The Lucrative Profitability Of A Move To Negative Interest Rates - Pandemic Edition

Interest-Rates / Negative Interest Rates Apr 05, 2020 - 11:09 AM GMTBy: Dan_Amerman

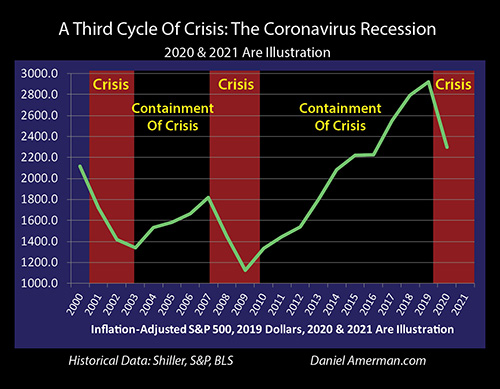

When it comes to the recession that is being created by the pandemic lockdowns - then the U.S. government and Federal Reserve have no intention of just letting the market forces play out. Instead, the intention is to contain a potential deeper round of crisis with the most extreme interventions yet. One very real possibility is for the Fed to follow the European Central Bank and the Bank of Japan, and to spend trillions of dollars to buy government (and corporate) debt while creating negative interest rates.

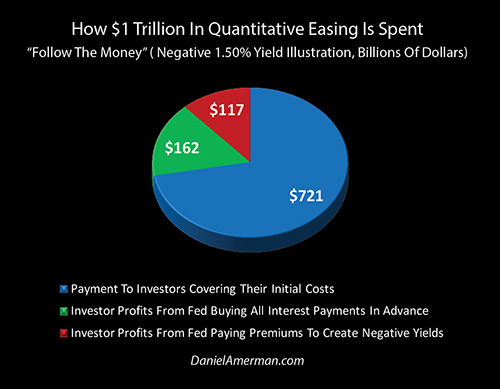

In this analysis, we will explore how the Federal Reserve could create one of the largest redistributions of wealth in U.S. history, with hundreds of billions of dollars in profits going disproportionately to insiders - at the expense of the general public (never let a national emergency go to waste). As illustrated with a step by step example, when we follow the money - $279 billion out of every $1 trillion in newly created money could end up going straight into the hands of organizations and individuals who make up a relatively small percentage of the nation.

To contain and exit recession, the Federal Reserve intends to engage in what could become the largest round of monetary creation in U.S. history. Those dollars will be quite real, and the reason for their creation is to spend them. A big chunk of that spending will become profits going straight into the pockets of investors. This won't actually be a closed game - anyone can try for a share of those new Federal Reserve dollars, but first they have to understand that the game exists, and then they need to learn how it is played.

This analysis is the 14th chapter in a free book. The earlier chapters are of essential importance for achieving full understanding, and an overview of the rest of the book is linked here.

A Potential Playbook For Very Quick & Large Profits

In the attempt to contain the economic damage caused by pandemic related shutdowns, the Federal Reserve has already slammed short term interest rates to zero percent, as projected in Chapter 4. It has announced $700 billion in new quantitative easing, as projected in Chapter 8. We are seeing some of the highest long bond prices in history, creating record profits for investors, as projected in Chapter 9.

Each one of those chapters was written long before the emergence of COVID-19 recession - because they were part of the playbook. All it took was a 35th cycle of recession (since 1854) as covered in Chapter 2 - from whatever the cause - and those market and life changing event were lined up in a row and waiting to go, as they now have. The record deficits in the U.S. and other nations were also entirely expected, as explored in the analysis linked here from November of 2018, which made the case that any reasonable and prudent retirement investor needed to be planning for an explosive increase in the national debt as the result of the next recession, and that they needed to be taking the potential impact on Social Security into consideration as well.

The sequence is not over, far from it, as the containment of the pandemic, the 3rd cycle of crisis, and the early stages of the attempt to create a 3rd cycle of the containment of crisis are all still developing. Indeed, we are in the very early stages of what is on the way, with extraordinary implications for future stock, bond, home and gold prices.

While it is not a certainty, there is a good chance that the Federal Reserve will end up following the playbooks previously established by the Bank of Japan and the European Central Bank, and move to a policy of negative interest rates.

If this does happen - extraordinary profits will be created. However, it is essential to keep in mind that these profits will happen on the front end, during the move to negative interest rates. They are likely to happen very fast, and they will be reserved for people who understand in advance what negative interest rates are and how they are achieved in practice.

