Financial Crisis 2008 Similar to 1987 Stock Market Crash

Stock-Markets / Financial Crash Oct 08, 2008 - 04:46 PM GMTBy: Doug_Wakefield

It's been almost five years since my oldest son and I produced a 45 minute film to see what could be learned from studying the history of certain monetary trends that have been unfolding for decades. And, in our July 2007 newsletter, when I told our readers that we appeared to be at the beginning of a worldwide credit contraction, I quoted from President Franklin Roosevelt's May 7th , 1933 fireside radio chat to the nation.

It's been almost five years since my oldest son and I produced a 45 minute film to see what could be learned from studying the history of certain monetary trends that have been unfolding for decades. And, in our July 2007 newsletter, when I told our readers that we appeared to be at the beginning of a worldwide credit contraction, I quoted from President Franklin Roosevelt's May 7th , 1933 fireside radio chat to the nation.

“Two months ago we were facing serious problems. The country was dying by inches. It was dying because trade and commerce had declined to dangerously low levels; prices for basic commodities were such as to destroy the value of the assets of national institutions such as banks , savings banks , insurance companies , and others . These institutions, because of their great needs, were foreclosing mortgages, calling loans, refusing credit. Thus there was actually in process a destruction of the property of millions of people, who had borrowed money on that property in terms of dollars which had had an entirely different value from the level of March, 1933 . That situation in that crisis did not call for any complicated consideration of economic panaceas or fancy plans. We were faced by a condition and not a theory.

There were just two alternatives: The first was to allow the foreclosures to continue, credit to be withheld and money to go into hiding, and thus forcing liquidation and bankruptcy of banks, railroads and insurance companies and a recapitalizing of all business and all property on a lower level . This alternative meant a continuation of what is loosely called ‘deflation,' the net result of which would have been extraordinary hardship on all property owners and, incidentally, extraordinary hardships on all persons working for wages through an increase in unemployment and a further reduction of the wage scale .

It is easy to see that the result of this course would have not only economic effects of a very serious nature but social results that might bring incalculable harm . Even before I was inaugurated I came to the conclusion that such a policy was too much to ask the American people to bear. It involved not only a further loss of homes, farms, savings and wages but also a loss of spiritual values -- the loss of that sense of security for the present and the future so necessary to the peace and contentment of the individual and of his family . When you destroy these things you will find it difficult to establish confidence of any sort in the future. It was clear that mere appeals from Washington for confidence and the mere lending of more money to shaky institutions could not stop this downward course.

prompt program applied as quickly as possible seemed to me not only justified but imperative to our national security. The Congress, and when I say Congress I mean the members of both political parties, fully understood this and gave me generous and intelligent support . The members of Congress realized that the methods of normal times had to be replaced in the emergency by measures which were suited to the serious and pressing requirements of the moment …The only thing that has been happening has been to designate the President as the agency to carry out certain of the purposes of the Congress. This was constitutional and in keeping with the past American tradition.” (Italics mine)

Actually, what Roosevelt did, with the help of the newly created (1913) banking cartel known as the Federal Reserve, was change the monetary system, by changing what backed our dollars, removing the U.S. from the gold exchange standard. Given the choice between the very real hardships that accompany deflation and removing the dollar from the gold standard, the choice was easy. Though it would have been better for the people to return to our pre-Fed monetary structure, the easier solution was taken, with its own long-term ramifications.

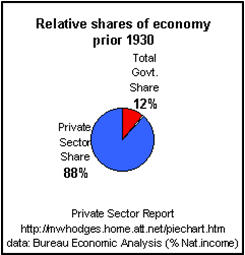

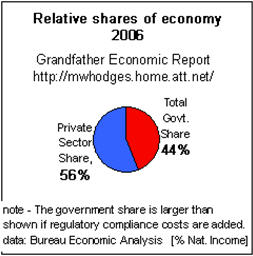

Concerned American and grandfather, Michael Hodges , prepared these two charts, presented in our November 2007 issue. Another grandfather, our former Comptroller General for the United States Government, David Walker , attests to the long-term unsustainability of the U.S. 's run away debt.

