Inflation ‘A mirror image of the early 1980s’

Economics / Inflation Jun 10, 2020 - 03:25 PM GMT“To propose a return of inflation is to be inflammatory,” writes Lightman Investment Management’s Rob Burnett in an opinion piece for the Financial Times. “Investors are committed to a deflationary thesis — and such is their fervor that many believe inflation cannot return in any circumstance. Yet if we look beyond today’s demand shock from the Covid-19 crisis, the forces driving the disinflation of the past 40 years appear to be in retreat. … [T]oday appears like a mirror image of the early 1980s. We have moved from inflation peak to deflation trough.”

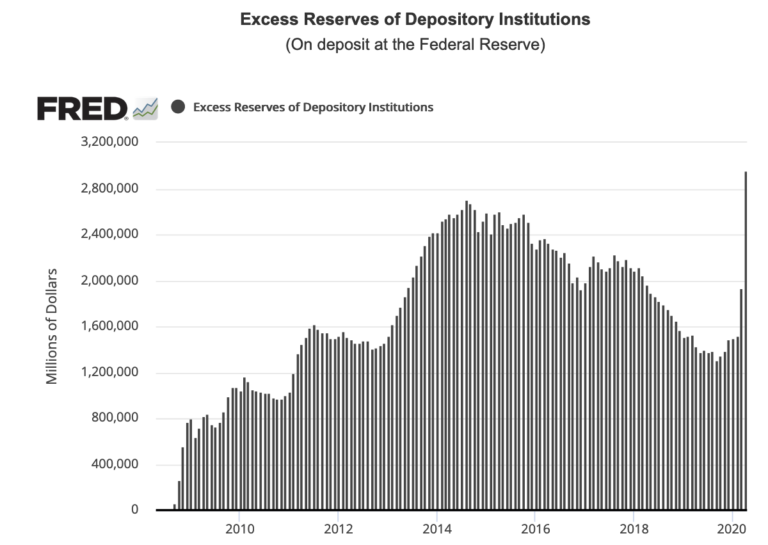

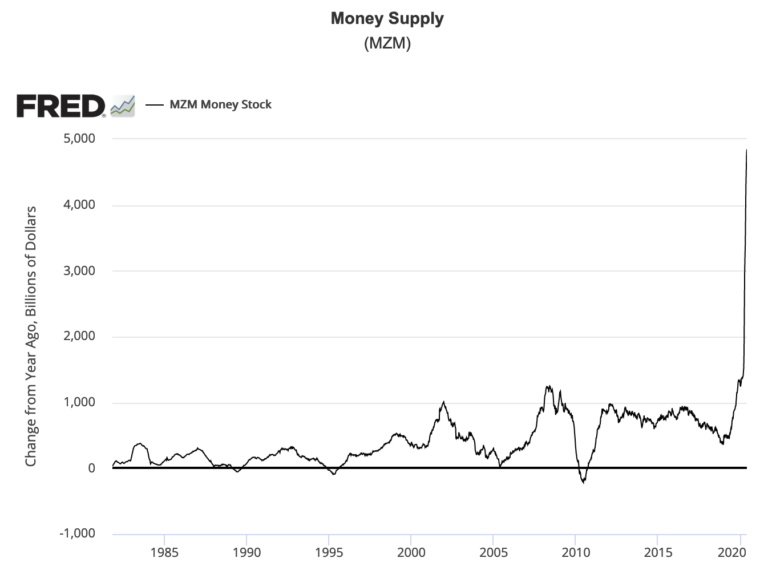

Evidence is beginning to mount that the new paradigm Burnett describes – moving from disinflation to inflation – might not be too far off the mark. During the financial crisis that began in 2008, the Fed sterilized its money creation by routing money back to its coffers in the form of commercial bank excess reserves – a strategy that kept the inflation rate from running out of control. As you can see in the first chart, the current level of sterilization, at least in the short term, is greater than what occurred in the 2008-2014 period. At the same time, as you can see in the second chart, the rapid growth in the money supply this time around goes beyond anything that occurred during the prior crisis. Whether or not Burnett is correct and the growth in the money supply translates to price inflation down the road remains to be seen. (Please take note that the growth in the money supply began roughly a year ago – well before the onslaught of the coronavirus pandemic.)

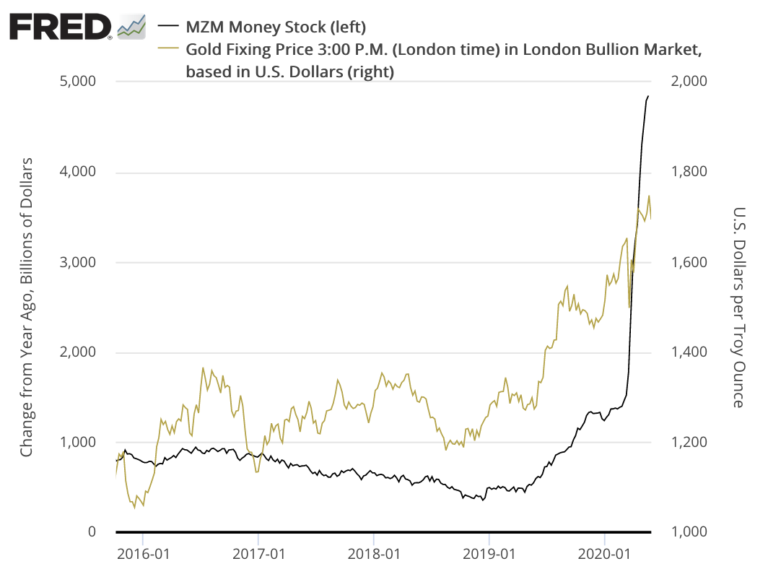

To understand what gold’s role might be in a historical shift of this magnitude, we turn to Atlantic House Fund Management’s Charlie Morris. “The point,” he says in a report published recently in The Alchemist quarterly review, “is that there is a rational framework from which you can understand the dynamics of the gold market. Owning gold does not mean you have to fly blind. The current gold premium is telling us that higher inflation is coming. The implications for asset classes are immense. Higher inflation implies a weaker dollar, which implies higher commodity prices and a surge in emerging market equities. It will make bonds unattractive and potentially drive down equity valuations in the developed world. The last time we saw this was in the 1970s. Those that thrived owned gold.”

The third chart in our grouping supports Morris’ thesis. Since late 2019, gold and the money supply have risen in tandem hinting that perhaps the inflation genie might yet escape the bottle.

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis, ICE Benchmark Administration (IBA)

A Mirror Image of the Early 1980s is the lead article for the June edition of USAGOLD’s monthly client letter. This month’s edition also includes a detailed look at current and future gold demand in three important sectors – funds and institutions, central banks and individual investors; why it is important to understand the amygdalotomy policymakers performed on Wall Street; how the Fed chairman Powell spilled the beans on money printing in a 60 Minutes interview; a bit of history on when the United States owned the largest hoard of gold on Earth and why it is important today …… and much more including our usual array of timely charts and cartoons.

Up-to-the-minute gold market news, opinion and analysis as it happens. If you appreciate NEWS & VIEWS, you might also take an interest in our Daily Top Gold News and Opinion page.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.