Concerned That Asia Could Blow A Hole In Future Economic Recovery

Economics / Coronavirus Depression Apr 04, 2020 - 09:20 AM GMTBy: Chris_Vermeulen

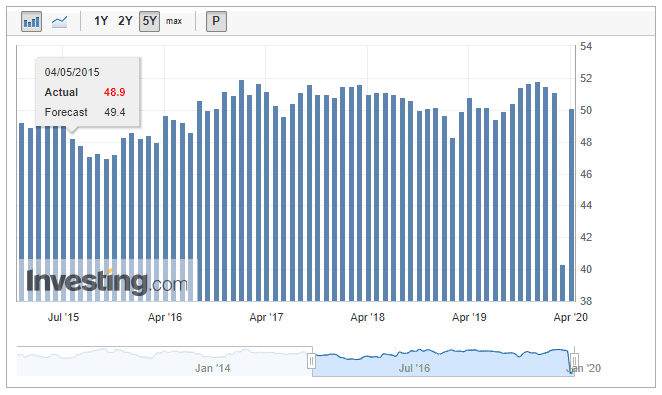

Thinking somewhat far off into the future, our researchers believe China/Asia could become the next Black Hole in the global economy. China recently released its March PMI number which came in at 52.0 – showing moderate expansion in Chinese manufacturing. The February Chinese PMI level was 35.7. We strongly believe China wants to show some strength in their perceived economic recovery and that these PMI numbers are somewhat “manufactured for effect”.

We believe the real economic toll taking place in China/Asia will continue to unfold over the next 3 to 6+ months as the historic expansion of wealth and the exported foreign investment from Wealthy Chinese continues to contract over this time. In a very similar manner to what happened in the US when the Japanese economy contracted in the 1990s – as wealth creation processes collapse, these foreign investors suddenly start to liquidate assets trying to protect their “home-country assets”.

(Suggested Reading: https://www.barrons.com/articles/china-pmi-data-coronavirus-51585666441)

We’ve recently posted an article suggesting the US Real Estate market could suddenly find itself in a real measurable collapse and we believe the foreign investors, speculators and speculative renters (Air BnB and others) will suddenly find themselves in a very difficult situation. You can find our Real Estate article here.

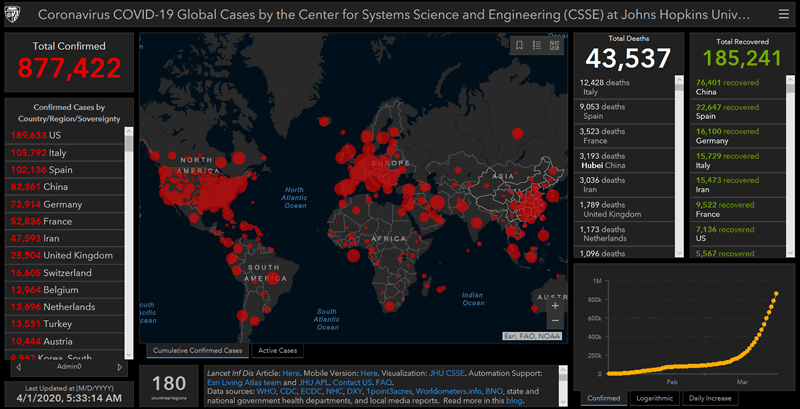

As the COVID-19 virus event continues to unfold, the data from global nations will quickly identify any outlier factors and data points related to China/Asia and how they are reporting their data. Chinese economic data has raised suspicions for quite some time with global analysts. It seems highly unlikely that the Chinese economy rebounded from an almost complete shutdown in February and most of March to a moderate manufacturing growth level at the end of March 2020. Meanwhile, throughout the rest of the globe, economies, and manufacturing levels are contracting as the COVID-19 shutdown continues.

