UK Covid-19 Deaths Analysis - Danger Real or Exaggerated?

Politics / Pandemic Apr 14, 2020 - 04:34 AM GMTBy: Nadeem_Walayat

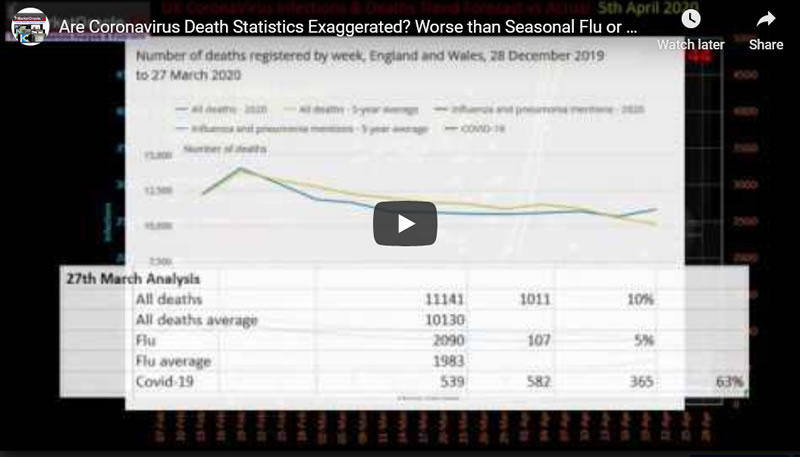

This is part 1 of 2 that updates the current trend trajectories for the coronavirus mega-trend, where whilst the pandemic itself may not last more than a year nevertheless the magnitude of which is likely to impact many aspects of our lives for decades to come. Where the purpose of this analysis is to ensure that we are not all getting carried away by media headlines that could be over exaggerating covid-19 that has resulted in unprecedented government measures. Especially as a significant percentage of people, usually those yet to experience the first hand consequences of the Coronavirus, see it largely in terms of being a corona hoax, fake news, a grab for power, a plandemic, the elites once more playing their power games to enrich themselves just as they did during the financial crisis.

My next analysis will update the UK and US trend trajectories and stock market implications thereof, and update AI stocks buying levels for Q2, to be posted soon after release of Tuesday's ONS data that will first be made available to Patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your Analyst

Nadeem Walayat

Copyright © 2005-2020 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.