Here Comes Another $2T Support for Stocks

Stock-Markets / Stock Markets 2020 Apr 10, 2020 - 12:37 PM GMTBy: P_Radomski_CFA

In anticipation of the previous $2T stimulus package that passed on Mar 27 and in its aftermath, stocks rallied, yet it wasn’t a one-way road. They had trouble overcoming the pre-stimulus highs, and actually sold off in the following week.

Today’s Fed announcement contained a $2.3T loan package to support the economy. While stocks didn’t sell off in its immediate aftermath, they haven’t rallied profoundly in the runup to further stimulus either.

High-yield corporate debt (HYG) predictably rallied in response to the real economy support with loans, but the bulls are having issues adding to their opening gains. That’s a shooting star, a bearish candle.

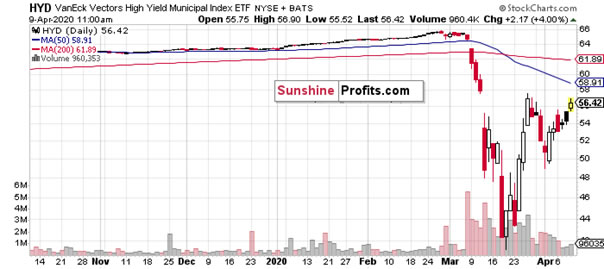

The already-supported municipal bonds haven’t overcome their late-March highs after this breaking news. Selling into strength is clearly visible here as well.

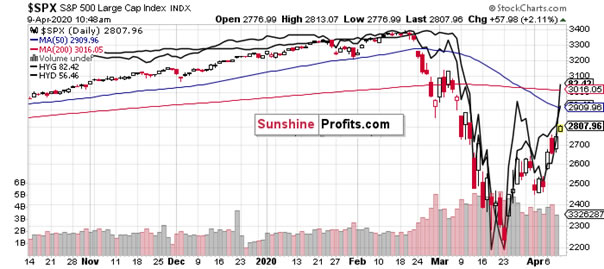

Finally, let’s see the intraday S&P 500 chart overlaid with these two debt markets.

While all three moved in unison higher, there appears to be less bang for a buck in this stimulus measure than in the preceding one. Should the credit markets lead higher and drag stocks along, that would be a game changer.

But the S&P 500 is currently trading sideways around 2785, and may very well sell off in the coming days similarly to the earlier fiscal stimulus aftermath. We will monitor the evolving market reaction – for now (11:30 Eastern time), and react accordingly.

We encourage you to sign up for our daily newsletter- it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Monica Kingsley

Stock & Oil Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

Monica Kingsley is a trader and financial markets analyst. Apart from diving into the charts on a daily basis, she is very much into economics, marketing and writing as well. Naturally, she has found home at Sunshine Profits - a leading company that has been publishing quality analysis for more than a decade. Sunshine Profits has been founded by Przemyslaw Radomski, CFA - a renowned precious metals investor and analyst.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.