For the great majority of people who wait to learn until negative interest rates actually arrive - it will be too late. The train will have run over them at that point, the record profits will no longer be available, and all they will be left with is a truly toxic environment for building and maintaining wealth, over what could be many years to come.

How Negative Bond Yields Are Created

There are two particularly big misunderstandings about negative interest rates. The first is the idea that investors have to make interest payments to borrowers, so that they literally have negative cash flows.

What the experience of Europe and Japan shows us is that while that can happen with the bank accounts of large depositors, there is no need for that with bonds. It would be a very messy process that would turn the system upside down - the financial world is just not set up for the borrowers collect the cash from the investors.

There is a much simpler way, which is what happens in practice, and it works for both new bonds that are issued as well as the many trillions in "legacy" bonds that have positive interest coupons. All we need for a negative rate is to just pay more today for the rights to a future cash flow, than what that cash flow will be.

So, if we buy a bond, where someone promises to pay us $100 in the future, but we pay $101 for that promise - we just bought a negative interest rate bond. If we hold the bond the maturity then we will lose money for sure, and we have locked in a negative yield.

Another way of looking at that is that achieving a negative yield requires paying out more money up front than what we will later receive. The easiest and cleanest way to do that is on the front end, increasing the amount we pay until it exceeds what we will collect, and then receiving those positive cash flows from there forward. That is what the system is set up for, and this is how it works for bonds in Europe and Japan. The key words to keep in mind - which very few U.S. individual investors seem to understand at this point - are "paying out more money up front".

There is second misunderstanding that is bigger and potentially more expensive, particularly for U.S. investors. Negative interest rates sound like a uniformly “bad thing” for bondholders.

Now, there are many, many terribly bad things about negative interest rates from economic, financial and societal perspectives. On a personal basis, I am appalled that central banks in Europe and Japan are so grossly distorting global markets and investor returns. For the good of our nation, I very much hope that we do not go to negative interest rates in the United States.

But, I'm not in charge of that decision. And in case the Fed follows in the footsteps of the Bank of Japan and European Central Bank, and in the recession caused by the coronavirus pandemic takes that incremental step of going from unprecedented zero percent interest rates to unprecedented negative interest rates - investors need to be prepared now, and they need to understand in advance how that changes asset prices and returns.

Let's return to the key words: "paying out more money up front". So, if there is a move to negative interest rates, then that is necessarily achieved by paying out ever more money up front - which goes to someone.

Exploring Negative Interest Rates & 10 Year Bonds

To explore how this could happen, let’s use a round number but practical example.

In an earlier chapter and as shown above, we explored how in the event of another recession, the Federal Reserve plans to respond by moving short term Fed Funds straight down to 0%, and to also aggressively use quantitative easing to buy what would likely be trillions of dollars in medium and long term U.S. Treasury bonds, in order to swiftly force down long term interest rates.

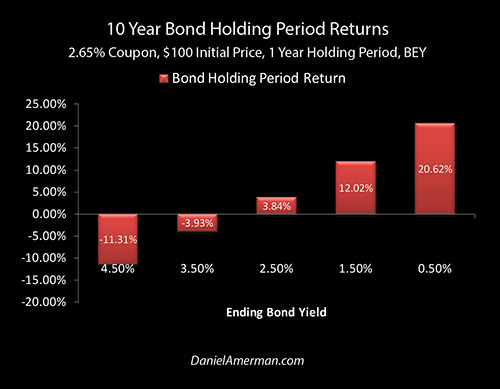

As explored in that analysis - by purchasing 10 year U.S. Treasury bonds (technically notes) in anticipation of the recession, investors could turn that recession and the resulting cyclical but extraordinary Fed interventions into a one year holding period return of 21%.

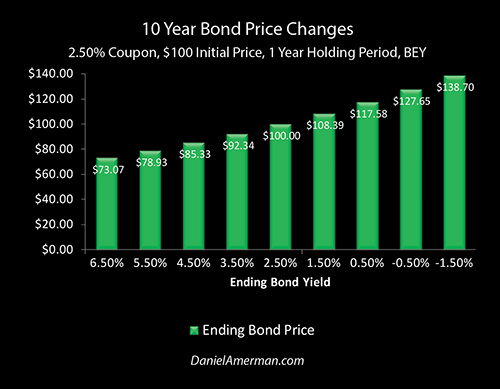

That same 10 year U.S. Treasury can also easily become a negative yield bond - but to do so, investors would have to pay more than the total cash that will be received from that bond.

