Gold-Silver Ratio And Correlation

Commodities / Gold & Silver 2020 Jun 03, 2020 - 06:56 PM GMTBy: Kelsey_Williams

From Investopedia:

“Correlation is a statistic that measures the degree to which two variables move in relation to each other. Correlation measures association, but doesn’t show if x causes y or vice versa, or if the association is caused by a third–perhaps unseen–factor.”

In order for correlation to exist, there must be fundamentals that directly connect the two items being compared.

For example, there is a possible correlation between localized, bad weather and crop failures. But how do you predict the timing and extent, or the effects, to a degree that can be profitable?

And there certainly is a correlation between the price of labor and materials vs. the finished cost of building a new home. But there is no correlation between the price of labor and materials vs. the number of new housing starts.

We can find patterns and rhythm that might appear to be correlation (or inverse correlation) by plotting the price differential of any two items but it still does not imply correlation.

So, are gold and silver correlated?

ARE GOLD AND SILVER CORRELATED?

Being literally specific according to the above (“correlation measures association…”) then, the question becomes “Is there association between gold and silver?”

The answer is yes, strictly speaking. But, only as it pertains to their use as money.

The association is blurred by the fact that silver’s primary role is industrial, and its role as money is secondary to its use in industry; whereas gold’s primary role is in its use as money, and its industrial use is secondary.

“The basic value of either gold or silver stems from its primary fundamental. This means that gold is valued for its role as real money and silver’s primary value stems from its use in industry. And the primary fundamental for each metal will always be the same, even though there can be changes in the relative relationship of primary and secondary uses.”(See Gold And Silver – Fundamentals Be Damned)

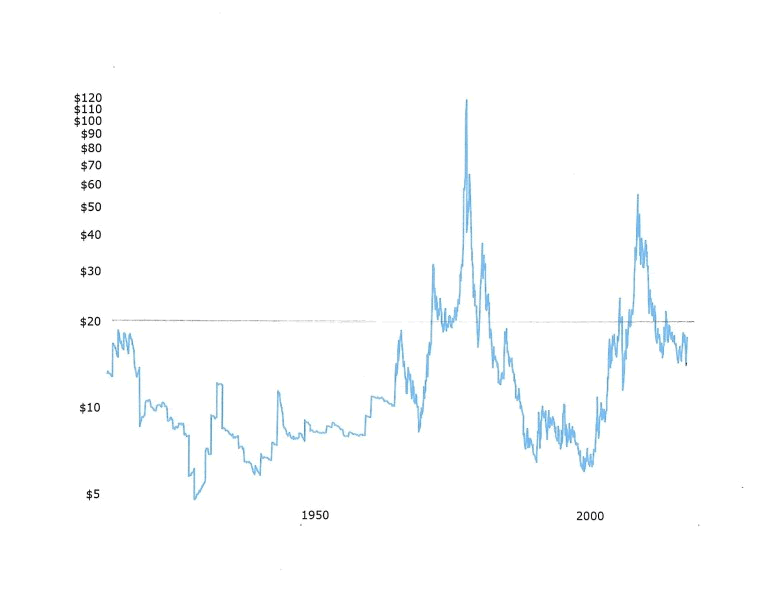

Below is a chart (source) of gold prices for the past one hundred years. The prices are adjusted for the effects of inflation…

As a result, we can see that gold’s value has increased considerably over the past one hundred years. Nearly all of that increase has come in the past fifty years.

Gold’s increase in price and value are inversely correlated to the decline in value of the US dollar over the same time frame.

This makes perfect sense because gold is real money and the original measure of value for all goods and services; whereas, the US dollar is a substitute for gold (i.e., real money).

There is an established association between gold and the US dollar. Gold’s higher price over time reflects the ongoing loss in value (purchasing power) of the US dollar. The more the US dollar loses value, the higher the price of gold will go.