While I could summarize the myriads of lessons we have brought to readers over the last 4 years, it may be more effective to examine the events that led up to the Crash of 1987, since a similar event is now unfolding.

October 1987 vs. October 2008

While working on our research paper on short selling, Riders on the Storm: Short Selling in Contrary Winds (January ‘06), I came across Dr. Bruce Jacobs' comprehensive book on the events surrounding the Crash of 1987 – Capital Ideas and Market Realities: Options Replication, Investor Behavior, and Stock Market Crashes . Consider the many parallels between the events that led to that fateful day and our current market milieu.

Having just lived through the bear markets of the 1970s, in the 1980s, institutional investors wanted to get back into equities and, at the same time, limit their downside exposure. So, financial firms came up with a “solution,” creating a product known as portfolio insurance.

Portfolio insurance was made possible by the 1982-development of highly leveraged stock index futures and the increasing use of computers to calculate complex math equations. In short, as the markets rose, the computer models bought more stock while selling stock index futures, giving institutional investors the peace of mind that should market start to move lower again, the “insurance” would protect them from downside. But, Dr. Jacobs notes,

“Options replication requires trend-following behavior – selling as the market falls and buying as it rises. Thus, when substantial numbers of investors are replicating options, their trading alone can exaggerate market trends.” (Page 4) (Italics mine)

Now, let's look at the parallels in the credit default swap market.

When rates started going back up in 1994, the bond and derivatives markets got hammered. For example, some of you may remember the historic bankruptcy filing of Orange County in December of 1994, which, by the way, still retained the highest Standard and Poor's and Moody's ratings in that same month. As the 90's continued, institutional investors were once again looking for a way to lower their risk while increasing their returns.

And once again, financial firms came up with a “solution,” creating a product known as credit default swaps in 1997. This highly leveraged tool was established in order to help protect debt holders from the possible loss of capital due to bond defaults. But, while the default risk was laid off on other financial players in the capital markets, since the risk could not be removed from the entire system, trend following once again created a classic fallacy of composition. As this multi-year trend unfolded, the perception of lower risk allowed bond yields to stay at artificially lower levels, increasing corporate cash flows and profits, and helping drive up stock prices, creating an unsustainable trend.

And, as we all know, when everyone moves to the same side of the boat, it must either tip over or the crowd must begin to move back to the other side. As we consider this, let's look at the events that took place in the 2 weeks prior to the Crash of ‘87.

During the week of October 5 th , just two weeks prior to Black Monday, the Dow closed down 159 points, it biggest weekly point drop ever. The slide intensified during the week of October 12 th , with the Dow sliding 3.8%, 2.4%, and 4.6% on Wednesday, Thursday, and Friday, respectively. By the close of business on Friday, October 16 th , the Dow was down 500 points, or 17.5%, from its high in August. Of course, we all remember the 22.6% decline on Black Monday, but consider the effect that program trading, through portfolio insurers, had on the speed of the demise:

“Between 11:40 a.m. and 2:00 p.m., portfolio insurers sold about $1.3 billion in futures, representing about 41 percent of public futures volume (Brady Commission, 1988: 36). In addition, portfolio insurers sold approximately $900 million in NYSE stocks. In stocks and futures combined, portfolio insurers had contributed over $3.7 billion in selling pressure by early afternoon.

Program selling pressure from portfolio insurers and arbitragers often hit the NYSE simultaneously. For example, total program selling constituted 61 percent of NYSE volume in S&P 500 stocks from 9:30 to 9:40 a.m., 63.4 percent from 1:10 to 1:20 p.m., and over 60 percent in two intervals from 1:30 to 2:00 p.m. (SEC 1988: 2.15-2.16).” (Page 152)

As Nobel Laureate William Sharpe stated after the '87 crash, “We learned in the 1987 crash that if everyone wants the upside and no one wants the downside, then everyone can't get it.”

