameters on the daily chart, which I’ll let speak for itself mostly.

The bottom line here is that if HUI does not exit its correction in the short-term it is still a candidate to correct to deeper levels. HUI does not have a gap at its second support area but the GDX ETF and XAU index do. Those may be meaningful. If we get such a pullback to the 38% or even better, the 50% Fib retrace level and world markets are caught in the grip of another significant correction, the indication will be to buy quality gold stocks*, and buy them hard.

The best buy area would be at the 50% Fib, just below the rising 200 day average. The gap was a breakaway gap that drove HUI back into an uptrend. It does not need to fill but it would not be a bad thing to get it out of there. But technically, any of the green shaded support zones is a candidate to halt the correction.

* We chart a multitude of quality senior, junior and exploration stocks every week in NFTRH in order to be prepared for such opportunities.

The Macro Indicators

So again, tuning out the inflationists, when looking to buy the gold mining sector we want a backdrop of declining asset prices, often including the miners as these babies get thrown out with the dirty, inflated bath water. The proper fundamentals have supported our bullish view for the last year and now should be no different, assuming the broad markets come back under duress.

We all know that the economy is in contraction, so we don’t need to account for the status of the #1 supportive macro indicator for gold stocks. Let’s proceed to #2.

Gold vs. Stocks (SPX)

This handy chart gave myself and NFTRH subscribers a heads up on the miner correction to come just as it did on two previous occasions. Gold/SPX is bullish and so this is a bullish macro indicator for gold mining. It did however, get too far stretched into risk territory back in May. That is being attended to now, either by a continued gold stock correction/consolidation or a resumption of gold’s bullish trend vs. stocks markets.

Yield Curve Steepens

From CNBC, here is the updated spread between the 10yr and the 2yr yield. Since last summer’s well hyped tick to inversion the curve has steepened. That tends to be gold-positive, whether it is an inflationary steepener or a deflationary steepener (both macro conditions can drive the curve).

This indicator remains constructive for gold and thus, gold stocks.

Gold vs. Commodities

This one is important not only on a macro indicator level (showing HUI’s performance vs. gold’s real, commodity-adjusted price) but also on a sector fundamental level as energy and materials commodities drive mining costs. Here is a log scale monthly chart showing HUI still in ‘value’ territory vs. this bullish indicator.

Gold vs. Currencies

We’ll make this the last item and skip the inflation items on the graphic at top because the inflationary rationale for owning gold stocks, while it can succeed for long periods like the 2003-2008 phase, is a canard. Cyclical inflation is not fundamentally positive for the gold miners. But gold’s standing vs. global currencies is definitely an indicator of investor sentiment toward steady, value retaining gold and a world of major paper/digital tramps.

Let’s check out a daily chart showing that as the US dollar has declined (as it should during the reflationary* post-March market sentiment adjustment rally) fellow risk ‘off’ vehicle gold has pulled back vs. most global currencies, but has begun a rebound. It is interesting that the two commodity currencies (Canada & Australia) have been the firmest lately. Interesting, but logical, since the most recent leg of the stock market sentiment rally had a reflationary component to it. This little rebound in gold vs. global currencies (but not necessarily the risk ‘off’ USD) needs to continue to get back in shape.

* As explained in NFTRH 606, my interpretation of ‘reflation’ vs. ‘inflation’ is that inflation is the attempt (by monetary and fiscal policymakers) to use currency and bond manipulation to bring about the desired result, and reflation is that desired result.

Bottom Line

The shear terror at the March lows experienced by casino patrons was bound to eventually resolve into a strong sentiment event going the other way. It has and we have taken advantage of it since March.

Yesterday may have been the first crack in the relief rally (we will look for certain confirmations or negations per a subscriber update this morning) and if it is, then the gold mining sector’s true fundamental and preferred macro backdrop will be in place for new buying, especially if the inflationist bugs sell and drive the miners down further to significant and logical support areas.

Regardless, this sector continues to look like the standout in macro markets and economies that will continue suffering from an ongoing confidence drain once the stock market relief rally is done and resolved. It’ll pay to have your list of preferred quality miners, royalties and exploration companies at the ready for new buying. Note the word “quality”, because there is a lot of junk out there waiting to be promoted for your hard earned funds.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2020 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.