As a starting point, let's assume a $100 bond that matures in ten years. If it makes 10 annual payments of 2.5% each then it pays out $2.50 per year, and $25 over the full ten years (actually 20 semiannual payments of 1.25% each, but the total is the same). When we take the return of the $100 in principal in the tenth year, and add the $25 in interest payments over the years, that means that an investor will receive a total of $125 in future cash flow.

Now, for someone who buys a ten year bond, holds it for a year, and then sells it - they would receive $2.50 in interest payments over that year. At the end of a one year holding period, there would be nine years of interest payments left, so we would have a 9 year bond paying out a total of $122.50.

If interest rates are 2.50% after a year - our bond is still worth $100 (or par) at that time, and the future income will be $22.50.

However, if as covered in previous chapters, rates are down to 0.5% - then the bond is worth much more, because someone buying the bond from us would be accepting much lower future income. So they would pay us $117.58 for the $122.50 in future cash flow, as can be seen in the green bar with the 0.5% at the base.

We would make a $17.58 one year gain on our $100 investment (plus the interest payments we received).

Paying More Money, Up Front

Now, this next part is something the U.S. has never seen before, and it is critical for investors to understand - before it happens.

If the U.S. does not just go to ZIRP (Zero Percent Interest Rate Policies), but to NIRP (Negative Interest Rate Policies) as part of the attempt to contain the current recession and crisis - then all existing bonds that trade at negative yields will by definition have market values that are greater than the sum of their future principal and interest payments.

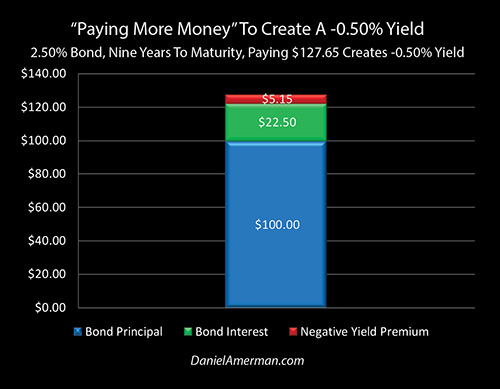

So, if the U.S. were to go to mildly negative interest rates of -0.5% for our (then) nine year bond, then we would have nine remaining interest payments for a total of $22.50. Add in the $100 return of principal and we have $122.50 in future cash flows over the next nine years.

Remember, the key words for understanding negative yields are "paying out more money up front." If that bond is to trade at a negative yield - then an investor buying it from us, will have to pay us more money than they will receive from the bond, and do so at the time they buy it from us.

If the bond is selling at the very low negative yield of negative one half of one percent, then it would have a market value of $127.65.

The components of that $127.65 price are broken out in the graph above. The bond price would include $100 for the bond principal (the blue area), and $22.50 for all of the interest payments (the green area). Those two by themselves would take us to an unusual place, which is a 0% yield, with $122.50 being paid up front for $122.50 in future cash flow.

To go negative - we have to go past that place, and the investor needs to pay us $5.15 more than the cash that the bond would produce in the future (the red area), for a total price of $127.65. By doing so, they would lock in a loss of $5.15 - and an exact -0.50% yield if they held the bond to maturity.

But there is nothing negative about this for someone who owned the 2.5% bond at a $100 basis. Instead, the entire $27.65 above that basis - including the $5.15 future loss - would all become profits on the front end (or at least after the assumed one year holding period).

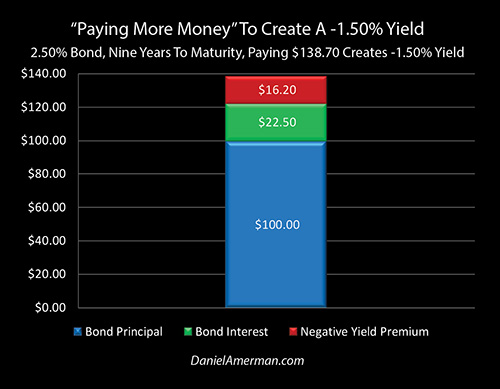

Now, if the nine year bond (at that time ) were to go to a -1.5% yield - then the larger negative yield is by definition created by locking in a larger loss, for bonds held to maturity. The way the investor would get that larger negative yield would be to pay us more money up front, which would be $138.70 for our $100 bond.

So they would pay us $100 for the future return of principal (the blue area), $22.50 for the future interest payments in full and in advance (the green area), and then stack another $16.20 on top of that for privilege of taking a loss (the red area), because the Federal Reserve will have forced negative interest rates in the attempt to contain a cycle of recession and crisis.