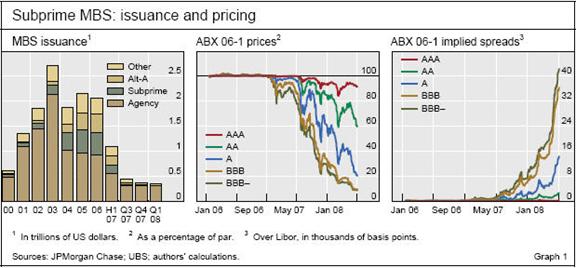

So, how do these events line up with our current market environment? The Bank of International Settlements notes, “The ABX indices, which are based on credit derivatives written on MBS backed by subprime mortgage loans, track the price of credit default insurance on a basket of such deals.” And, a s we can see from the charts below, the credit default derivatives markets, which grew from $55 billion in the fourth quarter of 1997 to $15,469 by the second quarter of 2008, have seen steep price declines, and the sell of new issues has completely collapsed from a year ago.

[ This chart was taken from a September 2008 BIS report on the ABX markets .]

In his most recent Credit Bubble Bulletin, Doug Noland , informs us:

“There was no Asset-Backed Securities (ABS) issuance this week. Year-to-date total US ABS issuance of $129bn (tallied by JPMorgan's Christopher Flanagan) is running at 26% of comparable 2007. Home Equity ABS issuance of $303 million compares with 2007's $224bn. Year-to-date CDO issuance of $24bn compares to the year ago $286bn.”

So, how do these events line up with our current market environment? Let's look to see if volatility is picking up.

As I wrote in “ The Day Free Markets Died ,” the solution in 1987 was the same one the Fed and Treasury are trying to implement today. Back then, the Fed only had to infuse $11 billion in new reserves to rig a market bottom.

“On Tuesday morning, before the markets open, the Federal Reserve Board released a statement from Chairman Alan Greenspan that the Fed stood ready to provide liquidity to support the financial system. The afternoon saw a turnabout, with massive corporate buy- back programs.” (Page 71, Jacobs)

At the time, Steven Wunsch, Vice President at Kidder Peabody, quipped:

“We must really have efficient markets now, if they're so sensitive to new information that they can drop 23 percent on October 19 th , and no one can even agree on what the bad news was, and then jump 17 percent by 10 a.m. the next morning…then efficiently adjust to another wave of bad news by falling 25 percent in the next two hours…I guess you'd believe the next move was the most impressive display of efficiency we have seen in this country: a 32 percent rise in the Major Market Index in thirty-two minutes, once again caused by phenomenal, but unidentified, good news.” (Page 83, Jacobs)

But today's problems are much larger than those of 1987, so, as our central banks try to keep the world's economies from seizing, tens of billions have given way to hundreds of billions in “liquidity injections.” Indeed, the headlines read, “ Fed Pumps Further $630 Billion into Financial System ,” “ €400 billion bailout: How We Got There ,” “ European Central Banks offer More Cash to Markets ,” and “ Fed to Double Cash Auctions to Banks, up to $900 billion .” It appears that the world's central bankers have learned Greenspan's lessons of Black Monday all too well. Pause for a moment, and look at the numbers in the headlines again. Twenty-one years ago it only took $11 billion to get US markets up and going and to calm global markets. Now, hundreds of billions have been created out of thin air, and the markets have yet to find a bottom. Doesn't this seem surreal?

And now, consider some solutions.

Practical Application in the Midst of a Meltdown

Those who advise business-as-usual approaches, suggesting simple solutions to our current situation, are singing the song of the mania we are leaving. There are no easy solutions. This should be apparent to everyone by now. Problems that have been building for decades will not be solved overnight.

No one in the investment community will argue the fact that a credit crisis began in the summer of 2007. As you look at the charts below, ask yourself, “How have investors who follow buy and hold investment strategies, based on an inflationary environment, fared?”

Unfortunately, many investors have not considered the impact that a slower economy and lower tax revenues have on local and state economies and, therefore, the municipal bond markets.

