Central Banks Panic as Bailouts Fail to Halt Stock Market Crash

Stock-Markets / Financial Crash Oct 10, 2008 - 02:22 AM GMTBy: Mike_Shedlock

The global economic dam has now cracked wide open. Water is pouring everywhere. The bursting of the dam is a fitting tribute to Paulson's and Bush's $700 billion boondoggle to add liquidity to banks.

The global economic dam has now cracked wide open. Water is pouring everywhere. The bursting of the dam is a fitting tribute to Paulson's and Bush's $700 billion boondoggle to add liquidity to banks.

The public was overwhelmingly against the plan (and rightly so) as were close to 200 economists. Paulson, Bush, Trichet, and Brown all goaded Congress to waste $700 billion of taxpayer money on grounds there would be a global meltdown if the plan was not passed. Congress had it right the first time. The $700 billion bailout helped bust the dam.

Neither the Bush administration nor the fools in Congress voting for the bailout bothered to figure out you cannot patch a failing dam by adding water.

Liquidity measures cannot and will not work, when the disease is the Fed, reckless Congressional spending, and fractional reserve lending carried to extreme. I talked about this earlier today in Cancerous Activity of the Fed and Treasury .

Too Big To Bail

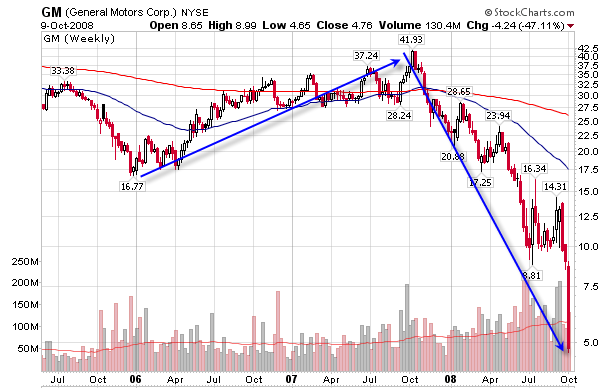

I have written about this on many occasions. I called it "Too Big To Bail". It is too big to bail. Look at the share price of GM and Ford. Look at the stock market. What about all those Credit Default Swaps on Lehman that still have not been sorted out? What about the currency crisis in Latin America? Let's stop mid-rant and take a look at the Currency Crisis.

Currency Intervention In Latin America

Banks in Brazil and Mexico have stepped in with currency interventions in foolish attempt to strengthen their currencies vs. the US dollar. Chile is expected to follow suit.

We have now come full cycle. Money poured into Latin America and places like Iceland driving their currencies to insane levels vs. the US dollar. Capital flows are now reversing.

Earlier today Iceland took over its biggest bank and closed its stock market. Iceland's Prime Minister stated: "What we have learned from this whole exercise over the last few years is that it is not wise for a small country to try to take a leading role in international banking.”

In my opinion, currency intervention is exactly the wrong thing to do. For more on Iceland and currency intervention, please consider Latin American Banks Attempt to Save Currencies .

Potential For Bond Market Revolt

Because Paulson has stepped into overdrive attempting to pour water on a busted dam, there is a potential beginning of a bond market revolt.

Treasury yields have climbed for three straight days showing unwillingness of investors to finance this mess. The long bond is still at 4.10, close to historic lows, but yields on the 10-year treasury have shot up close to 50 basis points. Obviously, this will not help the housing market one bit.

$50 billion in treasuries were auctioned in the past three days. What about financing the remaining pieces of this boondoggle?

Global Coordinated Rate Cuts

On Wednesday, the Fed, ECB, Bank of England, Bank of Canada, and Sweden's Riksbank all cut rates by 50 basis points. My response is Global Coordinated Rate Cuts Won't Solve Economic Crisis .

Fed Scared To Death Over Libor

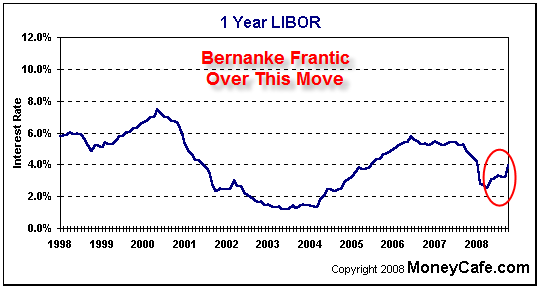

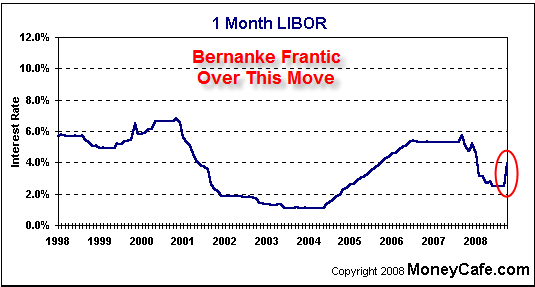

One of the reasons central bankers panicked into mass rate cuts is a huge mass of adjustable rate mortgages is about to reset. The rate cuts were a big attempt to force down LIBOR.