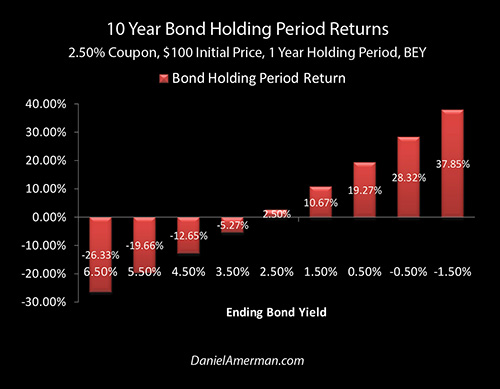

What those scenarios would do to holding period returns is shown in the graphic above. If we own a 2.50% year ten year bond for a year that we paid $100 for, and we sell it a year later for a 2.50% yield, then we earn a 2.50% one year holding period return.

If the there is a recession, the Fed contains that recession with a combination of zero percent interest rates and quantitative easing, and yields fall to 0.50% - then we would earn a 19% rate of return (we have moved the illustration bond coupon from 2.65% in the prior analysis to a round 2.50%, which reduces the yield from the earlier chapter).

If rates went to -0.50% - we would earn a 28% rate of return.

If rates went to -1.50% - we would earn a 38% one year rate of return.

These would be the most lucrative results - by far in the U.S. - ever seen by owning 2.50% ten year Treasury bonds.

Those elevated yields are the mathematically necessary result of the move to negative interest rates. And it wouldn’t be where the real money is, as will be explored in a later analysis in this series.

"Following The Money" & The Profits

It is also critical to realize that in this situation, it is the central bank, i.e. the Federal Reserve for the U.S., that becomes the single largest buyer of the negative rate bonds, using the money they create via quantitative easing. So, this a double gross monetary and financial distortion, where the central bank creates trillions of new dollars and uses that money to buy trillions in outstanding government debt at prices that are so high as to be completely unnatural. In the process of the transition to negative interest rates, potentially hundreds of billions of dollars in artificial profits are steered to those in the know.

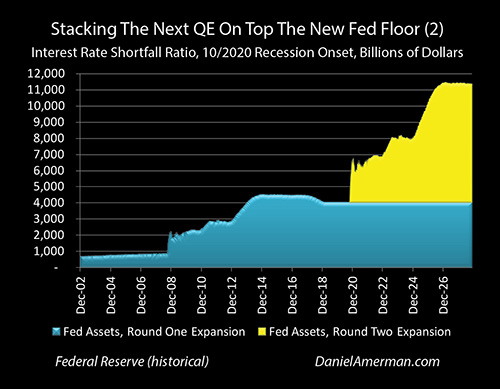

The graph above is from an earlier chapter, and it illustrates how the Fed intends to stack another round of quantitative easing on top of the last round (in the next recession). With this example, the total of the new money created out of the nothingness reaches $10 trillion. Now, I understand that for most people, the phrases "Federal Reserve", "quantitative easing", "$10 trillion", and "creating money out of the nothingness" are each individually abstract, and the combination of the four abstractions together may seem incomprehensively abstract.

There is nothing abstract about that graph, or the subject of this analysis. That new $3+ trillion that was already created is every bit as real as the money in your wallet, the money in your bank account, and the money in your retirement account. It has equal status with your money, and so will every single dollar of the next $7 trillion of newly created money (or whatever the amount turns out to be).

Sometimes the best way to unravel complexities is to simply "follow the money" and see who benefits.

The reason that a fantastic sum of money is created is to spend it. The intention is to use it to move investment markets to unnatural places. One of the most important uses of those trillions in new money is "paying out more money up front". Much of that newly created money goes to paying record prices for their investments to people - mainly the financial industry and sophisticated institutional investors - who do understand what is happening.

To go back to our simple examples of how negative interest rates impact current bondholders, we start with a more or less "natural" state of paying $100 for a $100 bond with a 2.5% interest rate (that interest rate is not actually natural, but is itself the product of the first $3+ trillion in monetary creation, rates would be substantially higher without it).

The Fed creates trillions in new money - and it uses that to "pay out money up front" - which would be $138.70 per $100 bond (in the negative 1.5% rate example). The graph below shows where the money would go with a $1 trillion increment of quantitative easing, and it shows a common color coding with the components of the single $100 bond graph above, to make it easier to follow.

With this illustration, for every $1 trillion in newly created money, then about $721 billion would go to repay investors for their cost, or basis, of $100 per bond (the blue area, $100 / $138.70 = .721).