So, has any strategy worked in the last year? Since 2005, I have written several times about the use of inverse funds and long-short or short-only managers as a method of offsetting losses or growing your money as markets around the world continue to deflate, in spite of central bankers' concerted efforts.

The fact is we have witnessed the greatest expansion of leveraged debt and the greatest explosion upward in equity markets prices that the world has ever seen. Over the past few years, and even more so since the credit crisis began last summer, we have warned our readers time and time again of the power of parabolic spikes. Whether it was the NASDAQ 100 and the Hang Seng last fall, platinum futures and gold stocks this spring, or oil and two of the heaviest traded tech companies this past summer, parabolic spikes have continued to demonstrate the power of trend-following crowds on both the up and the down side of the markets. Four-hundred years of market history has proven enormously destructive to those who suggest otherwise. As this leveraged debt unwinds, it will rapidly destroy prices and confidence. As painful as this will be, we must face it.

And, though the explosive bounces in every market will sway us back to our buy and hold strategies, as the credit contraction intensifies, it will become increasingly important that every investor have an exit strategy.

So where is the bottom of this downward spiral and when is it likely to come? Though the public is likely to continue to believe that bailouts, like the recent $700 billion dollar package, will produce a bottom, I don't see us reaching a long-term bottom anytime soon. As things continue to spiral out of control, like they did in 1987, our lenders of last resort have shown that they are likely to continue to change the rules and ultimately our currencies.

While spending an enormous amount of time reading world history, financial history, and political history gives us a clearer picture of future, individuals like Nassim Nicholas Taleb remind us that probabilities are just that, so we must be willing to alter our course along the way.

If you have yet to find professionals, whether long-short or short only managers, who have experience on the short side of our markets and who go net short, you are strongly encouraged to do so. My public and private writings, since 2006, have offered readers many possibilities.

If you are heavily invested in gold stocks and ETFs (not the metal), consider finding individuals who can teach you about trading or hiring an individual with extensive experience in trading the metals markets. Consider these words by Axel Merk in his October 7 th article, “ The World in Crisis: Where are the Safe Havens? ”

“While gold is currently fulfilling its role as sound money, it often trades in tandem with other commodities; this can result in stomach-twisting volatility. As a result, many hold gold as insurance, but few truly live on their personal gold standard.”

When we are taking great losses, it's good to stop the bleeding and regroup, giving us time to think. If we give in to the “what if I miss the rally” obsession, we will lose the clarity that would otherwise come. I used this example in my most recent short report.

“Think about this. A person with $1 million looses say $250,000 before exiting their current holdings. They feel like a fool. Then they talk with someone they know who has $5,000 and just lost their job. Head check. Even the person who has $5,000 can, if they think about it, gain appreciation for where they are at, if they read about the children in an orphanage in Uganda where two meals a day, every day, are porridge. Why do I know this, my oldest son just completed his 30 minute film on the Ugandan orphanage he worked at for 2 weeks this past June.

Today's a rough day, but more opportunities are still ahead.”

If you are interested in learning what you are missing from listening to the daily news without a historical perspective, consider joining our group of worldwide readers. To subscribe to our research, click here . To learn more about our research and advisory services, click here .

A current subscription to our research gains an individual access to all of our educational writings back to January 2006 as well as our industry research paper on short selling, Riders on the Storm: Short Selling in Contrary Winds.

By Doug Wakefield with Ben Hill,

President

Best Minds Inc. , A Registered Investment Advisor

3010 LBJ Freeway

Suite 950

Dallas , Texas 75234

doug@bestmindsinc.com

phone - (972) 488 -3080

alt - (800) 488 -2084

fax - (972) 488 -3079

Copyright © 2005-2008 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this communiqué should be construed as advice to buy, sell, hold, or sell short. The safest action is to constantly increase one's knowledge of the money game. To accept the conventional wisdom about the world of money, without a thorough examination of how that "wisdom" has stood over time, is to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of individuals, and at any time may or may not agree with those individual's advice. Challenging one's thinking is the only way to come to firm conclusions.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.