Stock Market Shift Away from Safety Begins

Stock-Markets / Stock Markets 2020 Jun 12, 2020 - 05:09 PM GMTBy: Donald_W_Dony

Sector performance or strength can tell an enormous amount about how Mr. Market is feeling.

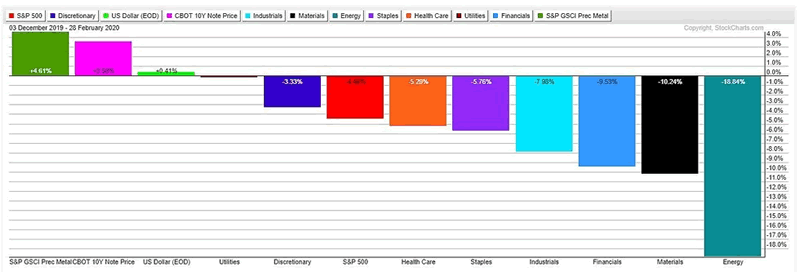

In Chart 1, from early December to late February, the four classic safe haven sectors (precious metals, bonds, U.S. dollar and utilities) were all outperforming the benchmark S&P 500.

The energy sector had the lowest performance (down 18.84%) as oil prices showed increasing signs of weakness. Light crude oil price ultimately plunged from $65.00 in early January to a brief low of $6.50 in mid-April.

The reason for the sharp contraction in oil prices was from the severe drop in transportation due to the COVID-19 pandemic.

The S&P 500 was down 4.49% during this time frame.

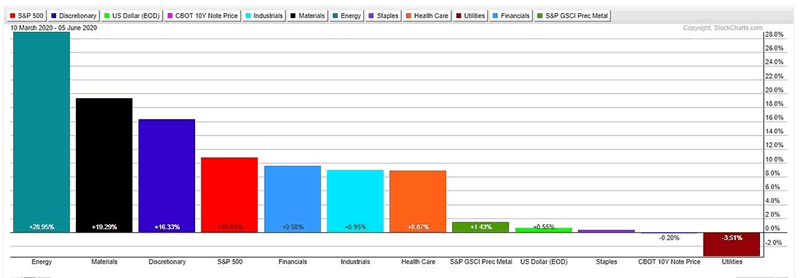

Nevertheless, over the last 60 days, the market has shown an incredible rebound and a change in outlook (Chart 2).

Those same safe haven sectors are now showing the lowest performance. Precious metals, U.S. dollar, bonds and utilities are being sold as evidence of a rally takes hold.

The energy, materials, consumer discretionary, financials and industrials sectors are surging as investors move away from the perspective of a prolonged downturn in the market and look toward a return of the bull market.

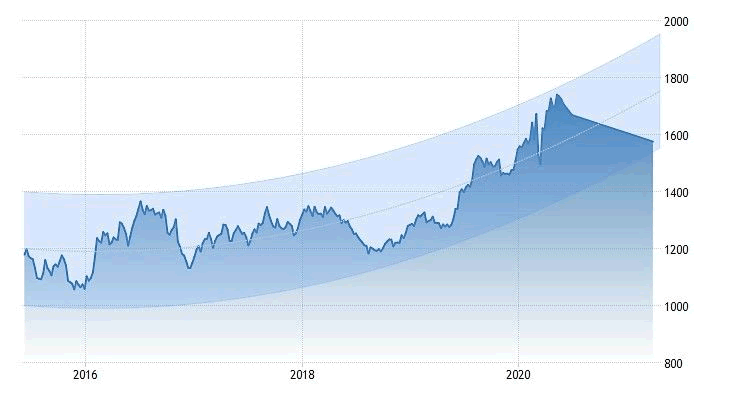

The recent price of gold is a good example of the shift away from safety (Chart 3).

The precious metal peaked out at $1,788.80 in early April after a strong run in the first few months of the year. Models are indicating additional price weakness for the rest of the year. The year-end target is just under $1,600.

Bottom line: The shift away from safety is a promising sign for the return of the bull market. The sectors that are normally associated with a prolonged secular advance are displaying strength now.

The one exception is energy.

Presently this group is showing the most upside performance. Normally this sector under performs during a bull market. Case in point, over the last five years, the energy sector has been the only industry group on the S&P 500 that has posted a negative return. Models suggest that by Q3 the performance in the energy sector will fade.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2020 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.