The Great Economy Reopening Gamble

Economics / Coronavirus Depression May 17, 2020 - 01:35 PM GMTBy: Patrick_Watson

We knew the April US jobs data would be ugly. Speaking on ABC’s “This Week” program last Sunday, Minneapolis Federal Reserve Bank President Neel Kashkari predicted “the worst is yet to come.”

Kashkari is right; this won’t get better while so much of the economy is sidelined. The stay-at-home orders, while they help reduce coronavirus spread, have other side effects, too. Domestic violence increases, children miss educational opportunities, people with other health conditions go untreated. These are real problems.

The question is how to reopen without making the situation worse. Kashkari had some advice on that, too: “To solve the economy, we must solve the virus.”

Unfortunately, it’s not happening. Which means we are making a massive bet against the odds.

Serious Problem

Let’s start by correcting some misinformation: COVID-19 is not “just the flu.”

Yes, most who get it seem to show only mild symptoms, or no symptoms at all. Similarly, most people who get in cars don’t have fatal accidents. But you probably don’t drive 100 mph down narrow streets without a seat belt. You modify your behavior to reduce the risk.

So, what’s the risk?

Well, the worst recent flu season was 2017–18, when the US had an estimated 61,000 flu-related deaths. And that was over an entire year. COVID-19 has killed 80,000 in just two months.

“Ah, but they were mostly old people,” you say. “I’m safe.”

No, you’re not.

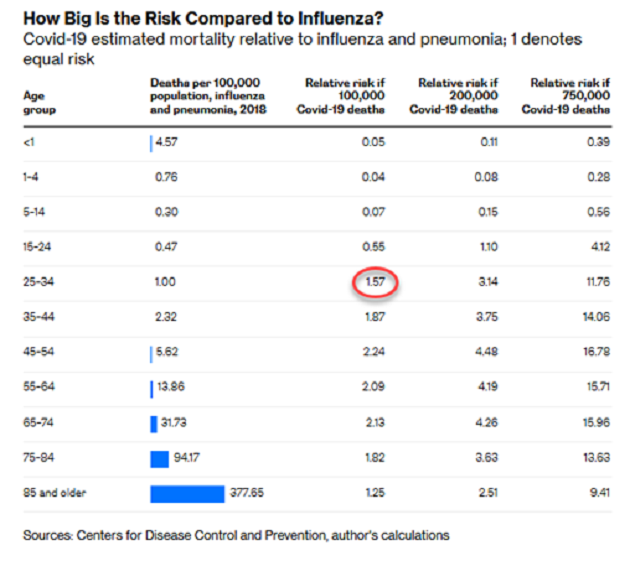

Here’s a Bloomberg analysis comparing risk of death by age group of the 2018 flu season vs. three possible COVID-19 scenarios.

Let me explain this. Look at the number I circled in red. “1.57” means that in the optimistic scenario, for people age 25-34, the risk of being one of 100,000 COVID-19 deaths is 1.57 times higher than the risk of dying from the flu if this flu season is as bad as 2017-2018. And it gets worse from there.

Bloomberg made similar calculations for auto accidents, drowning, etc. The results are consistent. If you are over age 40 or so, COVID-19 is significantly deadlier than anything else you will likely encounter this year. The odds are getting worse, not better.

The economy can’t recover if that is the case, and it will be the case if the virus is actively spreading. We need a plan to fix this.

Turns out, we have a plan… or at least, we did.

Abandoned Plan

Let’s review some ancient history—as in “four weeks ago.”

On April 16, the White House released a set of guidelines called Opening Up America Again. It advised governors how to gradually reopen their states while fighting the coronavirus.