Another $162 billion would go towards the unnatural condition of buying all the interest payments in advance for the bonds (the green area, $22.50 / $138.70 = .162). Then the last $117 billion in newly created money would go towards the far more unnatural creation of a negative interest rate bond that would have a yield to maturity of minus 1.50% (the red area, $16.20 / $138.70 = .117).

So, when we "follow the money" (with that example), then a cool $279 billion out of every $1 trillion in newly created money would go the lucrative benefit of the private parties and organizations who owned the securities that were being purchased. Let me suggest that there is nothing the slightest bit abstract about that amount of very real money, which incidentally happens to be disproportionately flowing to organizations (and thereby individuals) that comprise only a very small - one might even say "elite" - and somewhat concentrated portion of the overall nation.

There is another way of looking at this as well. The people and companies that owned the bonds that were purchased by the Fed for $1 trillion - only paid $761 billion for them. So that $279 billion in profit is off a $761 billion investment, and that takes us back to getting paid $138.50 for a $100 bond - as a matter of policy.

The amount of private wealth that is created when a central bank like the Federal Reserve literally creates trillions of dollars, and then quickly spends the money to overpay a (far from ordinary) group of investors by almost 40% is almost incomprehensible. There is nothing theoretical whatsoever about that extra $279 billion for the organizations and people who get that money, it is entirely real and spendable money right from the day that they get it.

And even if the overpayment is only 10% or 20% instead of our example near 40% (for instance maybe the spending is on the Fed's planned MEP as covered in the previous chapter rather than negative interest rates), and even if only a minority of that goes to the personal benefit of truly private parties - the amount of the transfer of wealth and the effective gift is still so stunning as to be off the scale.

However, we are told that this is all for our own good. The unfortunate situation where John Q. Public doesn't happen to share in the extraordinary profits (or is even aware of them), is, well, just the completely accidental byproduct of monetary policies that are vital for the national interest but are far too complex for us to worry our little heads about. Or so we are to believe.

So, for the average individuals in all their millions from coast to coast who do not understand what is happening, then they will not profit from the fantastic sums of upfront profits, but they will fully participate in the toxic negative rate environment that is funded by the newly created money, and they will potentially do so for many years to come. In other words, the bottom line by the time all is said and done is that the average person just gets shafted (again).

As much as I disagree with the use of negative rates, if it is going to happen, then average citizens need to be able to share in the many billions in "gifts" that will necessarily be handed out in the process - and not just the shafting. And this isn't actually a closed or private game - someone just needs see the existence of the game, and then learn enough to fully understand how it works.

When Two Negatives Create A Positive

As developed in previous analyses / chapters in this book that is in the process of being written, the Fed is caught in an interest rate trap of its own making. It is caught inside of cycles of crisis and the containment of crisis, and because it forced rates all the way down to zero percent in the last cycle, it has not since then been able to raise interest rates sufficiently high enough to escape the next cycle of recession in the usual manner. So it fully intends to use unconventional measures, and negative interest rates could end up being part of the mix, along with creating record amounts of new money via quantitative easing.

When it comes to phrases like "the containment of crisis" and "negative interest rates" - I think the reaction of most investors is likely to be that of fear and worry. There is ample justification for those emotions, and conventional financial planning strategies for retirement may have great difficulty in coping with realities of such a possible future.

However, not everything is negative. Indeed, if we are to survive what may be coming with our financial security intact, then this may very well require not just attempting to dodge the new negatives as the cycles likely continue to amplify, but to find and understand the new positives as well. Pure defense is unlikely to be enough, particularly over time - there have to be ways to bring in additional cash as well, preferably in large amounts, at least every now and then.