Rate cuts failed big time to stem the surge in LIBOR. Inquiring minds can see a chart of the TED spread in Cancerous Activity of the Fed and Treasury .

Most ARMs mortgages are tied to LIBOR or 1-year treasuries. The latter is no problem but LIBOR based mortgages are another matter indeed.

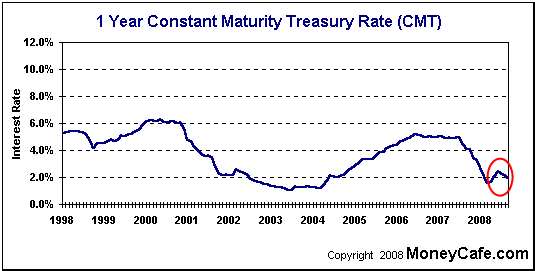

One Year Treasuries

One Year Libor

One Month Libor

The above charts courtesy of MoneyCafe .

The charts are a bit stale. The current 1 year treasury rates is down to 1.26% and LIBOR rates are slightly higher than the above charts.

Interest only loans are typically tied to 1-month LIBOR, while those in most other ARMs are tied to 1-year LIBOR.

Those in LIBOR based ARMs with teaser rates about to reset are going to be obliterated.

Torrent of Waterfalls

There are simply too may waterfalls to list but let's take a look at a few of the more recent ones.

Russell 2000 Small Cap Index Weekly Chart

In Elliott Wave terms the index in an impulsive wave 3 down. At some point there will be a corrective wave 4 up, with still more down to follow in wave 5. A lower low can be expected.

GM Weekly

Liquidity works until it doesn't and the above chart is stunning proof. There was no legitimate fundamental reason for GM to rally from 16 to 42.

The market is acting as if GM's debt is worthless, which of course it should be and will be unless the government (taxpayer) steps in to guarantee it. It's important to remember there is something like $1 trillion bet on GM credit default swaps should GM go under. Who is going to cover that bet, if and when it blows up?

For more on GM and the failed rescue attempt by Kirk Kerkorian, please see GM's Last Fatal Mistake .

Ford Weekly Chart

Ford and GM are both down close to 50% in less than a week. Can there be a bailout of GM without Ford, or vice versa? Who wants to pay for that?

Note that there are many stock funds that cannot hold stocks under $5. Those funds will now have to toss Ford and GM.

$CRB Commodities

There was no fundamental reason for commodities to explode upward like they did. The global economy has been weakening for quite some time. However, leverage kept flowing into the last thing that was "working".

This is what it takes to form a blowoff top.

Future Is Frugality

The world is on the backside of Peak Credit . The backside is deflation and The Future Is Frugality .

Global Recession Headed Our Way

I wish to end with what I said in Global Coordinated Rate Cuts Won't Solve Economic Crisis .

The world is heading for a global recession and a sure bet is that it will be blamed on a subprime crisis in the US. The reality is the greatest liquidity experiment in history is now crashing to earth.

The root cause of this crisis is fractional reserve lending, and micromanagement of interest rates by the Fed in particular and Central Banks in general. The Fed started the party by slashing interest rates to 1%, but Central Banks everywhere drank the same punch to varying degrees.

The Greenspan Fed lowering interest rates to 1% fueled the initial boom, but like an addict on heroin, the same dose a second time will not have the same effect. The Fed, the ECB, etc. could have slashed rates to 0% today and it would not have mattered one bit.

The reason is simple: There is no reason for banks to go on a lending spree with consumers tossing in the towel, unemployment rising, and rampant overcapacity everywhere one looks with the exception of the energy sector.

Consumers are tapped out, not just in the US, but in nearly every country on the planet. We had our party, and a fine party it was. However, the party is over and the bill is now past due. The price is a global recession. That price must be paid no matter what Central Banks do.

You Cannot Patch A Busted Dam With Water.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.