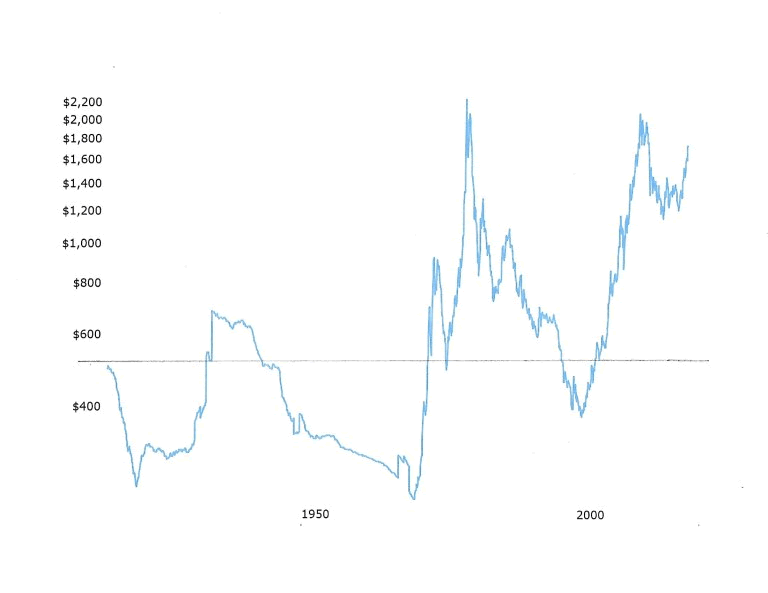

Now let’s look at a similar chart (source) for silver prices, also adjusted for inflation…

Here we can see that silver has declined in value over the past one hundred years and is cheaper now than it was a century ago.

The inflation-adjusted price of silver and its real value has stayed below its price point of one hundred years ago for eighty-four out of the past one hundred years.

The two times which silver prices moved generally in tandem with gold came when gold was responding – and catching up – to ongoing and accumulated losses in purchasing power of the US dollar.

After briefly exhibiting extreme volatility on the upside, silver prices quickly dropped back to their historically evident trading range below $20 per ounce, inflation-adjusted.

Any association/correlation between silver and gold is limited in nature because each metal has a fundamental role which is considerably different from the other. Gold price history is indicative of its association and inverse correlation with the US dollar. Silver prices reflect the white metal’s primary use as an industrial commodity.

GOLD-SILVER RATIO FAVORS GOLD

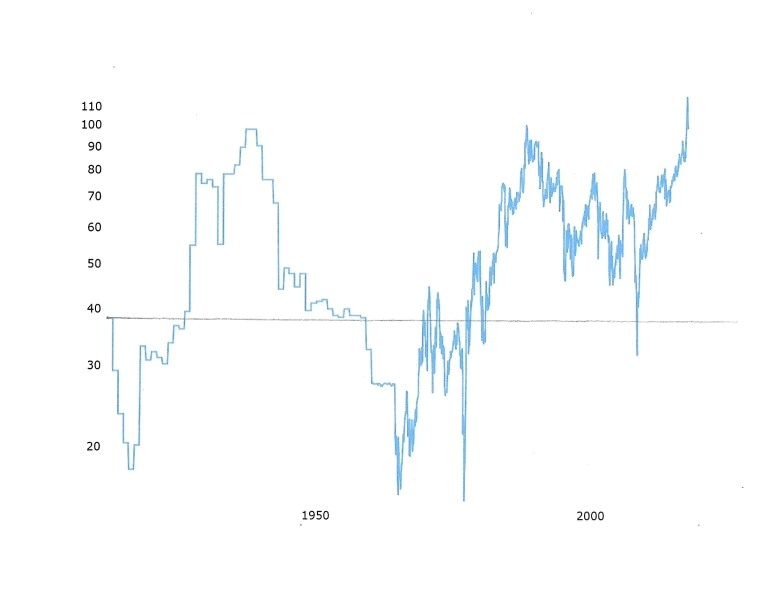

Let’s look at one more chart. This one is the ratio of gold prices to silver prices, the gold-to-silver ratio…

In this chart we see more evidence of what we saw in both charts above. In both price and value terms, gold continues to increase relative to silver.

Referring to the same point of focus as in both charts above, the gold-to-silver ratio is nearly three times higher than it was one hundred years ago. It has continued to move higher, favoring gold, over the past fifty years.

As we said before, we can calculate a ratio of prices for any two different items; but, those ratios will not imply correlation UNLESS there is measurable association.

As far as gold and silver are concerned, any association is strictly limited. It is not that the ratio cannot move lower, in favor of silver. It can. And, it probably will at some point. But it will likely be very short-lived.

The ratio cannot and does not tell us when such a situation might occur. Ironically, after looking at these charts again, it might be more reasonable to entertain a prediction that IF the ratio dropped to a significant degree in favor of silver, one might load up on gold and sell silver, with the expectation of quick resumption of the currently established clear trend of an ever higher ratio, favoring gold.

(also see Federal Reserve And Market Risk)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2020 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.