(Suggested Reading: https://www.yahoo.com/finance/news/asias-factory-activity-plunges-coronavirus-044302834.html)

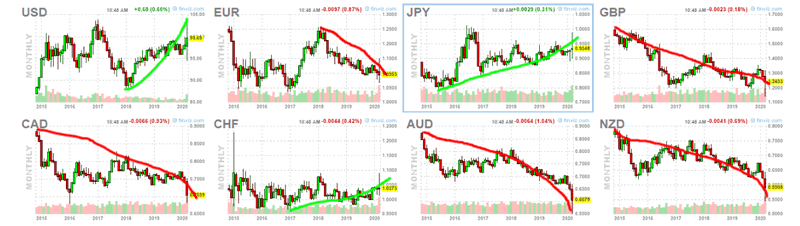

We believe the disparity between the global markets and the numbers China continues to proffer will quickly result in a complete lack of confidence in future data related to any Chinese economic activity or future expectations. We also believe the global capital markets will make an immediate shift away from risks associated with any falsified data originating from China by mitigating forward risks in investments and currency market exposure over the next 3 to 5+ years – possibly longer.

Before you continue, be sure to opt-in to our free market trend signals before closing this page, so you don’t miss our next special report!

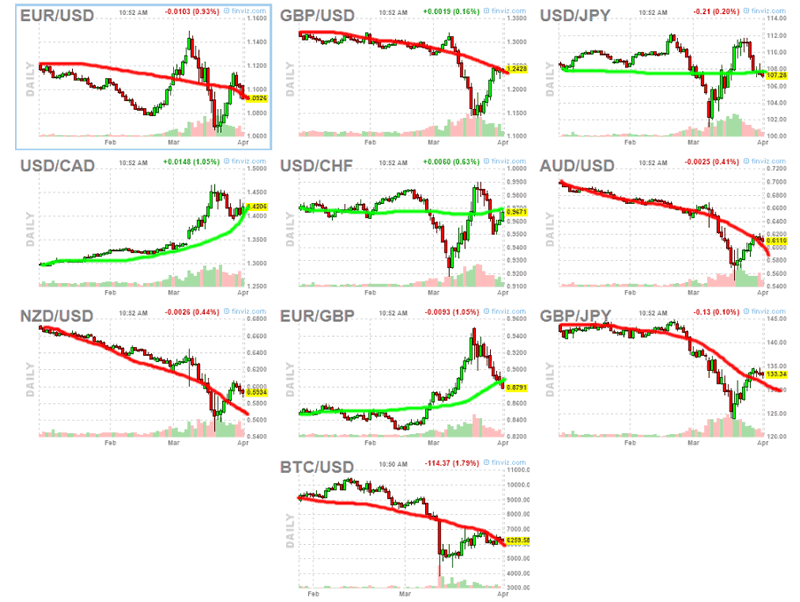

What happens when global events like the COVID-19 virus event takes place is that capital immediately attempts to identify extreme risks and attempt to move to safer environments. Currencies are no different. Global markets, investment, and manufacturing are increasingly exposed to risks related to the shifting markets and any false or otherwise “outlier” data being reported right now. The bigger players can’t afford to take risks and will take active measures to protect their futures and investments.

Source: Finviz.com

(Suggested Reading: https://www.cnbc.com/2020/03/31/asia-markets-china-official-pmi-coronavirus-global-economy-in-focus.html)

Our opinion is that the Chinese PMI level of 52 for March 2020 is an outlier data point. This virus event started in early January in China and almost all of February and March were when the globe suddenly became aware of the risks and infection spread. Even though China may have attempted to ramp up manufacturing over the past 2+ weeks to appear to be “back to normal” – it makes no sense to us that manufacturing in China actually “expanded”, based on historical levels, that quickly.

Watch how quickly global economies and currencies work to mitigate the risks related to perceived “outlier data”. We believe most of Asia will continue into an economic contraction over the next 3+ months and we believe the FOREX market will relate the immediate risk concerns related to Asia/China/global market expectations. In other words, watch the currencies to see how global investors perceive risks associated with true economic activity.

The World Bank many not have a deep enough piggy bank to back the extended risks of an Asian Economic contraction lasting 6+ months.

(Suggested Reading: https://www.marketwatch.com/story/world-bank-says-coronavirus-outbreak-may-take-heavy-toll-on-asias-economy-2020-03-30)

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for short-term swing traders.

If you are a more active trader and swing trader visit my Active ETF Trading Newsletter. If you are a long-term investor looking for signals when to own equities, bonds, or cash, be sure to look into my Long-Term Investing Signals.

Ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.