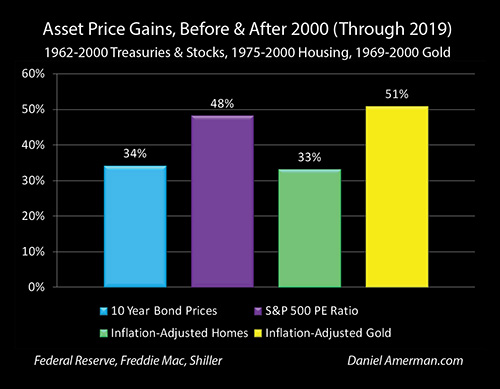

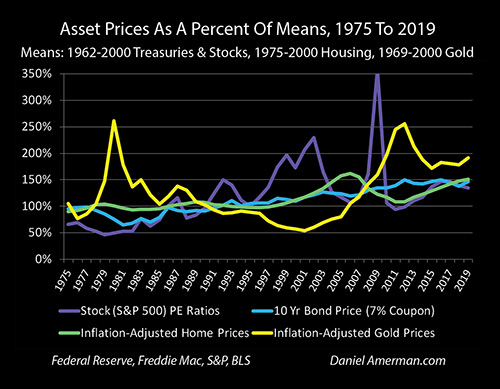

What we have examined in this analysis would be the most extreme example yet of a process that has been underway for almost twenty years. As explored individually for stocks, bonds, real estate and gold in the Chapter 1 analysis, the extraordinary "boom & bust" cycles created by the Fed have led to asset prices over the period from 2001 to 2019, that are 30% to 50% higher than the previous long term averages.

However, as also explored in that analysis, while the four major asset categories share a common causality (the Fed's unprecedented interventions) leading to a common destination (record average asset prices) - the path there has been anything but smooth. We have seen an explosion in volatility - with each asset category traveling different paths from the others - and we may have seen nothing yet compared to the next round with the currently developing recession.

The new recession could inflict staggering losses for stocks and real estate that are currently at record or near record highs - that part is easy to understand.

If the coronavirus recession is ultimately contained with negative interest rates - that will create a strange and toxic environment that we have never seen before in the United States, with particularly dire implications for many retirement strategies and retirement investors. While most people would rather not think about it - until if and when they have no choice - that part is also, unfortunately, relatively easy to understand.

How the two negatives could combine to create record profits in multiple asset categories - for particular periods of time that vary by the asset category - is not so simple to understand, and is likely profoundly counterintuitive for many average people.

Yet, such is the world in which we live.

The 1-2-3-4 of 1) zero percent interest rates; 2) massive new monetary creation by the Federal Reserve; 3) record long bond prices and profits; and 4) record new deficits, that I described in detail well in advance and why they would occur with a new recession - have now happened. And we're still just getting started, this is very much the early stages of what could become a very severe recession, or possibly even a depression.

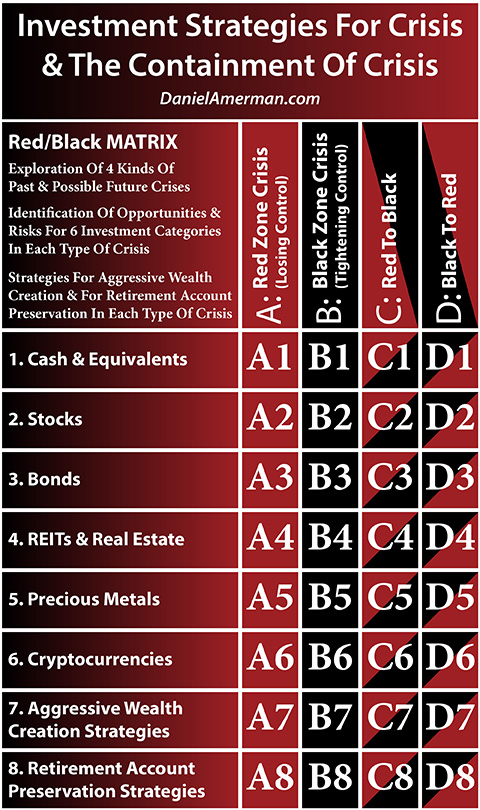

A long term investor who did not see all four of those coming and why they would happen with a new recession, was, unfortunately - investing blind. The investment world has fundamentally changed, and the Federal Reserve's previous increasingly dominant relationship over stock, bond, home and gold prices is likely to get even more dominant in the year and years ahead (unless they lose control altogether). The framework shown below has to be understood, as does how it profoundly changes risks and returns for all the major asset classes and retirement accounts in the years ahead.

(More information on the Red/Black matrix is available in Chapter 1, linked here.)

The usual approach of assuming free and efficient markets cranking out somewhat reliable repetitions of historical asset class returns - which underlies most conventional financial planning - is woefully obsolete now, and that was the case long before the new virus emerged out of Wuhan.

Hopefully this analysis of how negative interest rates are built on "paying out more money up front" has been helpful to you in seeing one of the many practical aspects of how strange events can create record profits in ways that we have never previously seen - before it happens, and while there is still time. Because if and when negative interest rates finally arrive, for those wait until then to learn - it will be far too late, and there will be no second chances, that ship will have sailed.

Learn more about the rest of the free book.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2020 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.