Our Fib Trading System is Telling Us Where The Stock Market Is Headed Next

Stock-Markets / Stock Markets 2020 Apr 11, 2020 - 10:42 AM GMTBy: Chris_Vermeulen

In this section of our multi-part research post centered around our Adaptive Fibonacci Price Modeling system’s expectations, we are focusing on the NQ (NASDAQ futures) and the future expected price rotations. As we discussed earlier, in Part I, Fibonacci price theory teaches us that price must always attempt to establish new price highs or new price lows within a trend. Reversals happen when price fails to continue establishing new price highs or new price lows and breaks above or below a recent critical price level.

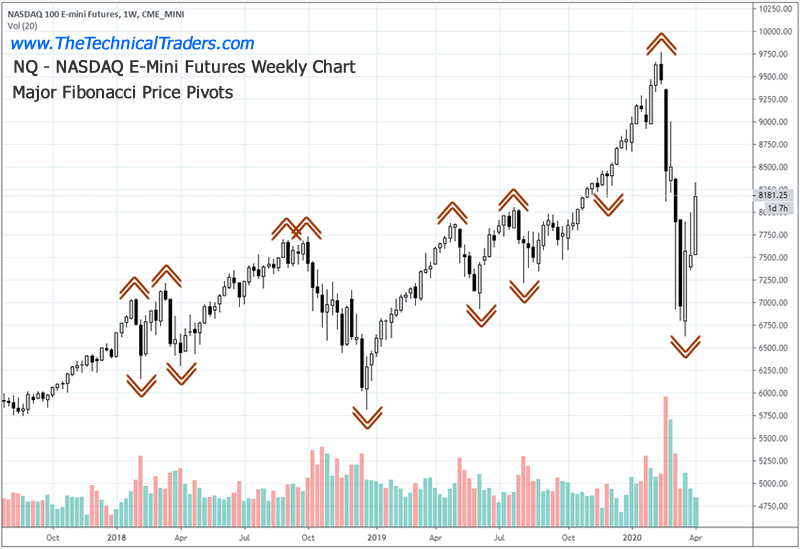

First, we’ll focus on the major Fibonacci Price Pivots and how to identify and use them with the Fibonacci Price Theory. Major Price Pivots are points in time where a major new High or Low price is established that becomes a critical price top or bottom. Often, within extended trending, a minor price pivot will become a major price pivot simply because the price trend has extended for many weeks or months without establishing any type of moderate price rotation. The reason we could consider a minor price pivot as a major price pivot is that, within the extended trend, we attempt to identify where price setup a “unique low” or “unique high” as a point of support or resistance within the trend.

Before we continue, be sure to opt-in to our free market trend signals before closing this page, so you don’t miss our next special report!

Weekly Nasdaq Chart – MAJOR PIVOTS

Here is a Weekly NQ chart highlighting the major Fibonacci Price Pivots. Notice the Major Low Pivot in late November 2019 that was identified as a “minor to major” pivot. These major price pivots become a road map telling us where price MUST go in order to establish a new trend or to change trend direction.

Currently, the bearish trend is clearly identifiable because the price has recently broken below the last major Fibonacci Low Price Pivots and established a “new price low”. In order for us to consider this bearish trend is completed or over, the price would have to rally all the way back to break the move recent major Fibonacci High Price Pivot (near the recent peak). A couple of weeks go I published a PDF guide on how to identify market trends both short-term and long-term using some basic indicators.

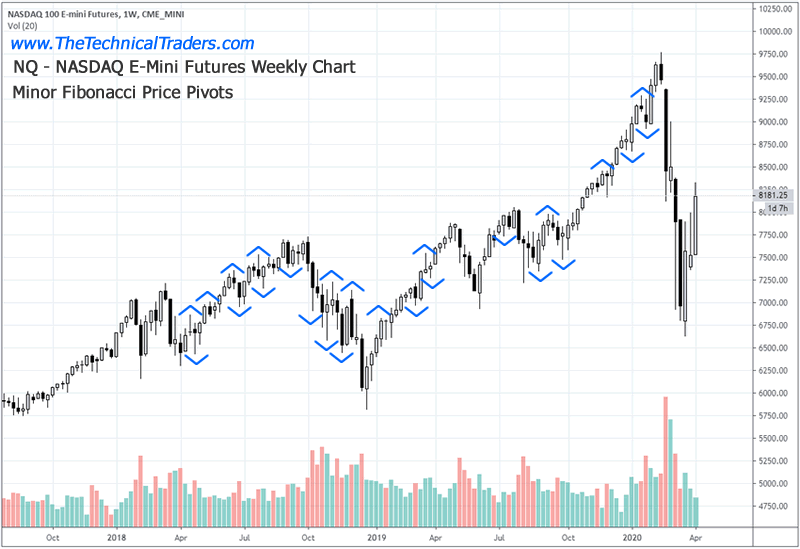

Nasdaq Weekly Chart – MINOR PIVOTS

Now, let’s learn about the minor Fibonacci Price Pivots…

This next Weekly NQ chart highlights the minor Fibonacci Price Pivots. These are the price lows and highs that do not constitute a “critical price high or low” on the chart. They are still valid for us in our understanding of Fibonacci price theory and where future price may attempt to rally or selloff to and they help skilled traders in understanding the true nature of price activity and structure.