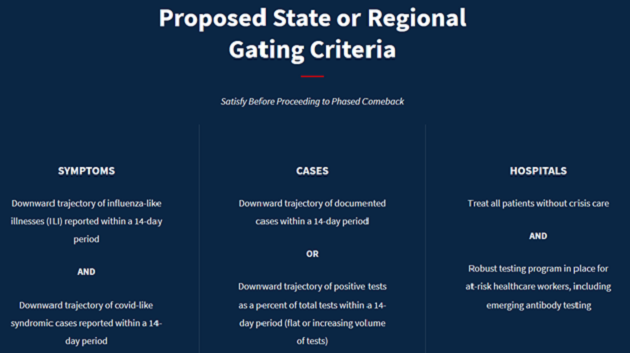

The plan begins with a set of “gating criteria.” The key one: a “downward trajectory” of documented COVID-19 cases within a 14-day period. The plan recommends relaxing restrictions in phases with each such period of improvement.

Image: The White House

Those who follow me on Twitter know I’ve been very critical of the Trump administration’s handling of this crisis. But I thought this plan was sensible. Similar methods seemed to be working elsewhere, so it gave me some much-needed hope.

My hope didn’t last because, within days, governors whose states were nowhere near meeting the criteria announced plans to start reopening anyway.

Note, the White House hasn’t withdrawn its recommendations. It’s still the official advice, even though many governors are doing things differently.

Stranger still, the president has been inviting those governors to the White House to congratulate them. It’s like he is saying, “Here are my recommendations and I’m glad you are ignoring them.”

Why publish a plan and then act like it never existed? The only way this makes sense is if Trump and these governors have decided reopening businesses is more important than reducing virus deaths, but they don’t want to say so publicly.

That’s a big gamble. They could lose both ways.

No Good Outcomes

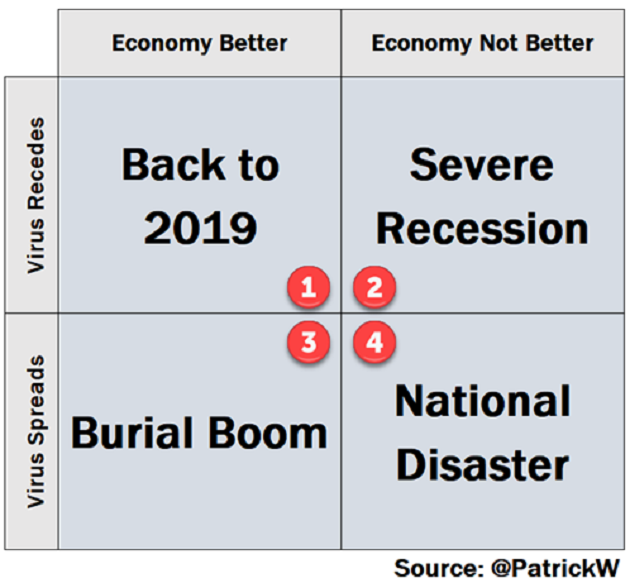

Gamblers need to know all the possible outcomes. In this case, we can simplify the next few months to two variables.

- The economy will either get better or not.

- The coronavirus will either spread or recede.

That means we have four paths, as shown in this matrix.

Let’s look at each:

- If the virus recedes soon and the economy gets back on its feet, then we’ll be essentially back to 2019. That was better than where we are now, but hardly great. The economy was growing slowly and maybe approaching recession, with stocks overpriced and the financial system wobbly.

- If the virus recedes but the economy doesn’t improve, then we will pay for all this with a severe recession. Millions will stay unemployed and many businesses go bankrupt.

- If the virus keeps spreading but relaxing the lockdowns helps the economy, the mortuary and funeral industry will be hiring as it expands rapidly. This burial boom would be an opportunity for jobless restaurant workers and maybe others, too.

- Finally, if the virus keeps spreading and the economy doesn’t recover, we will face a major national disaster: economic depression concurrent with mass sickness and death.

You can debate what the odds are for each scenario. None lead anywhere good. One is unbelievably bad. So, it makes sense to do all we can to avoid that one.

Are we? We’ll know in a few weeks.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best-seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could trigger in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

By Patrick_Watson

© 2020 Copyright Patrick_Watson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.