Minor Fibonacci Price Pivots are intermediate unique high or low price levels that set up the “wave structure” in price that we are attempting to illustrate to you. When price moves higher, a series of new higher highs and higher lows usually sets up within that trend. When price moves lower, a series of new lower lows and lower highs usually set up within that trend. These minor pivots are a method of tracking this type of price activity and a process of learning the major and minor price levels that usually become very important in determining what is really happening in price structure.

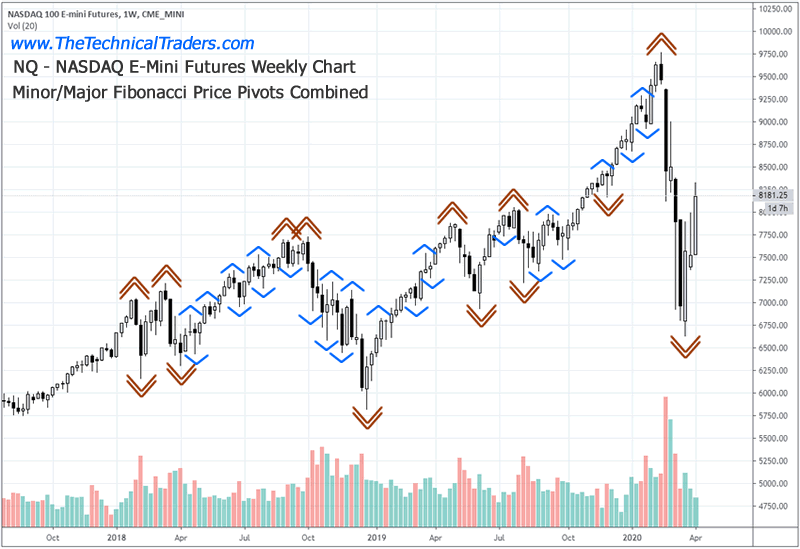

Combining Both Minor and Major Pivots

Now, we’ll combine these major and minor pivots onto one chart to grasp the bigger price structure.

Once we combine these major and minor Fibonacci Price Pivots onto one chart, you should be able to see the “road-map” of the structure of price fairly easily. You should be able to see how Major Pivots setup massive critical price structures (tops and bottoms) that establish the major support and resistance levels in price. These also become major trigger levels for broader trends and reversals in price. You should also be able to see how the Minor Pivot Levels offer intermediate price guidance and shorter-term support and resistance as price attempts to work through the Fibonacci Price Theory Structure.

Remember, the Fibonacci Price Theory suggests that price is always attempting to reach new highs or new lows within a trend. Thus, if it is not attempting to reach new highs, then it must be an attempt to reach new lows. These pivot structures are the keys to understanding the true Fibonacci price theory.

Concluding Thoughts:

Currently, The NQ would have to rally all the way back above 9750, the most recent Major Fibonacci Pivot High, in order to qualify for a new Longer-term Bullish trend. We expect the price of the NQ will rotate lower in the near future simply because the most recent confirmed price trend was the breakdown low in early 2020 that broke below the past three major Fibonacci Low Price Pivots.

Remember the Fibonacci Price Theory tells us that Price is always attempting to establish new price highs or lows – all the time. Thus, if the newest price low has broken below the past Major Low Price Pivots, then the trend is considered Bearish until price confirms it has broken above the most recent Major High Price Pivot.

As you continue to learn Fibonacci Price Theory and apply these techniques, remember that these types of price structures are fundamental components to the much broader technical analysis techniques and modeling systems we use every day for our clients. We want to help you learn to become a better trader and learn to identify solid trading signals.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders.

I hope you found this informative, and if you would like to get a pre-market video every day before the opening bell, along with my trade alerts visit my Active ETF Trading Newsletter.

We all have trading accounts, and while our trading accounts are important, what is even more important are our long-term investment and retirement accounts. Why? Because they are, in most cases, our largest store of wealth other than our homes, and if they are not protected during a time like this, you could lose 25-50% or more of your entire net worth. The good news is we can preserve and even grow our long term capital when things get ugly like they are now and ill show you how and one of the best trades is one your financial advisor will never let you do because they do not make money from the trade/position.

If you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Long-Term Investing Signals which we issued a new signal for subscribers.

Ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.